Bitcoin Falls to $60.5K as Coinbase Premium Gap Points to Sell Pressure

Bitcoin had a rough Wednesday, starting the day above $62,000 but quickly slipping to a daily low of $60,541. The market turbulence didn’t stop there, as over $40 million in bitcoin long positions were wiped out. Across the broader crypto space, both long and short positions saw liquidations totaling $169.45 million in the past 24 hours.

$40M Bitcoin Longs Liquidated as Coinbase Premium Gap Hits -$48.4

By 7:35 p.m. Eastern Time on Wednesday, the overall cryptocurrency market was valued at $2.13 trillion, marking a slight 1% drop over the day. Bitcoin (BTC) slid almost 2%, while ethereum (ETH) dipped by about 1%.

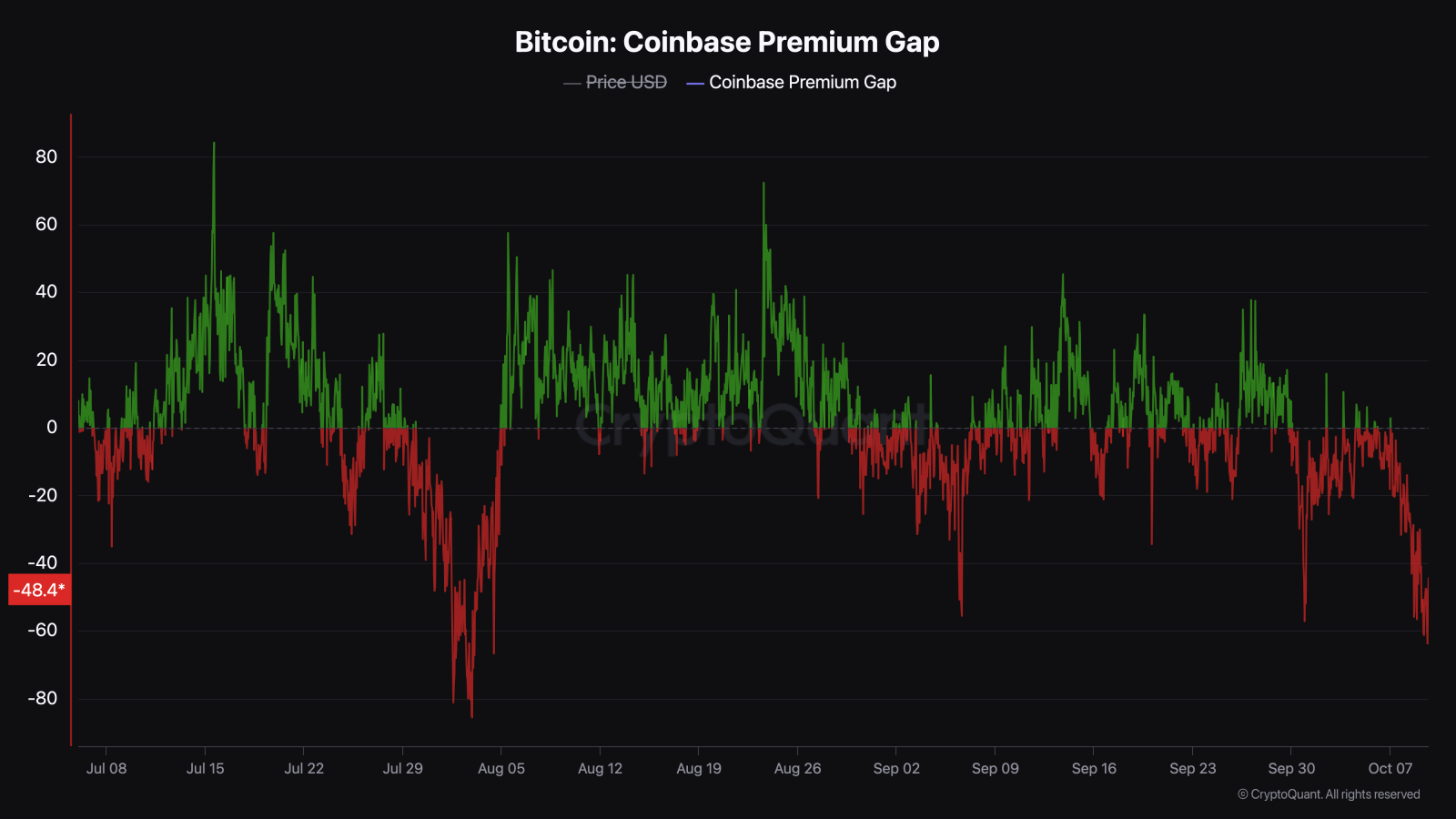

Market analyst Maartunn, sharing data from cryptoquant.com, provided a key insight, noting the day before that “the Coinbase Premium has fallen to -$41, signaling strong selling pressure from U.S. institutions.”

By Wednesday, Cryptoquant’s data showed the Coinbase Premium Gap had widened further to -$48.4. This metric, the Coinbase Premium, tracks the price difference of bitcoin between Coinbase Pro (USD pair) and Binance (USDT pair).

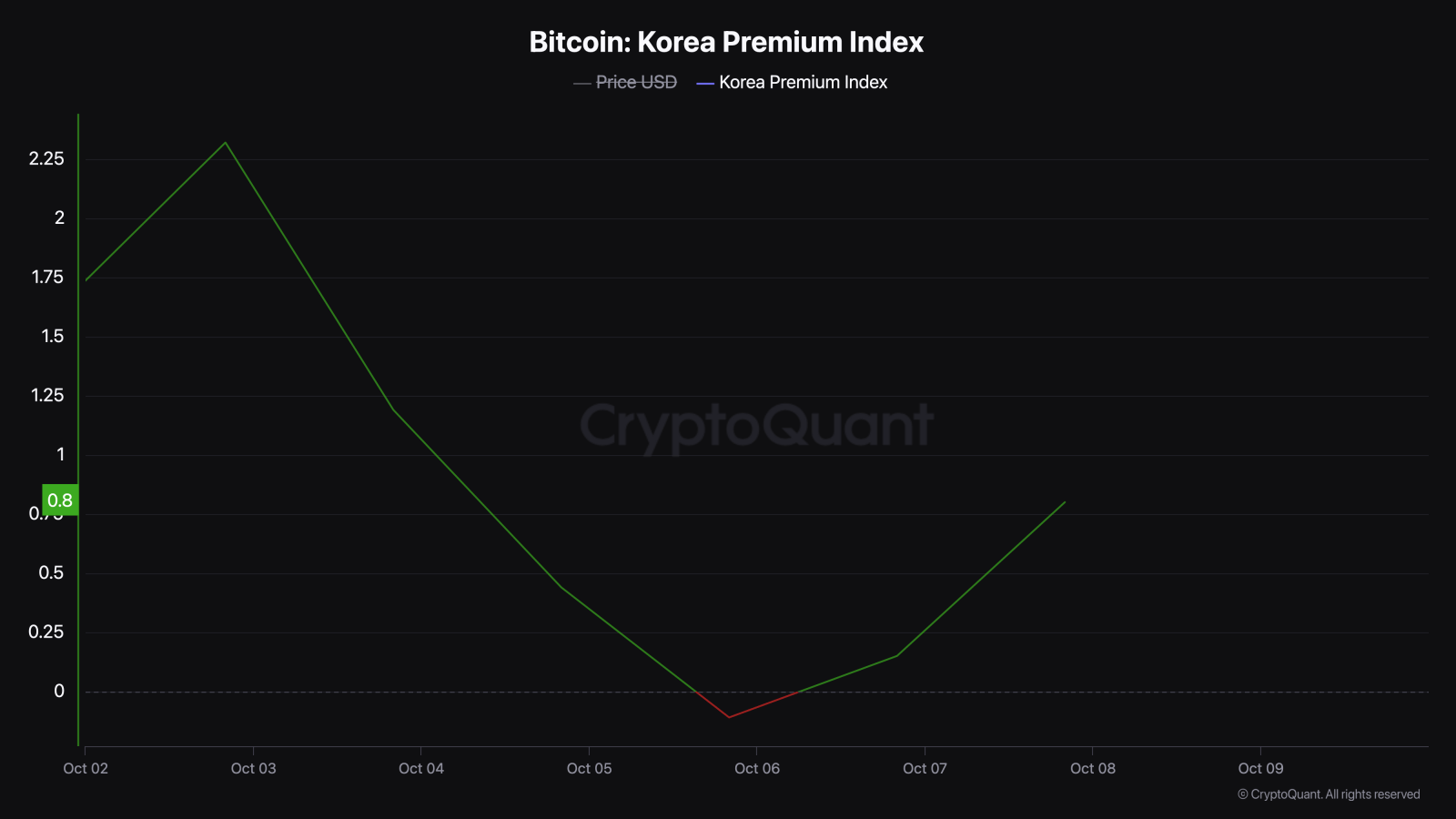

A higher premium indicates active buying on Coinbase, while a lower one could signal selling or low activity. Cryptoquant data also highlights that in South Korea, the premium turned negative again over the past week.

This isn’t the first time a discount appeared. It happened twice in September, hitting a 1.15% markdown on Sept. 25. On Oct. 5, another dip occurred, though this time it only dropped by 0.11%. Right now, there’s a slight premium of 0.8%, staying under the 1% mark.

These shifting premiums and market trends reveal the delicate dance between institutional investors and the broader digital asset environment. As prices continue to waver, global sentiment and ongoing uncertainty keep shaping the crypto market.

What do you think about bitcoin’s price wavering on Wednesday and the Coinbase Premium Gap sinking? Share your thoughts and opinions about this subject in the comments section below.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  Cardano

Cardano  Dogecoin

Dogecoin  TRON

TRON  Chainlink

Chainlink  LEO Token

LEO Token  Stellar

Stellar  Hedera

Hedera  Litecoin

Litecoin  Bitcoin Cash

Bitcoin Cash  Monero

Monero  Dai

Dai  OKB

OKB  Gate

Gate  Ethereum Classic

Ethereum Classic  Cronos

Cronos  VeChain

VeChain  Cosmos Hub

Cosmos Hub  Algorand

Algorand  KuCoin

KuCoin  Maker

Maker  Stacks

Stacks  Theta Network

Theta Network  Tether Gold

Tether Gold  Tezos

Tezos  IOTA

IOTA  NEO

NEO  Zcash

Zcash  TrueUSD

TrueUSD  Polygon

Polygon  Synthetix Network

Synthetix Network  Dash

Dash  Zilliqa

Zilliqa  Qtum

Qtum  Basic Attention

Basic Attention  0x Protocol

0x Protocol  Decred

Decred  Holo

Holo  Siacoin

Siacoin  Ravencoin

Ravencoin  NEM

NEM  Enjin Coin

Enjin Coin  DigiByte

DigiByte  Ontology

Ontology  Nano

Nano  Waves

Waves  Hive

Hive  Lisk

Lisk  Status

Status  Huobi

Huobi  Pax Dollar

Pax Dollar  Numeraire

Numeraire  Steem

Steem  BUSD

BUSD  Bitcoin Gold

Bitcoin Gold  OMG Network

OMG Network  Ren

Ren  Bitcoin Diamond

Bitcoin Diamond  Augur

Augur  HUSD

HUSD  Kyber Network Crystal Legacy

Kyber Network Crystal Legacy