Bitcoin Gold Rockets 140% in 24 Hours Despite Looming Upbit Delisting Deadline

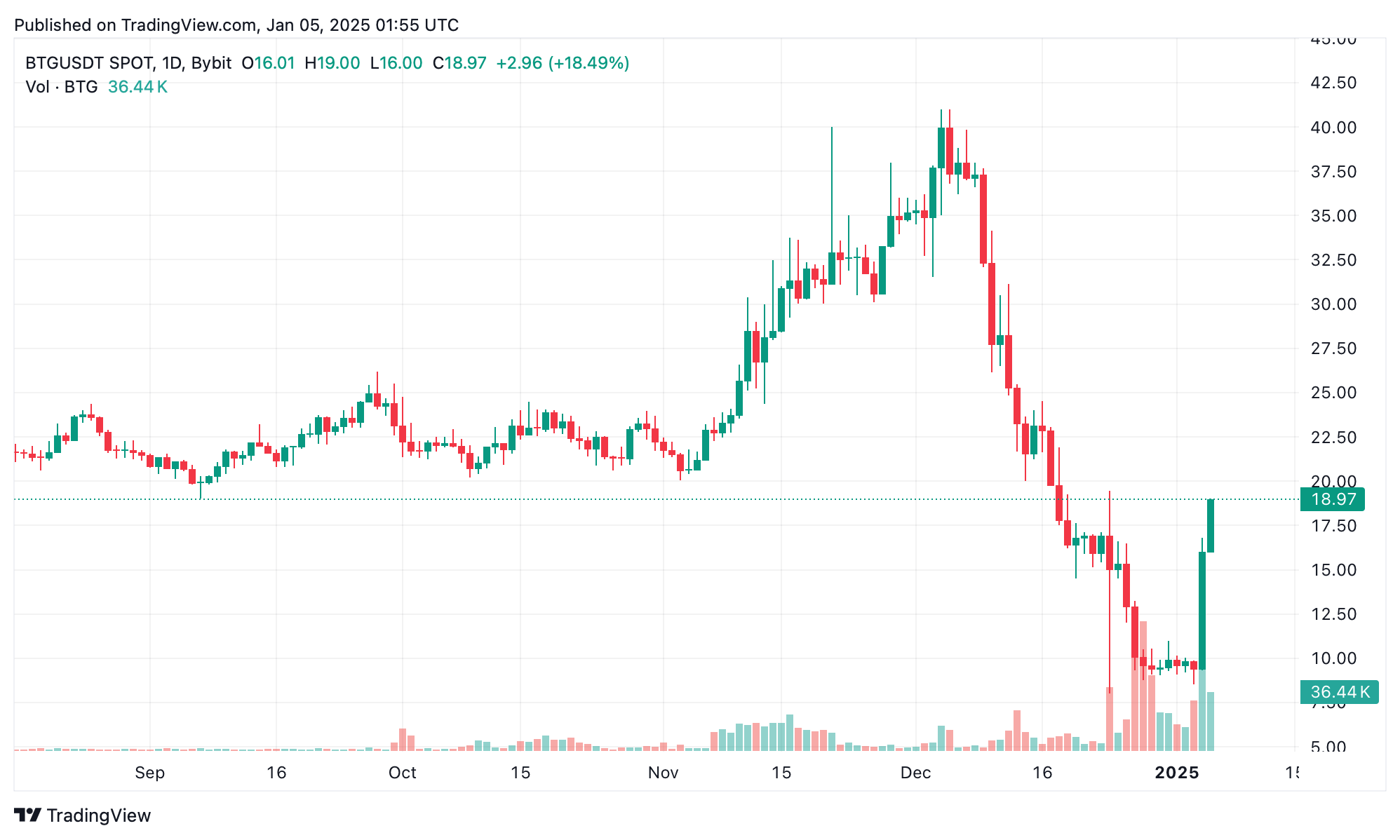

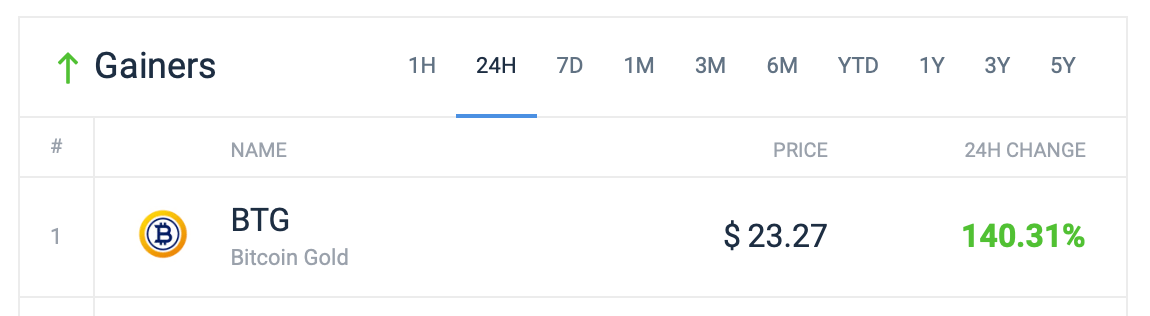

While numerous so-called ‘dino’ cryptocurrencies have begun to reawaken, the Bitcoin fork known as bitcoin gold (BTG) has experienced an astonishing rise of 140.31% within the last 24 hours. On Saturday, this digital asset oscillated between an intraday low of $9.30 and a high of $23.27.

South Korea’s Upbit Drives Bitcoin Gold Mania

Years ago, on Oct. 24, 2017, a collective of individuals bifurcated the Bitcoin software, birthing a new asset and blockchain christened Bitcoin Gold (BTG). The initial intent behind BTG was to foster greater decentralization, enabling proponents to mine the cryptocurrency using GPUs (graphics processing units). Nonetheless, the network has suffered from multiple 51% attacks in 2018 and 2020, casting a shadow over its reputation, akin to other networks like Vertcoin, Verge, and Bitcoinsv that have endured similar assaults.

This weekend, bitcoin gold (BTG), the native cryptocurrency of its network, rose an astounding 140.31% against the U.S. dollar. The token emerged as the day’s supreme performer in terms of overall percentage gains over the past 24 hours, standing alone as the only cryptocurrency to achieve triple-digit growth. Intriguing indeed, this climb coincides with Upbit’s announcement to delist BTG on Jan. 23. Upbit, a South Korean trading platform, is currently witnessing significant trading activity and a premium on BTG.

For example, the weighted global exchange rate for BTG stands at $19.01, yet on Upbit, it fetches $24.75. As of 9:00 p.m. Eastern Time on Saturday, it reigns as the leading coin on Upbit. Interestingly, on the rival exchange Bithumb, BTG trades at $18.90 without a premium, yet it still holds the title of the most traded coin there. In fact, the majority of BTG’s trading volume originates from South Korea, with Upbit recording $1.31 billion in BTG transactions over the last day, while Bithumb observed $232 million

Bitcoin gold’s (BTG) brief resurgence, fueled by speculative trading in South Korea, highlights its fading relevance in the broader cryptocurrency ecosystem. The stark contrast between its meteoric 24-hour gains and Upbit’s imminent delisting underscores a grim reality: BTG’s narrative has shifted from innovation to obsolescence. Despite the fleeting spike, the project appears to be a relic of a bygone crypto era.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  Dogecoin

Dogecoin  USDC

USDC  Cardano

Cardano  TRON

TRON  Chainlink

Chainlink  Stellar

Stellar  Hedera

Hedera  Bitcoin Cash

Bitcoin Cash  Litecoin

Litecoin  LEO Token

LEO Token  Cronos

Cronos  Ethereum Classic

Ethereum Classic  Monero

Monero  Dai

Dai  Algorand

Algorand  OKB

OKB  Cosmos Hub

Cosmos Hub  Stacks

Stacks  Theta Network

Theta Network  Gate

Gate  Tezos

Tezos  Maker

Maker  KuCoin

KuCoin  IOTA

IOTA  NEO

NEO  Polygon

Polygon  Zcash

Zcash  Synthetix Network

Synthetix Network  Tether Gold

Tether Gold  Dash

Dash  TrueUSD

TrueUSD  Holo

Holo  Zilliqa

Zilliqa  0x Protocol

0x Protocol  Enjin Coin

Enjin Coin  Basic Attention

Basic Attention  Siacoin

Siacoin  Qtum

Qtum  Ravencoin

Ravencoin  Hive

Hive  Decred

Decred  DigiByte

DigiByte  NEM

NEM  Bitcoin Gold

Bitcoin Gold  Ontology

Ontology  Huobi

Huobi  Nano

Nano  Status

Status  Waves

Waves  Lisk

Lisk  Steem

Steem  Numeraire

Numeraire  Pax Dollar

Pax Dollar  BUSD

BUSD  OMG Network

OMG Network  Ren

Ren  Bitcoin Diamond

Bitcoin Diamond