Bitcoin Is Going to $80K Regardless of Trump or Harris Win, Traders Say

Crypto options traders are increasing their bets that bitcoin will touch fresh highs by the end of November, per Bloomberg.

Options due to expire on November 8 have their highest open interest at the $75,000 strike price, indicating a key market focus area for that period.

Bitcoin (BTC) may cross previous highs in the coming weeks regardless of which candidate becomes the U.S. president, some traders say, in a shift of tone ahead of the November elections.

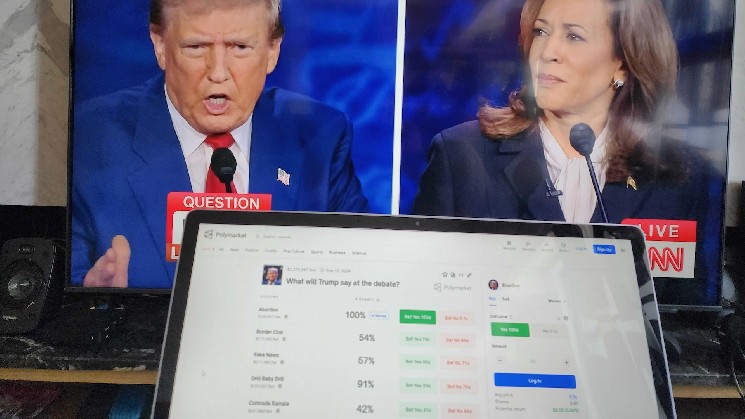

Traders have long perceived Republican Donald Trump’s victory as a bullish catalyst for the industry for his pro-crypto stance and promises to make the U.S. a bitcoin powerhouse. Democrat Kamala Harris, on the other hand, has not made similar promises but said he would introduce regulations to protect certain groups.

Such stances have skewed expectations of a Republican win as better for bitcoin. However, some say the asset is poised to go higher either way as several macroeconomic factors weigh in.

“Both Presidential candidates have adopted pro-crypto stances to appeal to voters, but it’s tough to say if any of their promises will come to pass,” Jeff Mei, chief operating officer at crypto exchange BTSE, told CoinDesk in a Telegram message. “However, It is clear that the market is responding positively to the upcoming change in administration and policies – whether it’s Harris or Trump, traders and investors think any sort of change will be good.”

“The fact that this coincides with the first Fed rate cuts in four years and a recent run-up in stock prices only adds to the thesis that Bitcoin could surpass its all-time high and reach $80,000,” Mei added.

Options traders are already increasing bets that bitcoin will touch fresh highs by the end of November, per Bloomberg. The implied volatility for bitcoin options due around election day is elevated.

The open interest for call options expiring on November 29 shows a significant concentration at the $80,000 strike price, followed by a notable interest at the $70,000 level. For call options with expiration on December 27, the open interest is primarily grouped around the $100,000 and $80,000 strike prices.

Options due to expire on November 8 have their highest open interest at the $75,000 strike price, indicating a key market focus area for that period.

However, some are terming the price behavior as an election hedge rather than a bullish outlook.

“I wouldn’t say that people buying 80K calls on BTC to be a bet on higher prices, but is more like a cheap option (implied vol really hasn’t gone up that much) against a broader market rally,” Augustine Fan, head of insights at SOFA, told CoinDesk in a Telegram message.

“BTC vol skews heavily in favor of higher prices post election, but that has been the case for quite a few weeks now as an election ‘hedge,” Fan added.

BTC is down 0.7% over the past 24 hours, CoinGecko data shows, outperforming a 1.6% drop in the broad-based CoinDesk 20 (CD20).

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  Dogecoin

Dogecoin  USDC

USDC  Cardano

Cardano  TRON

TRON  Chainlink

Chainlink  Stellar

Stellar  Hedera

Hedera  Bitcoin Cash

Bitcoin Cash  LEO Token

LEO Token  Litecoin

Litecoin  Cronos

Cronos  Ethereum Classic

Ethereum Classic  Monero

Monero  Dai

Dai  Algorand

Algorand  OKB

OKB  Cosmos Hub

Cosmos Hub  Stacks

Stacks  Theta Network

Theta Network  Gate

Gate  Maker

Maker  KuCoin

KuCoin  Tezos

Tezos  IOTA

IOTA  NEO

NEO  Polygon

Polygon  Zcash

Zcash  Synthetix Network

Synthetix Network  Tether Gold

Tether Gold  TrueUSD

TrueUSD  Dash

Dash  Holo

Holo  Zilliqa

Zilliqa  0x Protocol

0x Protocol  Enjin Coin

Enjin Coin  Qtum

Qtum  Basic Attention

Basic Attention  Siacoin

Siacoin  Ravencoin

Ravencoin  Bitcoin Gold

Bitcoin Gold  Decred

Decred  NEM

NEM  DigiByte

DigiByte  Ontology

Ontology  Nano

Nano  Status

Status  Hive

Hive  Huobi

Huobi  Lisk

Lisk  Waves

Waves  Numeraire

Numeraire  Steem

Steem  Pax Dollar

Pax Dollar  BUSD

BUSD  OMG Network

OMG Network  Ren

Ren  Bitcoin Diamond

Bitcoin Diamond  Bytom

Bytom