Bitcoin Is Only 9% From All-Time High, But a Reversal Might be Incoming

Bitcoin’s price recently experienced a surge, pushing it to a near three-month high. This rally has brought Bitcoin closer to its all-time high (ATH), sparking renewed optimism among traders and investors.

However, despite this momentum, the presence of large whale transactions and substantial profits suggests a possible market drawdown, putting Bitcoin’s bullish outlook in jeopardy.

Bitcoin Is the Talk of the Town

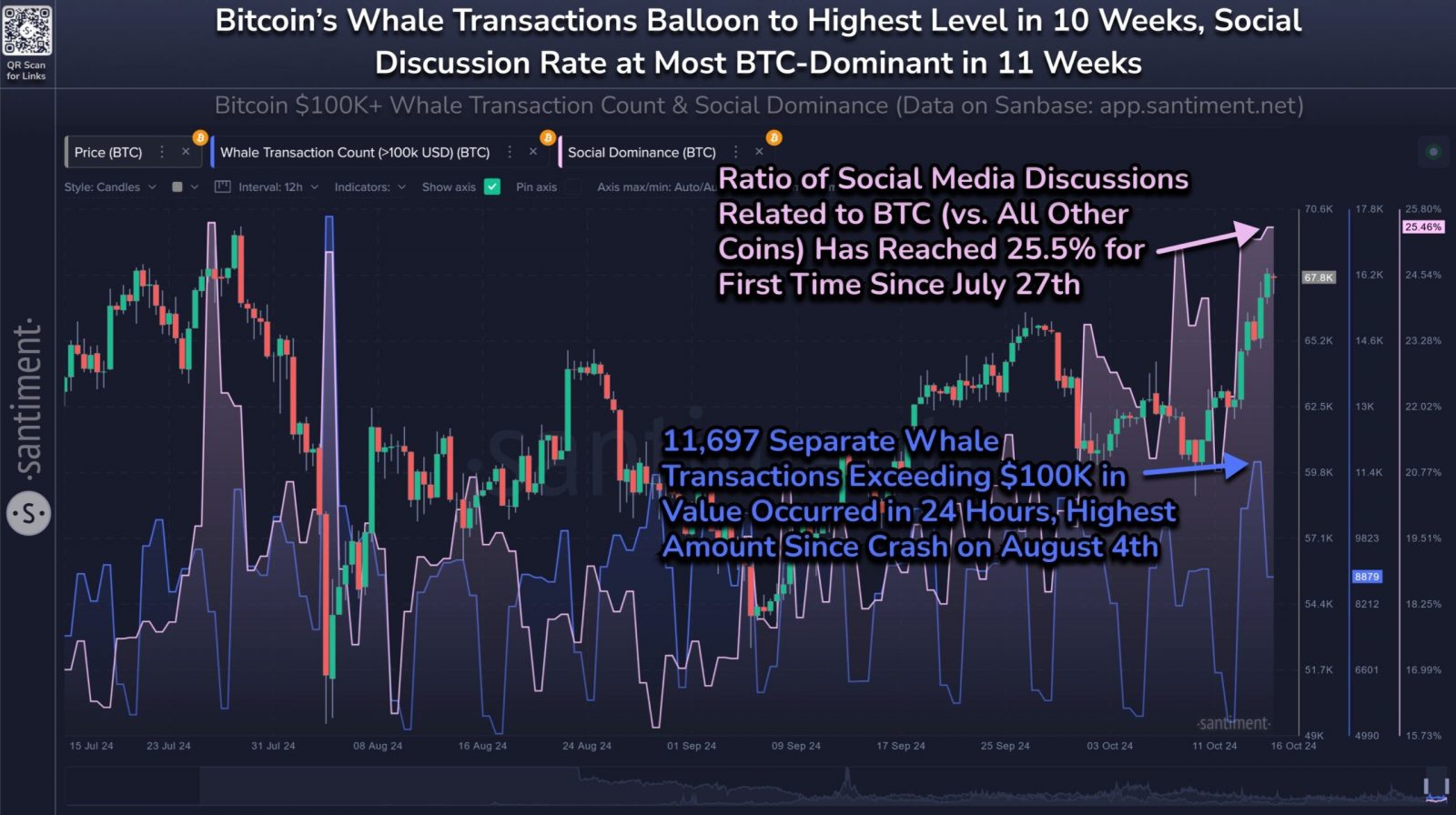

Santiment’s latest data reveals a significant increase in whale transactions, with Bitcoin transactions over $100,000 reaching a 10-week high. This surge in whale activity often signals a shift in market behavior, as large holders are known to influence price movements by either accumulating or offloading their assets. Currently, the heightened volume of whale transactions is raising concerns about a potential price correction.

At the same time, Bitcoin’s dominance in social media conversations has grown substantially, accounting for 25% of all crypto-related discussions. This trend indicates a shift in attention away from altcoins, with many traders focusing on Bitcoin’s performance. Historically, when Bitcoin captures such a large share of the crypto spotlight, it often precedes market volatility, heightening the likelihood of a drawdown.

“Both of these signals are signs that the rally may be on hold due to key stakeholder profit taking and high crowd FOMO. However, with mid and long term metrics still looking bullish, any price correction would likely be a short one,” said Santiment.

Read more: What Happened at the Last Bitcoin Halving? Predictions for 2024

Bitcoin Whale Transaction and Media Discussion. Source: Santiment

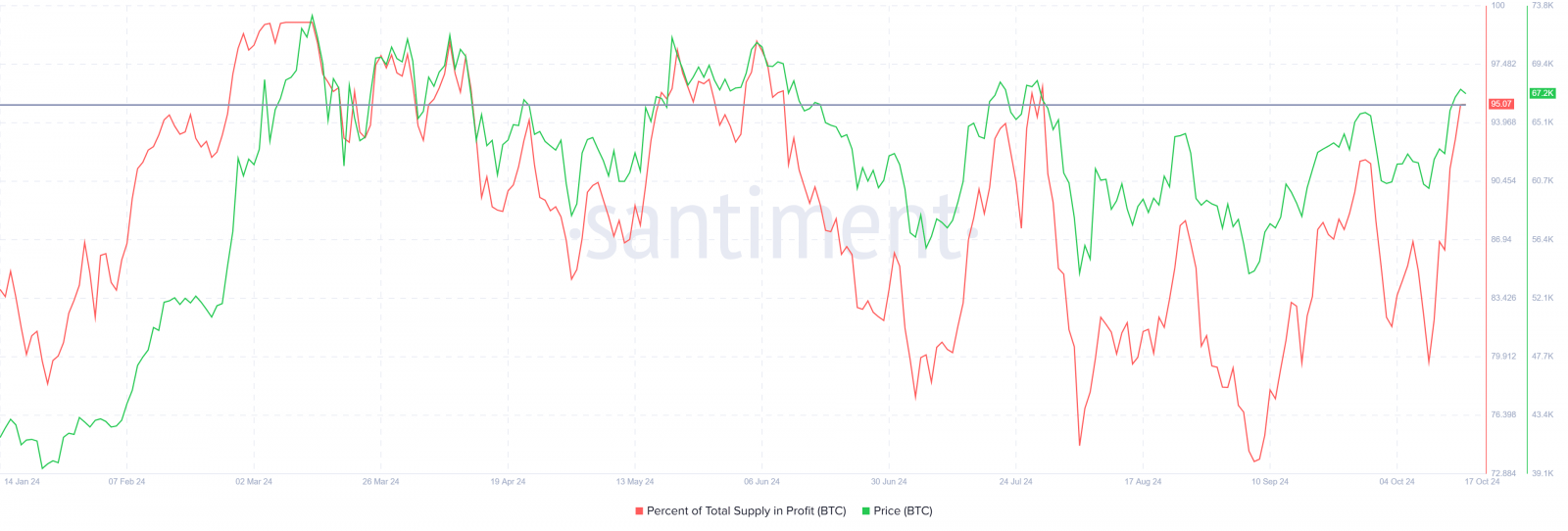

Bitcoin’s macro momentum paints a similarly cautionary picture. At present, 95% of Bitcoin’s circulating supply is in profit, a statistic that has historically aligned with market tops.

When the majority of holders are in profit, selling pressure often increases, leading to downward price corrections. This scenario has unfolded in previous market cycles and appears to be repeating itself, suggesting that Bitcoin may be approaching a near-term peak.

With such a high percentage of the supply in profit, the current market environment is reminiscent of conditions that led to previous corrections. The high profitability encourages many investors to secure their gains, thereby putting pressure on Bitcoin’s price. If these conditions persist, a market top may form, triggering a decline.

Bitcoin Supply in Profit. Source: Santiment

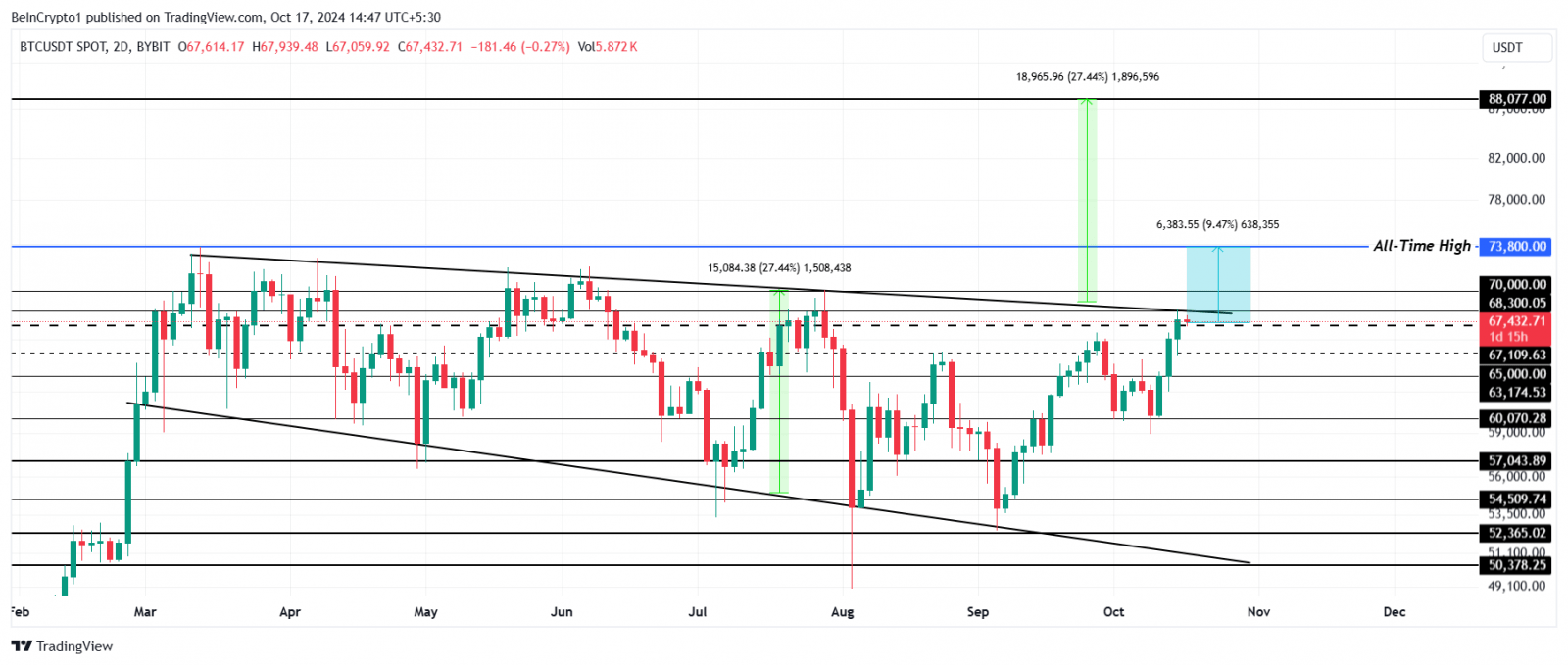

BTC Price Prediction: No ATH

Bitcoin is currently trading at $67,432, edging closer to the critical $68,000 resistance level. Additionally, Bitcoin is on the verge of breaking out of a descending wedge pattern that has been in play since March. A breakout from this pattern could fuel a rally of up to 27%, potentially pushing the price to $88,077.

However, past patterns indicate that Bitcoin may not sustain such a rally. A breakout attempt could fail, leading to a correction that brings the price back down to $65,000. This price action would likely result in a temporary dip rather than a sustained move toward a new ATH.

Read more: Bitcoin Halving History: Everything You Need To Know

Bitcoin Price Analysis. Source: TradingView

Without the necessary momentum, Bitcoin will struggle to break its ATH of $73,800, a level that remains just 9% above the current price. A failure to breach this level would invalidate the bullish outlook, keeping Bitcoin below its previous peak.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  Dogecoin

Dogecoin  USDC

USDC  Cardano

Cardano  TRON

TRON  Chainlink

Chainlink  Stellar

Stellar  Hedera

Hedera  Bitcoin Cash

Bitcoin Cash  LEO Token

LEO Token  Litecoin

Litecoin  Cronos

Cronos  Ethereum Classic

Ethereum Classic  Monero

Monero  Dai

Dai  Algorand

Algorand  OKB

OKB  Cosmos Hub

Cosmos Hub  Stacks

Stacks  Theta Network

Theta Network  Gate

Gate  Maker

Maker  KuCoin

KuCoin  Tezos

Tezos  IOTA

IOTA  NEO

NEO  Zcash

Zcash  Polygon

Polygon  Synthetix Network

Synthetix Network  Tether Gold

Tether Gold  TrueUSD

TrueUSD  Dash

Dash  Holo

Holo  Zilliqa

Zilliqa  0x Protocol

0x Protocol  Enjin Coin

Enjin Coin  Qtum

Qtum  Basic Attention

Basic Attention  Siacoin

Siacoin  Bitcoin Gold

Bitcoin Gold  Ravencoin

Ravencoin