Bitcoin Miners Go BRRR, While Profit Margins Go Brrrr-oke

The difficulty of mining Bitcoin (BTC) has surged to unprecedented levels, intensifying competition among publicly listed cryptocurrency miners from Wall Street and putting pressure on their profit margins. Despite the “miners go BRRR” (reference to a popular money-printing meme) at full speed, it’s insufficient to keep up with the increase in network complexity.

Bitcoin Mining Difficulty Reaches All-Time High, Squeezing Bitcoin Miners Profit Margins

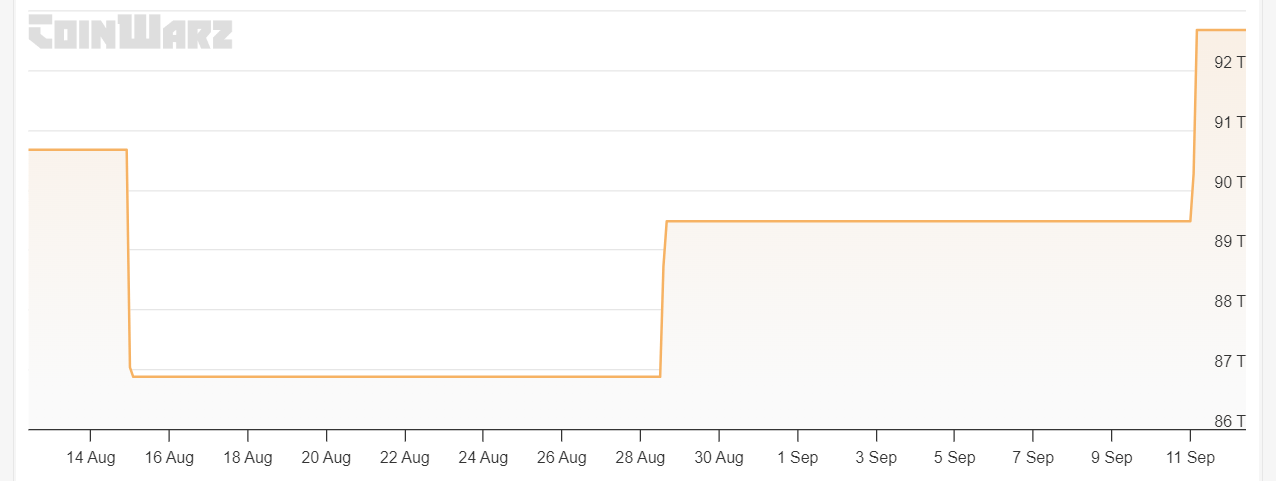

According to data from crypto-mining tracker CoinWarz, mining difficulty increased by 3.5% on Wednesday, reaching a new record high. This metric, which reflects the computational power required to mine new Bitcoin, has been steadily climbing and is often seen as an indicator of future price movements.

Source: CoinWarz

The rise in difficulty comes at a challenging time for miners, who are still grappling with the effects of April’s “halving” event. This programmed reduction in mining rewards has already cut potential revenues by half, contributing to a roughly 10% drop in Bitcoin’s price since then.

“The 4th Bitcoin halving event cut the number of daily coins mined (and all else equal, the daily revenue opportunity) in half, resulting in lower margins and profitability across our coverage universe,” commented Reginald Smith and Charles Pearce in the recent JPMorgan report.

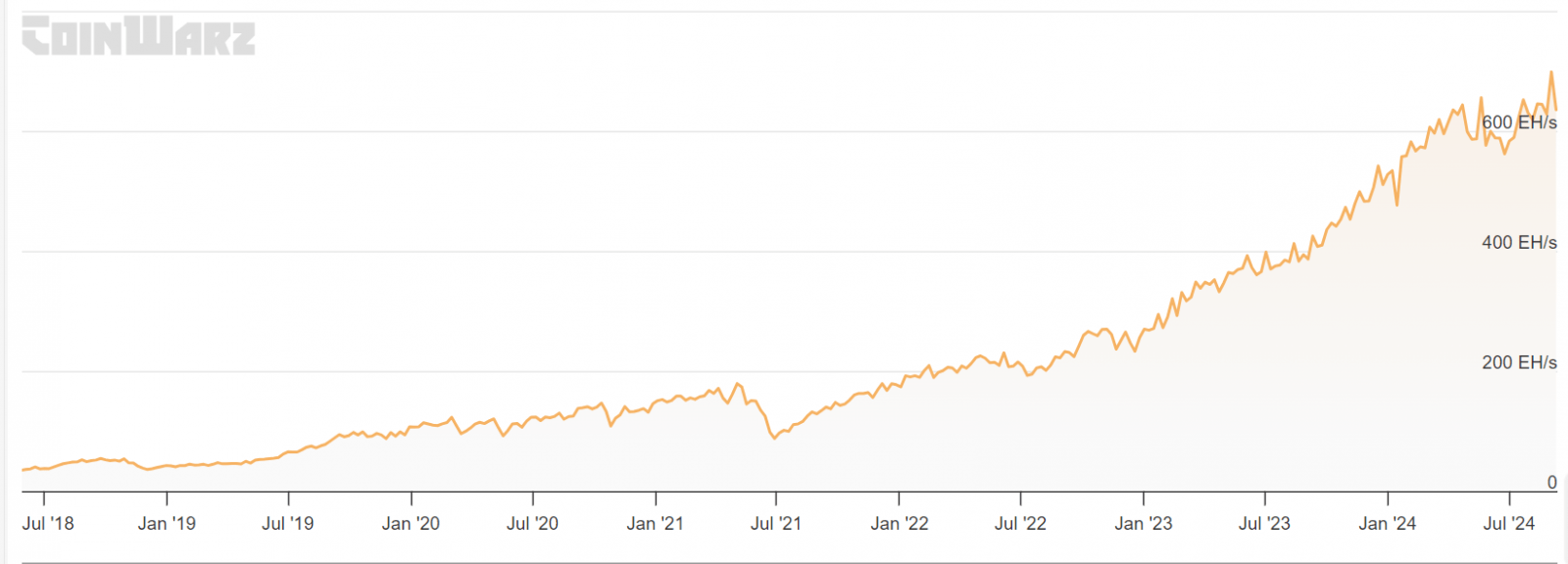

However, the increasing difficulty has not deterred miners from expanding their operations. Bitcoin’s hash rate, which measures the total computing power supporting the network, also hit an all-time high in September. This suggests that miners are betting on a significant price increase in the near future.

Source: CoinWarz

Despite the challenges, Bitcoin’s price has shown resilience, rising 38% year-to-date and reaching a peak of $73,798 in March. The cryptocurrency was trading at around $58,000 on Thursday.

Higher Difficulty = Lower Output

The mining industry’s struggles are reflected in the stock performance of major publicly traded mining companies. Shares of Marathon Digital Inc. and Riot Platforms Inc. have fallen 31% and 54% respectively this year.

Fred Thiel, CEO, MARA, Source: LinkedIn

“During the second quarter of 2024, our BTC production was impacted by unexpected equipment failures and transmission line maintenance at the Ellendale site operated by Applied Digital, increased global hash rate, and the April halving event,” said Fred Thiel, CEO of publicly traded miner Marathon Digital Holdings. The company’s revenue for the second quarter was $145.1 million, missing the FactSet estimate of $157.9 million.

This is also evident from the Bitcoin mining results for the last month. Argo Blockchain (NASDAQ: ARBK) reported mining 38 Bitcoin in August, down from 48 in July. At the same time, HIVE Digital Technologies (NASDAQ: HIVE) mined 112 Bitcoin, which is 4 less than the 116 Bitcoin reported the previous month.

“We remain focused on our strategy of maintaining the lowest G&A expenses per Bitcoin mined, maximizing cash flow return on invested capital, and achieving high revenue per employee while minimizing share dilution,” commented Frank Holmes, Executive Chairman of HIVE.

CleanSpark (NASDAQ: CLSK) and Bitfarms (NASDAQ: BITF) also reported a decline in their Bitcoin production compared to the previous month. As a result, August revenues for Wall Street’s Bitcoin miners fell to $828 million, the lowest in a year. This marks a 57% drop from March’s peak, highlighting growing challenges in the mining sector.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  Dogecoin

Dogecoin  Cardano

Cardano  TRON

TRON  Chainlink

Chainlink  Bitcoin Cash

Bitcoin Cash  LEO Token

LEO Token  Litecoin

Litecoin  Dai

Dai  Ethereum Classic

Ethereum Classic  Monero

Monero  Stellar

Stellar  Cronos

Cronos  Stacks

Stacks  OKB

OKB  Hedera

Hedera  Cosmos Hub

Cosmos Hub  Maker

Maker  KuCoin

KuCoin  Theta Network

Theta Network  Gate

Gate  Algorand

Algorand  Polygon

Polygon  NEO

NEO  EOS

EOS  Zcash

Zcash  Tezos

Tezos  Tether Gold

Tether Gold  Synthetix Network

Synthetix Network  TrueUSD

TrueUSD  IOTA

IOTA  Bitcoin Gold

Bitcoin Gold  Holo

Holo  Dash

Dash  0x Protocol

0x Protocol  Zilliqa

Zilliqa  Siacoin

Siacoin  Enjin Coin

Enjin Coin  Ravencoin

Ravencoin  Qtum

Qtum  Basic Attention

Basic Attention  Decred

Decred  Ontology

Ontology  NEM

NEM  Lisk

Lisk  Nano

Nano  Numeraire

Numeraire  DigiByte

DigiByte  Pax Dollar

Pax Dollar  Waves

Waves  Status

Status  Huobi

Huobi  Hive

Hive  Steem

Steem  BUSD

BUSD  Ren

Ren  OMG Network

OMG Network  Bitcoin Diamond

Bitcoin Diamond  Bytom

Bytom  Kyber Network Crystal Legacy

Kyber Network Crystal Legacy  HUSD

HUSD