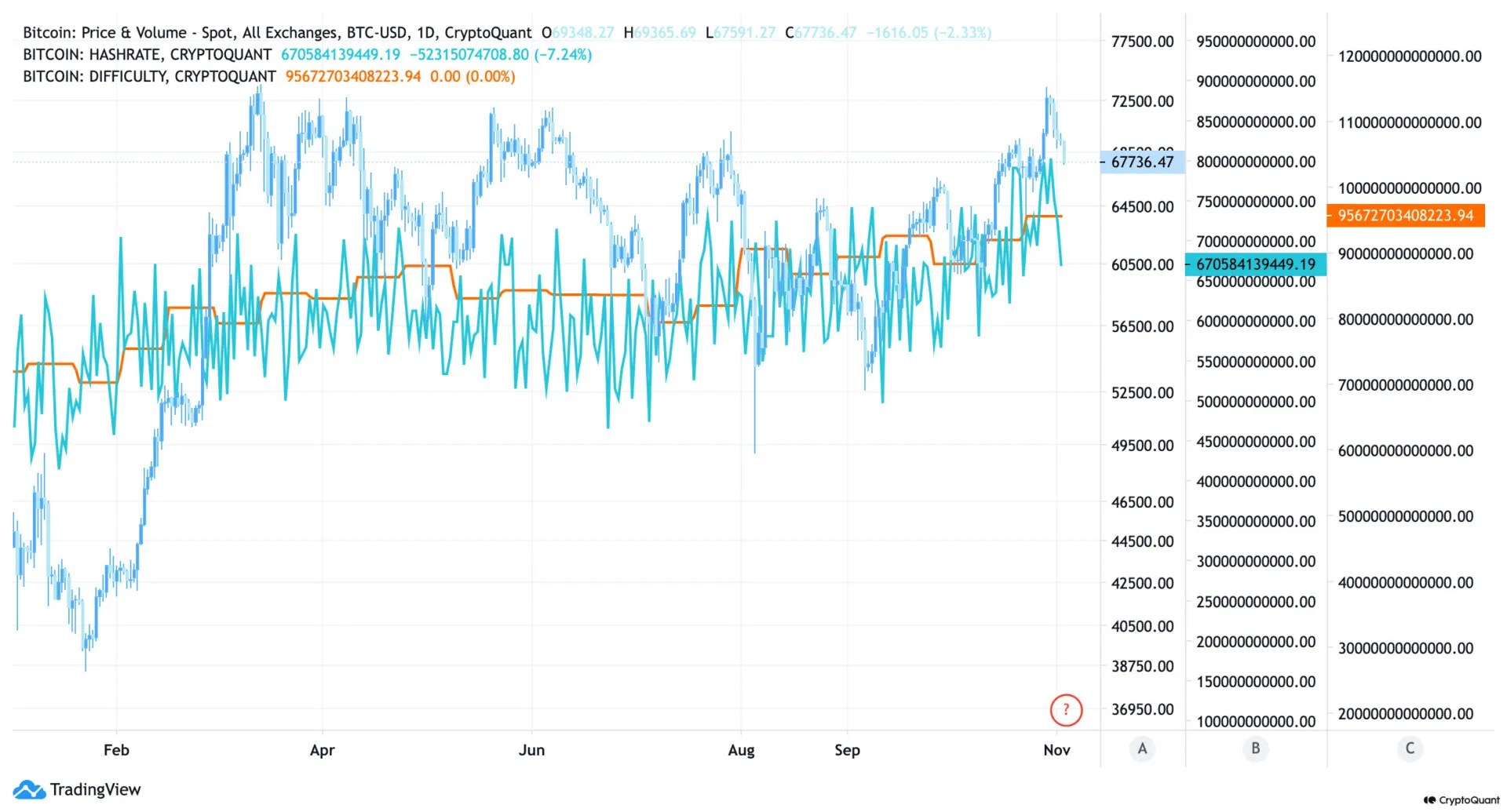

Bitcoin mining difficulty breaks yet another all-time high

Bitcoin mining difficulty just set a new record, hitting heights that are forcing miners to throw even more resources at the network.

With competition heating up and Bitcoin holding steady near its all-time highs, the industry faces new pressures. Now miners need even more computational power to keep pace, leading to higher costs and potentially straining the system’s sustainability.

Miners aren’t just dealing with new difficulty levels. Bitcoin’s recent price action has them scrambling as well. As demand rises—largely driven by ETF purchases—mining competition is climbing, but so are expenses.

And transaction fees, which often help cover mining costs, might not be enough to offset these rising expenses. That’s causing some to wonder if this spike in difficulty will start cutting into profits.

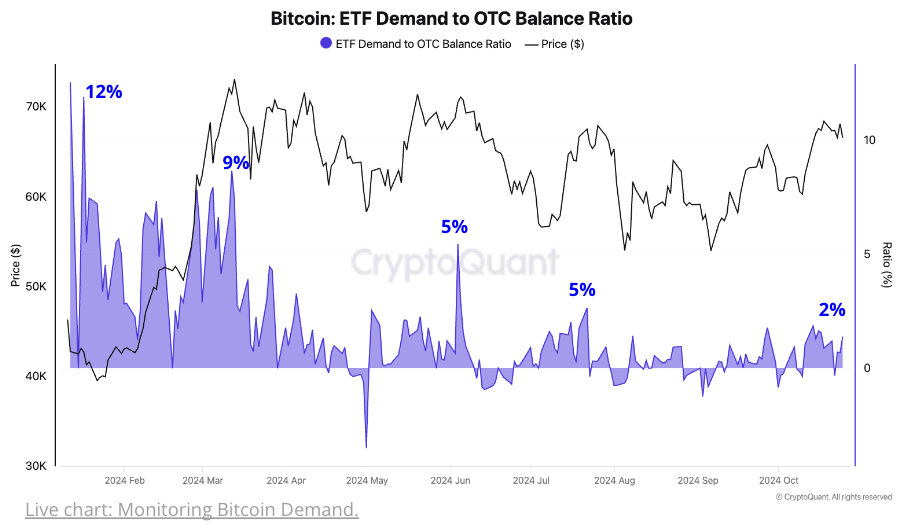

ETF demand and its role in Bitcoin’s price surge

Bitcoin has been trading way too close to its all-time high recently, and the push from U.S.-based ETFs is a big part of that. Since early October, ETF activity has spiked significantly. At the beginning of the month, net daily ETF purchases were down by 1.3K Bitcoin.

By the end of October, though, that volume had skyrocketed to 5.8K. On October 13 alone, ETFs purchased 7.7K Bitcoin—the highest single-day buy so far.

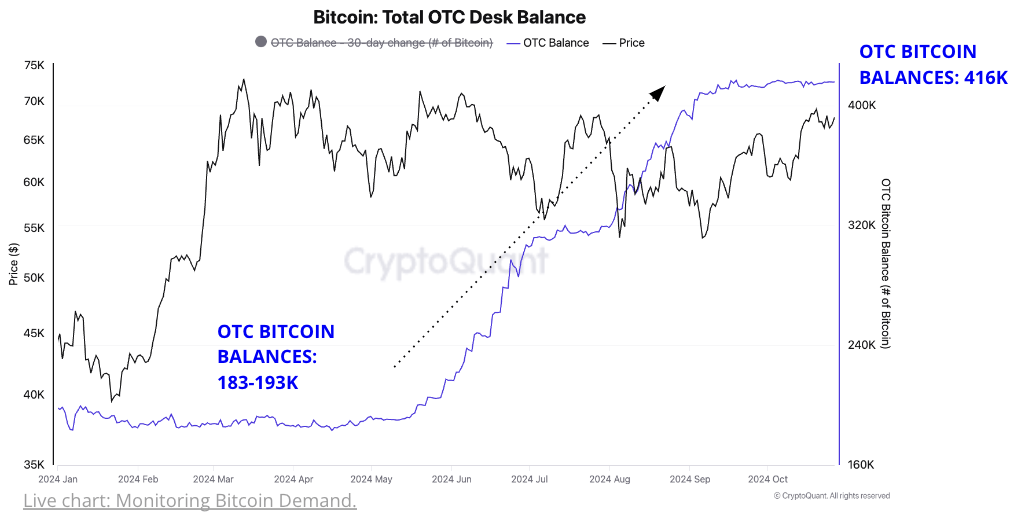

As demand from ETFs grows, it’s worth noting the shifting dynamics with Over-The-Counter (OTC) desks. CryptoQuant’s data shows that OTC desks have kept Bitcoin supplies at record levels, with a total inventory of around 416K Bitcoin, compared to 183K–193K at the start of the year.

This surplus means ETFs can get their fill without touching public exchanges and spiking the price. Instead, they buy straight from OTC desks, which shields the broader market from sharp price swings.

The daily ETF purchases now represent just 1% to 2% of the total inventory held by OTC desks. Compare that to the first quarter of 2024, where daily ETF buys took up a much larger chunk—up to 12% of OTC’s inventory. ETFs would need to ramp up demand even more if they’re going to make a serious dent in OTC supplies.

And there’s a shift happening in those inventory numbers. OTC desks’ overall Bitcoin balance isn’t climbing like it did earlier this year. During Q2 and Q3, their stockpiles ballooned by over 77K and 92K Bitcoin in August and June, respectively. In the last month, however, that balance rose by only 3K.

Lower daily Bitcoin inflows to these desks (down to 90K from the year-to-date average of 189K) are helping to slow the inventory growth. This drop in supply might add upward pressure to Bitcoin’s price if ETF demand holds strong.

Market nerves ahead of the U.S. election

With the U.S. presidential election approaching, Bitcoin is facing market jitters. Trading activity has reached new heights, with open interest hitting records this week. After pushing toward an all-time high of $73,800, Bitcoin stumbled, signaling that market players are feeling the strain. Analysts are now predicting a possible price retracement before any serious gains resume.

Crypto analyst Titan of Crypto spotted a local bottom at $66,200 and questioned if a bounce might follow. His chart showed Ichimoku cloud data for a one-day timeframe, highlighting a price dip below the Tenkan-sen trend line, suggesting Bitcoin could still slide further.

He said, “BTC couldn’t close above Tenkan, signaling a possible more profound pullback. If the breakout is confirmed, we might see a retest of Kijun around $66,200, which could mark a local bottom.”

Bitcoin closed October with a 10% gain, finishing the month above $70,000 for the first time since March. But with the election days away, the market isn’t exactly stable.

Observers note that election uncertainty could trigger volatility in the short term, while Bitcoin’s overall supply-demand dynamics remain bullish. Investors have expressed mixed opinions on how each candidate might impact the industry.

Nic Puckrin, CEO at Coin Bureau, said, “What’s driving price action is undoubtedly the election.” He added, “The markets will take their cue based on who wins the White House. Trump is widely seen as pro-crypto, although irrespective of who wins, Bitcoin is still primed for a pump.”

Election-related tension is amplifying Bitcoin’s typical October-November rally. Historically, these months have been strong for the cryptocurrency, with Bitcoin closing higher in seven of the last eleven Novembers. While investors prepare for post-election swings, some are betting that a Trump win could add 10%–15% to Bitcoin’s price, while a Harris victory might cause a similar-sized dip.

This election season also overlaps with key milestones for Bitcoin. October marked six months since the last halving event, which halved the rate of new Bitcoin issuance. With supply tightening and demand increasing, some analysts believe Bitcoin is on the path to another record, though election volatility might be a stumbling block in the near term.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  Dogecoin

Dogecoin  USDC

USDC  Cardano

Cardano  TRON

TRON  Chainlink

Chainlink  Stellar

Stellar  Hedera

Hedera  Bitcoin Cash

Bitcoin Cash  LEO Token

LEO Token  Litecoin

Litecoin  Cronos

Cronos  Ethereum Classic

Ethereum Classic  Monero

Monero  Dai

Dai  Algorand

Algorand  OKB

OKB  Cosmos Hub

Cosmos Hub  Stacks

Stacks  Theta Network

Theta Network  Gate

Gate  Maker

Maker  Tezos

Tezos  KuCoin

KuCoin  IOTA

IOTA  NEO

NEO  Zcash

Zcash  Polygon

Polygon  Synthetix Network

Synthetix Network  Tether Gold

Tether Gold  TrueUSD

TrueUSD  Dash

Dash  Holo

Holo  Zilliqa

Zilliqa  Enjin Coin

Enjin Coin  0x Protocol

0x Protocol  Basic Attention

Basic Attention  Qtum

Qtum  Siacoin

Siacoin  Ravencoin

Ravencoin  Bitcoin Gold

Bitcoin Gold  Decred

Decred  NEM

NEM  DigiByte

DigiByte  Ontology

Ontology  Nano

Nano  Status

Status  Hive

Hive  Huobi

Huobi  Waves

Waves  Lisk

Lisk  Steem

Steem  Numeraire

Numeraire  Pax Dollar

Pax Dollar  BUSD

BUSD  OMG Network

OMG Network  Ren

Ren  Bitcoin Diamond

Bitcoin Diamond  Bytom

Bytom