Bitcoin mining: hashrate reaches new highs pre-halving

In recent months, the hashrate metric of Bitcoin, which indicates the amount of computational power provided by mining activities, has grown significantly, exceeding the threshold of 700 EH/s shortly before the fourth halving.

So far, despite some small adjustment shocks from miners, who reduce their hash rate waiting for the halving of the cryptographic protocol, the 7-day average hashrate is approaching new all-time highs.

Let’s see everything in detail below.

Summary

- Bitcoin mining: hashrate chart continuously increasing shortly before the halving

- 11 days from the fourth Bitcoin halving

Bitcoin mining: hashrate chart continuously increasing shortly before the halving

The chart of Bitcoin’s total hashrate, which shows the trend of the total amount of hashes per second generated by the mining operators of the cryptographic network, is about to reach a new all-time high.

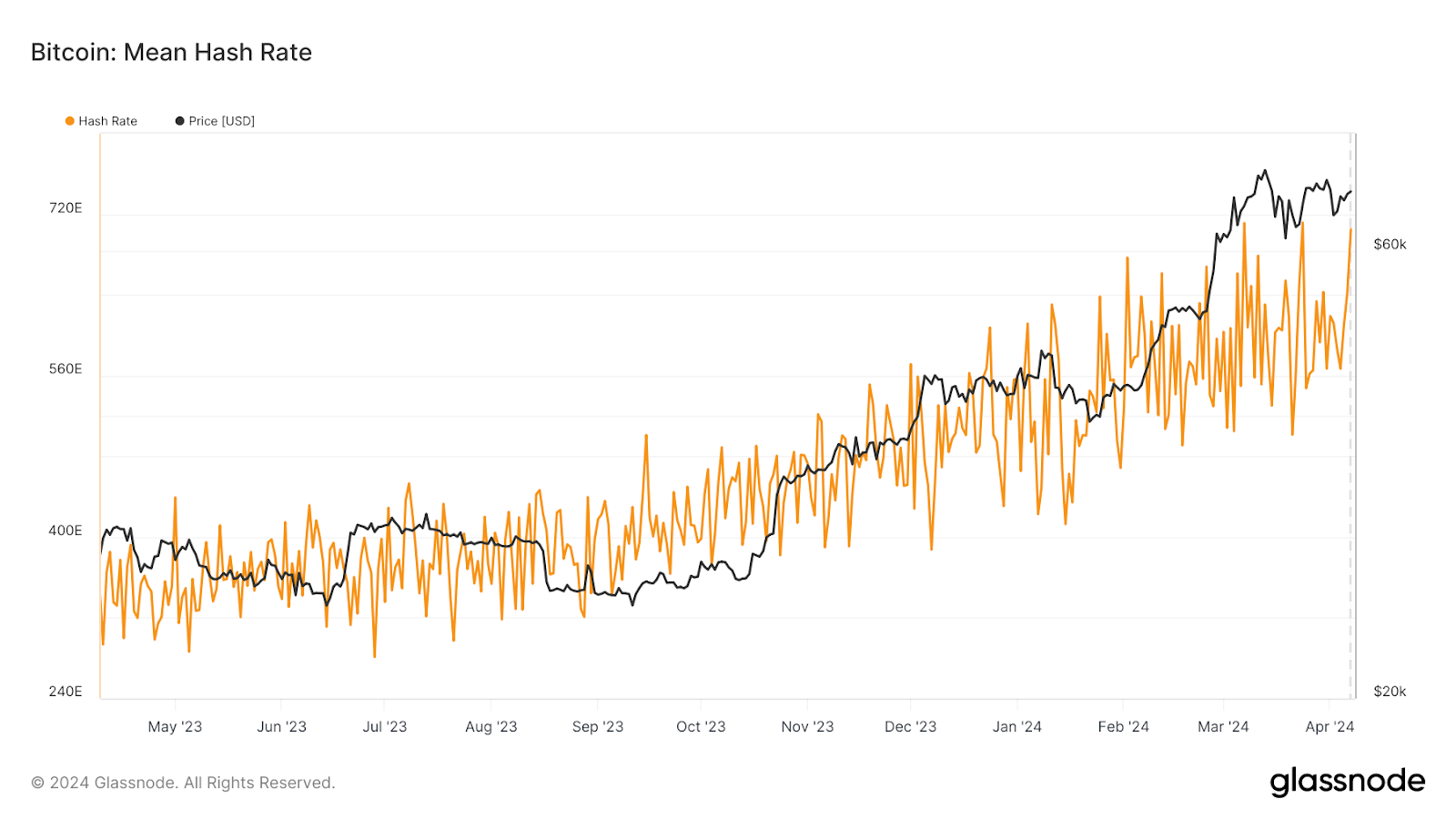

As shown by the on-chain analysis tool Glassnode, the “Mean Hashrate” of the cryptocurrency, which is the 7-day average hashrate, is almost at a new ATH totaling 704.8 EH/s.

On March 7th and March 24th, the network recorded slightly higher values than the current ones, which could however be broken very soon.

Despite in recent days some miners have reduced their computational power in preparation for the Bitcoin halving event, which as an event halves their income from solving blocks, we can see how generally the hashrate continues to grow.

Just think that just a year ago the metric was below 400 EH/s, about 40% less than today.

In the midst of the general growth of the computational power of the network, there are those who think of further increasing their quantity of hashes, accumulating as many BTC as possible in anticipation of a future appreciation of the cryptocurrency.

For example, the Buddhist Kingdom of Bhutan, located near the eastern Himalayas, has recently planned to expand its mining production powered by hydroelectric energy by 6 times, reaching 600 MW.

In the specific case of this South Asian reality, we can say that the presence of renewable energy sources helps miners save a lot of money, putting them in a privileged position compared to all other operators who use electricity.

Despite the imminent halving of the protocol, with the production of new BTC effectively halved, the Kingdom of Bhutan believes in the future of cryptocurrency and seeks to accumulate as much as possible through digital mining.

In case you’re wondering why #Bitcoin hashrate keeps going up. https://t.co/UCjoYHot1n

— Samson Mow (@Excellion) April 5, 2024

11 days from the fourth Bitcoin halving

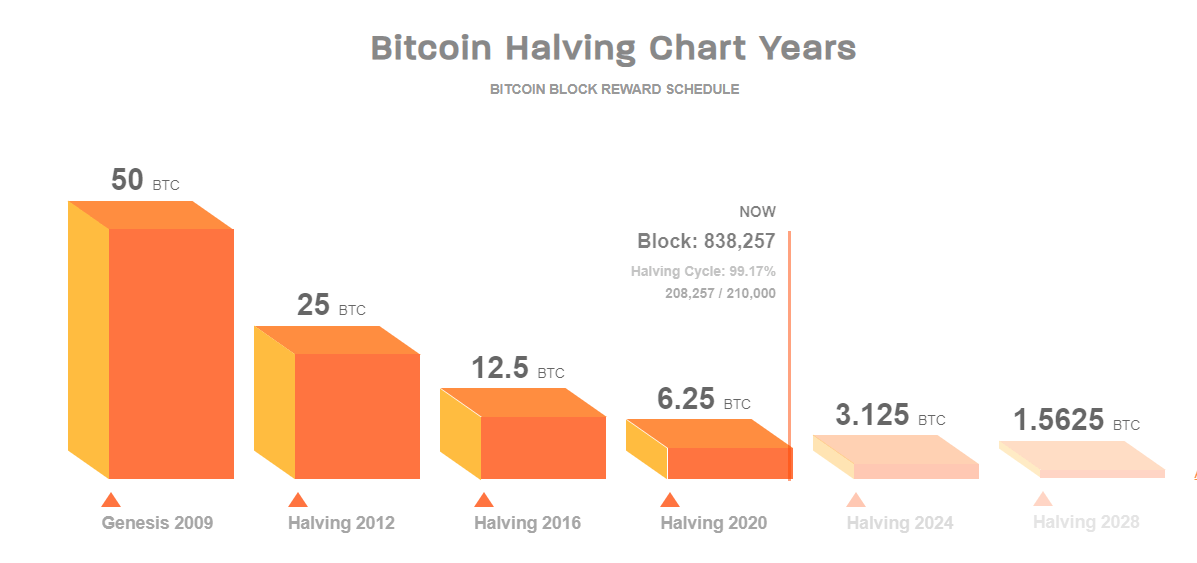

As mentioned, bitcoin miners are gearing up for the fourth halving in the history of the decentralized protocol that will halve the block reward from the current 6.25 BTC to 3.125 BTC for each solved block.

This means that miners, excluding transaction fees earnings, earned exactly half in terms of satoshi.

This mechanism helps reduce the emission of new coins, pushing up the price of the cryptographic asset if there is the same pre-halving demand on the market.

At the time of writing the article there are about 11 days, or rather 1,743 blocks, left until the much anticipated halving that will occur exactly at block height 840,000.

The expected time is approximately at 07:30 pm UTC, but it may vary slightly if the average resolution time of the miners were to change in these days.

In preparation for the network’s halving, many companies that offer services related to the world of Bitcoin mining are thinking of innovative solutions to minimize the economic impact of the reduction in block reward on their finances.

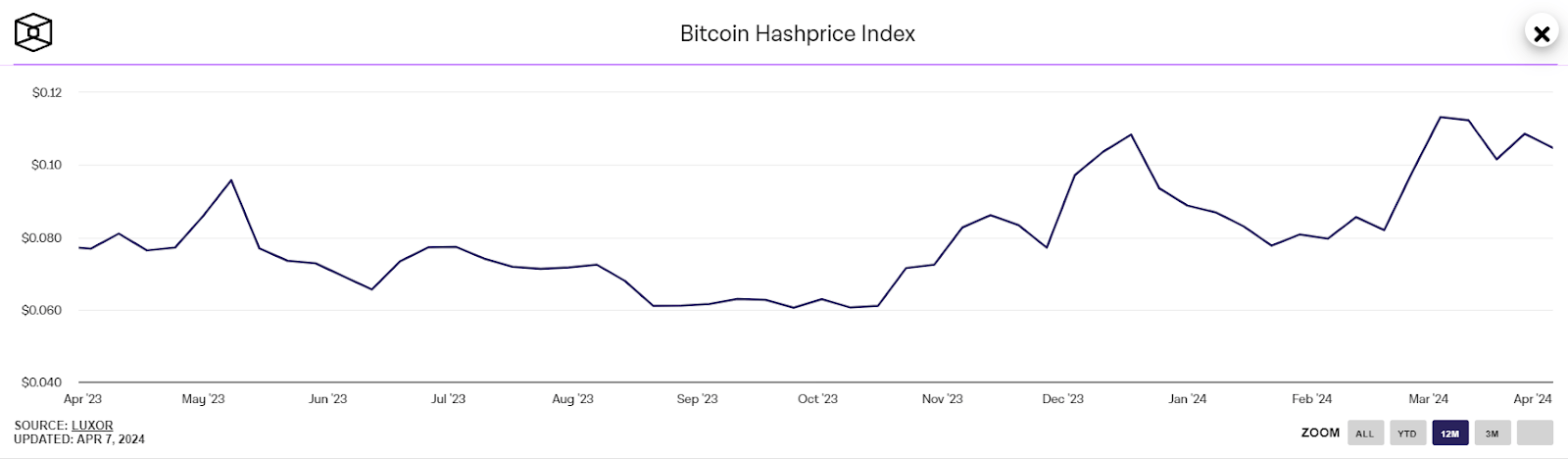

One of these, Luxor Technology recently collaborated with the cryptographic derivatives company Bitnomial to try to offer a form of hedging to miners in order to cover the risk of halving revenues.

The idea is based on the creation of an ETF futures based on the price of the network’s hash (hashprice), so that miners can short the instrument with a portion of their earnings.

The product will be regulated on the stock exchange rather than in OTC forms, ensuring more liquidity and greater security for operators involved in the buying and selling of this asset.

Hashprice saw a -9% decline over the past 2 days.

Hashprice could go even lower heading into the halving.

However, #Bitcoin miners using Luxor’s Hashrate Forward Marketplace are protected against short term volatility. 🛡️⛏️ pic.twitter.com/sdpAih6CFD

— Luxor Technology 🟧⛏️ (@LuxorTechnology) April 2, 2024

Beyond all these hedging techniques to reduce the risk of mining experts, we point out that exactly one year ago the hashprice (1 TH/s) was about 0.07 dollars while today it stands at 0.1 dollars.

This means that despite the increase in hashrate and competition within the network, miners are still able to be profitable and carry out their activities without particularly fearing the advent of the halving.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  Dogecoin

Dogecoin  USDC

USDC  Cardano

Cardano  TRON

TRON  Chainlink

Chainlink  Stellar

Stellar  Hedera

Hedera  Bitcoin Cash

Bitcoin Cash  LEO Token

LEO Token  Litecoin

Litecoin  Cronos

Cronos  Ethereum Classic

Ethereum Classic  Monero

Monero  Dai

Dai  Algorand

Algorand  OKB

OKB  Cosmos Hub

Cosmos Hub  Stacks

Stacks  Theta Network

Theta Network  Gate

Gate  Maker

Maker  KuCoin

KuCoin  Tezos

Tezos  IOTA

IOTA  NEO

NEO  Polygon

Polygon  Zcash

Zcash  Synthetix Network

Synthetix Network  Tether Gold

Tether Gold  TrueUSD

TrueUSD  Dash

Dash  Holo

Holo  Zilliqa

Zilliqa  Enjin Coin

Enjin Coin  0x Protocol

0x Protocol  Qtum

Qtum  Basic Attention

Basic Attention  Siacoin

Siacoin  Ravencoin

Ravencoin  Bitcoin Gold

Bitcoin Gold  Decred

Decred  NEM

NEM  DigiByte

DigiByte  Ontology

Ontology  Nano

Nano  Status

Status  Huobi

Huobi  Hive

Hive  Lisk

Lisk  Waves

Waves  Numeraire

Numeraire  Steem

Steem  Pax Dollar

Pax Dollar  BUSD

BUSD  OMG Network

OMG Network  Ren

Ren  Bitcoin Diamond

Bitcoin Diamond  Bytom

Bytom