Bitcoin outperforms during periods of monetary expansion

Bitcoin (BTC) thrives during periods of monetary expansion, outperforming other assets. As BTC heads into a year of lower Fed rates, monetary policy may add to its performance.

Bitcoin (BTC) may have favorable support from a more dovish Fed, as the asset thrives during periods of monetary expansion and low interest rates. After the latest Fed rate cut by a quarter point to 4.5-4.75 range, BTC started its post-election rally, retesting all-time high prices several times in the span of a day.

A day after the rate cut, BTC rallied again during US trading hours, breaking into price discovery above $77,252,77, one of the series of all-time highs. Although the November 7 rate cut was expected, BTC still added the factor to its latest bullish move.

BTC also relies on liquidity internal to the crypto world, based on stablecoin inflows and highly active trading pairs. However, increased money supply may bring back retail buying and institutions looking for the chance of price discovery and outperformance.

The rate cut was among many factors affecting the price, but monetary policy and money supply may be factors for BTC to perform in the final months of 2024 and into 2025.

Fed’s Chair Jerome Powell already signaled the rate cuts may not be as steep and rapid as during the 2020 pandemic. Due to a recovering economy, the Fed may cut rates gradually, with a 3.25% target by the end of 2025. As BTC already makes forays into mainstream finance, the rate cuts may act as a background factor to price appreciation.

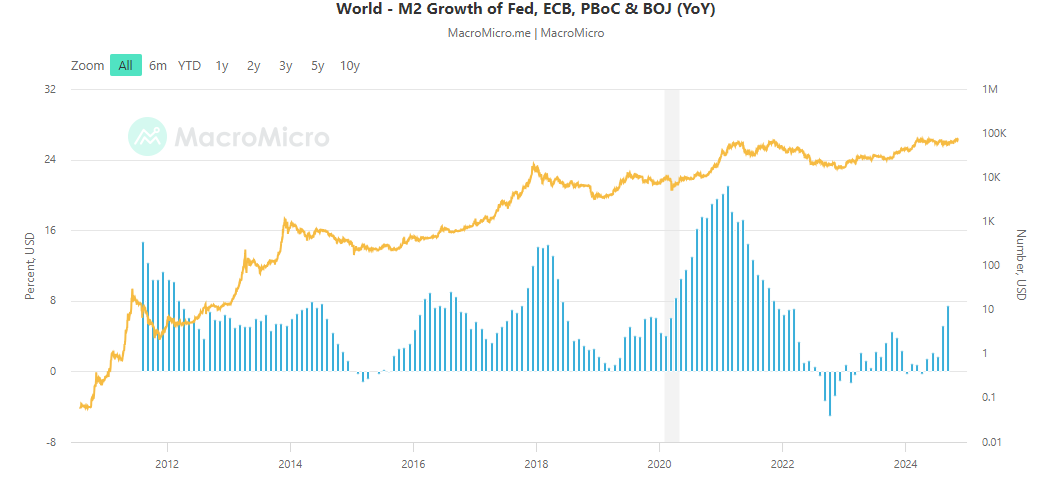

In the case of a longer period of monetary expansion, where liquidity flows into all assets, BTC outperforms the stock market by 4x and gold by as much as 20x, shows research by Coinrank. The exact timing and duration of the BTC rally may differ, and the price action may lag between the interest rate cuts and M2 expansion.

Bitcoin (BTC) rallies as a lagging indicator following periods of M2 expansion. | Source: MacroMicro

BTC may retain its correlation with gold, as in the case of gold, but still retain its faster mechanisms for price discovery and outperform in the short term.

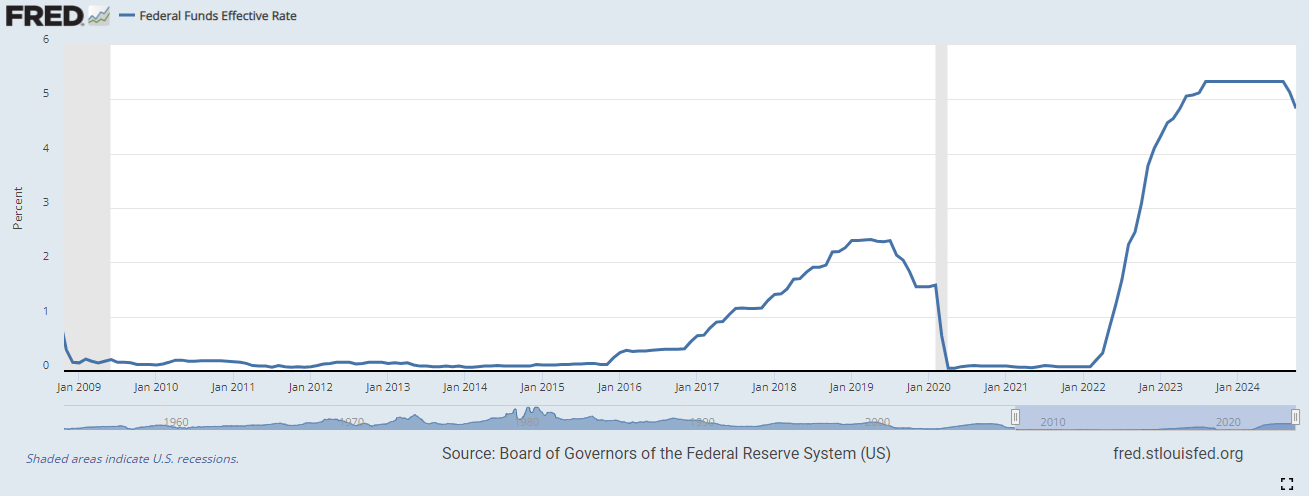

BTC emerged in a low interest rate environment

The first dramatic bull market for BTC in fact happened after a series of rate hikes, which were meant to curb the liquidity expansion from 2008 to 2014. The 2008 financial crisis, which helped spawn BTC, also led to a long period of extremely low rates. Later rallies coincided with much more dynamic Fed policies and shifts in solutions to inflation or recession threats.

BTC is now preparing to enter a period of rate cuts, as well as a new expansion cycle of M2 money supply worldwide. Expansions in the M2 money supply precede BTC rallies by weeks to months.

BTC has reacted to rate cuts in the past. Its first few years of growth coincided with a long streak of low interest rates worldwide. Between 2020 and 2024, BTC grew in a climate of rock-bottom rates. However, this did not prevent BTC from also rising during the latest series of rate hikes.

Bitcoin’s development happened during years with extremely low Fed rates. | Source: FRED Economic Data

In October, BTC was also tightly correlated to equity index S&P500. BTC can behave both as a risk-on asset, tracking general economic expansion, and return to its basic function as a tool against money debasement and inflation. BTC works as an inflation hedge due to its potential for outperforming other assets but is not a safe haven, due to unexpected crashes and drawdowns.

On the positive side, access to easier liquidity at a lower rate may raise demand for investments. BTC already has the potential to absorb mainstream buying through one of its ETFs.

On the downside, multiple crypto projects are holding T-Bills as their reserves and may see their revenues decrease with lower interest rates.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  Dogecoin

Dogecoin  Cardano

Cardano  TRON

TRON  Chainlink

Chainlink  Bitcoin Cash

Bitcoin Cash  LEO Token

LEO Token  Litecoin

Litecoin  Dai

Dai  Monero

Monero  Ethereum Classic

Ethereum Classic  Stellar

Stellar  Cronos

Cronos  Stacks

Stacks  OKB

OKB  Hedera

Hedera  Cosmos Hub

Cosmos Hub  Maker

Maker  KuCoin

KuCoin  Theta Network

Theta Network  Gate

Gate  Algorand

Algorand  Polygon

Polygon  NEO

NEO  EOS

EOS  Zcash

Zcash  Tezos

Tezos  Tether Gold

Tether Gold  Synthetix Network

Synthetix Network  TrueUSD

TrueUSD  IOTA

IOTA  Bitcoin Gold

Bitcoin Gold  Holo

Holo  Dash

Dash  0x Protocol

0x Protocol  Zilliqa

Zilliqa  Siacoin

Siacoin  Enjin Coin

Enjin Coin  Ravencoin

Ravencoin  Qtum

Qtum  Basic Attention

Basic Attention  Decred

Decred  Ontology

Ontology  NEM

NEM  Lisk

Lisk  Nano

Nano  Numeraire

Numeraire  Pax Dollar

Pax Dollar  Waves

Waves  DigiByte

DigiByte  Status

Status  Hive

Hive  Huobi

Huobi  Steem

Steem  BUSD

BUSD  Ren

Ren  OMG Network

OMG Network  Bitcoin Diamond

Bitcoin Diamond  Bytom

Bytom  Kyber Network Crystal Legacy

Kyber Network Crystal Legacy  HUSD

HUSD