Bitcoin Poised for Breakout as Short Liquidations Hit $9 Billion in Massive Market Shift

- Bitcoin funding rates have turned negative, signaling more shorts than longs, which often precedes an uptrend reversal.

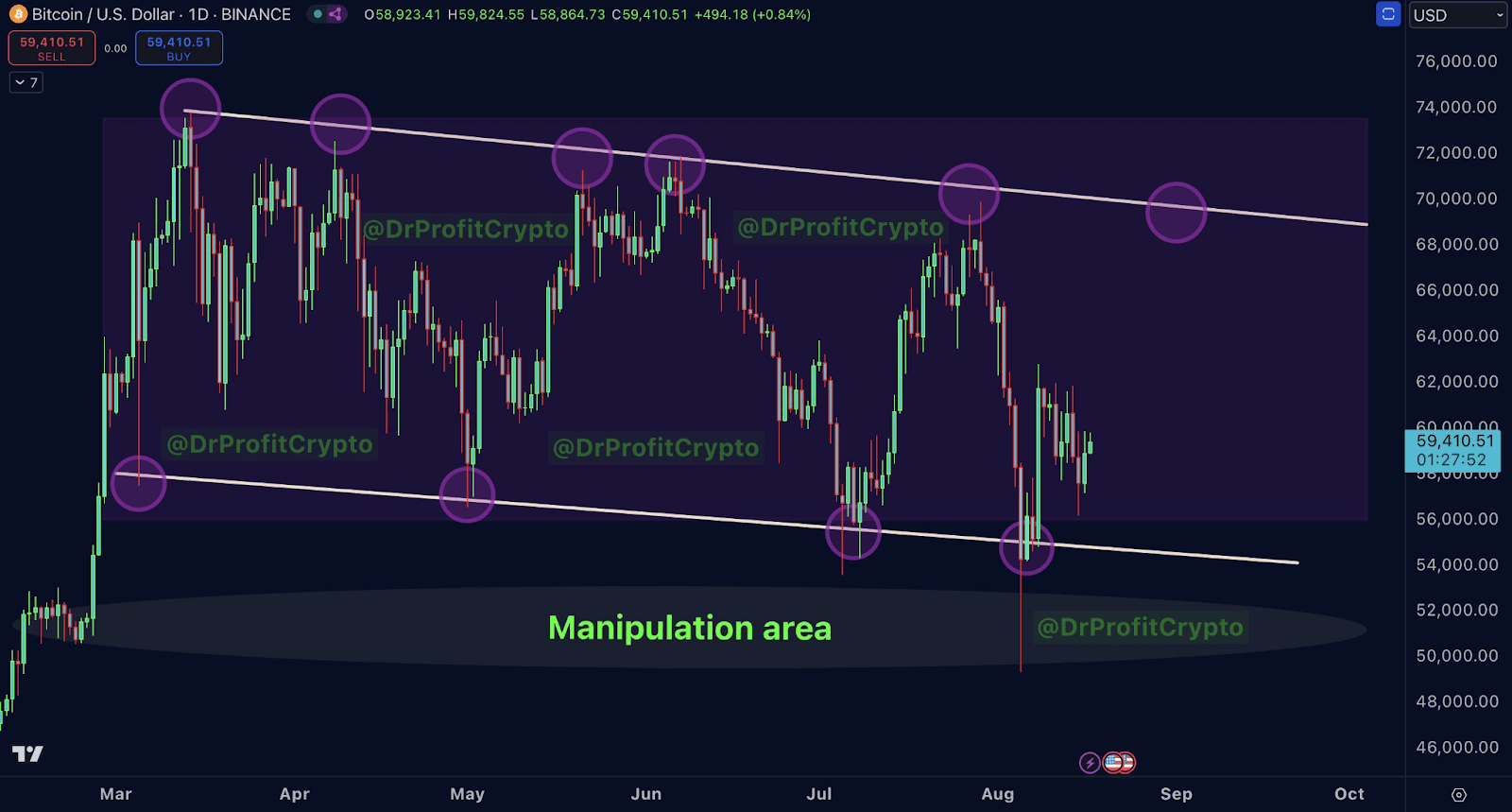

- Traders eye the $54,000 to $55,000 zone for accumulation as Bitcoin fluctuates within a descending channel with strong support and resistance.

- The potential breakout above the descending channel could ignite Bitcoin’s next major price surge, creating valuable buying opportunities.

A recent analysis of Bitcoin’s market performance by crypto analyst Doctor Profit suggests a substantial shift in favor of a healthier market. Traders have witnessed major developments, with $9 billion in short liquidations occurring near $68,000 and funding rates reaching their lowest point since October 2023.

#Bitcoin – What’s Next?

The big Sunday report, all you need to know:

🚩 TA/LCA/Psychological Breakdown: This week has delivered a massive shift in favor of a healthy market! Since 50k, I’ve been telling you to buy the crash and add on every dip. The market won’t wait! And a lot… pic.twitter.com/UOXCsT1rJd

— Doctor Profit 🇨🇭 (@DrProfitCrypto) August 18, 2024

Notably, funding rates have turned negative, indicating that the market is now flooded with more shorts than longs. Doctor Profit noted that this setup often leads to an uptrend reversal, driven by market makers capitalizing on liquidity.

Descending Channel Confirms Critical Support and Resistance Levels

Bitcoin’s price action continues to fluctuate within a downward-sloping channel, marked by two key trendlines, one acting as resistance and the other as support. The price has repeatedly tested both levels, reinforcing their significance.

Each interaction with these trendlines highlights the importance of these levels in determining future movements. Traders have been taking note of this repetitive behavior, finding potential entry points near the lower support while watching for possible breakouts at the upper resistance.

Additionally, Doctor Profit’s observation suggests that the “manipulation area” near $54,000 may see heightened volatility. This zone represents the lower boundary of the channel, and the potential for exaggerated price movements creates uncertainty in this area. Notably, despite the bearish trend implied by the channel, a breakout could signal a reversal, which many traders are positioning for.

Strategic Outlook on Bitcoin’s Future Movements

Doctor Profit has outlined a strategy that remains focused on accumulation during price dips. As Bitcoin continues its sideways movement, traders are positioning for potential squeezes on shorts, especially given the substantial liquidation levels.

The strategy involves taking advantage of dips, particularly in the $54,000 to $55,000 range, which Doctor Profit believes could serve as a crucial area for orders. As the market continues to consolidate, these dips may provide valuable buying opportunities. The chart structure supports the strategy of accumulation as a potential breakout above the descending channel could trigger the next major price surge.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  Dogecoin

Dogecoin  USDC

USDC  Cardano

Cardano  TRON

TRON  Chainlink

Chainlink  Stellar

Stellar  Hedera

Hedera  Bitcoin Cash

Bitcoin Cash  LEO Token

LEO Token  Litecoin

Litecoin  Cronos

Cronos  Ethereum Classic

Ethereum Classic  Monero

Monero  Dai

Dai  Algorand

Algorand  OKB

OKB  Cosmos Hub

Cosmos Hub  Stacks

Stacks  Theta Network

Theta Network  Gate

Gate  Maker

Maker  KuCoin

KuCoin  Tezos

Tezos  IOTA

IOTA  NEO

NEO  Polygon

Polygon  Zcash

Zcash  Synthetix Network

Synthetix Network  Tether Gold

Tether Gold  TrueUSD

TrueUSD  Dash

Dash  Holo

Holo  Zilliqa

Zilliqa  0x Protocol

0x Protocol  Enjin Coin

Enjin Coin  Qtum

Qtum  Siacoin

Siacoin  Basic Attention

Basic Attention  Bitcoin Gold

Bitcoin Gold  Ravencoin

Ravencoin  Decred

Decred  NEM

NEM  Ontology

Ontology  DigiByte

DigiByte  Nano

Nano  Hive

Hive  Status

Status  Huobi

Huobi  Lisk

Lisk  Waves

Waves  Steem

Steem  Numeraire

Numeraire  Pax Dollar

Pax Dollar  BUSD

BUSD  OMG Network

OMG Network  Ren

Ren  Bitcoin Diamond

Bitcoin Diamond  Bytom

Bytom