Bitcoin Price Analysis: BTC Is on its Way to $60K and $64K if it Remains Above This Level

Bitcoin’s price has been consolidating below the $60K level over the last few weeks.

However, things might be about to change soon as the asset flew to an 8-day peak of almost $58,500 earlier today.

Technical Analysis

By Edris Derakhshi

The Daily Chart

On the Daily chart, the price has recently rebounded from the $52K support level and has broken back above the $57K mark. Currently, the market is likely to rise toward the $60K resistance level in the coming days.

Meanwhile, the RSI is also climbing above the 50% threshold, which would point to a potential uptrend in the short-term.

The 4-Hour Chart

The 4-hour chart also demonstrates a classical bullish price action pattern. The market has been declining in a descending channel. However, it has recently broken above it.

Based on classical price action, this pattern will result in a bullish rally, which could lead to an uptrend toward the $60K and even the $64K levels. Yet, the price must hold above the $57K support level for this scenario to be valid.

On-Chain Analysis

By Edris Derakhshi

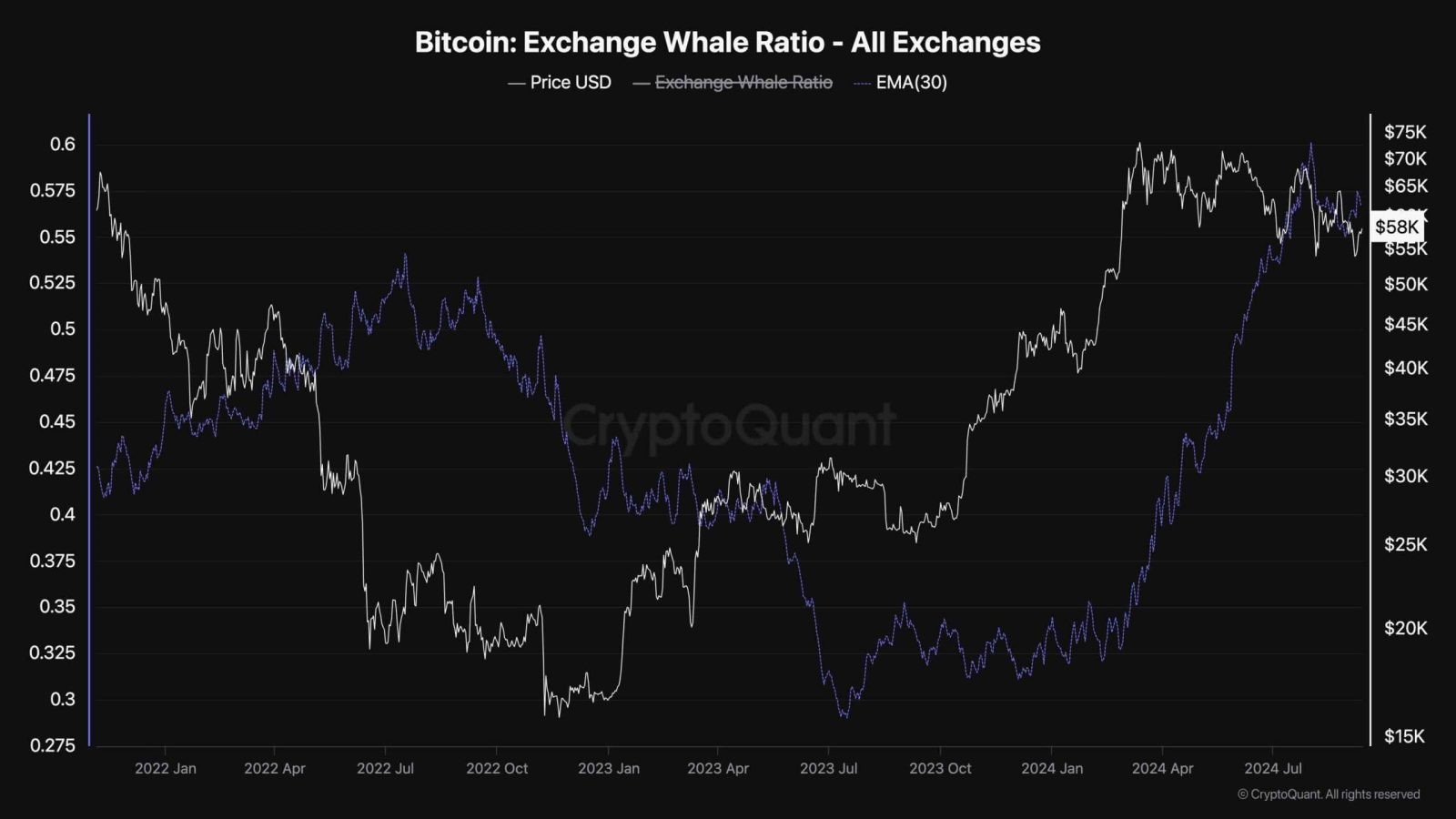

Bitcoin Exchange Whale Ratio

While bitcoin’s price has been going through a frustrating consolidation, the underlying market dynamics have changed significantly. Therefore, on-chain metrics can yield beneficial results.

This chart demonstrates the Bitcoin Exchange Whale Ratio, a metric for measuring the ratio of large transactions compared to overall deposits to the exchanges.

As the chart suggests, the Exchange Whale Ratio metric has been rapidly surging during the recent consolidation. This indicates that many large transactions are happening, as some market participants are distributing their BTC while others are accumulating. While the effects of this shift on the price remain to be seen, a significant price move is probable.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  Dogecoin

Dogecoin  USDC

USDC  Cardano

Cardano  TRON

TRON  Bitcoin Cash

Bitcoin Cash  Chainlink

Chainlink  LEO Token

LEO Token  Litecoin

Litecoin  Cronos

Cronos  Stellar

Stellar  Ethereum Classic

Ethereum Classic  Dai

Dai  Stacks

Stacks  Monero

Monero  OKB

OKB  Hedera

Hedera  Cosmos Hub

Cosmos Hub  Algorand

Algorand  Theta Network

Theta Network  Maker

Maker  KuCoin

KuCoin  Gate

Gate  EOS

EOS  Polygon

Polygon  NEO

NEO  Tezos

Tezos  Tether Gold

Tether Gold  Zcash

Zcash  Bitcoin Gold

Bitcoin Gold  IOTA

IOTA  TrueUSD

TrueUSD  Synthetix Network

Synthetix Network  Holo

Holo  Zilliqa

Zilliqa  Dash

Dash  0x Protocol

0x Protocol  Qtum

Qtum  Siacoin

Siacoin  Ravencoin

Ravencoin  Basic Attention

Basic Attention  Enjin Coin

Enjin Coin  Decred

Decred  Ontology

Ontology  NEM

NEM  Lisk

Lisk  Status

Status  DigiByte

DigiByte  Waves

Waves  Nano

Nano  Pax Dollar

Pax Dollar  Numeraire

Numeraire  Hive

Hive  Steem

Steem  Huobi

Huobi  BUSD

BUSD  Ren

Ren  OMG Network

OMG Network  Bitcoin Diamond

Bitcoin Diamond  Bytom

Bytom  Kyber Network Crystal Legacy

Kyber Network Crystal Legacy