Bitcoin Price Analysis: The Reason Behind BTC’s Crash to $60K Today

Bitcoin’s price is currently trending down as a result of the potential war brewing in the Middle East. A key level is lost, which could lead to a further decline in the short term.

Technical Analysis

By Edris Derakhshi (TradingRage)

The Daily Chart

In the daily timeframe, the BTC price dropped below the key $64K mark and the 200-day moving average, which is located around the same price mark. Currently, the $60K support level remains intact, as investors remain hopeful that this decline is a temporary pullback.

However, with the RSI also showing values slightly below 50%, the momentum is shifting bearish, and a move lower toward $56K remains a possibility.

The 4-Hour Chart

The 4-hour chart demonstrates a clear bearish shift in market structure in terms of classical price action. The market has decisively broken an important bullish trendline to the downside. Yet, the price bounced from the $60K level, as the RSI has also shown an oversold state in momentum.

Meanwhile, a complete rebound is still less probable, as the market structure suggests a deeper correction toward the $57K level is more likely. This scenario would, of course, fail if the price somehow climbs back above the $64K level soon.

On-Chain Analysis

By Edris Derakhshi (TradingRage)

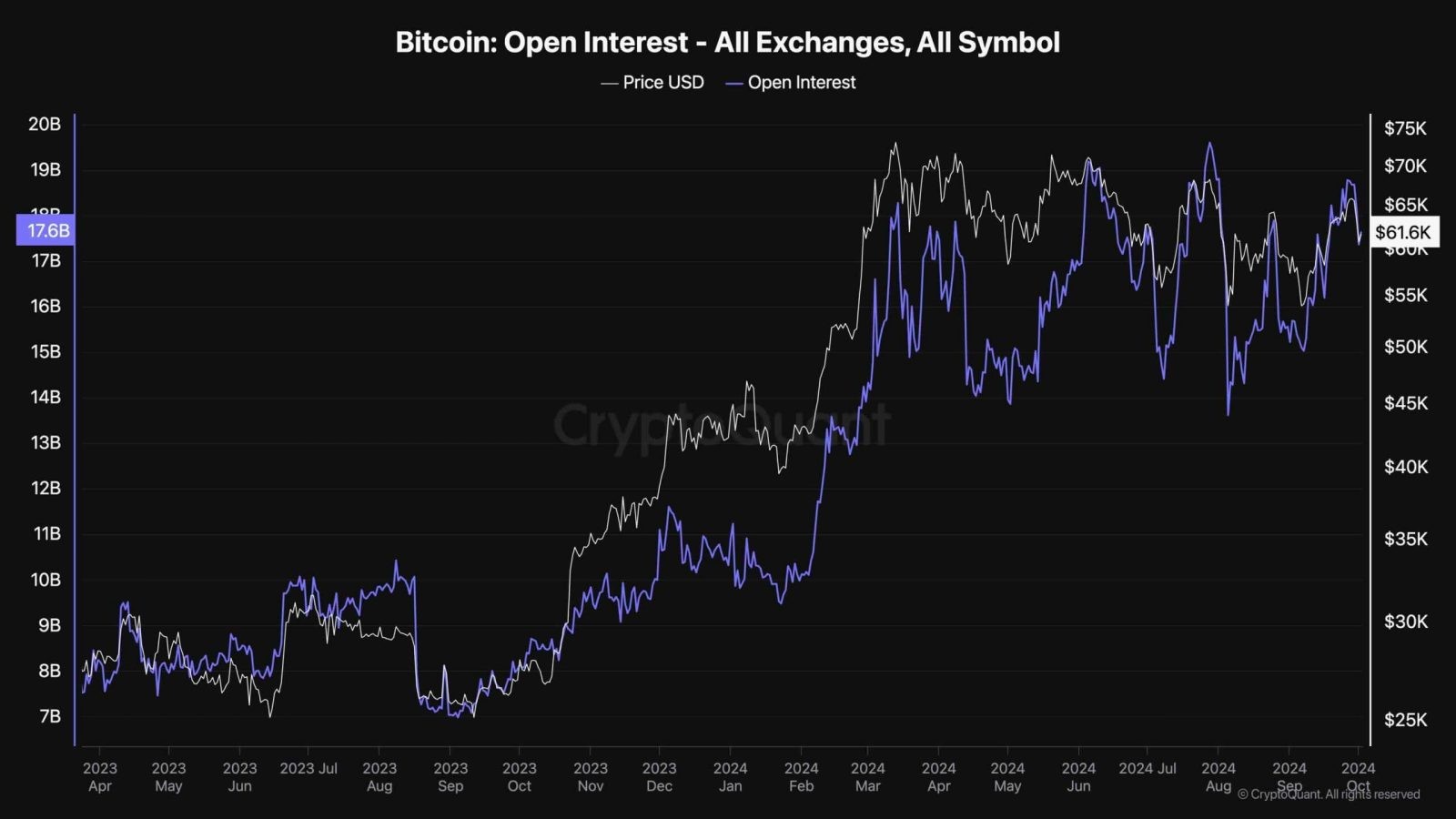

Bitcoin Open Interest

While Bitcoin’s price has been dropping over the past few days, future market sentiment metrics are still overheated.

This chart presents the BTC open interest, which shows the number of open perpetual futures positions, both bullish and bearish.

As the recent drop suggests, the minimal decline in open interest indicates that a long liquidation cascade has not occurred yet. A capitulation event would be highly probable in the event of a further price decline, which could lead to a rapid market crash and push the price even lower toward the $50K area.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  Dogecoin

Dogecoin  USDC

USDC  Cardano

Cardano  TRON

TRON  Chainlink

Chainlink  Stellar

Stellar  Hedera

Hedera  Bitcoin Cash

Bitcoin Cash  LEO Token

LEO Token  Litecoin

Litecoin  Cronos

Cronos  Ethereum Classic

Ethereum Classic  Monero

Monero  Dai

Dai  Algorand

Algorand  OKB

OKB  Cosmos Hub

Cosmos Hub  Stacks

Stacks  Theta Network

Theta Network  Gate

Gate  Maker

Maker  Tezos

Tezos  KuCoin

KuCoin  IOTA

IOTA  NEO

NEO  Zcash

Zcash  Polygon

Polygon  Synthetix Network

Synthetix Network  Tether Gold

Tether Gold  TrueUSD

TrueUSD  Dash

Dash  Holo

Holo  Zilliqa

Zilliqa  Enjin Coin

Enjin Coin  0x Protocol

0x Protocol  Qtum

Qtum  Basic Attention

Basic Attention  Siacoin

Siacoin  Ravencoin

Ravencoin  Bitcoin Gold

Bitcoin Gold  Decred

Decred  NEM

NEM  DigiByte

DigiByte  Ontology

Ontology  Nano

Nano  Hive

Hive  Waves

Waves  Status

Status  Huobi

Huobi  Lisk

Lisk  Numeraire

Numeraire  Steem

Steem  Pax Dollar

Pax Dollar  BUSD

BUSD  OMG Network

OMG Network  Ren

Ren  Bitcoin Diamond

Bitcoin Diamond  Bytom

Bytom