Bitcoin Price Forecast: Reports show increasing presence of institutional investors

Bitcoin price today: $67,000

- Bitcoin bounces off the $66,000 level, with a possible recovery on the cards.

- Glassnode weekly report highlights an increasing presence of institutional investors in the digital asset space.

- BTC Futures Open Interest recorded a new ATH of $32.9 billion, indicating an influx of capital.

Bitcoin (BTC) bounced back to trade slightly above $67,000 on Thursday after three consecutive days of decline since Monday. Reports indicate a growing presence of institutional investors in the digital asset space, as evidenced by the new all-time high in Futures Open Interest, which suggests optimism for Bitcoin’s price outlook.

Bitcoin short-term holders keep betting on BTC

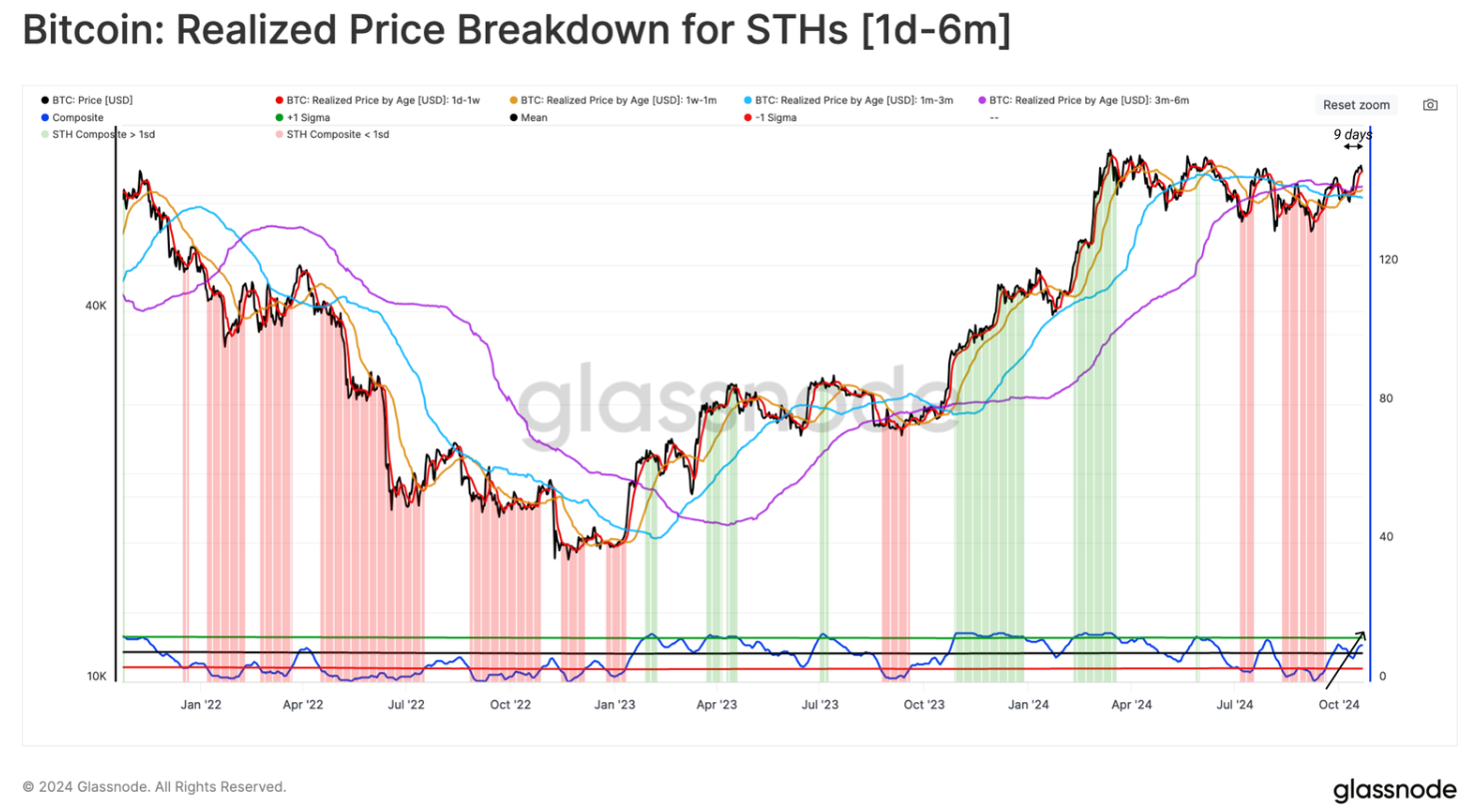

Glassnode weekly report highlights the unrealized profits of the short-term holder cohort, a metric that serves as a key indicator of the sentiment among recent buyers in the market.

The spot price trades above the average acquisition price of all short-term holders sub-age groups, as shown in the graph below. This means almost all recent buyers hold an unrealized profit, highlighting the relief that the recent rally has provided to investors.

Bitcoin Realized Price Breakdown for STHs chart. Source: Glassnode

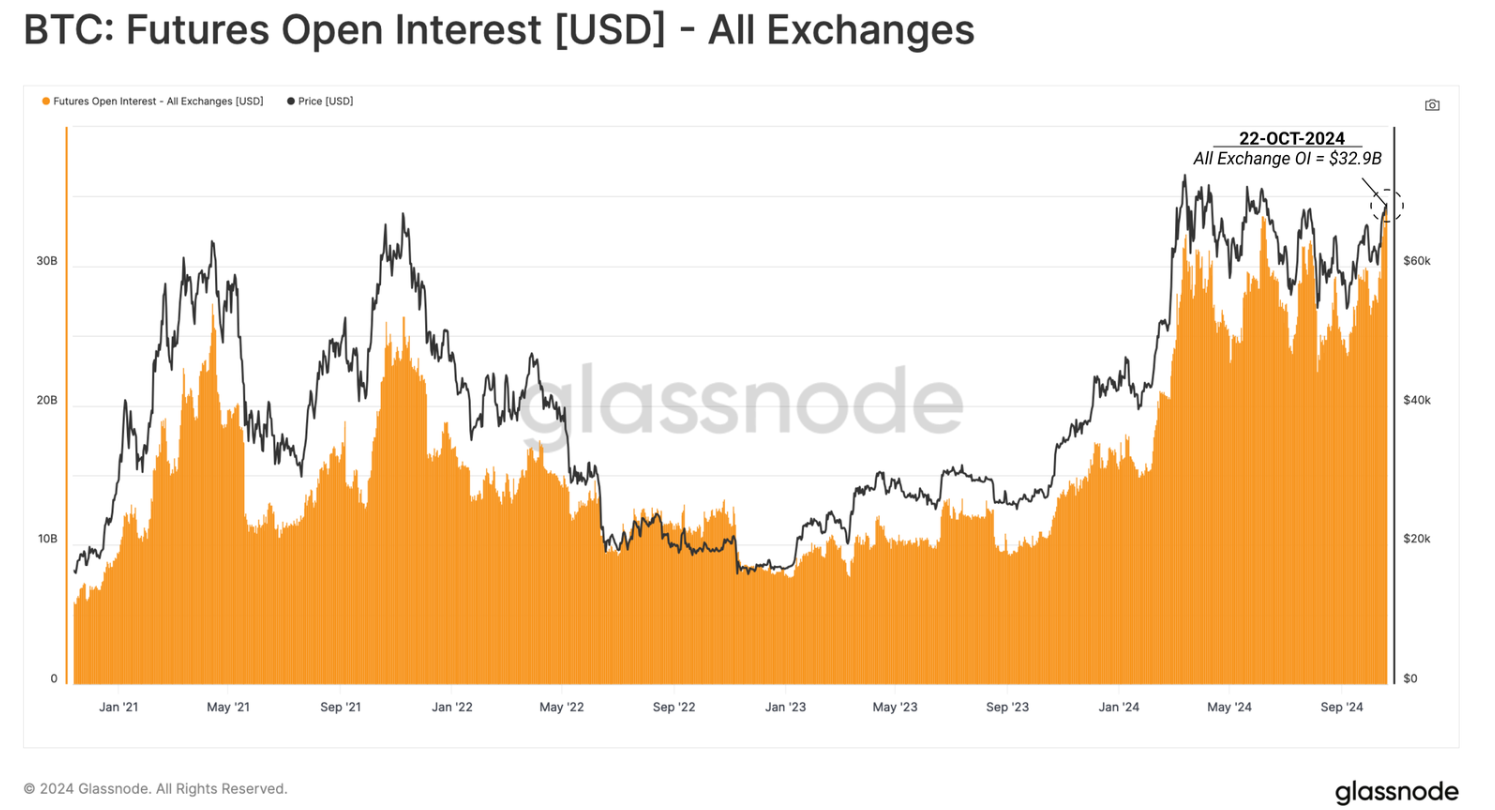

The report also explains that Open Interest (OI) across both perpetual and fixed-term futures contracts has recorded a new all-time high (ATH) of $32.9 billion this week, suggesting a marked increase in aggregate leverage entering the system.

BTC Futures Open Interest chart. Source: Glassnode

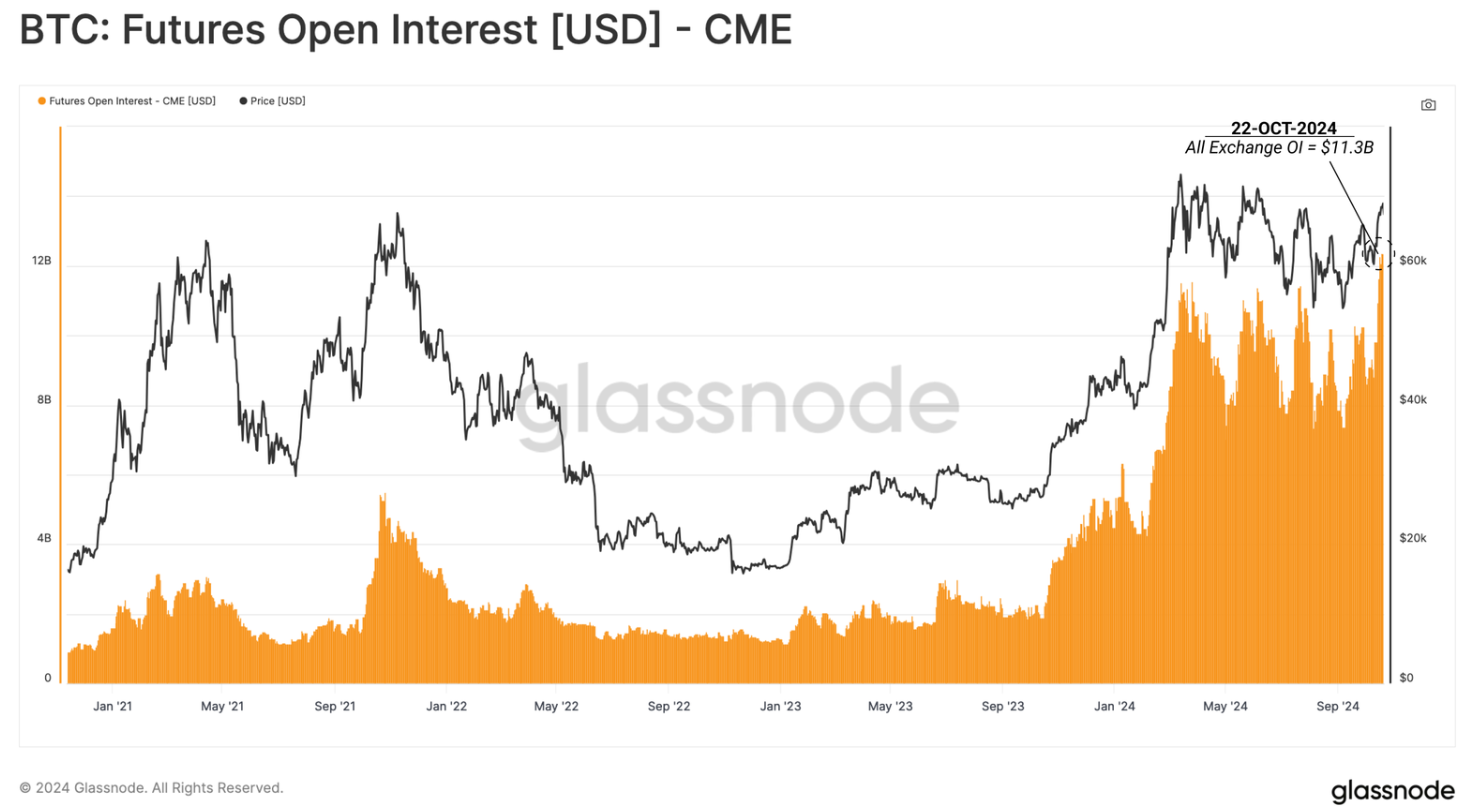

“The dominance of the CME Group exchange highlights an increasing presence of institutional investors in the digital asset space, which strongly indicates that a cash-and-carry strategy is in play,” the report says.

BTC CME chart. Source: Glassnode

Bitcoin Price Forecast: Small bounce

Bitcoin price declined for a third consecutive day on Wednesday, falling below $66,000 and reaching a daily low of $65,260 after encountering resistance near the key psychological level of $70,000 on Monday. However, it rebounded after retesting its support level of $66,000 and is trading slightly above $67,000 on Thursday.

If the $66,000 level holds as support, it could rally to reclaim its Monday high of $69,519.

The Relative Strength Index (RSI) indicator on the daily chart reads 58 and points downwards after rejecting the overbought level of 70, indicating weakness in bullish momentum. If it continues to decline and closes below its neutral level of 50, it could lead to a sharp decline in Bitcoin’s price.

BTC/USDT daily chart

Conversely, if BTC breaks and closes below $66,000 support, it could decline 5.8% to retest its next support at $62,055, its 61.8% Fibonacci retracement level (drawn from July’s high of $70,079 to August’s low of $49,072).

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  Dogecoin

Dogecoin  TRON

TRON  Cardano

Cardano  Bitcoin Cash

Bitcoin Cash  Chainlink

Chainlink  LEO Token

LEO Token  Litecoin

Litecoin  Dai

Dai  Monero

Monero  Stellar

Stellar  Ethereum Classic

Ethereum Classic  Stacks

Stacks  OKB

OKB  Cronos

Cronos  Hedera

Hedera  Cosmos Hub

Cosmos Hub  Gate

Gate  KuCoin

KuCoin  Theta Network

Theta Network  Maker

Maker  Algorand

Algorand  Polygon

Polygon  Tether Gold

Tether Gold  NEO

NEO  EOS

EOS  Tezos

Tezos  Zcash

Zcash  TrueUSD

TrueUSD  Synthetix Network

Synthetix Network  Bitcoin Gold

Bitcoin Gold  IOTA

IOTA  Holo

Holo  Dash

Dash  Zilliqa

Zilliqa  Siacoin

Siacoin  0x Protocol

0x Protocol  Ravencoin

Ravencoin  Basic Attention

Basic Attention  Enjin Coin

Enjin Coin  Qtum

Qtum  Decred

Decred  Ontology

Ontology  NEM

NEM  Lisk

Lisk  Pax Dollar

Pax Dollar  Nano

Nano  Numeraire

Numeraire  Waves

Waves  Status

Status  DigiByte

DigiByte  Huobi

Huobi  Hive

Hive  Steem

Steem  BUSD

BUSD  Ren

Ren  OMG Network

OMG Network  Bitcoin Diamond

Bitcoin Diamond  Bytom

Bytom  Kyber Network Crystal Legacy

Kyber Network Crystal Legacy  HUSD

HUSD  Energi

Energi