Bitcoin Price Prediction as ‘Buy The Dip’ Sentiment Floats It Above $43K – Can It Sustain the Momentum?

In the realm of Bitcoin price prediction, the premier digital currency recently saw a dip below the $43,000 mark, impacted by a downturn in the US stock market and Coinbase shares’ performance.

Despite these headwinds, Bitcoin demonstrated resilience, buoyed by a ‘buy the dip’ sentiment among investors, and managed to stay above $42,000.

A fascinating data for #Bitcoin bulls.

Bitcoin balance on exchanges is at the lowest point (yellow) despite #BTC trading above 42K.

Why

Whales storing their BTC in cold wallets and expecting hire price in future with #ETFs on hand.

I personally don’t think #BTC will get… pic.twitter.com/7QMtkeWcH9

— Zia ul Haque (@ImZiaulHaque) February 6, 2024

This steadiness persists despite rising US Treasury bond yields and comments from Federal Reserve Chair Jerome Powell, which moderated expectations for a March rate cut.

Amid these economic indicators, influential figures like Cathie Wood offer their outlook on Bitcoin, while regulatory changes in Hong Kong signal potential shifts in the cryptocurrency’s valuation and market dynamics.

Cathie Wood’s Outlook on Bitcoin

Cathie Wood, CEO of ARK Invest, believes Bitcoin could become more valuable than gold. She sees it as “digital gold” because it’s seen as a safe place to put money during uncertain times.

In a recent interview, Wood and ARK’s Brett Winton talked about how Bitcoin has been doing better than gold lately, especially during tough economic times.

Even when other investments were struggling, Bitcoin went up by 40% during a regional bank crisis in March 2023.

Despite a temporary drop in Bitcoin’s price after ETF approval, Wood thinks it will keep growing, especially as more people can invest through Spot Bitcoin ETFs, which could attract big investors.

CRYPTO BREAKING NEWS

ARK Invest CEO Cathie Wood Believes Bitcoin Will Overtake Gold, Here’s Why. ARK Invest Chief Executive Officer (CEO) and Chief Information Officer (CIO) Cathie Wood, has expressed her optimism about Bitcoin’s capabilities … check us out @… pic.twitter.com/H3cfpyhNTK— InnovatekMobile (@Neome_com) February 6, 2024

Cathie Wood’s positive outlook on Bitcoin as ‘digital gold’ and its ability to stay strong during crises might make investors more confident.

This could lead to the price of Bitcoin going up, even if there are ups and downs in the short term.

Hong Kong’s Crypto Regulation Impact on BTC Price

Hong Kong’s financial regulator, the Securities and Futures Commission (SFC), wants all crypto exchanges to get a license by February 29 or face closure by May 31. This follows a global trend of stricter rules for cryptocurrencies.

The SFC advises people to use licensed platforms. Only two, HashKey and OSL, have licenses, while 14 others, like Bybit and OKX, are waiting.

Hong Kong wants to regulate crypto but still be friendly to it. They are also thinking about making it easier to approve Bitcoin ETFs.

Harvest Fund Hong Kong has already applied. This shows Hong Kong wants to be a top spot for digital assets in Asia-Pacific.

HONG KONG REGULATOR WARNS CRYPTO EXCHANGES TO GET LICENSE

Hong Kong’s Securities and Futures Commission (SFC) has issued a warning to crypto exchanges, instructing them to submit a license application by February 29 or cease operations in the region by the end of May.

Source:… pic.twitter.com/wlzsrm5H2y

— Crypto Town Hall (@Crypto_TownHall) February 6, 2024

Therefore, the deadline for crypto exchange licenses in Hong Kong might create some uncertainty at first. However, it shows that regulators are starting to accept and regulate cryptocurrencies more seriously.

This could ultimately make Bitcoin more legitimate and stable in the long run, which could positively impact its price.

Bitcoin Price Prediction

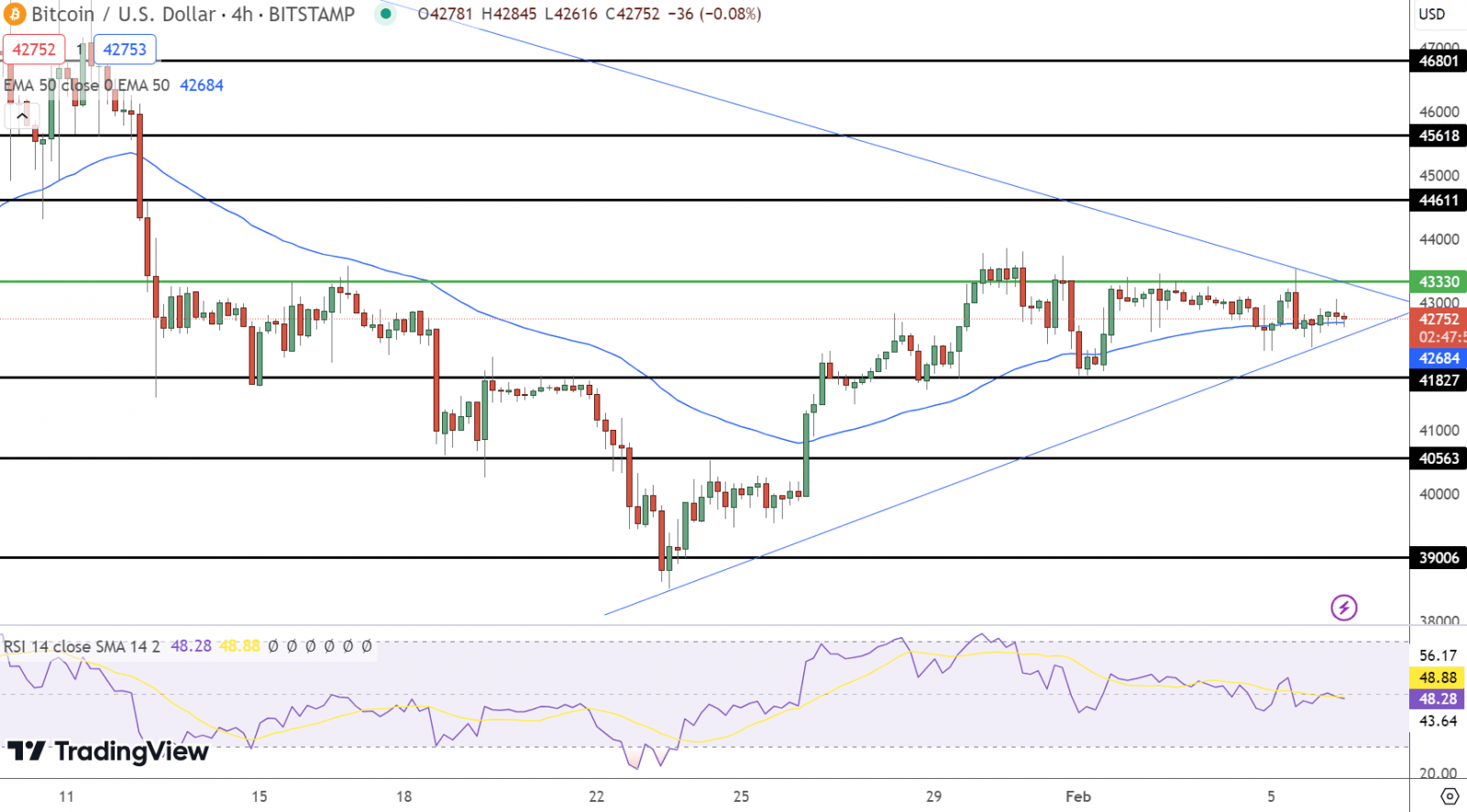

As of February 6, Bitcoin hovers around the $43,000 mark, underscoring a pivotal moment as reflected in the 4-hour chart analysis. The pivot point, set at $42,208, serves as a barometer for immediate market direction.

The cryptocurrency faces resistance at $42,895, $43,704, and $44,727, marking thresholds that could challenge bullish advances. In contrast, support levels established at $41,444, $40,532, and $39,541 provide a buffer against price dips.

Technical analysis yields a nuanced perspective. The Relative Strength Index (RSI), at 47, indicates a balanced market dynamic, neither overbought nor oversold.

Bitcoin Price Chart – Source: Tradingview

Bitcoin’s price movement is further delineated by the Moving Average Convergence Divergence (MACD), which, at a value of -37 below the signal line’s -31, subtly hints at bearish pressure.

Meanwhile, the 50-day Exponential Moving Average (EMA) at $42,895 emerges as a critical resistance zone, suggesting a battleground for bullish persistence.

Currently, Bitcoin’s price activity, navigating the range between $43,000 and $42,000, signals a market exercising caution. The overall sentiment tilts towards optimism above the $42,200 pivot, implying a potential uplift should Bitcoin maintain or exceed this level.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  Dogecoin

Dogecoin  Cardano

Cardano  TRON

TRON  Chainlink

Chainlink  LEO Token

LEO Token  Stellar

Stellar  Hedera

Hedera  Litecoin

Litecoin  Bitcoin Cash

Bitcoin Cash  Monero

Monero  Dai

Dai  OKB

OKB  Cronos

Cronos  Gate

Gate  Ethereum Classic

Ethereum Classic  VeChain

VeChain  Cosmos Hub

Cosmos Hub  Algorand

Algorand  KuCoin

KuCoin  Maker

Maker  Stacks

Stacks  Theta Network

Theta Network  Tether Gold

Tether Gold  Tezos

Tezos  IOTA

IOTA  Zcash

Zcash  TrueUSD

TrueUSD  NEO

NEO  Polygon

Polygon  Synthetix Network

Synthetix Network  Dash

Dash  Zilliqa

Zilliqa  0x Protocol

0x Protocol  Qtum

Qtum  Basic Attention

Basic Attention  Decred

Decred  Holo

Holo  Siacoin

Siacoin  DigiByte

DigiByte  Ravencoin

Ravencoin  NEM

NEM  Enjin Coin

Enjin Coin  Nano

Nano  Waves

Waves  Ontology

Ontology  Hive

Hive  Lisk

Lisk  Status

Status  Pax Dollar

Pax Dollar  Numeraire

Numeraire  Huobi

Huobi  Steem

Steem  BUSD

BUSD  OMG Network

OMG Network  Ren

Ren  Bitcoin Diamond

Bitcoin Diamond  Bitcoin Gold

Bitcoin Gold  Augur

Augur  HUSD

HUSD  Kyber Network Crystal Legacy

Kyber Network Crystal Legacy