Bitcoin Scarcity Grows as Miner and Exchange Reserves Drop by 183,253 BTC Since January

Over the past 158 days, starting from the beginning of the year, the quantity of bitcoin held by exchanges and miners has decreased by 183,253 BTC, valued at nearly $13 billion. Roughly 90.95% of this bitcoin withdrawal originated from cryptocurrency exchange reserves.

Exchanges and Miners See Massive Reductions

From Jan. 1 to June 7, 2024, a substantial amount of bitcoin (BTC) has exited the reserves of bitcoin miners and exchanges. Although less than 10% of the total originated from BTC miners, their combined holdings are steadily decreasing. According to data from cryptoquant.com, around 183,253 BTC, valued at $12.9 billion, has been withdrawn from the combined wallets of miners and exchanges.

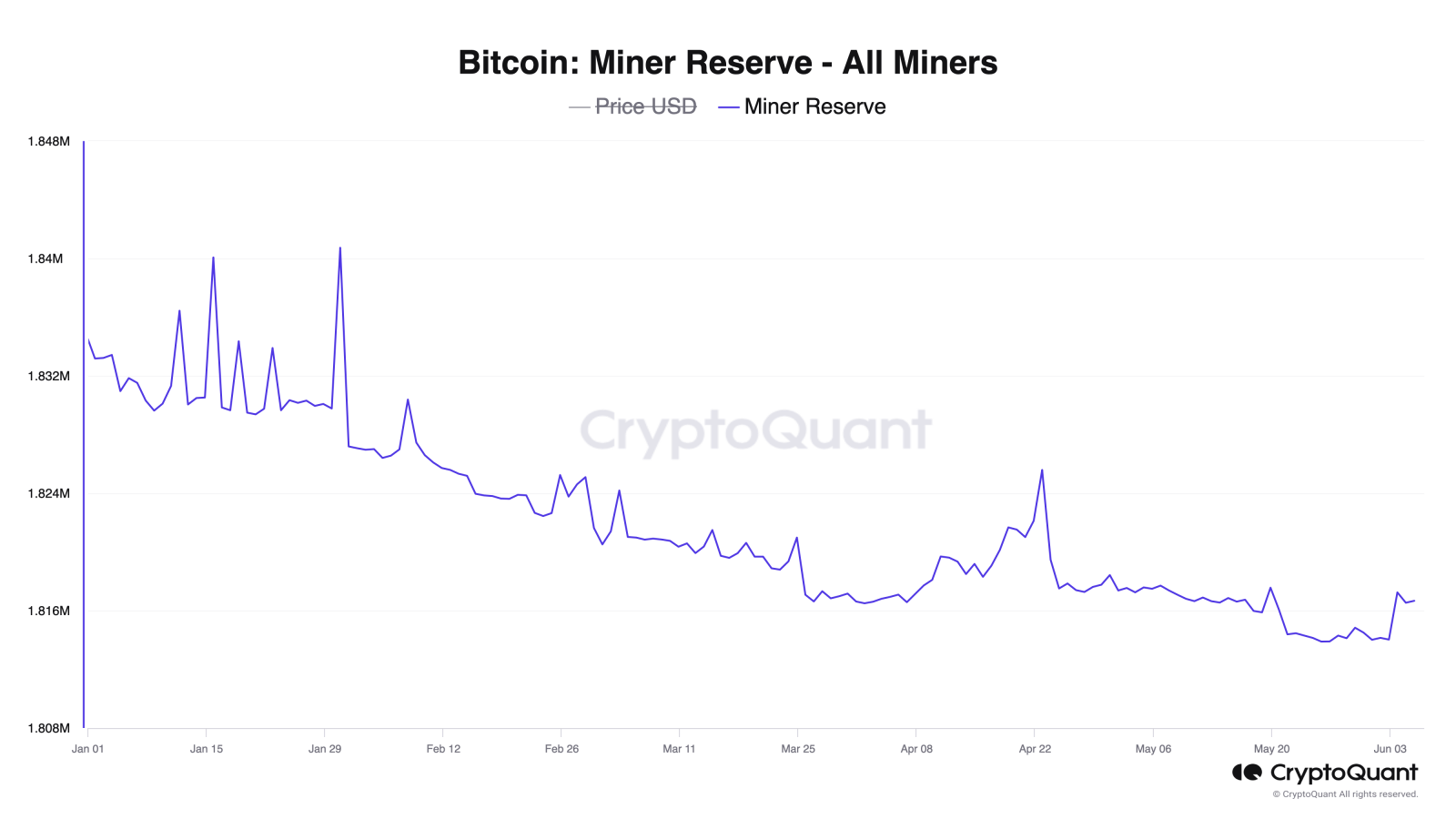

Bitcoin miner reserves since Jan. 1, 2024, according to cryptoquant.com.

Approximately 9.05%, or 16,578 BTC valued at $1.17 billion, has departed from the collective addresses of current BTC miners. At the year’s outset, miners held 1,833,179 BTC, which has now decreased to 1,816,601 BTC. However, reserves have seen a slight increase since June 3, when they hit a low of 1.814 million. Crypto trading platforms experienced a significant loss, with 90.95%, or 166,675 BTC, withdrawn since Jan. 1.

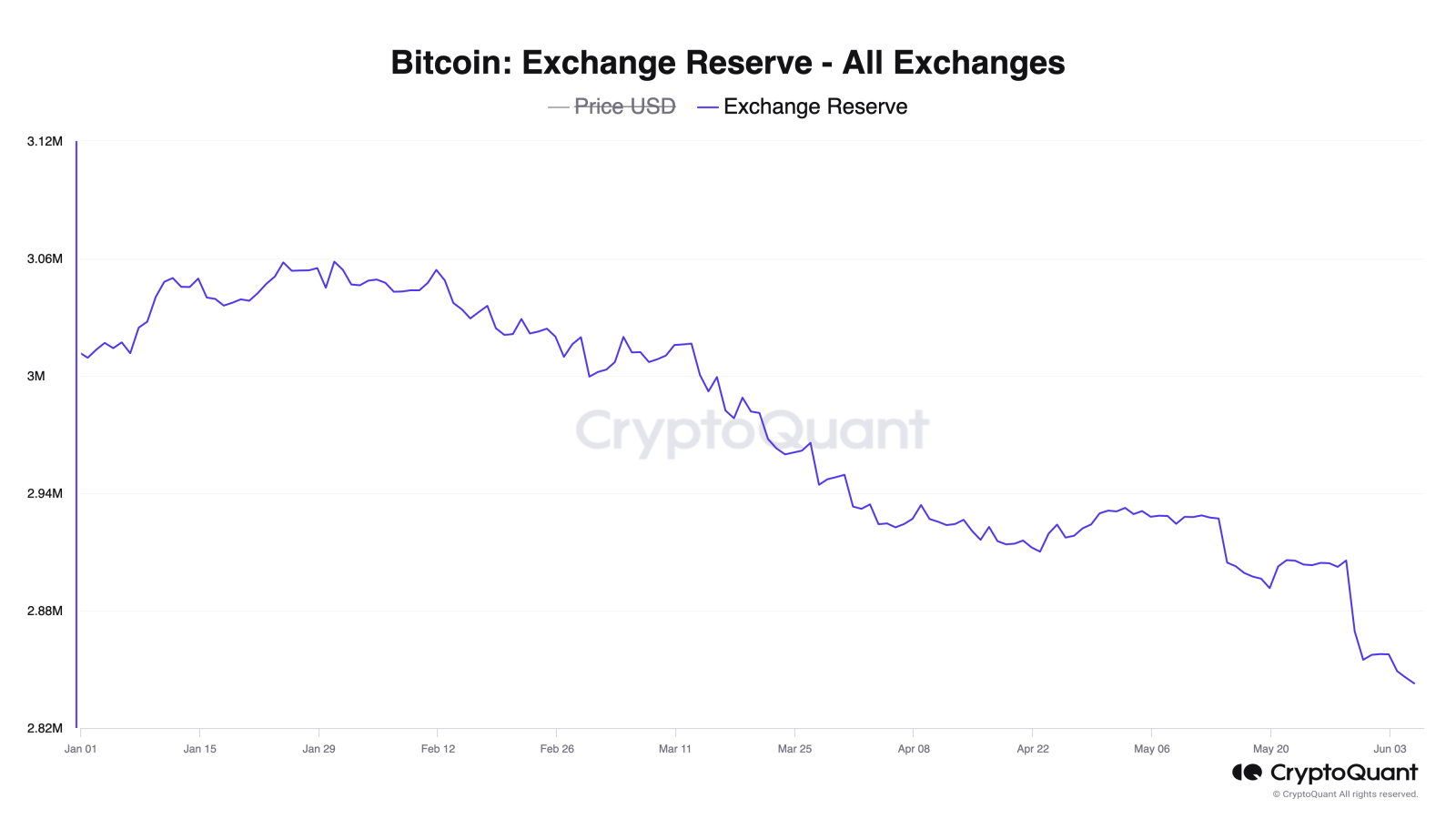

At the beginning of the year, exchanges held 3,009,239 BTC, which has since dropped to 2,842,564 BTC. A lot has changed this year, especially with the launch of spot bitcoin exchange-traded funds (ETFs) on Jan. 11, 2024. Data from sosovalue.xyz shows that these ETFs have seen cumulative net inflows of around $15.34 billion since their inception. Meanwhile, Grayscale’s GBTC has shed more than 333,000 BTC since Jan. 11.

Bitcoin exchange reserves since Jan. 1, 2024, according to cryptoquant.com.

As of now, it has been 48 days since the fourth bitcoin halving, which occurred at block height 840,000. Since then, and moving forward, the number of BTC issued has significantly decreased, making it challenging for miners to maintain reserves amid operating costs and overhead. An increase in hashprice, which has been rising since BTC surpassed the $70,000 mark, will help bolster reserves.

After hitting a low of $45 per petahash per second per day, the expected value of a petahash has now stabilized at $62. This continuous depletion of bitcoin from exchanges and miners not only underscores a trend toward greater individual holding but also amplifies bitcoin’s inherent value through increased scarcity. As more BTC exits public trading venues, its rarity could further propel its market worth, suggesting a potential for even higher valuation in a landscape where supply increasingly lags behind demand.

What do you think about the number of bitcoins that left the wallets of miners and exchanges? Share your thoughts and opinions about this subject in the comments section below.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  Dogecoin

Dogecoin  USDC

USDC  Cardano

Cardano  TRON

TRON  Chainlink

Chainlink  Stellar

Stellar  Hedera

Hedera  Bitcoin Cash

Bitcoin Cash  LEO Token

LEO Token  Litecoin

Litecoin  Cronos

Cronos  Ethereum Classic

Ethereum Classic  Monero

Monero  Dai

Dai  Algorand

Algorand  OKB

OKB  Cosmos Hub

Cosmos Hub  Stacks

Stacks  Theta Network

Theta Network  Gate

Gate  Maker

Maker  KuCoin

KuCoin  Tezos

Tezos  IOTA

IOTA  Zcash

Zcash  NEO

NEO  Polygon

Polygon  Synthetix Network

Synthetix Network  Tether Gold

Tether Gold  TrueUSD

TrueUSD  Dash

Dash  Holo

Holo  Zilliqa

Zilliqa  Enjin Coin

Enjin Coin  0x Protocol

0x Protocol  Basic Attention

Basic Attention  Qtum

Qtum  Siacoin

Siacoin  Ravencoin

Ravencoin  Bitcoin Gold

Bitcoin Gold  Decred

Decred  NEM

NEM  Ontology

Ontology  DigiByte

DigiByte  Nano

Nano  Status

Status  Hive

Hive  Huobi

Huobi  Waves

Waves  Lisk

Lisk  Numeraire

Numeraire  Steem

Steem  Pax Dollar

Pax Dollar  BUSD

BUSD  OMG Network

OMG Network  Ren

Ren  Bitcoin Diamond

Bitcoin Diamond  Bytom

Bytom