Bitcoin Sees Highest Number of 10+ BTC Wallets in Two Months Amid Whale Accumulation

Bitcoin whale and shark wallets increased by 261 in July, reaching the highest count since May 21, while small traders sold off their holdings.

Recent data from Santiment, a market intelligence platform, reveals a significant increase in Bitcoin whale and shark wallets, despite the market dip. In July alone, there was a net increase of 261 wallets holding at least 10 BTC. This spiked the number of wallets holding at least 10 BTC to 152K, the highest since May 21.

🐳📈 Bitcoin whale and shark wallets are increasing in number while small traders sell off their bags during this dip period. July has seen a net increase of +261 wallets that now hold at least 10 BTC, which should give traders comfort in a long-term bullish future. pic.twitter.com/y0BwKDxNGm

— Santiment (@santimentfeed) July 11, 2024

This accumulation contrasts sharply with the behavior of smaller traders who have been selling off their Bitcoin holdings during this period.

Large Holders vs. Small Traders

The Santiment report highlights a distinct divergence between large holders, often referred to as “whales” and “sharks,” and smaller traders. Whales, holding 1,000 BTC or more, and sharks, with 10 to 1,000 BTC, are increasing their Bitcoin holdings.

This trend suggests that these larger holders are taking advantage of the lower prices to accumulate more Bitcoin, anticipating future price increases. In contrast, small traders are liquidating their holdings, possibly due to angst, which has contributed to the current selling pressure in the market.

Bitcoin Holdings Distribution

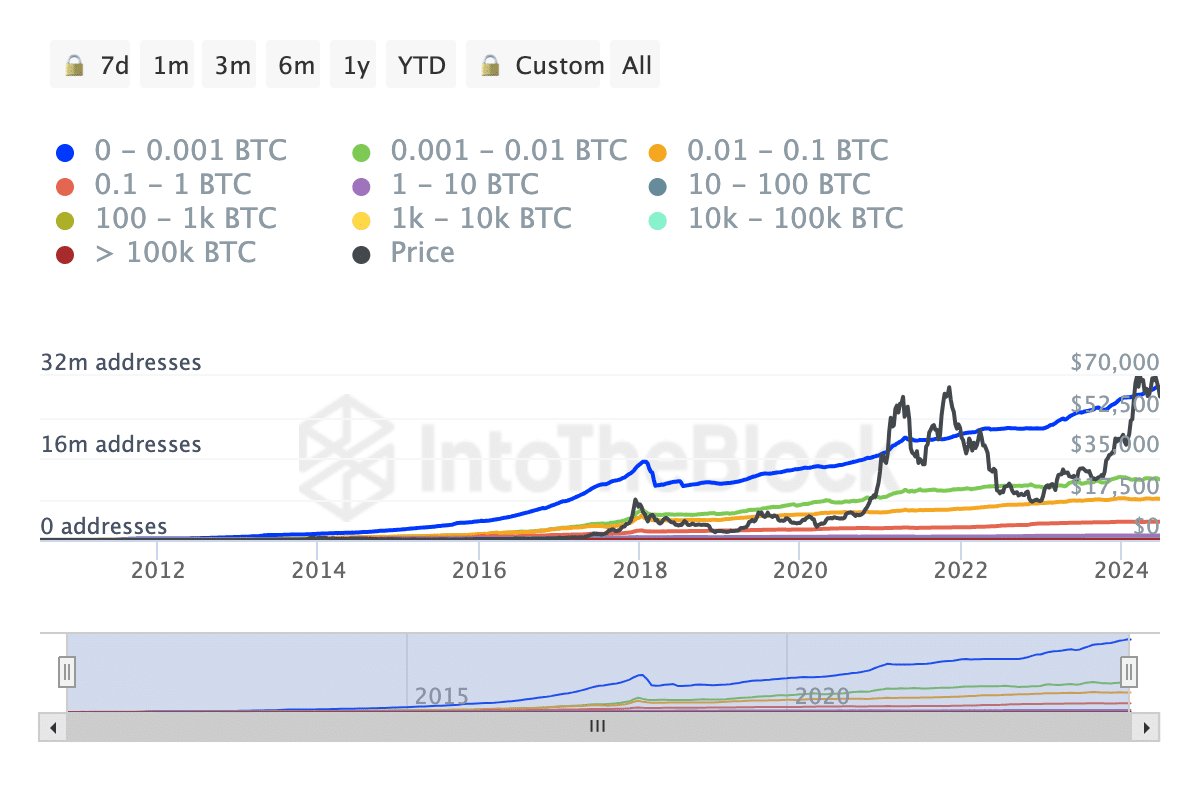

Meanwhile, data from IntoTheBlock provides further insights into Bitcoin holdings distribution. As of June 24, 2024, addresses with 0 to 0.001 BTC constitute the largest group, with 29.8 million addresses.

Bitcoin Addresses | IntoTheBlock

Addresses holding 0.001 to 0.01 BTC number 11.86 million, while those with 0.01 to 0.1 BTC total 8.03 million. Medium-sized holders (0.1 to 1 BTC) account for 3.54 million addresses, and more substantial holders (1 to 10 BTC) represent 859.7K addresses.

Larger investors, holding 10 to 100 BTC, number 136.97K, and major investors with 100 to 1,000 BTC total 13.81K addresses. Institutional investors and high-net-worth individuals holding 1,000 to 10,000 BTC number 1.96K, with extremely large holdings (10,000 to 100,000 BTC) held by 102.5 addresses.

Notably, three addresses hold over 100,000 BTC, likely belonging to exchanges or major entities.

Significant Bitcoin Outflow from BitMEX

Elsewhere, BitMEX, a prominent crypto exchange, experienced its second-largest Bitcoin outflow in history, signaling bullish sentiment. On July 5 and 6, 35,807 BTC, worth approximately $2.1 billion, flowed out of BitMEX.

According to Joao Wedson, a data scientist at CryptoQuant, this outflow indicates major investors are moving their holdings to other platforms, potentially reducing immediate selling pressure on BitMEX and stabilizing Bitcoin’s price.

He asserted that these withdrawals suggest that whales are betting on a Bitcoin uptrend, reinforcing the bullish outlook reported by Santiment and IntoTheBlock. However, BitMEX clarified that the outflow was the result of a fund reshuffling carried out by its internal team.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  Dogecoin

Dogecoin  USDC

USDC  Cardano

Cardano  TRON

TRON  Chainlink

Chainlink  Stellar

Stellar  Hedera

Hedera  LEO Token

LEO Token  Bitcoin Cash

Bitcoin Cash  Litecoin

Litecoin  Cronos

Cronos  Ethereum Classic

Ethereum Classic  Monero

Monero  Dai

Dai  Algorand

Algorand  OKB

OKB  Cosmos Hub

Cosmos Hub  Stacks

Stacks  Theta Network

Theta Network  Gate

Gate  Maker

Maker  KuCoin

KuCoin  Tezos

Tezos  IOTA

IOTA  NEO

NEO  Zcash

Zcash  Polygon

Polygon  Synthetix Network

Synthetix Network  Tether Gold

Tether Gold  TrueUSD

TrueUSD  Dash

Dash  Holo

Holo  Zilliqa

Zilliqa  Enjin Coin

Enjin Coin  0x Protocol

0x Protocol  Basic Attention

Basic Attention  Qtum

Qtum  Siacoin

Siacoin  Ravencoin

Ravencoin  Bitcoin Gold

Bitcoin Gold  Decred

Decred  NEM

NEM  DigiByte

DigiByte  Ontology

Ontology  Nano

Nano  Status

Status  Huobi

Huobi  Waves

Waves  Hive

Hive  Lisk

Lisk  Numeraire

Numeraire  Steem

Steem  Pax Dollar

Pax Dollar  BUSD

BUSD  OMG Network

OMG Network  Ren

Ren  Bitcoin Diamond

Bitcoin Diamond  Bytom

Bytom