Bitcoin Technical Analysis: $100K in Sight as Bulls Battle Key Resistance Levels

Bitcoin, currently coasting along at $96,566 to $96,751 over the last hour, with a 24-hour volume of $27.76 billion and a market valuation of $1.92 trillion, has been bouncing between $93,444 and $96,794, hinting at exciting volatility according to technical indicators.

Bitcoin

On the hourly chart, bitcoin‘s price has been on an impressive upward climb from $92,768 to $96,794, now taking a little breather. This chill near resistance levels hints at an upcoming breakout or a slight backtrack, with support at $95,800 and resistance waiting at $97,500. Volume spikes during these ascents point to a flurry of activity, possibly from those cashing in or making strategic moves.

BTC/USD 1H chart on Jan. 2, 2024.

Switching to the 4-hour chart, bitcoin’s recovery from $91,000 to $96,794 is bolstered by consistent higher lows and an upbeat momentum. Key levels to watch are $94,500 for support and $97,500 to $98,000 for resistance, coinciding with noticeable volume upticks around these markers. The price action shows a recovery within a wider range, buoyed by heightened interest at crucial points.

BTC/USD 4H chart on Jan. 2, 2024.

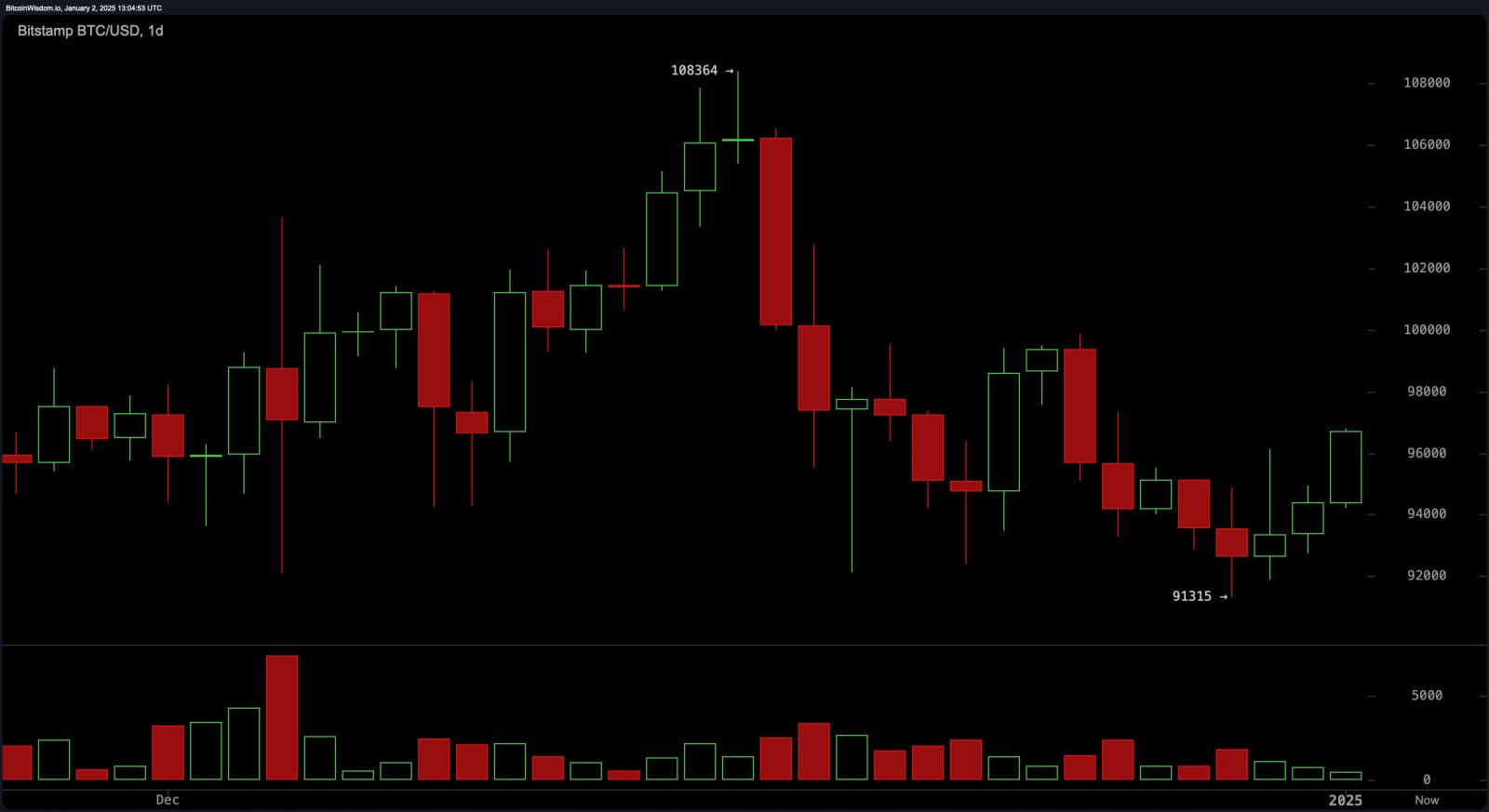

The daily chart showcases a shift from a downward trend, where bitcoin rebounded from a local bottom of $91,315 and soared past $96,000. Moving averages like the EMA and SMA across different timeframes reveal a mixed bag of emotions, with immediate buy signals clashing against resistance from longer-term averages.

BTC/USD Daily chart on Jan. 2, 2024.

Oscillators, such as the relative strength index (RSI) at 51 and the Stochastic at 34, stay neutral, pointing to market indecision. The momentum oscillator gives a buy signal at 1,955, while the MACD at −616 suggests lingering selling pressure. Together, they paint a picture of a market that’s balanced yet cautious.

Bull Verdict:

Bitcoin’s recent recovery from $91,000 to $96,794, coupled with bullish signals from short-term moving averages and upward momentum on hourly and 4-hour charts, indicates the potential for a breakout above $97,500. A successful breach of this resistance could pave the way for a test of the $100,000 psychological barrier, bolstered by strong market interest and steady volume spikes.

Bear Verdict:

Despite the recovery, neutral oscillators and selling pressure indicated by the MACD suggest caution. If bitcoin fails to break above $97,500 or retraces below $94,500, bearish momentum could take over, potentially testing support levels around $91,000 as the broader market sentiment appears mixed.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  Dogecoin

Dogecoin  USDC

USDC  Cardano

Cardano  TRON

TRON  Chainlink

Chainlink  Stellar

Stellar  Hedera

Hedera  Bitcoin Cash

Bitcoin Cash  Litecoin

Litecoin  LEO Token

LEO Token  Cronos

Cronos  Ethereum Classic

Ethereum Classic  Monero

Monero  Algorand

Algorand  Dai

Dai  OKB

OKB  Cosmos Hub

Cosmos Hub  Stacks

Stacks  Theta Network

Theta Network  Gate

Gate  Tezos

Tezos  Maker

Maker  KuCoin

KuCoin  IOTA

IOTA  NEO

NEO  Polygon

Polygon  Zcash

Zcash  Synthetix Network

Synthetix Network  Tether Gold

Tether Gold  Dash

Dash  TrueUSD

TrueUSD  Holo

Holo  0x Protocol

0x Protocol  Zilliqa

Zilliqa  Enjin Coin

Enjin Coin  Basic Attention

Basic Attention  Qtum

Qtum  Ravencoin

Ravencoin  Siacoin

Siacoin  Bitcoin Gold

Bitcoin Gold  Decred

Decred  DigiByte

DigiByte  Hive

Hive  NEM

NEM  Ontology

Ontology  Nano

Nano  Huobi

Huobi  Status

Status  Waves

Waves  Lisk

Lisk  Steem

Steem  Numeraire

Numeraire  Pax Dollar

Pax Dollar  BUSD

BUSD  OMG Network

OMG Network  Ren

Ren  Bitcoin Diamond

Bitcoin Diamond