Bitcoin’s August Slump: Dormant Wallets Stirred, But Vintage BTC Spending Slowed

Bitcoin faced a challenging August, with its price dipping by 8.6%. Data shows that although 84 previously inactive bitcoin wallets became active last month, the total amount of vintage BTC spent was lower in August than in July. Specifically, dormant wallets spent around 2,291 BTC from addresses that hadn’t been touched between 2011 and 2017.

August Sees Lower Spending From Long-Term Bitcoin Holders

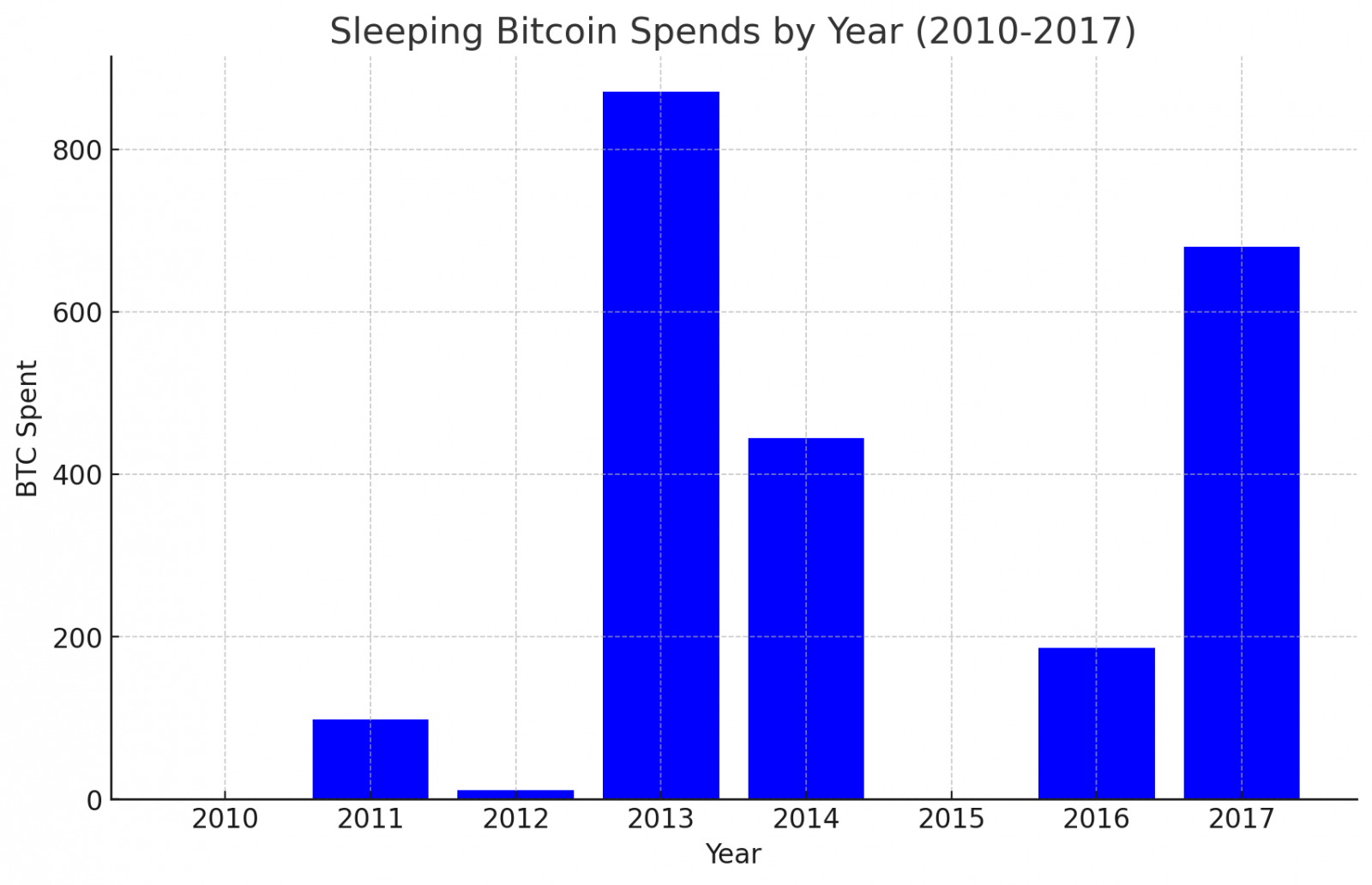

August was pretty quiet when it came to spending sleeping bitcoin, with no movement from wallets created in 2010. Data shows that 2010 addresses have become increasingly rare, but three wallets from 2011 did spring to life. Together, these three accounts transferred 98.18 BTC for the first time in over a decade.

Adding to the intrigue, two wallets from 2012 moved a total of 10.99000001 BTC, which included a tiny dust transfer of 0.00000001 BTC at block height 855,148. Spending from 2013 wallets saw much more activity, with 37 different transactions moving a hefty 870.9 BTC.

Among these were a few significant transfers, including one that moved 250 BTC. Many of the 2013 transactions involved moving 10 BTC in substantial batches. Wallets from 2014 weren’t left out, with six transactions moving a combined 444.94 BTC.

August sleeping bitcoin spends according to btcparser.com metrics.

There were only minor movements from 2015 addresses, with two transfers totaling a modest 0.015 BTC, while 2016 saw seven transactions moving 185.95 BTC. According to btcparser.com, 2017 wallets came in second in terms of activity, with 27 transactions moving a total of 680.23 BTC.

In all, the 84 transfers accounted for approximately 2,291.20500001 BTC, valued at around $131 million. However, August’s total was significantly lower than July’s 6,536.17 BTC spent and also below the 4,681.438 BTC moved in June.

The decline in vintage bitcoin spending suggests a cautious approach among long-term bitcoin holders, possibly reflecting uncertainty or strategic patience in the current market. With August’s activity lower than in previous months, the data may indicate a broader trend of reluctance to liquidate assets.

During the 2020 and 2021 bitcoin bull run, vintage BTC addresses from 2010-2017 sprang into action, moving significant amounts of bitcoin as prices hovered around $50K and higher. Fast forward to 2024, and long-term holders are gripping their assets even tighter, holding out for the possibility of much higher prices.

What do you think about the bitcoin movements from vintage wallets in August? Share your thoughts and opinions about this subject in the comments section below.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  Dogecoin

Dogecoin  USDC

USDC  Cardano

Cardano  TRON

TRON  Chainlink

Chainlink  Stellar

Stellar  Hedera

Hedera  Bitcoin Cash

Bitcoin Cash  LEO Token

LEO Token  Litecoin

Litecoin  Cronos

Cronos  Ethereum Classic

Ethereum Classic  Monero

Monero  Dai

Dai  Algorand

Algorand  OKB

OKB  Cosmos Hub

Cosmos Hub  Stacks

Stacks  Theta Network

Theta Network  Gate

Gate  Maker

Maker  KuCoin

KuCoin  Tezos

Tezos  IOTA

IOTA  NEO

NEO  Polygon

Polygon  Zcash

Zcash  Synthetix Network

Synthetix Network  Tether Gold

Tether Gold  TrueUSD

TrueUSD  Dash

Dash  Holo

Holo  Zilliqa

Zilliqa  0x Protocol

0x Protocol  Enjin Coin

Enjin Coin  Qtum

Qtum  Siacoin

Siacoin  Basic Attention

Basic Attention  Bitcoin Gold

Bitcoin Gold  Ravencoin

Ravencoin  Decred

Decred  NEM

NEM  Ontology

Ontology  DigiByte

DigiByte  Nano

Nano  Hive

Hive  Status

Status  Huobi

Huobi  Lisk

Lisk  Waves

Waves  Steem

Steem  Numeraire

Numeraire  Pax Dollar

Pax Dollar  BUSD

BUSD  OMG Network

OMG Network  Ren

Ren  Bitcoin Diamond

Bitcoin Diamond  Bytom

Bytom