BNB Price Hits $715 All-time High, Beats Solana to $100B Valuation

BNB price broke the $700 barrier on Wednesday, June 5, 2024, to reach a new all-time high for the first time since November 2021; as bulls prepare to take profits, BNB appears at risk of a major correction phase.

BNB price Records $715 All-time High

Binance, the world’s largest cryptocurrency exchange, has been subject to extensive regulatory pressure over the past two years. While battling bans in countries like China, Nigeria, and the Philippines, Binance has also been locked in a $4.6 billion settlement lawsuit with the US authorities.

Binance has adversely affected its entire ecosystem. Daily trading volumes on the exchange dropped, allowing Coinbase and BitGet and other competitors to encroach market share, while the growth of Binance’s native BNB chain and BNB coin also slowed.

However, there has been a resurgence of bullish momentum within the Binance ecosystem as the prolonged case with the US SEC finally reached a conclusion.

Binance ex-CEO Changpeng Zhao began a 4-month prison sentence in California, far more lenient than the 3-year jail term sought by prosecutors.

CZ’s sentencing effectively marks the end of a protracted legal battle, and curiously, it has triggered bullish reactions across the BNB markets.

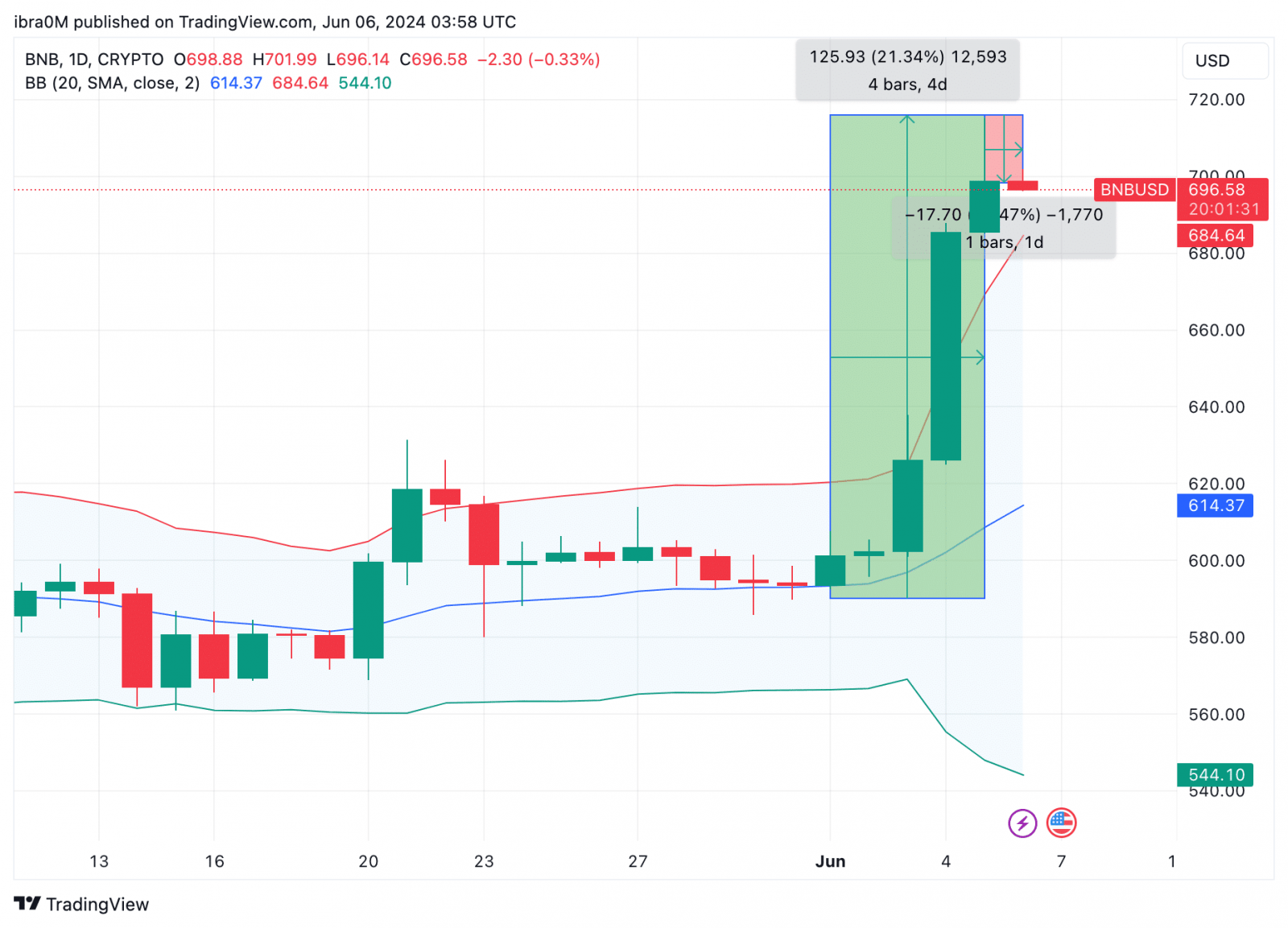

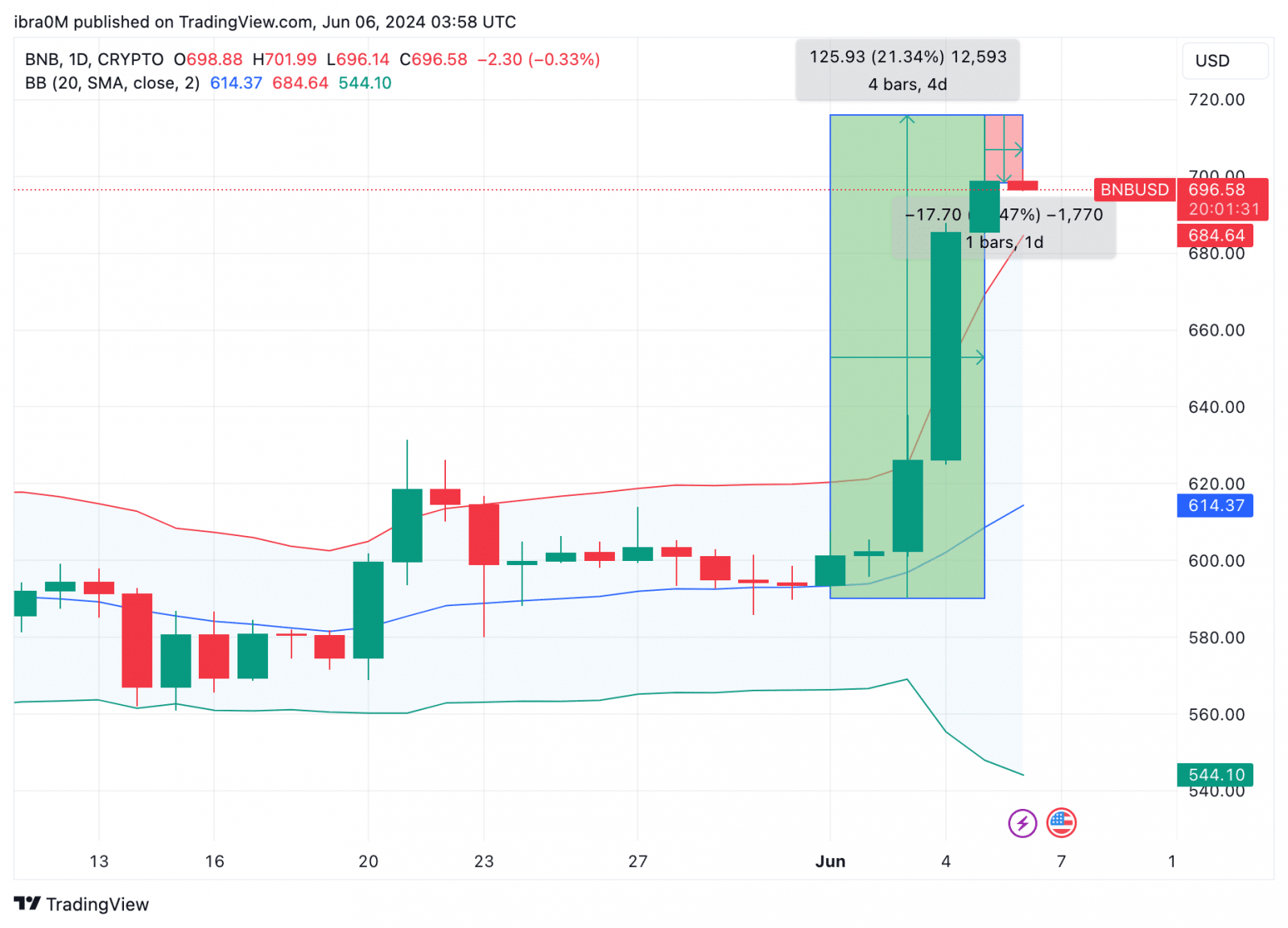

BNB Price Action June 2024 | TradingView

As vividly illustrates above, BNB price has increased 21% between June 1 and June 5, hitting an all-time high of $715 by June 5m before retracing 2% towards the $697 area at the time of writing on June 6.

This landmark achievement means that BNB has now overtaken Solana (SOL) to become only the 4th crypto asset to cross the coveted $100 billion mark, behind Bitcoin, Ethereum, and USDT.

Interestingly, this close convergence between BNB’s price rally and Zhao’s prison term suggests the resolution of the case had catalyzed a considerable influx of LONG positions in the derivatives markets.

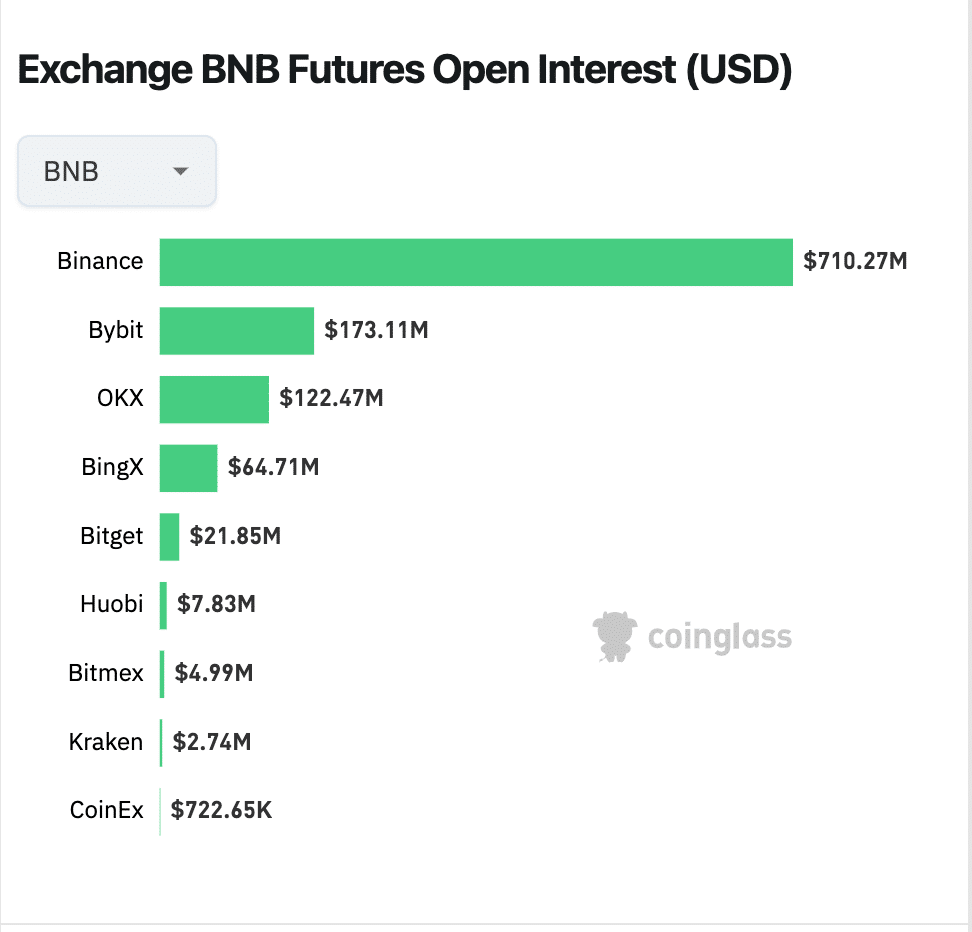

BNB Price vs Open Interest | Coinglass

Coinglass’ futures open interest chart above, which monitors the total capital invested speculative contracts, BNB’s open interest was $594 million as of May 31.

Curiously, since Zhao’s prison term began, speculative traders have significantly increased their capital inflows. By June 5, BNB’s open interest had reached $1.01 billion, a substantial $405 million rise. Although BNB’s price increased by 21.28% over five days, open interest surged by 68%.

When there’s a faster rise in open interest compared to the price uptrend, strategic traders often interpret is as an early indication that the market trend is nearing its peak.

This rapid increase in open interest could mean that this week’s BNB price rally has been driven mainly by the activities of speculative traders. Hence, BNB’s open interest, which is $1.01 billion, poses a risk of significant liquidations and sharp downward movement if traders begin to take profits in the near term.

BNB Price Forecast: Bears Eyeing $650 Reverse

BNB is currently exchanging hands at an all-time high of around $700 as of June 6. However, the speculative contracts surging $400 million indicate a potential profit-taking wave could trigger a sharp near-term decline towards the $600 level.

In terms of short-term support area to monitor, the Bollinger upper-band technical indicator currently marks the $670 price level as a potential trend reversal point.

BNB Price Forecast | TradingView

But, should the profit-taking trigger widespread LONG liquidations as predicted, BNB’s price could quickly retrace to the 20-day SMA price level at $608.

Conversely, if upward momentum continues, bulls could attempt to push the rally toward the $750 level, especially if the upcoming Non-Farm Payrolls report on Friday, June 7, 2024, provides a positive outcome for risk assets.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  Dogecoin

Dogecoin  USDC

USDC  Cardano

Cardano  TRON

TRON  Chainlink

Chainlink  Stellar

Stellar  Hedera

Hedera  Bitcoin Cash

Bitcoin Cash  LEO Token

LEO Token  Litecoin

Litecoin  Cronos

Cronos  Ethereum Classic

Ethereum Classic  Monero

Monero  Dai

Dai  Algorand

Algorand  OKB

OKB  Cosmos Hub

Cosmos Hub  Stacks

Stacks  Theta Network

Theta Network  Gate

Gate  Maker

Maker  KuCoin

KuCoin  Tezos

Tezos  IOTA

IOTA  NEO

NEO  Polygon

Polygon  Zcash

Zcash  Synthetix Network

Synthetix Network  Tether Gold

Tether Gold  TrueUSD

TrueUSD  Dash

Dash  Holo

Holo  Zilliqa

Zilliqa  Enjin Coin

Enjin Coin  0x Protocol

0x Protocol  Qtum

Qtum  Basic Attention

Basic Attention  Siacoin

Siacoin  Ravencoin

Ravencoin  Bitcoin Gold

Bitcoin Gold  Decred

Decred  NEM

NEM  Ontology

Ontology  DigiByte

DigiByte  Nano

Nano  Status

Status  Huobi

Huobi  Hive

Hive  Lisk

Lisk  Waves

Waves  Numeraire

Numeraire  Steem

Steem  Pax Dollar

Pax Dollar  BUSD

BUSD  OMG Network

OMG Network  Ren

Ren  Bitcoin Diamond

Bitcoin Diamond  Bytom

Bytom