Bonk (BONK) Breaks Out of Symmetrical Triangle, Analysts Predict 16X Rally

Bonk trading shows bullish momentum following a breakout from a symmetrical triangle. The memecoin, currently trading at 0.00002375 with a 12.72% weekly gain, is drawing attention as traders expect a potential rally. If the current trend holds, analysts target a potential 16x price increase.

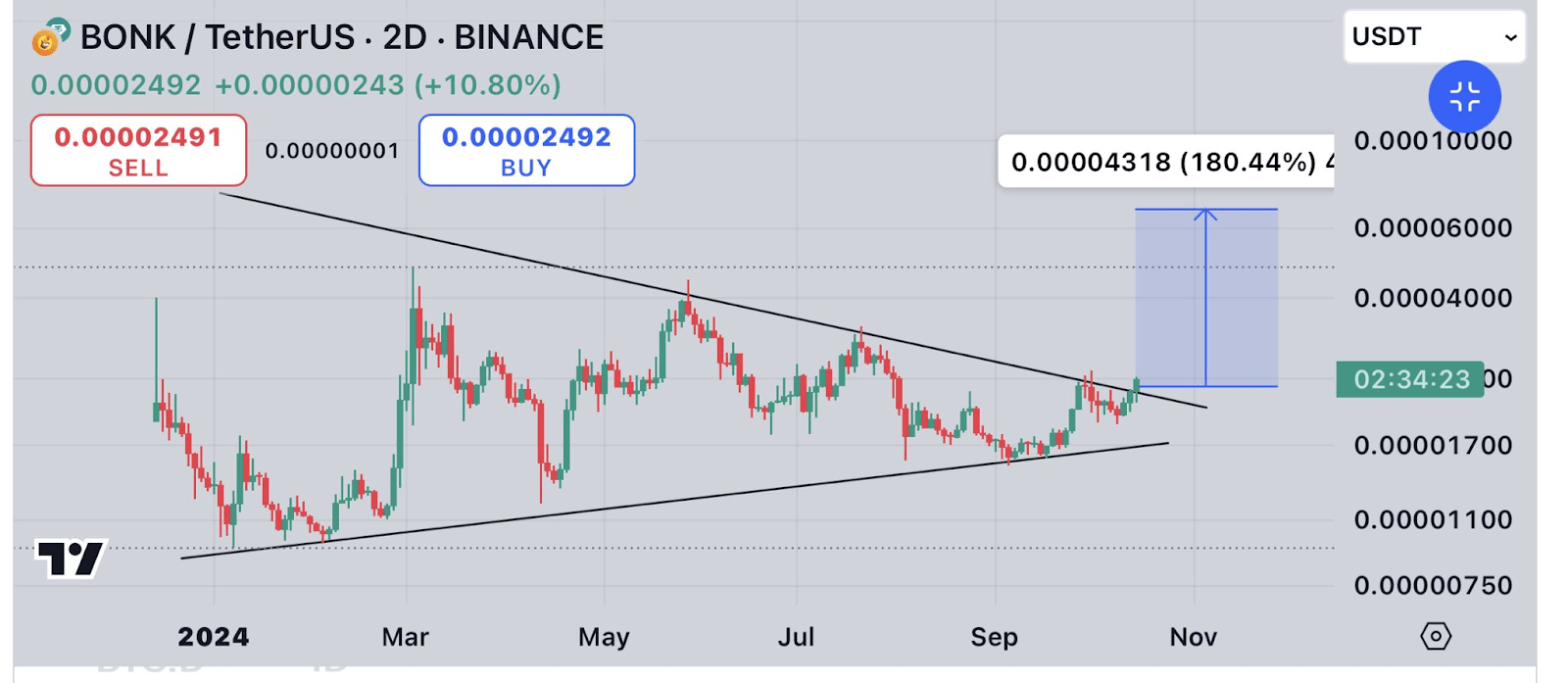

Symmetrical Triangle Breakout Signals Bullish Momentum

Bonk has recently broken out of a symmetrical triangle pattern characterized by converging trend lines that signal consolidation before a breakout. The breakout has occurred to the upside, suggesting that the bullish momentum is starting to build.

Source:X

According to the analyst’s chart, the measured move from this breakout could result in a price target of 0.00004318, a potential gain of 180.44%.

– Advertisement –

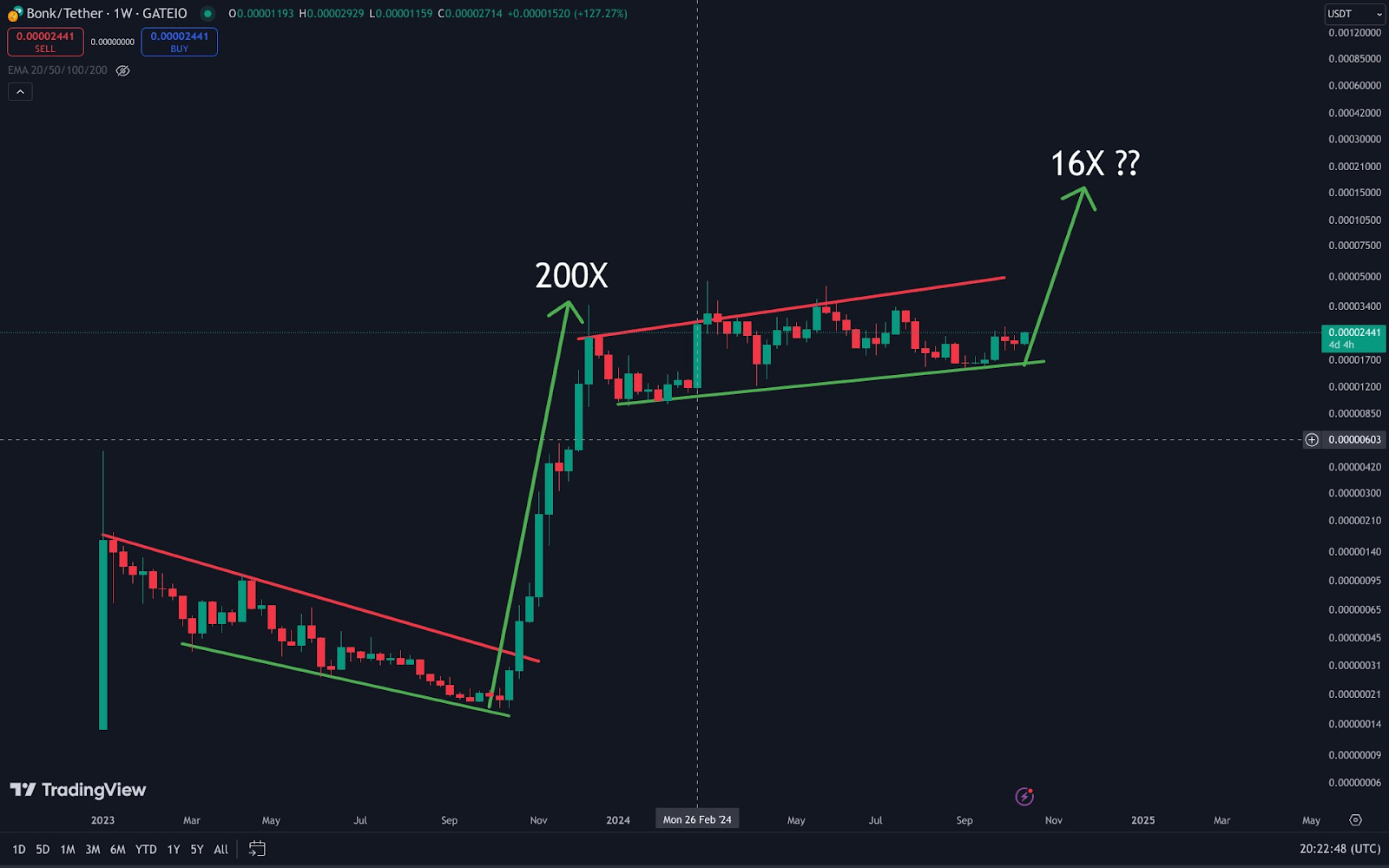

Analysts Anticipate a 16X Rally Based on Chart Patterns

Several analysts predict a significant upside potential for Bonk. One analyst, Solberg Invest, compared the current chart to previous bullish patterns, stating, “While a 200x return might be a stretch this time, the chart is looking reminiscent of its explosive past.”

Source:X

Analyst Solberg is now targeting a 16x gain, which is more realistic given Bonk’s current market cap and conditions.

The chart shows similarities to Bonk’s historical performance, where a descending wedge in the past led to a 200x price surge. Solberg’s analysis suggests a significant bullish rally could follow if Bonk breaks above the current channel resistance.

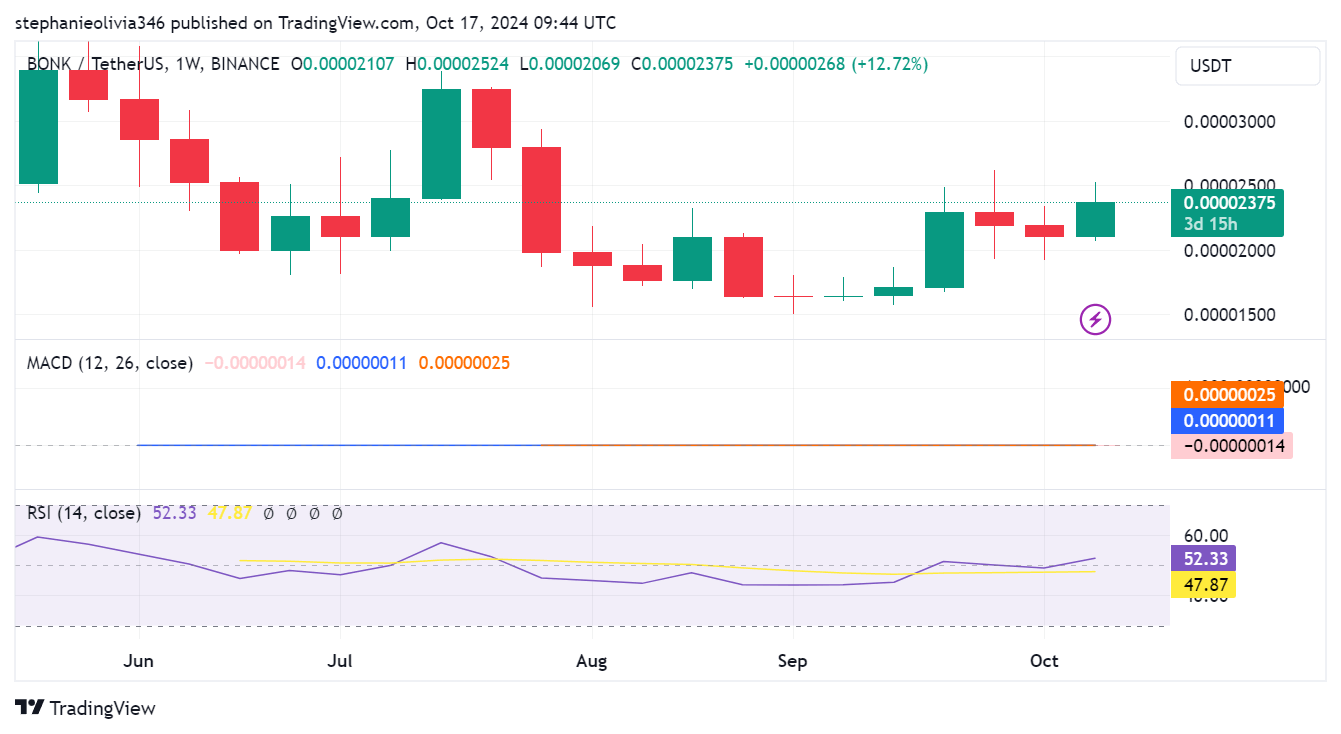

Bullish Sentiment Backed by MACD and RSI Indicators

The MACD and RSI indicators show growing bullish momentum for Bonk. The MACD line at 0.00000011 is just below the signal line at 0.00000025, but the narrowing gap signals growing positive momentum. A crossover of the MACD line above the signal line would confirm a bullish trend.

7-day BONK trading chart: Source Tradingview

The RSI, sitting at 52.33, is trending upward, signaling potential for further gains. As it approaches higher levels, it reflects increasing buyer interest, but it has yet to reach overbought territory, meaning there is still room for upward movement.

Analysts closely monitor these indicators, which provide confirmation signals for traders. If the MACD flips bullish and the RSI continues to rise, this could trigger further buying pressure, pushing Bonk toward the following resistance levels.

Market sentiment is also shifting positively, with social media discussion highlighting Bonk’s potential for another substantial move. However, traders are cautious, waiting for confirmation from other technical indicators before committing to long positions.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  Dogecoin

Dogecoin  USDC

USDC  Cardano

Cardano  TRON

TRON  Chainlink

Chainlink  Bitcoin Cash

Bitcoin Cash  LEO Token

LEO Token  Stellar

Stellar  Litecoin

Litecoin  Cronos

Cronos  Hedera

Hedera  Ethereum Classic

Ethereum Classic  Dai

Dai  Monero

Monero  Stacks

Stacks  OKB

OKB  Cosmos Hub

Cosmos Hub  Algorand

Algorand  Theta Network

Theta Network  Maker

Maker  KuCoin

KuCoin  Gate

Gate  Tezos

Tezos  Polygon

Polygon  NEO

NEO  Tether Gold

Tether Gold  Zcash

Zcash  IOTA

IOTA  Synthetix Network

Synthetix Network  Bitcoin Gold

Bitcoin Gold  TrueUSD

TrueUSD  Zilliqa

Zilliqa  Holo

Holo  0x Protocol

0x Protocol  Enjin Coin

Enjin Coin  Siacoin

Siacoin  Dash

Dash  Qtum

Qtum  Ravencoin

Ravencoin  Basic Attention

Basic Attention  Decred

Decred  Ontology

Ontology  NEM

NEM  DigiByte

DigiByte  Lisk

Lisk  Waves

Waves  Status

Status  Nano

Nano  Numeraire

Numeraire  Pax Dollar

Pax Dollar  Hive

Hive  Huobi

Huobi  Steem

Steem  BUSD

BUSD  OMG Network

OMG Network  Ren

Ren  Bitcoin Diamond

Bitcoin Diamond  Bytom

Bytom  Kyber Network Crystal Legacy

Kyber Network Crystal Legacy