BTC, EIGEN, KAS: Top cryptocurrencies to watch this week

The market experienced a rollercoaster ride, with the global crypto market cap rising from $2.33 trillion to a three-month peak of $2.5 trillion by mid-week before settling at $2.38 trillion at the end of the week.

Bitcoin (BTC) triggered the uptrend, having surged to retest the March 2024 all-time high above $73,000 before facing a major correction.

Here are some of the prominent crypto assets to pay attention to this week following their noteworthy price action:

BTC retests ATH

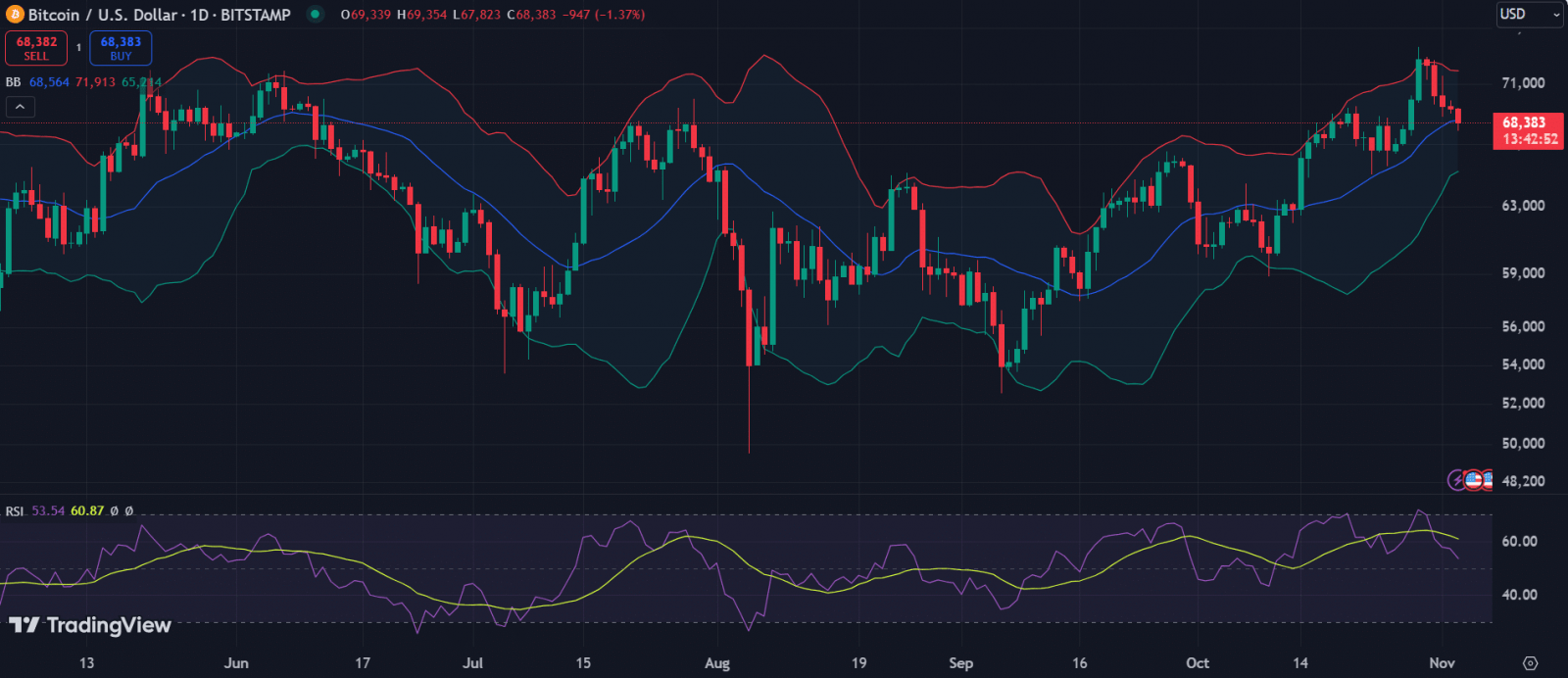

Bitcoin’s start to the week coincided with a bullish momentum that began on Oct. 26. By Monday, the asset had recorded three consecutive intraday gains, knocking at the $70,000 region.

BTC 1D chart | Source: Trading View

The impressive uptrend spilled into Oct. 29, as Bitcoin first overcame the $71,000 resistance and pushed further to breach the elusive $73,000 level, reaching a seven-month peak. This allowed the leading cryptocurrency to retest its March ATH.

However, this surge preceded a massive correction. Consequently, Bitcoin’s price action went downhill in the four days that followed, with the 20-day MA at $68,564 now acting as an immediate defense against further downside risk.

If the 20-day MA support gives way, BTC would need to hold above the lower Bollinger Band at $65,214 amid the upcoming US presidential election this week. However, a recovery above $71,913 could grant the bulls renewed strength to again reach the ATH.

You might also like: Crypto VC funding: Kraken bags $42.5m from Optimism, Glow Labs raises $30m

EIGEN slides 17%

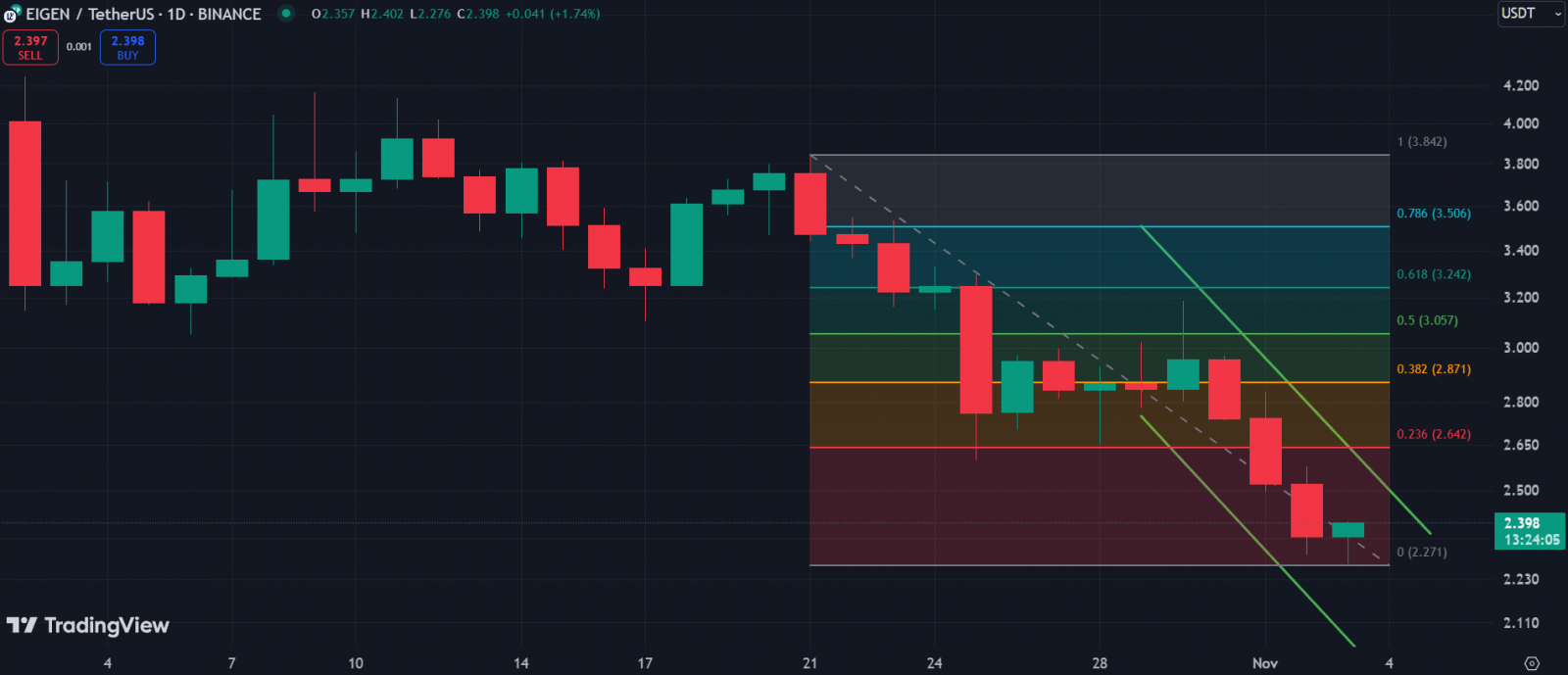

Despite the broader market seeing mild gains last week, EigenLayer (EIGEN), the native token of the Ethereum restaking protocol of the same name, closed the week with a massive 17% drop after an initial rise.

EIGEN 1D chart | Source: Trading View

EIGEN has been struggling to reclaim its peak above $4 since the Oct. 1 debut. The asset had rallied to a high of $4.90 on Binance before correcting. It has since continued to consolidate, with last week introducing more bearish pressure.

As Bitcoin retraced mid-week, EIGEN faced massive declines over three days, forming a downward channel. To overcome this trend, EigenLayer must close above the 23.6% Fibonacci retracement level at $2.642 this week.

KAS faces uncertainty

Last week, Kaspa (KAS) charted its course amid market uncertainties, diverging from broader market trends. Although it saw gains toward the end of the week, KAS ultimately closed with a 4.4% decline.

KAS 1D chart | Source: Trading View

The token experienced fluctuations throughout the week but remained below the pivot level of $0.2592, confirming the prevailing bearish momentum, as the -DI at 31.1 largely exceeds the +DI at 13.3.

For KAS to shift momentum this week, it must break through this pivot level and recover the late October high of $0.1311.

Surpassing this level would introduce the first major resistance at $0.1492. Kaspa could use this zone as a springboard to reclaim the psychological levels of $0.15 and $0.16, with a second key hurdle at $0.1636.

Read more: CZ talks about making friends in prison in new interview

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  Dogecoin

Dogecoin  USDC

USDC  Cardano

Cardano  TRON

TRON  Chainlink

Chainlink  Stellar

Stellar  Hedera

Hedera  Bitcoin Cash

Bitcoin Cash  LEO Token

LEO Token  Litecoin

Litecoin  Cronos

Cronos  Ethereum Classic

Ethereum Classic  Monero

Monero  Dai

Dai  OKB

OKB  Algorand

Algorand  Cosmos Hub

Cosmos Hub  Stacks

Stacks  Theta Network

Theta Network  Gate

Gate  Maker

Maker  Tezos

Tezos  KuCoin

KuCoin  IOTA

IOTA  NEO

NEO  Zcash

Zcash  Polygon

Polygon  Synthetix Network

Synthetix Network  Tether Gold

Tether Gold  TrueUSD

TrueUSD  Dash

Dash  Holo

Holo  Zilliqa

Zilliqa  0x Protocol

0x Protocol  Enjin Coin

Enjin Coin  Basic Attention

Basic Attention  Qtum

Qtum  Siacoin

Siacoin  Ravencoin

Ravencoin  Decred

Decred  NEM

NEM  Ontology

Ontology  DigiByte

DigiByte  Huobi

Huobi  Nano

Nano  Bitcoin Gold

Bitcoin Gold  Status

Status  Lisk

Lisk  Waves

Waves  Hive

Hive  Numeraire

Numeraire  Steem

Steem  Pax Dollar

Pax Dollar  BUSD

BUSD  OMG Network

OMG Network  Ren

Ren  Bitcoin Diamond

Bitcoin Diamond