BTC Price Analysis: Is Bitcoin Targeting $70K in the Short Term?

Bitcoin’s price has broken post a key level recently and is seemingly targeting a new all-time high in the short term.

Technical Analysis

By Edris Derakhshi (TradingRage)

The Daily Chart

On the daily chart, the price has finally broken above the $64K level and the 200-day moving average, which is located around the same mark.

With the RSI also showing a clear bullish momentum, the cryptocurrency will likely continue its uptrend toward the $68K resistance zone in the short term.

Otherwise, in case of a correction, the 200-day moving average is still likely to hold the price and push the market higher.

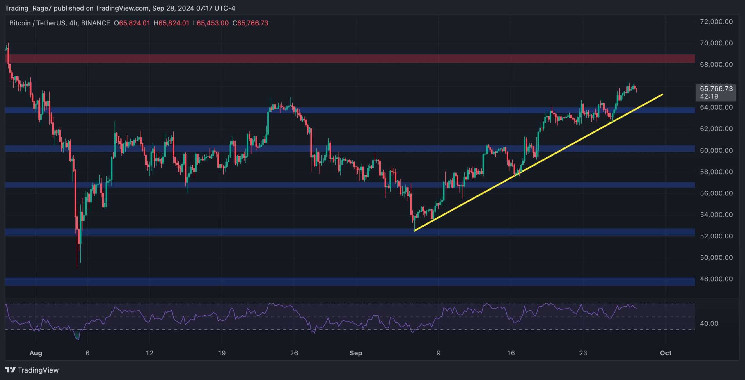

The 4-Hour Chart

Looking at the 4-hour timeframe, the price has been creating higher highs and lows ever since its rebound from the $52K support level.

The market’s bullish move has created a clear trendline, which has been supporting Bitcoin for weeks. If this trend remains intact, it will only be a matter of time before the market reaches the $68K level.

On the other hand, if the trendline gets broken to the downside, at least a pullback to the $60K level would be probable.

On-Chain Analysis

By Edris Derakhshi (TradingRage)

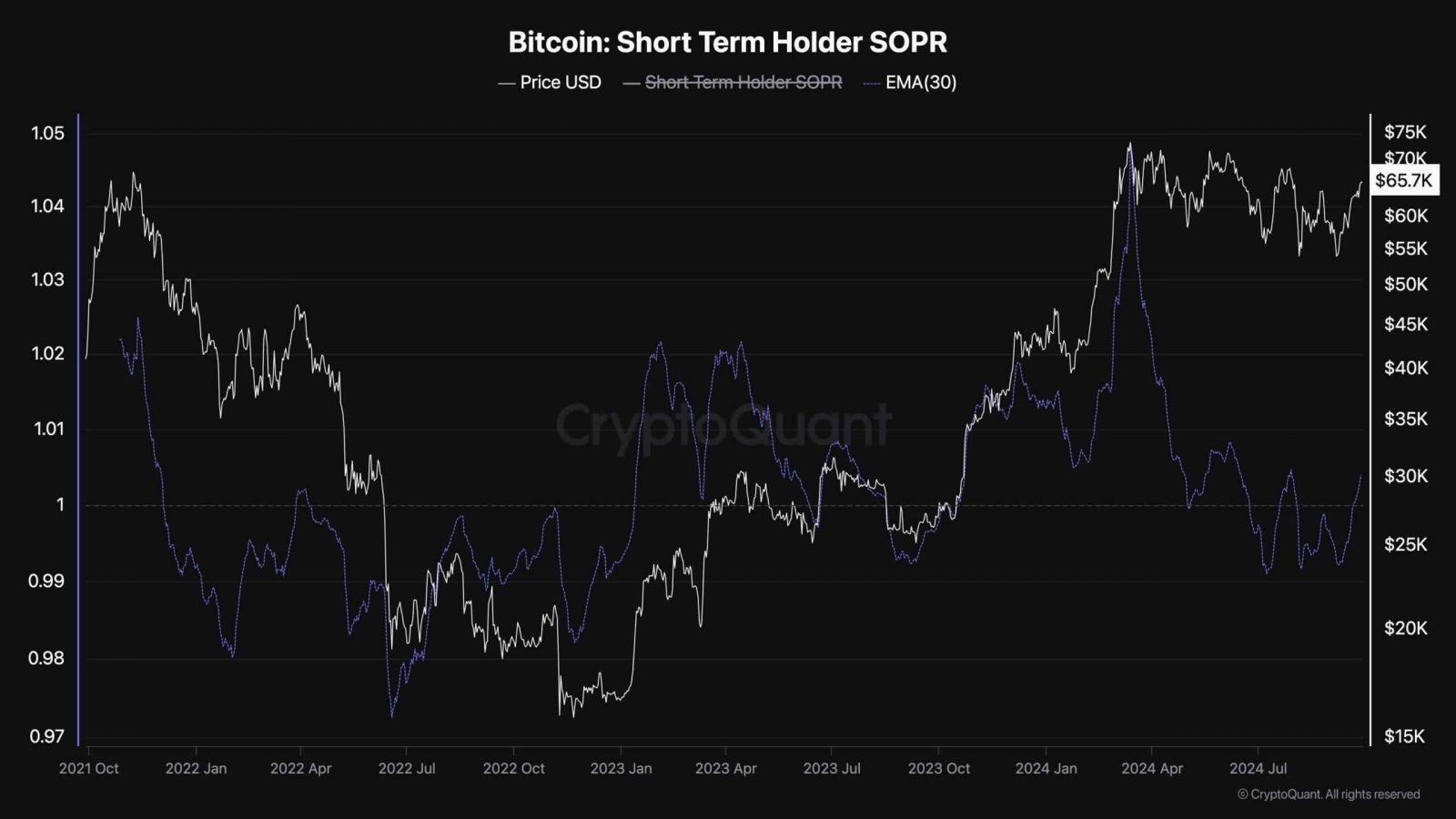

Bitcoin Short-Term Holder SOPR

During the recent Bitcoin price consolidation and gradual correction, many short-term holders, even those not in profit, panicked and sold their coins. This chart shows the Bitcoin Short-Term Holder SOPR, which measures the ratio of profits/losses realized by short-term investors.

As the chart suggests, the STH SOPR made a new record high when the price hit $70K first, but it has rapidly declined during the past few months. Short-term holders have even been realizing losses since July, as the metric has dropped below one. However, with the recent price rally, these investors are now realizing profits once again.

While this is a natural behavior in bull markets, if the selling pressure resulting from this profit-taking is not met with sufficient demand, the price could drop lower again.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  Dogecoin

Dogecoin  USDC

USDC  Cardano

Cardano  TRON

TRON  Chainlink

Chainlink  Stellar

Stellar  Hedera

Hedera  Bitcoin Cash

Bitcoin Cash  LEO Token

LEO Token  Litecoin

Litecoin  Cronos

Cronos  Ethereum Classic

Ethereum Classic  Monero

Monero  Dai

Dai  Algorand

Algorand  OKB

OKB  Cosmos Hub

Cosmos Hub  Stacks

Stacks  Theta Network

Theta Network  Gate

Gate  Maker

Maker  KuCoin

KuCoin  Tezos

Tezos  IOTA

IOTA  NEO

NEO  Polygon

Polygon  Zcash

Zcash  Synthetix Network

Synthetix Network  Tether Gold

Tether Gold  TrueUSD

TrueUSD  Dash

Dash  Holo

Holo  Zilliqa

Zilliqa  Enjin Coin

Enjin Coin  0x Protocol

0x Protocol  Siacoin

Siacoin  Qtum

Qtum  Basic Attention

Basic Attention  Bitcoin Gold

Bitcoin Gold  Ravencoin

Ravencoin  Decred

Decred  NEM

NEM  DigiByte

DigiByte  Ontology

Ontology  Nano

Nano  Status

Status  Waves

Waves  Huobi

Huobi  Lisk

Lisk  Hive

Hive  Numeraire

Numeraire  Steem

Steem  Pax Dollar

Pax Dollar  BUSD

BUSD  OMG Network

OMG Network  Ren

Ren  Bitcoin Diamond

Bitcoin Diamond  Bytom

Bytom