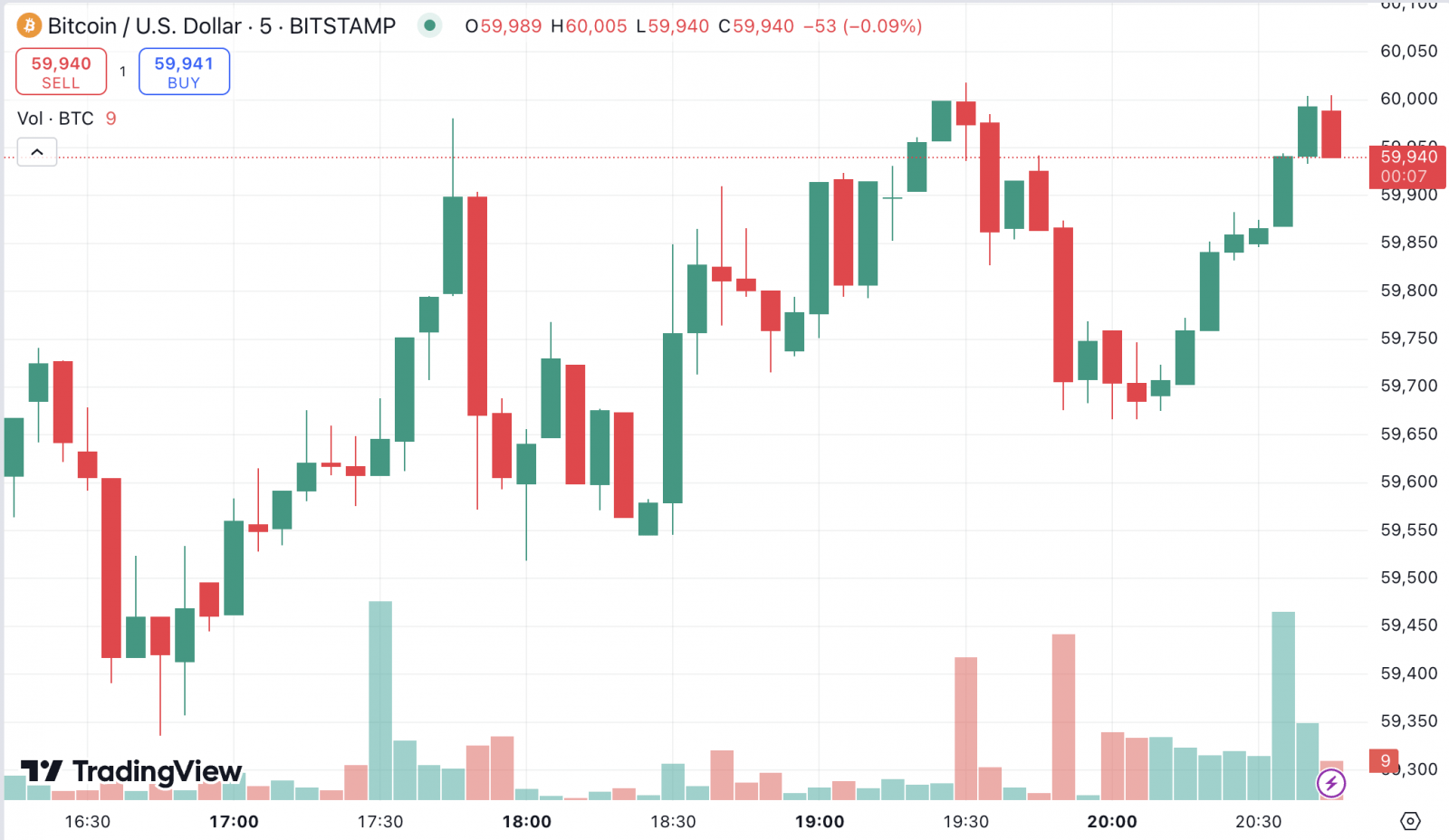

Bulls Back in Driver’s Seat as BTC Reclaims $60K

The price of Bitcoin soared back above the make-it-or-break-it $60,000 level earlier this Friday, peaking at $60,018 on the Bitstamp exchange.

The current month has now turned green with a modest 1.48% gain. This is despite the fact that September is Bitcoin’s worst-performing month, with only three years in the green since 2013. In 2023, for instance, the flagship cryptocurrency lost as much as 11.29% during September.

If bulls continue to hold their ground, this could end up bucking the persistent trend.

Bitcoin’s recent price spike was likely driven by new developments on the macro front. Market participants are now speculating about the U.S. Federal Reserve implementing a 50-basis point interest rate cut. This came after former New York Federal Reserve President Bill Dudley voiced support for such a move. According to betting site Poymarket, there is currently a 36% chance of the Fed opting for the higher-than-expected rate cut.

Earlier today, MicroStrategy co-founder Michael Saylor also announced the acquisition of $1.1 billion worth of Bitcoin. However, the massive purchase, which once again underscored the billionaire’s conviction, did not affect the price action in a substantial way.

The largest cryptocurrency has now approached a crucial resistance zone. According to pseudonymous trader Ali, the price of Bitcoin could potentially surge to $64,000 if bulls manage to maintain their momentum.

Christopher Burniske, partner at VC firm Placeholder, has opined that Bitcoin is now “getting its mojo back” in a recent social media post.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  Dogecoin

Dogecoin  USDC

USDC  Cardano

Cardano  TRON

TRON  Chainlink

Chainlink  Bitcoin Cash

Bitcoin Cash  LEO Token

LEO Token  Litecoin

Litecoin  Cronos

Cronos  Stellar

Stellar  Ethereum Classic

Ethereum Classic  Dai

Dai  Stacks

Stacks  Monero

Monero  OKB

OKB  Hedera

Hedera  Cosmos Hub

Cosmos Hub  Theta Network

Theta Network  Maker

Maker  KuCoin

KuCoin  Algorand

Algorand  Gate

Gate  Polygon

Polygon  EOS

EOS  NEO

NEO  Tezos

Tezos  Tether Gold

Tether Gold  Zcash

Zcash  Synthetix Network

Synthetix Network  IOTA

IOTA  TrueUSD

TrueUSD  Bitcoin Gold

Bitcoin Gold  Holo

Holo  Zilliqa

Zilliqa  0x Protocol

0x Protocol  Dash

Dash  Siacoin

Siacoin  Enjin Coin

Enjin Coin  Basic Attention

Basic Attention  Ravencoin

Ravencoin  Qtum

Qtum  Decred

Decred  Ontology

Ontology  NEM

NEM  Lisk

Lisk  Status

Status  DigiByte

DigiByte  Nano

Nano  Numeraire

Numeraire  Waves

Waves  Pax Dollar

Pax Dollar  Hive

Hive  Steem

Steem  Huobi

Huobi  BUSD

BUSD  Ren

Ren  OMG Network

OMG Network  Bitcoin Diamond

Bitcoin Diamond  Bytom

Bytom  Augur

Augur  Kyber Network Crystal Legacy

Kyber Network Crystal Legacy