Can Solana Break the $202 Resistance? SOL Traders Diversify with TON and LINK

- Solana aims to break $202 resistance but needs to turn resistance into support.

- Toncoin offers a solid long-term investment opportunity with a favorable risk-reward ratio.

- Chainlink’s growth is fueled by DeFi expansion and increasing use of its oracles.

Solana recently saw a 5.5% increase in just 24 hours and a 37% gain over the past month. Over the past year, Solana has surged by 365%. To continue this momentum, Solana must close the week above a key resistance level.

If that happens, a retest of that level is likely. That retest could act as support, opening up a path to $202. But reaching that target may not be straightforward. Let’s explore why SOL investors are flocking to TON and LINK.

Toncoin: A Strong Bet for Long-Term Growth

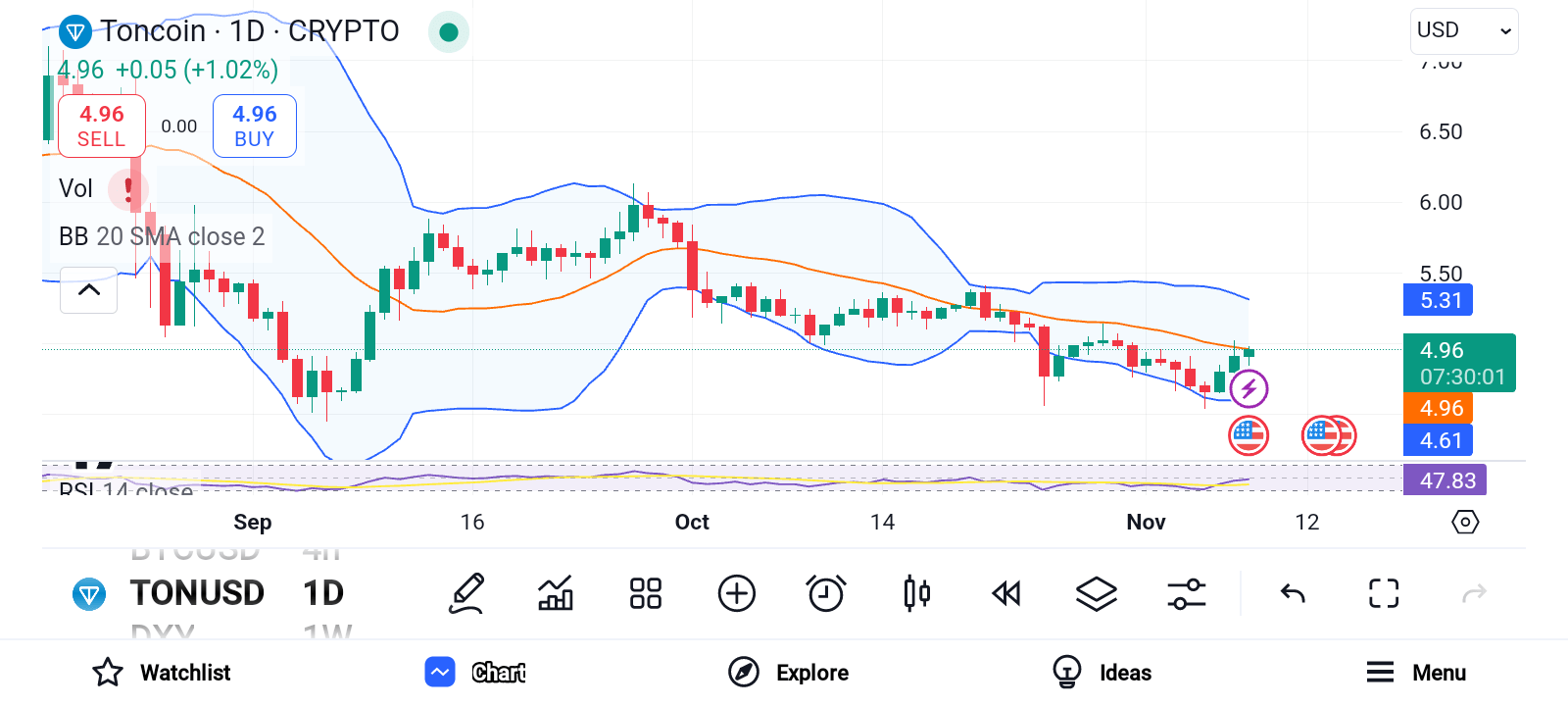

Source: Trading View

Toncoin, priced around $4.9, has had a slight rally recently. However, historical data shows a drop below its one-year moving average (MA), a pattern typically seen during bear markets. According to CryptoQuant, the price drop could offer an excellent risk-reward opportunity for long-term investors.

Though Toncoin’s price movement has been calm, the asset’s volatility has decreased. Some analysts predict the price could stay at its one-year MA level for a while. This could be a perfect time to buy. If Toncoin hits the Sigma8 target, investors could see solid returns.

Chainlink: Boosted by DeFi Growth

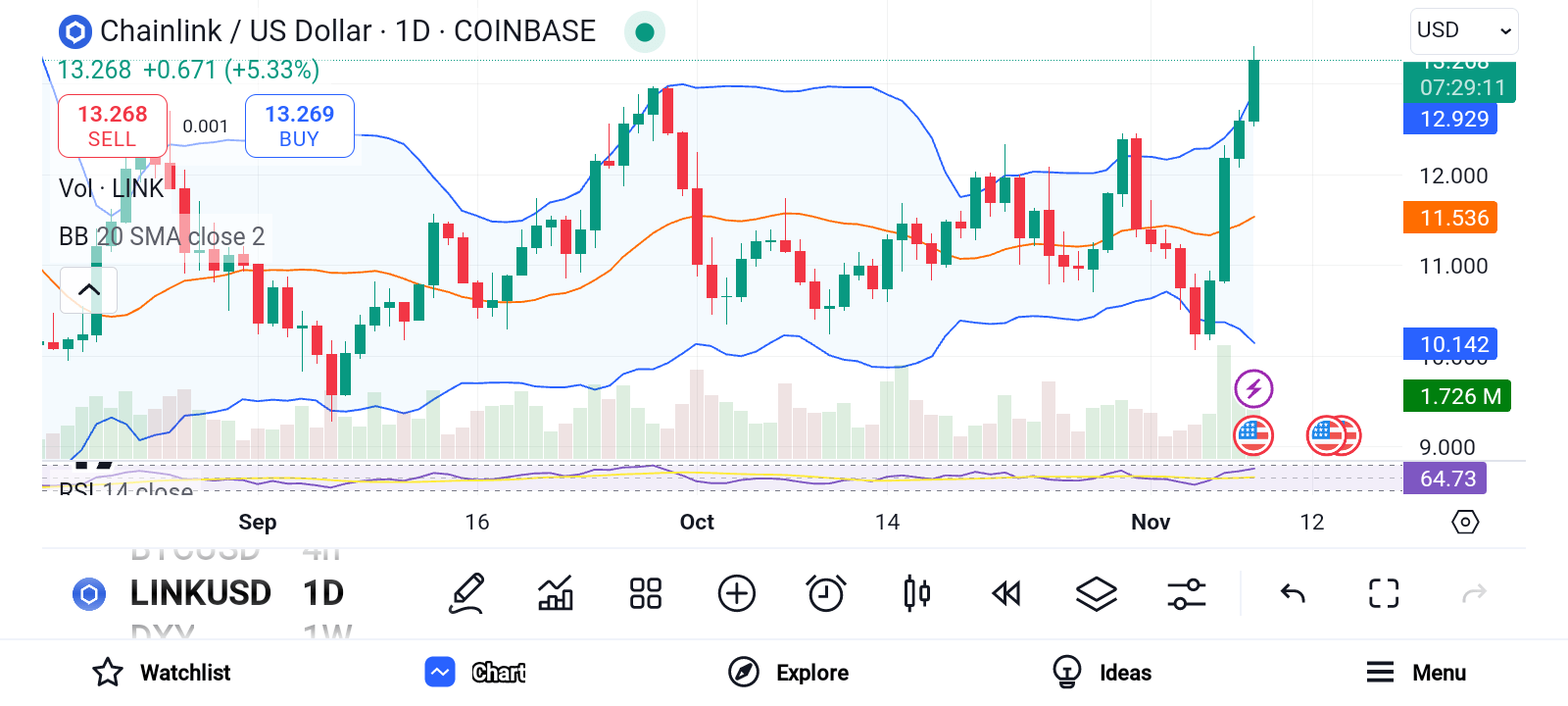

Source: Trading View

Chainlink’s price surged after BlockTower Capital began accumulating popular DeFi tokens like Uniswap and AAVE. Even though Chainlink wasn’t directly acquired, the move signals confidence in the DeFi space. BlockTower’s portfolio is worth nearly $447 million, with significant holdings in Ethereum and USD Coin.

Chainlink’s role in the DeFi market has grown substantially. DeFi Llama shows that the total value secured in Chainlink has reached $27.7 billion. Additionally, Chainlink gained attention from Forbes, which highlighted how businesses are using its oracles to create unified records.

Solana could break through the $202 resistance, but it must first turn resistance into support. Meanwhile, Toncoin looks like a solid pick for long-term investors seeking better risk-reward ratios. Chainlink continues to thrive as DeFi grows, with Chainlink staying at the forefront of that expansion.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  Dogecoin

Dogecoin  USDC

USDC  Cardano

Cardano  TRON

TRON  Bitcoin Cash

Bitcoin Cash  Chainlink

Chainlink  LEO Token

LEO Token  Litecoin

Litecoin  Cronos

Cronos  Stellar

Stellar  Ethereum Classic

Ethereum Classic  Dai

Dai  Stacks

Stacks  Monero

Monero  OKB

OKB  Hedera

Hedera  Cosmos Hub

Cosmos Hub  Theta Network

Theta Network  KuCoin

KuCoin  Maker

Maker  Gate

Gate  Algorand

Algorand  Polygon

Polygon  EOS

EOS  NEO

NEO  Tezos

Tezos  Tether Gold

Tether Gold  Zcash

Zcash  Bitcoin Gold

Bitcoin Gold  Synthetix Network

Synthetix Network  TrueUSD

TrueUSD  IOTA

IOTA  Holo

Holo  Zilliqa

Zilliqa  Dash

Dash  0x Protocol

0x Protocol  Ravencoin

Ravencoin  Siacoin

Siacoin  Qtum

Qtum  Enjin Coin

Enjin Coin  Basic Attention

Basic Attention  Decred

Decred  Ontology

Ontology  NEM

NEM  Lisk

Lisk  Waves

Waves  DigiByte

DigiByte  Status

Status  Nano

Nano  Numeraire

Numeraire  Pax Dollar

Pax Dollar  Hive

Hive  Steem

Steem  Huobi

Huobi  BUSD

BUSD  OMG Network

OMG Network  Ren

Ren  Bitcoin Diamond

Bitcoin Diamond  Bytom

Bytom  Kyber Network Crystal Legacy

Kyber Network Crystal Legacy  Augur

Augur