Cardano (ADA) Price Prediction for December 17

ADA, the native token of the Cardano blockchain, is gaining significant attention from crypto giants despite its ongoing price consolidation. On December 17, 2024, data from on-chain analytics firm Santiment revealed a massive rise in whale activity on the Cardano network, signaling potential upside momentum.

Whale Transactions Surge on Cardano Network

According to the data, the Cardano network witnessed a substantial 687 transactions, each worth more than $1 million, recorded in the past 24 hours. This highlights whales’ rising interest and confidence in the altcoin, suggesting a major price rally could be on the horizon.

Additionally, these notable transaction details were highlighted by crypto experts on X (formerly Twitter). However, ADA experienced this surge in transactions during a period of consolidation, as it traded within a tight range over the past week.

A massive surge in whale activity on the #Cardano $ADA network! In the past 24 hours, 687 transactions exceeding $1 million were recorded. pic.twitter.com/p8vzuLaFVP

— Ali (@ali_charts) December 16, 2024

Cardano (ADA) Technical Analysis and Upcoming Level

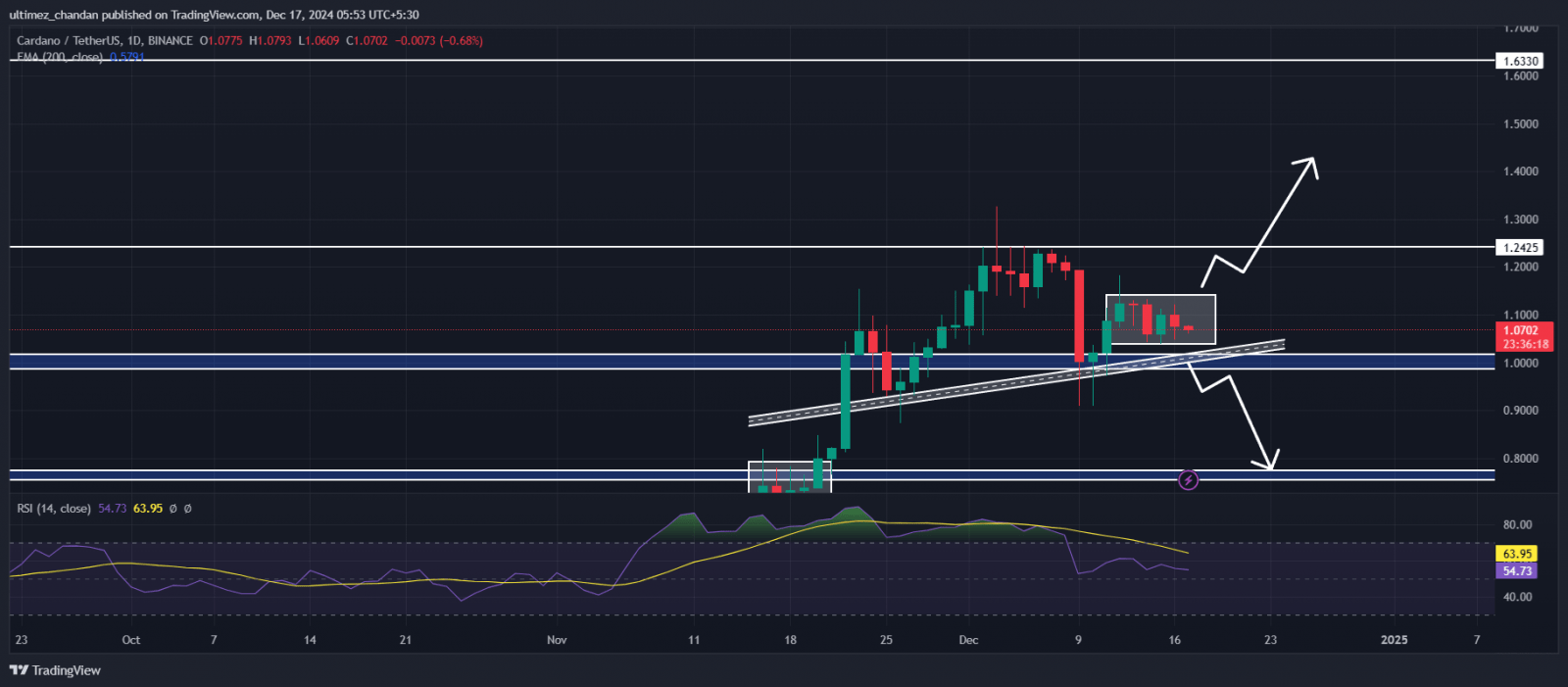

According to expert technical analysis, ADA appears to have formed a bearish head and shoulders price action pattern. However, this pattern isn’t yet complete, as the price remains trapped in a consolidation range between $1.07 and $1.14. This range could determine whether ADA moves upward or downward in the coming days.

Source: Trading View

ADA Key Levels and Current Price Momentum

Based on recent price action, if ADA breaks out of the narrow range and closes a daily candle above the $1.14 level, the bearish pattern would be invalidated, and ADA’s price could soar by 43% to reach the $1.63 mark in the future.

Conversely, if ADA breaks down from the range and closes a daily candle below $1, the bearish pattern would be confirmed, and ADA could witness a price decline of 24%, falling to the $0.78 level.

However, this bearish outlook currently appears manageable, as ADA continues to receive support from an ascending trendline.

On the positive side, ADA’s Relative Strength Index (RSI) currently stands at 52, below the overbought zone, indicating that the asset has enough room to rise in the coming days.

Currently, ADA is trading near $1.07 and has recorded a price decline of 2.7% in the past 24 hours. During the same period, its trading volume surged by 50%, indicating heightened participation from traders and investors and rising interest in the asset.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  Dogecoin

Dogecoin  USDC

USDC  Cardano

Cardano  TRON

TRON  Chainlink

Chainlink  Hedera

Hedera  Stellar

Stellar  Bitcoin Cash

Bitcoin Cash  LEO Token

LEO Token  Litecoin

Litecoin  Cronos

Cronos  Ethereum Classic

Ethereum Classic  Monero

Monero  Dai

Dai  Algorand

Algorand  OKB

OKB  Cosmos Hub

Cosmos Hub  Stacks

Stacks  Theta Network

Theta Network  Gate

Gate  Maker

Maker  Tezos

Tezos  KuCoin

KuCoin  IOTA

IOTA  Zcash

Zcash  NEO

NEO  Polygon

Polygon  Synthetix Network

Synthetix Network  Tether Gold

Tether Gold  TrueUSD

TrueUSD  Dash

Dash  Holo

Holo  Zilliqa

Zilliqa  Enjin Coin

Enjin Coin  0x Protocol

0x Protocol  Basic Attention

Basic Attention  Qtum

Qtum  Siacoin

Siacoin  Ravencoin

Ravencoin  Decred

Decred  NEM

NEM  Bitcoin Gold

Bitcoin Gold  Ontology

Ontology  DigiByte

DigiByte  Nano

Nano  Status

Status  Huobi

Huobi  Hive

Hive  Waves

Waves  Lisk

Lisk  Numeraire

Numeraire  Steem

Steem  Pax Dollar

Pax Dollar  BUSD

BUSD  OMG Network

OMG Network  Ren

Ren  Bitcoin Diamond

Bitcoin Diamond