Cardano Down 90% Since September 2021, Did Smart Contracts ‘Kill’ ADA?

At the peak of the 2020 to 2021 bull run, ADA, the native token of Cardano, rose to $3 in August. Interestingly, developers activated smart contracts around the top of this cycle after completing the Alonzo hard fork, ushering in the Goguen phase.

Did Alonzo And Smart Contracts Kill ADA?

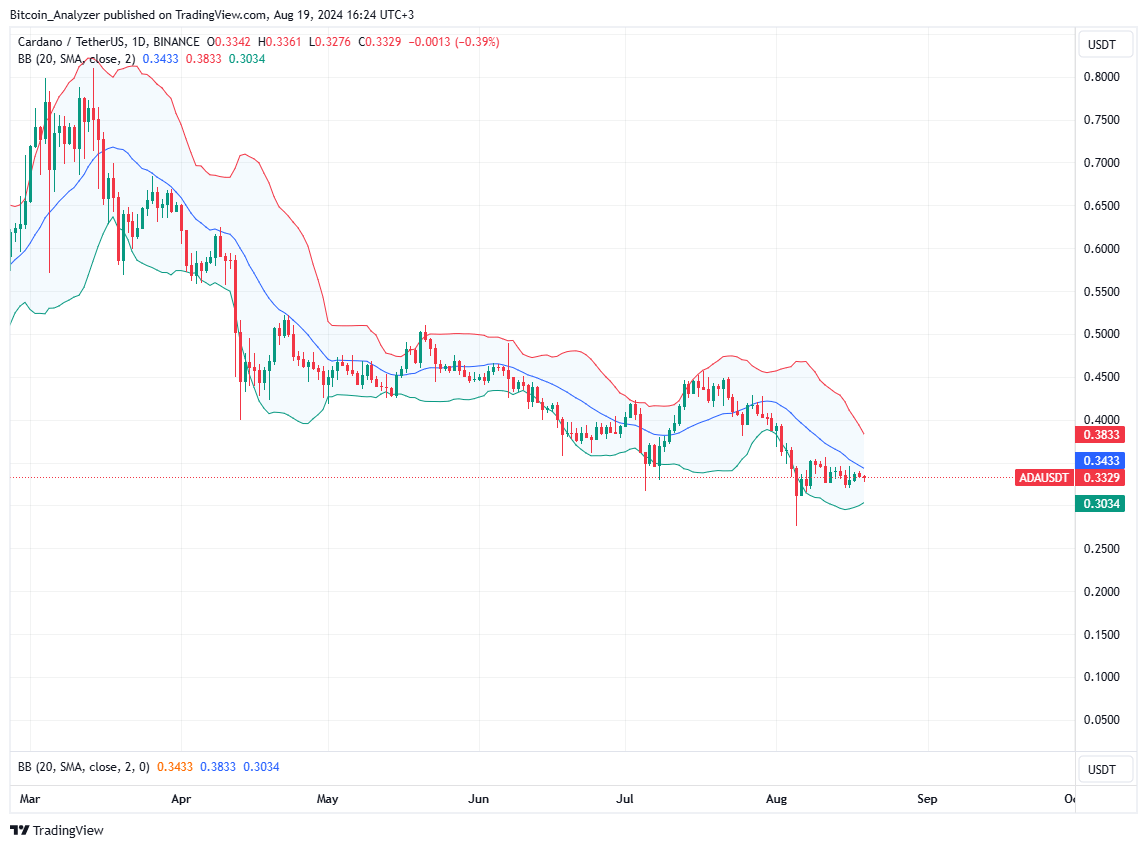

However, as Atomic Wallet analysts note, ADA has been on a downtrend since then, crumbling by over 90% over the years at the time of writing. ADA is changing hands at $0.32 when writing, finding immediate support at around $0.30, a psychological number.

Though traders are optimistic about what lies ahead, the turn of events over the last three years could suggest that the activation of smart contracts on Cardano did “kill” the coin’s valuation. The plummeting prices, made worse by the 2022 crypto winter, mean those who bought in August 2021 are holding mud.

Whether ADA will recover in the coming weeks and rewind losses of 2022 remains to be seen. What’s clear is that the activation of the Alonzo hard fork and the start of the Goguen era was a key milestone for Cardano. The transition was crucial considering that before September 2021, developers couldn’t deploy dApps and take on Ethereum and competing properties supporting smart contracts.

For years, since the genesis block, Cardano developers have been accused of delaying the process while using billions for development. After Alonzo, users can, even now, create complex smart contracts using Plutus scripts and run dApps. Like other blockchains, all fees are payable in ADA, the native token.

Over the years, Cardano has grown its ecosystem, looking at the total value locked (TVL). According to DeFiLlama, DeFi protocols on Cardano, active after Alonzo, now manage over $177 million in assets.

Though relatively low compared to those in Ethereum and the BNB Chain, developers took advantage of smart contracts and built solutions on the network.

Cardano Transitioning To Voltaire: Will Things Change?

The current disconnect between ADA valuation and the expectation of coin holders post-Goguen is a concern. It is so especially as Cardano completes the Basho stage, moving to Voltaire, the final phase of the platform’s development.

Voltaire focuses on making Cardano governance decentralized. Here, ADA will have more utility, allowing holders to vote on proposals and directly helping improve the network. Additionally, there will be a treasury for funding projects deploying on Cardano. So far, the Chang hard fork is in progress, with roughly 33% of all stake pool operators (SPOs) ready.

Meanwhile, ADA remains under immense selling pressure and could plunge to 2023 lows of around $0.22 if buyers don’t step in. If prices rise above $0.50, bulls will likely push ADA toward March 2024 highs.

Feature image from Shutterstock, chart from TradingView

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  Dogecoin

Dogecoin  TRON

TRON  Cardano

Cardano  Chainlink

Chainlink  Bitcoin Cash

Bitcoin Cash  LEO Token

LEO Token  Litecoin

Litecoin  Dai

Dai  Monero

Monero  Stellar

Stellar  Ethereum Classic

Ethereum Classic  Stacks

Stacks  OKB

OKB  Cronos

Cronos  Hedera

Hedera  Cosmos Hub

Cosmos Hub  Theta Network

Theta Network  Gate

Gate  KuCoin

KuCoin  Maker

Maker  Algorand

Algorand  Polygon

Polygon  Tether Gold

Tether Gold  NEO

NEO  EOS

EOS  Tezos

Tezos  Zcash

Zcash  TrueUSD

TrueUSD  Synthetix Network

Synthetix Network  Bitcoin Gold

Bitcoin Gold  IOTA

IOTA  Holo

Holo  Dash

Dash  Zilliqa

Zilliqa  0x Protocol

0x Protocol  Siacoin

Siacoin  Enjin Coin

Enjin Coin  Ravencoin

Ravencoin  Basic Attention

Basic Attention  Qtum

Qtum  Decred

Decred  Ontology

Ontology  NEM

NEM  Lisk

Lisk  Pax Dollar

Pax Dollar  Nano

Nano  Numeraire

Numeraire  DigiByte

DigiByte  Waves

Waves  Status

Status  Huobi

Huobi  Hive

Hive  Steem

Steem  BUSD

BUSD  Ren

Ren  OMG Network

OMG Network  Bitcoin Diamond

Bitcoin Diamond  Bytom

Bytom  Kyber Network Crystal Legacy

Kyber Network Crystal Legacy  HUSD

HUSD