Cardano Price Faces 45% Downside Risk Amid Open Interest Decline

During Friday’s U.S. trading hours, the crypto market witnessed a relief rally from the recent correction trend as Bitcoin holds $90k support. However, the uptick is yet to confirm the continuation of the prevailing uptrend as most major altcoins including Cardano price, show a breakdown below key support. Amid the declining slope in ADA’s future open interest, the seller could drive a prolonged correction trend.

By press time, the ADA price trades at $0.92 with an intraday gain of 4.77%. According to Coingecko, the asset’s market cap stands at $32.7 Billion, while the trading volume is at $2.9 Billion.

Key Highlights:

- The Cardano price breakdown from a symmetrical triangle pattern drives its current correction trend.

- A sharp decline in ADA’s OI and funding rate accentuates a weakening bearish momentum.

- The coin price sustainability above 50% Fibonacci retracement level indicates the broader trend remains bullish.

Cardano Price Risks Persist as Open Interest and Funding Rate Decline

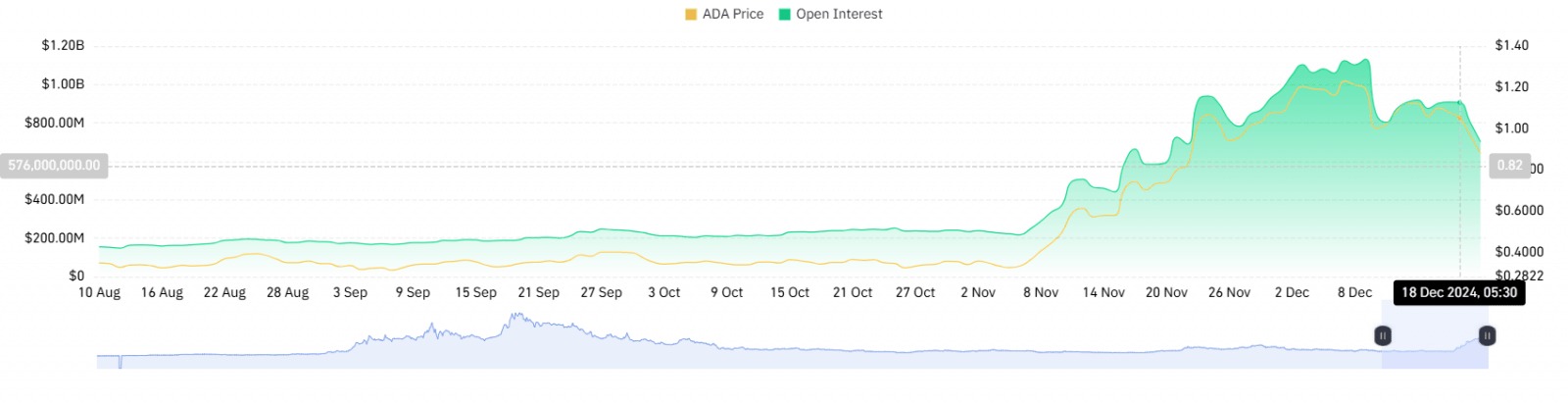

According to CoinGlass data, the ADA’s future open interest has witnessed a sharp decline from $1.13 Billion to $701 Million— within a fortnight— registering a 38% loss. This sharp decrease implies reduced trader confidence and diminishing speculative activity in ADA, potentially signaling bearish sentiment or a lack of momentum in the market.

ADA Futures Open Interest| CoinGlass

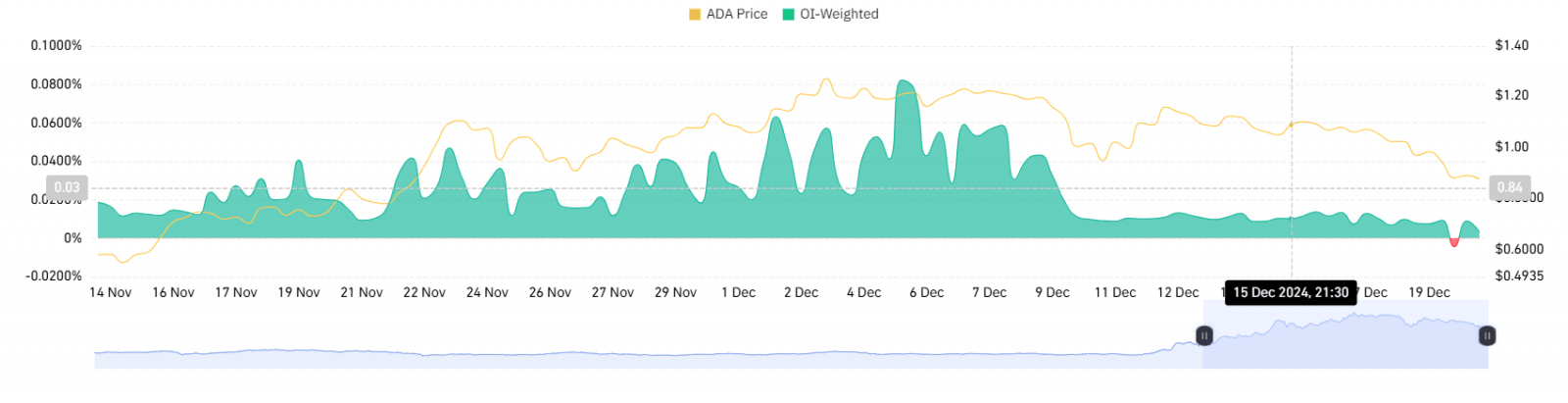

In addition, Cardano’s Open Interest (OI)-Weighted Funding Rate has dropped significantly to 0.009. While still in positive territory, this low value indicates reduced bullish sentiment and a lack of strong upward momentum in the market. It reflects a cautious approach among traders, with limited expectations for a major price rally in the short term.

ADA OI-Weighted Funding Rate | CoinGlass

Triangle Pattern Breakdown Hints for Prolonged Downfall

The Cardano price traded sideways over the past three weeks, resonating within two converging trendlines. While the consolidation may indicate a lack of initiation from buyers to sellers, the daily chart reveals the formation of the symmetrical triangle pattern.

Theoretically, the chart setup sets a temporary pause for buyers to regain bullish momentum before continuing the prevailing uptrend. However, with the current market correction, the ADA price pierced the pattern’s bottom trendline on Thursday.

Currently, the Cardano price trades at $0.9 and would likely retest the breached trendline as resistance to indicate price sustainability for further correction. If this resistance holds, the sellers could drive a post-correction fall to $0.52, marking a 43% potential fall.

On a contrary note, the daily candle shows a long-tail rejection candle at a 50% Fibonacci retracement level, indicating an intact demand pressure at the bottom. If the aforementioned retest surge surges past the $0.1 level, the buyers will regain control over this asset.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  Dogecoin

Dogecoin  USDC

USDC  Cardano

Cardano  TRON

TRON  Chainlink

Chainlink  Hedera

Hedera  Stellar

Stellar  Bitcoin Cash

Bitcoin Cash  LEO Token

LEO Token  Litecoin

Litecoin  Cronos

Cronos  Ethereum Classic

Ethereum Classic  Monero

Monero  Dai

Dai  OKB

OKB  Algorand

Algorand  Cosmos Hub

Cosmos Hub  Theta Network

Theta Network  Stacks

Stacks  Gate

Gate  KuCoin

KuCoin  Maker

Maker  Tezos

Tezos  IOTA

IOTA  NEO

NEO  Zcash

Zcash  Polygon

Polygon  Synthetix Network

Synthetix Network  Tether Gold

Tether Gold  TrueUSD

TrueUSD  Dash

Dash  Holo

Holo  Zilliqa

Zilliqa  0x Protocol

0x Protocol  Enjin Coin

Enjin Coin  Basic Attention

Basic Attention  Qtum

Qtum  Siacoin

Siacoin  Ravencoin

Ravencoin  Decred

Decred  NEM

NEM  Ontology

Ontology  DigiByte

DigiByte  Huobi

Huobi  Nano

Nano  Bitcoin Gold

Bitcoin Gold  Hive

Hive  Status

Status  Waves

Waves  Lisk

Lisk  Steem

Steem  Numeraire

Numeraire  Pax Dollar

Pax Dollar  BUSD

BUSD  OMG Network

OMG Network  Ren

Ren  Bitcoin Diamond

Bitcoin Diamond  Bytom

Bytom