Cardano Skyrockets 300% in Funds Inflows as Bulls Take Charge

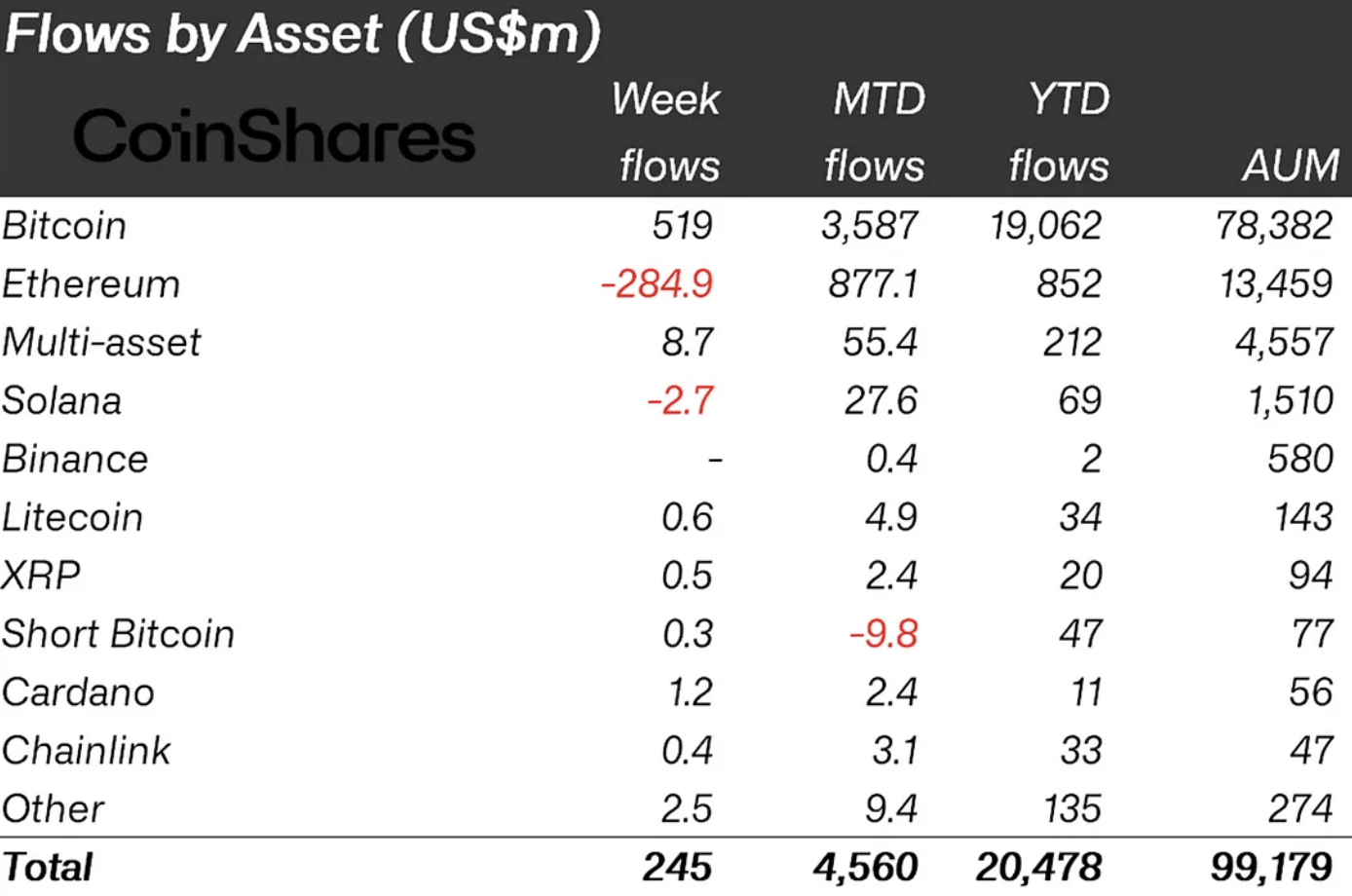

According to the latest CoinShares weekly report on crypto-related ETF inflows, another $245 million were added to the market last week. As things stand, the year-to-date figure is positive, starting at $20.48 billion.

As always, Bitcoin – the largest cryptocurrency – led the way last week, with several ETFs from major financial institutions such as BlackRock and Franklin Templeton. Over the past seven days, these investment vehicles have seen inflows of $519 million, which is literally 97.9% of all the money that has flowed into crypto-related investment products over the period.

However, there were other winners as well – digital assets, investment products that have shown exceptional momentum in terms of inflows, although not as much as Bitcoin. One of these is Cardano (ADA). According to the data, inflows into Cardano ETPs totaled $1.2 million last week, 300% more than the week before.

Furthermore, this week’s result puts Cardano in second place among all crypto ETPs. In total, since the start of 2024, Cardano-oriented investment products have attracted $11 million from traditional investors.

Cardano’s next big hard fork

Such an increase for the ADA blockchain can be attributed to the upcoming Chang hard fork. As reported by U.Today, the hard fork is expected to bring the ultimate decentralization to Cardano, when even the popular blockchain’s treasury will be managed through voting by ADA stakeholders.

It also includes the adoption of the Cardano Constitution, which will cement all the principles and rules of decentralized governance of the blockchain.

The hard fork is scheduled for this year, so it is possible that investors will try to make this play through Cardano ETPs, and that is why we are seeing increasing flows into these investment products.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  Dogecoin

Dogecoin  TRON

TRON  Cardano

Cardano  Bitcoin Cash

Bitcoin Cash  Chainlink

Chainlink  LEO Token

LEO Token  Litecoin

Litecoin  Dai

Dai  Monero

Monero  Stellar

Stellar  Ethereum Classic

Ethereum Classic  Stacks

Stacks  OKB

OKB  Cronos

Cronos  Hedera

Hedera  Cosmos Hub

Cosmos Hub  Gate

Gate  KuCoin

KuCoin  Theta Network

Theta Network  Maker

Maker  Algorand

Algorand  Polygon

Polygon  Tether Gold

Tether Gold  NEO

NEO  EOS

EOS  Tezos

Tezos  Zcash

Zcash  TrueUSD

TrueUSD  Synthetix Network

Synthetix Network  Bitcoin Gold

Bitcoin Gold  IOTA

IOTA  Holo

Holo  Dash

Dash  Zilliqa

Zilliqa  Siacoin

Siacoin  0x Protocol

0x Protocol  Ravencoin

Ravencoin  Basic Attention

Basic Attention  Enjin Coin

Enjin Coin  Qtum

Qtum  Decred

Decred  Ontology

Ontology  NEM

NEM  Lisk

Lisk  Pax Dollar

Pax Dollar  Nano

Nano  Numeraire

Numeraire  Waves

Waves  Status

Status  DigiByte

DigiByte  Huobi

Huobi  Hive

Hive  Steem

Steem  BUSD

BUSD  Ren

Ren  OMG Network

OMG Network  Bitcoin Diamond

Bitcoin Diamond  Bytom

Bytom  HUSD

HUSD  Kyber Network Crystal Legacy

Kyber Network Crystal Legacy  Energi

Energi