Cathie Wood’s Ark Invest offloaded another $20 million worth of Coinbase shares

Ark Invest’s Coinbase selling spree reached $50 million last week after offloading another 133,823 COIN ($20.6 million) on Friday, according to the company’s latest trade filing.

Of the total Coinbase shares offloaded on Friday, Cathie Wood’s investment management firm sold 107,151 shares ($16.5 million) from its Innovation exchange-traded fund, 15,892 shares ($2.4 million) from its Next Generation Internet ETF and 10,780 shares from its Fintech Innovation ETF ($1.7 million).

Adding to the $25.3 million worth of COIN it sold on Wednesday and $4.1 million on Thursday, Ark unloaded a total of $50 million in Coinbase shares from its funds last week — despite the stock falling around 10%.

Ark has continued to rebalance its fund weightings after also selling $200 million worth of Coinbase shares in December amid a surge in COIN’s price — up more than 40% last month.

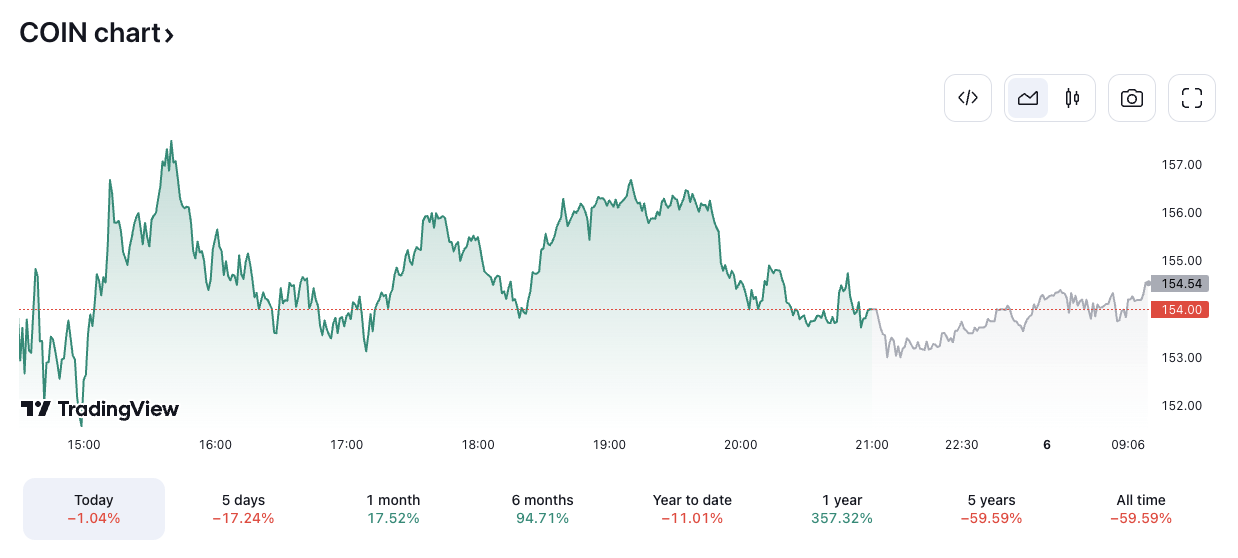

Coinbase stock traded for $153.98 at market close on Friday, down around 1% on the day, according to TradingView. The stock is up over 350% during the past year but remains 55% down from an all-time high of $342.98 set during the peak of the crypto bull market in November 2021.

COIN/USD price chart. Image: TradingView.

Bitcoin spot ETF issuers turn to Coinbase for custody

The crypto industry has been vying for a bitcoin spot ETF for years, with Ark Invest/21Shares, Valkyrie and Bitwise among the current total of 14 asset managers hoping to finally win approval from the U.S. Securities and Exchange Commission this week.

The majority of the issuers — including Ark, as well as BlackRock, Franklin Templeton and Grayscale — have tasked Coinbase to provide custodial services, should their funds be approved. However, that has led to concerns regarding a lack of diversification and counterparty risk. Fidelity and VanEck are notable exceptions, choosing self-custody and Gemini for their funds, respectively.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  Dogecoin

Dogecoin  TRON

TRON  Cardano

Cardano  Chainlink

Chainlink  Bitcoin Cash

Bitcoin Cash  LEO Token

LEO Token  Litecoin

Litecoin  Dai

Dai  Monero

Monero  Stellar

Stellar  Ethereum Classic

Ethereum Classic  Stacks

Stacks  OKB

OKB  Cronos

Cronos  Hedera

Hedera  Cosmos Hub

Cosmos Hub  Gate

Gate  KuCoin

KuCoin  Theta Network

Theta Network  Maker

Maker  Algorand

Algorand  Polygon

Polygon  Tether Gold

Tether Gold  NEO

NEO  EOS

EOS  Tezos

Tezos  Zcash

Zcash  TrueUSD

TrueUSD  Synthetix Network

Synthetix Network  Bitcoin Gold

Bitcoin Gold  IOTA

IOTA  Holo

Holo  Dash

Dash  Zilliqa

Zilliqa  0x Protocol

0x Protocol  Siacoin

Siacoin  Ravencoin

Ravencoin  Enjin Coin

Enjin Coin  Basic Attention

Basic Attention  Qtum

Qtum  Decred

Decred  Ontology

Ontology  NEM

NEM  Lisk

Lisk  Pax Dollar

Pax Dollar  Nano

Nano  Numeraire

Numeraire  Waves

Waves  DigiByte

DigiByte  Status

Status  Huobi

Huobi  Hive

Hive  Steem

Steem  BUSD

BUSD  Ren

Ren  OMG Network

OMG Network  Bitcoin Diamond

Bitcoin Diamond  Bytom

Bytom  Kyber Network Crystal Legacy

Kyber Network Crystal Legacy  HUSD

HUSD