Chainlink eyes 25% surge after whale-driven breakout

While cryptocurrencies target robust recoveries, decentralized oracle platform Chainlink (LINK) looks to explode following its latest price breakout.

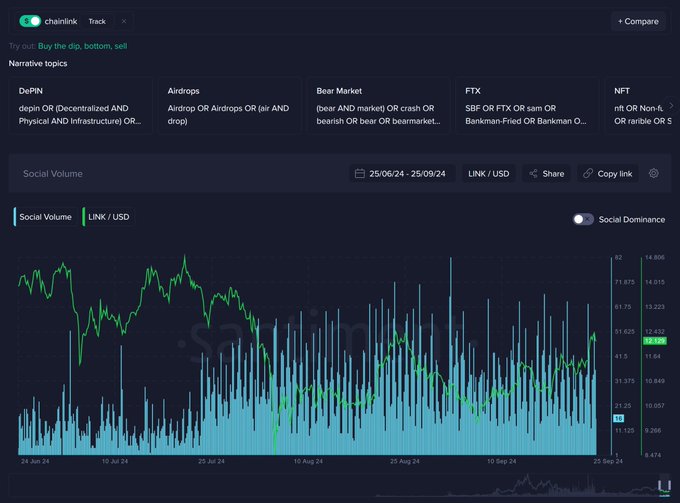

Santiment reveals that massive whale accumulations drove LINK’s prevailing revival.

Large-scale investors have consistently purchased the tokens in the last six weeks, buying over 8.5 million Chainlink coins.

Santiment @santimentfeed ·Follow

🔗📊 Chainlink’s recent price breakout has come on the backs of whales accumulating over 8.5M LINK in the past 6 weeks. Our featured article breaks down the enthusiastic community, spikes in on-chain activity, & more for the #14 ranked cryptocurrency! 👇 insights.santiment.net/read/link-on-t…

That reflects confidence in the asset’s anticipated surges, and overpowering the falling channel pattern could trigger price upswings to $15, translating to an over 25% uptick from LINK’s current price of $12.45.

According to Santiment’s analysis,

“This surge in whale transactions highlights the interest of high-net-worth individuals and institutional investors in Chainlink, and their increased interest in moving the 14th largest market cap assets. Their activities are often indicative of significant price volatility ahead, and in this case (based on price trajectory at the time of the spike) may be of the bullish variety.”

Chainlink ready for uptrends as bullish catalysts resurface

Santiment revealed factors behind LINK’s latest price performance.

Besides the enormous whale accumulation in the last six weeks, several catalysts support Chainlink’s upside trajectory.

The altcoin’s monthly MVRV ratio recently climbed to +9.2%, suggesting potential growth.

Meanwhile, a jump to +15 could indicate a price top and imminent dips.

Nevertheless, the 365-day Market Value to Realized Value is -13.1%, indicating a massive room for LINK’s anticipated surge.

Also, the Mean Dollar Invested Age saw a sharp dip on 19 September.

The metric shows the average timeframe that assets have been dormant in LINK wallets.

The drop confirmed reactivations of assets that have been idle.

Source: Santiment

Sending dormant tokens back to circulation reflects renewed holder optimism.

Long-term investors are willing to participate amid potential bullish moves.

LINK ready to break free from a descending channel

The 24-hour chart shows the alt has traded within a plunging channel formation since the March 2024 rejection.

Meanwhile, Chainlink teases a breakout after forming a solid support floor at $9.60.

The latest double-bottom rebound saw LINK gaining nearly 28% in the past 20 days, soaring from $9.556 to surpass the 50-day Exponential Moving Average.

Moreover, the recent jump past the resistance at the 100-day Exponential Moving Average, coinciding with $12.16, opened the path for more upswings.

LINK bulls target $15

Chainlink is testing the crucial hurdle at 23.60% FIB retracement level ($12.43).

Overcoming this hurdle will open the doors toward 38.20% FIB (14.21) and 50% FIB ($15.64).

That would lead to a 25.62% surge from LINK’s current price.

Current LINK performance

Chainlink trades at $12.45 after gaining 0.75% in the past day.

The alt gained 10.83% the previous week, and the massive whale interest indicates continued bullishness.

Source: Coinmarketcap

Technical indicators and on-chain metrics support the upside stance.

Thus, LINK will likely close September with gains and explode in the highly awaited October rally.

The post Chainlink eyes 25% surge after whale-driven breakout appeared first on Invezz

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  Dogecoin

Dogecoin  USDC

USDC  Cardano

Cardano  TRON

TRON  Chainlink

Chainlink  Stellar

Stellar  Hedera

Hedera  Bitcoin Cash

Bitcoin Cash  LEO Token

LEO Token  Litecoin

Litecoin  Cronos

Cronos  Ethereum Classic

Ethereum Classic  Monero

Monero  Dai

Dai  Algorand

Algorand  OKB

OKB  Cosmos Hub

Cosmos Hub  Stacks

Stacks  Theta Network

Theta Network  Gate

Gate  Maker

Maker  KuCoin

KuCoin  Tezos

Tezos  IOTA

IOTA  Zcash

Zcash  NEO

NEO  Polygon

Polygon  Synthetix Network

Synthetix Network  Tether Gold

Tether Gold  TrueUSD

TrueUSD  Dash

Dash  Holo

Holo  Zilliqa

Zilliqa  Enjin Coin

Enjin Coin  0x Protocol

0x Protocol  Basic Attention

Basic Attention  Qtum

Qtum  Siacoin

Siacoin  Ravencoin

Ravencoin  Bitcoin Gold

Bitcoin Gold  Decred

Decred  NEM

NEM  DigiByte

DigiByte  Ontology

Ontology  Nano

Nano  Status

Status  Huobi

Huobi  Hive

Hive  Waves

Waves  Lisk

Lisk  Numeraire

Numeraire  Steem

Steem  Pax Dollar

Pax Dollar  BUSD

BUSD  OMG Network

OMG Network  Ren

Ren  Bitcoin Diamond

Bitcoin Diamond