Chainlink Sees Massive Whale Accumulation: 8.5M LINK Added in Six Weeks as On-Chain Activity Soars

Chainlink (LINK), the decentralized oracle network, has witnessed a remarkable price breakout, primarily driven by significant whale accumulation.

Over the last six weeks, whale investors have added over 8.5 million LINK tokens to their holdings, leading to a renewed bullish sentiment within the market.

This surge coincides with increased on-chain activity, making Chainlink a focal point for investors seeking long-term growth.

As the 14th-ranked cryptocurrency by market capitalization, Chainlink has seen its price rise by 8.8% relative to Bitcoin in recent days.

Whale Accumulation Signals Bullish Outlook

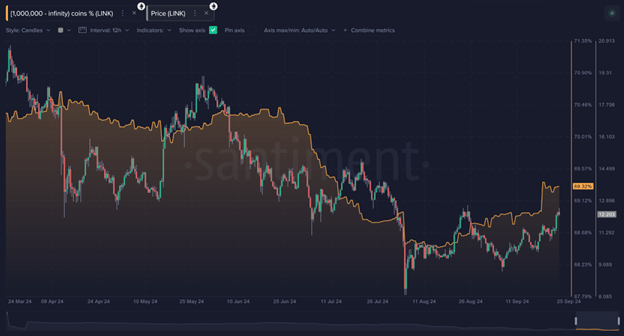

Chainlink’s recent price movement can be traced back to whale accumulation. On-chain data reveals that large investors holding over 1 million LINK have significantly increased their holdings over the past six weeks.

The collective holdings of these wallets rose from 685.5 million LINK in mid-August to 694.0 million by late September—a total increase of 8.5 million LINK.

🔗📊 Chainlink’s recent price breakout has come on the backs of whales accumulating over 8.5M LINK in the past 6 weeks. Our featured article breaks down the enthusiastic community, spikes in on-chain activity, & more for the #14 ranked cryptocurrency! 👇 https://t.co/SEE0gMKSHY pic.twitter.com/E26cc9qUSd

— Santiment (@santimentfeed) September 25, 2024

According to data from Santiment, whale transaction worth over $1 million surged in September. Such moves from institutional investors and high-net-worth individuals often precede large price movements. As of now, the trajectory suggests continued bullish momentum, although caution may be warranted.

Chainlink Whale Transaction Counts

On-Chain Activity and Dormant Tokens Point to Confidence

A significant boost in on-chain activity has also contributed to Chainlink’s price increase. On September 19th, Chainlink recorded its third-largest daily token circulation spike of the year.

This surge often signals renewed interest from both retail and institutional investors. However, the “Mean Dollar Invested Age,” which tracks how long LINK tokens have been held, saw a sharp decline in mid-September, suggesting that long-term holders were once again moving their tokens.

Brian Q., a crypto analyst, noted in his report that “the reactivation of dormant tokens is typically a bullish signal, as it reflects renewed confidence among long-term holders.” This activity indicates that many investors who had previously been holding their LINK in wallets are now engaging with the market again, further strengthening the price rally.

Additionally, Chainlink’s Network Realized Profit/Loss (NRPL) has shifted into profitable territory, showing that many investors are now “in the money,” which reduces selling pressure.

Chainlink Whales

Community Sentiment and Development Activity Propel Chainlink

Chainlink’s community remains one of its strongest assets, with vocal supporters across social media platforms such as X (formerly Twitter) and Reddit. These communities often amplify positive developments, further driving investor interest.

As seen in previous market cycles, strong crowd sentiment can have a direct impact on market performance. Brian Q.’s research indicates that increased social media activity about Chainlink often coincides with buying pressure, causing short-term price increases.

Beyond social sentiment, Chainlink has maintained a robust development ecosystem. According to data from Santiment, the project logged 624 notable GitHub events in the past 30 days, outpacing Ethereum and other major ERC-20 tokens.

Santiment previously noted that significant developer activity suggests confidence in the protocol, which can lead to long-term value for token holders.

Chainlink Development Rate

Whale Movements Could Signal Volatility

While Chainlink’s price surge has been supported by whale accumulation and positive on-chain metrics, there is also reason for caution. Historical data shows that significant whale movements can sometimes precede market volatility.

The recent transfer of 18 million LINK tokens to Binance suggests that some large holders may be preparing to take profits. Santiment’s research indicates that after each whale-driven accumulation phase, a period of consolidation or correction often follows.

Although LINK’s long-term outlook remains positive, with its decentralized Oracle technology continuing to drive real-world applications, investors should remain aware of potential short-term fluctuations.

The current Market Value to Realized Value (MVRV) ratio indicates that while LINK still has upside potential, prices nearing +15% MVRV could signal an overbought market condition.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  Dogecoin

Dogecoin  USDC

USDC  Cardano

Cardano  TRON

TRON  Chainlink

Chainlink  Bitcoin Cash

Bitcoin Cash  LEO Token

LEO Token  Stellar

Stellar  Litecoin

Litecoin  Hedera

Hedera  Cronos

Cronos  Ethereum Classic

Ethereum Classic  Dai

Dai  Stacks

Stacks  Monero

Monero  OKB

OKB  Cosmos Hub

Cosmos Hub  Algorand

Algorand  Theta Network

Theta Network  Maker

Maker  KuCoin

KuCoin  Gate

Gate  Tezos

Tezos  Polygon

Polygon  NEO

NEO  Zcash

Zcash  Tether Gold

Tether Gold  IOTA

IOTA  Synthetix Network

Synthetix Network  Bitcoin Gold

Bitcoin Gold  TrueUSD

TrueUSD  Zilliqa

Zilliqa  Holo

Holo  0x Protocol

0x Protocol  Enjin Coin

Enjin Coin  Dash

Dash  Siacoin

Siacoin  Qtum

Qtum  Ravencoin

Ravencoin  Basic Attention

Basic Attention  Decred

Decred  Ontology

Ontology  NEM

NEM  Lisk

Lisk  DigiByte

DigiByte  Waves

Waves  Status

Status  Nano

Nano  Numeraire

Numeraire  Hive

Hive  Pax Dollar

Pax Dollar  Huobi

Huobi  Steem

Steem  BUSD

BUSD  Ren

Ren  OMG Network

OMG Network  Bitcoin Diamond

Bitcoin Diamond  Bytom

Bytom  Kyber Network Crystal Legacy

Kyber Network Crystal Legacy