Clober liquidity vault has been exploited for 133 ETH, the team offers white hat bounty

Clober, a decentralized market on Base, has been exploited for 133 ETH. The team offered the white hat a 20% fee to regain access to the funds.

One of the liquidity vaults of Clober, a DEX on the Base chain, recently suffered an exploit. The hacker managed to withdraw 133 wrapped ETH in a single transaction.

🚨 URGENT: Security Breach Alert 🚨

We regret to inform our community that the Clober Liquidity Vault has been compromised in a security breach.

We want to reassure our users that the Clober protocol itself is unaffected, and all core functionalities continue to operate…

— Clober | Fully on-chain CLOB DEX (@CloberDEX) December 10, 2024

After the exploit, the funds were bridged back to the Ethereum main chain, which has a lot of paths for mixing or trading.

The protocol claimed no other features of the protocol were unaffected, and did not make any call for users to take any further extra steps.

Base is one of the relatively safer chains with few reported exploits. However, the growth of its DeFi sector has increased the frequency of attempts to steal valuable funds. As with other exploits, scammers may try to post phishing links attempting to drain wallets.

In addition to Base, Clober has built an Arbitrum version, which remains unaffected by the hack. Clober Core and the Mitosis testnet are also safe and will not be frozen or stopped.

The vault in question has been drained, and no other funds are at risk. The Clober V2 vault is still operational and is currently building up its value locked, based on Messari data. That vault contains a little over $17K.

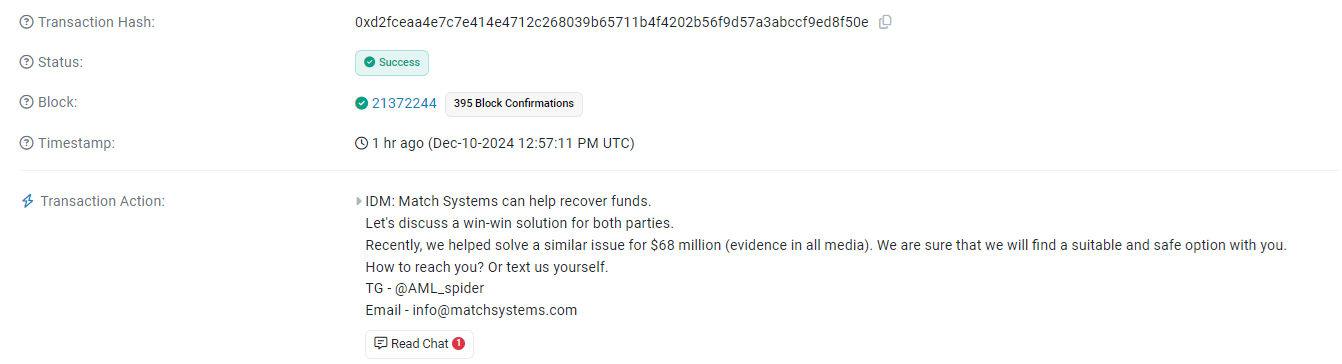

Despite the call for a white hat fee, the hacker retained the funds. The team contacted the hacker directly through the Ethereum chain with a message to resolve the issue.

Clober’s team called for assistance and offered a white hat fee to return the liquidity. | Source: Etherscan

The project is working with Match Systems for a potential white hat solution, where the hacker receives a fee but returns most of the liquidity.

Hacker used burn function flaw to steal funds

To complete the exploit, the Clober hacker deposited just 2.87 ETH from Binance. After withdrawing the funds, they moved through the Across protocol bridge, ending up on two Ethereum addresses.

The two addresses (1 &2) were created specifically for the bridge transaction to take the funds out of Base and onto the Ethereum mainnet.

According to PeckShield, the hack was possible due to issues with the burn function, which allowed the withdrawal call.

Clober offered fully on-chain order books

Clober is still an early-stage protocol with relatively low liquidity. Its liquidity vault is now practically empty. The protocol also onboarded the liquidity as late as December 9, based on DeFi Llama data. The hack happened a day later, suggesting the hacker may have been closely following the protocol.

The past few days saw similar exploits for relatively small sums. The recent events have exploited logic flaws in smart contracts, leading to relatively easy attempts to drain funds.

The recent exploit happened just days after Clober completed an audit of its smart contracts. It hired Kupia Security for the audit, a firm known for multiple bug bounties for high-profile projects.

Just days before that, Clober also advertised its liquidity vault approach, which aimed to smooth out DEX activity and swaps. At the time, it boasted that its $500K liquidity could generate volumes of $1.2M in 24 hours, serving to complete trades more efficiently. It was precisely this available liquidity that the exploiter carted away.

The Clober liquidity vault was first launched on Base just over a week ago, with the goal of replacing the usual Automated Market Makers (AMM) for DEX trades. Clober was also highly active with its promotion, specifically drawing attention to its targeted liquidity approach and the potential for high volumes.

Clober launched just after Base had achieved a new record in value locked, with its DeFi sector now carrying $3.86B in TVL. Clober aims to offer a model similar to Aerodrome, where targeted liquidity achieves much higher volumes, by targeting the most common price range for traders.

Land a High-Paying Web3 Job in 90 Days: The Ultimate Roadmap

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  Dogecoin

Dogecoin  USDC

USDC  Cardano

Cardano  TRON

TRON  Chainlink

Chainlink  Stellar

Stellar  Hedera

Hedera  Bitcoin Cash

Bitcoin Cash  LEO Token

LEO Token  Litecoin

Litecoin  Cronos

Cronos  Ethereum Classic

Ethereum Classic  Monero

Monero  Dai

Dai  Algorand

Algorand  OKB

OKB  Cosmos Hub

Cosmos Hub  Stacks

Stacks  Theta Network

Theta Network  Gate

Gate  Maker

Maker  KuCoin

KuCoin  Tezos

Tezos  IOTA

IOTA  NEO

NEO  Zcash

Zcash  Polygon

Polygon  Synthetix Network

Synthetix Network  Tether Gold

Tether Gold  TrueUSD

TrueUSD  Dash

Dash  Holo

Holo  Zilliqa

Zilliqa  Enjin Coin

Enjin Coin  0x Protocol

0x Protocol  Siacoin

Siacoin  Qtum

Qtum  Basic Attention

Basic Attention  Ravencoin

Ravencoin  Bitcoin Gold

Bitcoin Gold  Decred

Decred  NEM

NEM  DigiByte

DigiByte  Ontology

Ontology  Nano

Nano  Status

Status  Waves

Waves  Huobi

Huobi  Hive

Hive  Lisk

Lisk  Numeraire

Numeraire  Steem

Steem  Pax Dollar

Pax Dollar  BUSD

BUSD  OMG Network

OMG Network  Ren

Ren  Bitcoin Diamond

Bitcoin Diamond  Bytom

Bytom