Coinbase calls spot bitcoin ETF approval ‘watershed moment’

Cryptocurrency exchange Coinbase, which has long been at loggerheads with the Securities and Exchange Commission, cheered the regulator’s decision to approve a host of spot bitcoin ETFs on Wednesday.

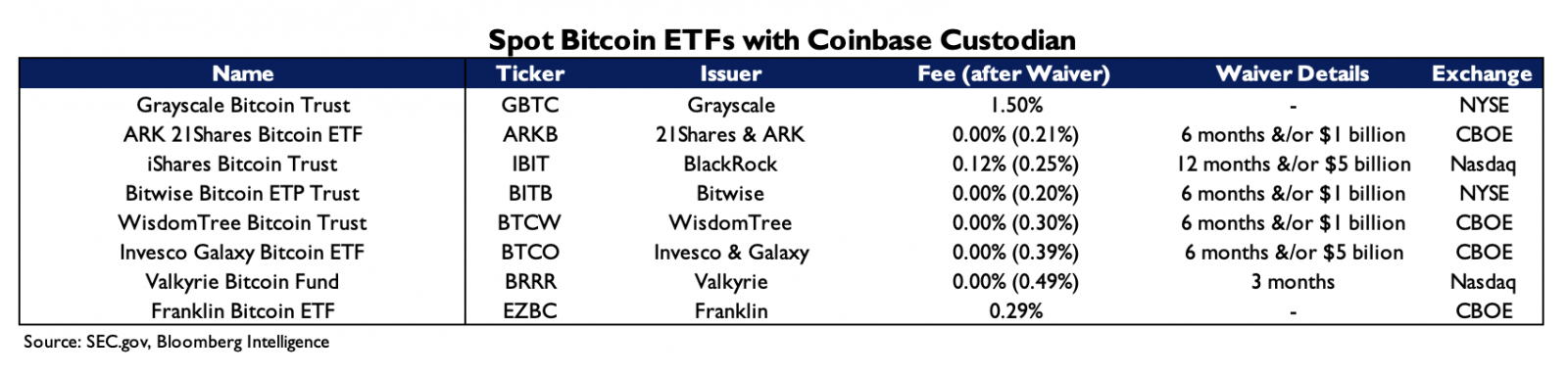

“The SEC’s approval of 11 spot bitcoin ETFs, eight of which are partnered with Coinbase, is a watershed moment for the expansion of the cryptoeconomy,” the company said in a blog post. “Spot bitcoin ETFs introduced by the world’s largest asset managers will unlock diversified pools of new investors to spur long-term growth and product innovation.”

Spot bitcoin ETFs using Coinbase as custodian. Image: The Block.

‘Grateful to Grayscale’

After months of speculation and with a deadline looming, the SEC approved 11 spot bitcoin ETFs on Wednesday. Trading on the newly approved financial instruments that allow investors to wager on the price of bitcoin without having to own it directly is expected to start tomorrow.

Traditional financial institutions like BlackRock and Grayscale are among the companies that are offering the exchange traded funds.

Coinbase and the SEC have had their fair share of public battles, but in this case the cryptocurrency exchange appears pleased with the regulator’s decision.

“We should all be grateful to Grayscale for pushing back against the SEC’s arbitrary and capricious behavior, and clearing the way to get these spot BTC +2.70% ETFs over the finish line,” Coinbase’s Chief Legal Officer Paul Grewal posted to X following the regulator’s decision.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  Dogecoin

Dogecoin  USDC

USDC  Cardano

Cardano  TRON

TRON  Chainlink

Chainlink  Stellar

Stellar  Hedera

Hedera  Bitcoin Cash

Bitcoin Cash  LEO Token

LEO Token  Litecoin

Litecoin  Cronos

Cronos  Ethereum Classic

Ethereum Classic  Monero

Monero  Dai

Dai  Algorand

Algorand  OKB

OKB  Cosmos Hub

Cosmos Hub  Stacks

Stacks  Theta Network

Theta Network  Gate

Gate  Maker

Maker  KuCoin

KuCoin  Tezos

Tezos  IOTA

IOTA  NEO

NEO  Polygon

Polygon  Zcash

Zcash  Synthetix Network

Synthetix Network  Tether Gold

Tether Gold  TrueUSD

TrueUSD  Dash

Dash  Holo

Holo  Zilliqa

Zilliqa  Enjin Coin

Enjin Coin  0x Protocol

0x Protocol  Siacoin

Siacoin  Qtum

Qtum  Basic Attention

Basic Attention  Ravencoin

Ravencoin  Bitcoin Gold

Bitcoin Gold  Decred

Decred  NEM

NEM  DigiByte

DigiByte  Ontology

Ontology  Nano

Nano  Status

Status  Waves

Waves  Huobi

Huobi  Lisk

Lisk  Hive

Hive  Numeraire

Numeraire  Steem

Steem  Pax Dollar

Pax Dollar  BUSD

BUSD  OMG Network

OMG Network  Ren

Ren  Bitcoin Diamond

Bitcoin Diamond  Bytom

Bytom