Crucial Bitcoin (BTC) Signal, $3,000 Is Now or Never for Ethereum (ETH), Toncoin (TON) Whales Buy 13 Million in 2 Days

Bitcoin’s trading volume made a huge comeback that not many expected since the market’s sentiment remains suppressed. However, numerous altcoins saw inflows from larger institutional investors, and the improvement of the market sentiment is a great sign.

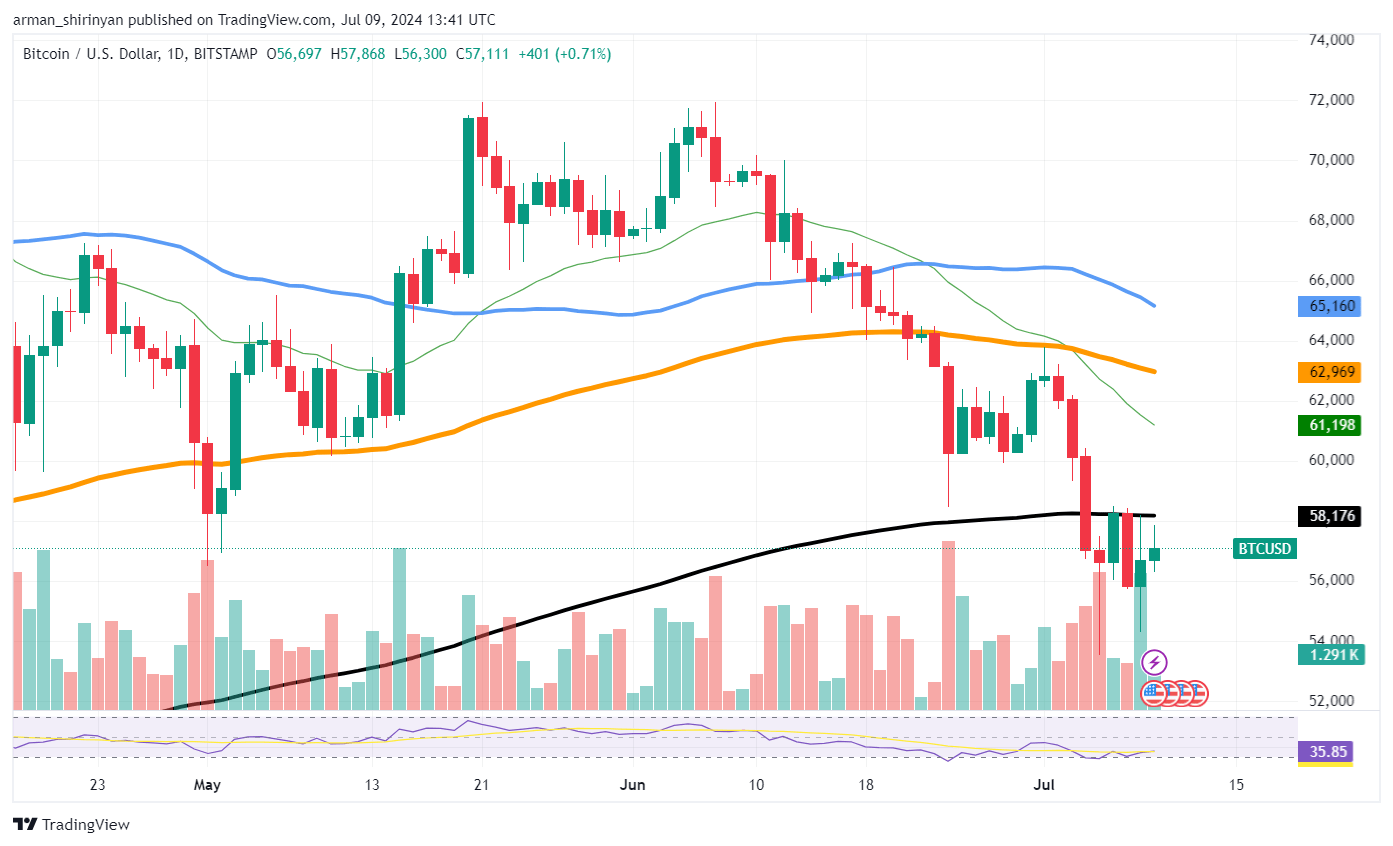

Increased interest in and activity on the Bitcoin market can be inferred from the spike in trading volume. Significant price changes, whether upward or downward, are frequently preceded by higher volumes. The increase in trading volume in this instance indicates that there may be a resurgence of interest and room for price movement for Bitcoin.

Institutional investors’ restored confidence may be one of the main causes of this spike in trading volume. Larger market participants have made sizable investments in a number of altcoins over the last few weeks.

This capital inflow has probably helped to create a positive atmosphere that has permeated Bitcoin trading as well. Moreover, a possible bullish trend is also supported by the technical indicators for Bitcoin, as of right now. As it moves out of the oversold area, the relative strength index or RSI, is beginning to recover.

Ethereum keeps pushing

Ethereum has once again crossed the $3,000 threshold and might finally regain confidence needed for the rally’s continuation. However, there is an issue: the major 200 EMA resistance level.

The market is feeling more optimistic now that it has surpassed $3,000. Ethereum may be showing signs of renewed confidence from buyers if it can break through this psychological barrier. However, this confidence is not unwavering, particularly given the impending 200 EMA resistance.

A popular technical indicator, the 200 EMA frequently serves as a strong resistance or support level. At this point, Ethereum’s trajectory could either sharply increase or completely reverse. The current state of Ethereum is influenced by various factors. First, there is a slow but steady improvement in market sentiment overall. Ethereum’s price action has been positively impacted by the recent spike in Bitcoin volume and institutional interest in altcoins.

Because of its wide range of applications and vibrant developer community, Ethereum continues to be a valuable asset for institutional investors, who are diversifying their holdings. On-chain metrics also point to a cautiously optimistic mixed picture.

It appears that the selling pressure may be abating as the Relative Strength Index (RSI) for Ethereum has left the oversold area. The market is still cautious, even though buyers are entering the market, as seen by the lack of a noticeable increase in trading volume. The larger macroeconomic environment is another important factor to take into account.

Toncoin heading to recovery

Toncoin whales are pushing the asset forward, creating substantial buying support for the asset. After the most recent correction, whales are piling up on cheap TON available on the market. Here is the breakdown of what’s happening under the hood.

There has been a discernible rise in the quantity of significant Toncoin transactions, according to recent data. The number of large transactions has increased over the last week, suggesting increased activity among major holders. In particular, there have been nine significant transactions in the last 24 hours, totaling 359,000 TON.

Whale activity has increased, which indicates that investors are very optimistic about Toncoin’s future. The overall transaction volume of TON has been exhibiting notable fluctuations in terms of volume. On July 6, 2024, the seven-day high was 962,000 TON, and on July 7, 2024, the low was 52,000 TON. This variation suggests that whales are buying more tokens during price drops, probably in the hope that the price will rise in the future. The underlying whale activity has been mirrored in the movement of the price of Toncoin.

Price resilience is demonstrated by its ability to bounce back from recent lows and hold a position above important support levels. Because they show important levels of support and resistance, the 50 EMA and 100 EMA are important indicators to keep an eye on. After recently hitting a low of about $7.09, TON is currently trading at around $7.28.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  Dogecoin

Dogecoin  Cardano

Cardano  TRON

TRON  Chainlink

Chainlink  LEO Token

LEO Token  Stellar

Stellar  Hedera

Hedera  Litecoin

Litecoin  Bitcoin Cash

Bitcoin Cash  Monero

Monero  Dai

Dai  Cronos

Cronos  OKB

OKB  Gate

Gate  Ethereum Classic

Ethereum Classic  VeChain

VeChain  Cosmos Hub

Cosmos Hub  Algorand

Algorand  KuCoin

KuCoin  Maker

Maker  Stacks

Stacks  Theta Network

Theta Network  Tether Gold

Tether Gold  Tezos

Tezos  IOTA

IOTA  Zcash

Zcash  TrueUSD

TrueUSD  NEO

NEO  Polygon

Polygon  Synthetix Network

Synthetix Network  Dash

Dash  Zilliqa

Zilliqa  0x Protocol

0x Protocol  Basic Attention

Basic Attention  Qtum

Qtum  Holo

Holo  Decred

Decred  DigiByte

DigiByte  Siacoin

Siacoin  Ravencoin

Ravencoin  NEM

NEM  Enjin Coin

Enjin Coin  Nano

Nano  Ontology

Ontology  Waves

Waves  Hive

Hive  Lisk

Lisk  Status

Status  Pax Dollar

Pax Dollar  Huobi

Huobi  Numeraire

Numeraire  Steem

Steem  BUSD

BUSD  OMG Network

OMG Network  Ren

Ren  Bitcoin Diamond

Bitcoin Diamond  Bitcoin Gold

Bitcoin Gold  Augur

Augur  HUSD

HUSD  Kyber Network Crystal Legacy

Kyber Network Crystal Legacy