Crypto Price Prediction: Top Altcoins To Watch Amid Market Correction

Crypto Price Prediction: The cryptocurrency market on the weekend recorded a bearish note as the leading cryptocurrency Bitcoin plunged below The supply pressure in the last three days has triggered a market-wide correction evidenced by the 7-8% drop in Ethereum and XRP, a 5% drop in Cardano, and 9-11% fall in top memes coins Dogecoin and Shiba Inu.

However, it seems that industry experts take this downfall as a common retracement for buyers to regain strength. Moreover, the correction may validate the sustainability of an asset for higher levels and offer suitable entry opportunities before the next leap.

Furthermore, Bitcoin price continues to witness a notable inflow through ETFs as Wu Blockchain highlighted notable ETF movements on March 15th, reporting a total net inflow of $198 million into Bitcoin spot ETFs. Grayscale’s GBTC faced a net outflow of $139 million, while Fidelity’s ETF led with a net inflow of $155 million, contributing to its $6.87 billion total historical net inflow.

On March 15th, the total net inflow of Bitcoin spot ETFs was $198 million. Grayscale ETF GBTC had a net outflow of $139 million for the day. The Bitcoin spot ETF with the highest net inflow for the day was Fidelity’s ETF FBTC, with a net inflow of approximately $155 million.… pic.twitter.com/5Rh3KznqCf

— Wu Blockchain (@WuBlockchain) March 16, 2024

Also Read: Crypto Prices Today March 16: Bitcoin At 69K, ETH & ADA Rebound As PEPE Continues Decline

1)Ethereum(ETH)

Ethereum(ETH)| Tradingview

Ethereum (ETH) stands as a pioneering force in the blockchain sector, providing a platform for decentralized applications (dApps) through its smart contract functionality. It distinguishes itself as the backbone for numerous crypto projects and the Decentralized Finance (DeFi) ecosystem.

With a current market cap of $445.7 Billion, Ethereum is positioned as the second-largest cryptocurrency. Amid the recent downturn in the crypto market, the ETH price plunged from $4091 to $3709, registering a 9.3% loss.

The daily time frame chart shows the Ethereum price is seeking support at 23.6% Fibonacci retracement level, a tool projecting the potential demand zone for buyers to regain control.

If the supply pressure persists, the coin holders may witness a downfall to $3360 or $3135, the horizontal levels which coincide with 38.2% and 50% FIB levels.

2)Solana(SOL)

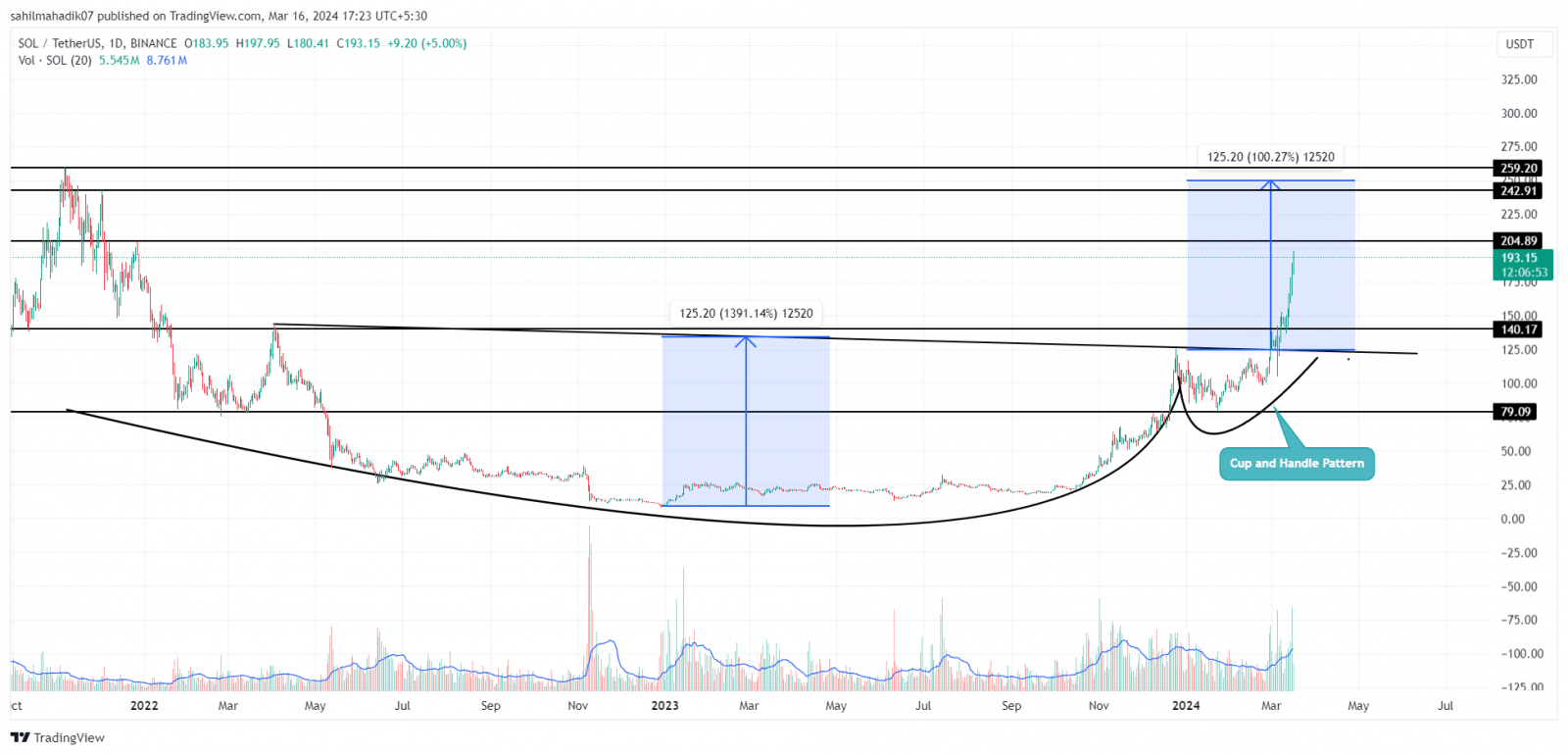

Solana(SOL)| Tradingview

Solana (SOL) is known for its high-performance capabilities with a blockchain that emphasizes low transaction costs, scalability, and rapid processing. Its unique hybrid protocol allows for notably reduced validation times for transactions and smart contract execution.

Defying the current market correction, the Solana price outperformed its peers with a steady recovery evidenced by the six green candles in the daily chart. The bullish upswing recorded 45% growth, which uplifted the SOL value to $196, and the current market cap of $86.6 Billion.

The recent positive momentum in the SOL price is being bolstered by a substantial trading volume, which currently stands at around $11.3 billion. This high trading activity may push the price towards encountering resistance near the $205 and $243 price levels.

Conversely, the key support levels stand at $169, and $140.

Also Read: Solana Price Rally Eyes $250 as Users Top 1 Million

3)Chainlink(LINK)

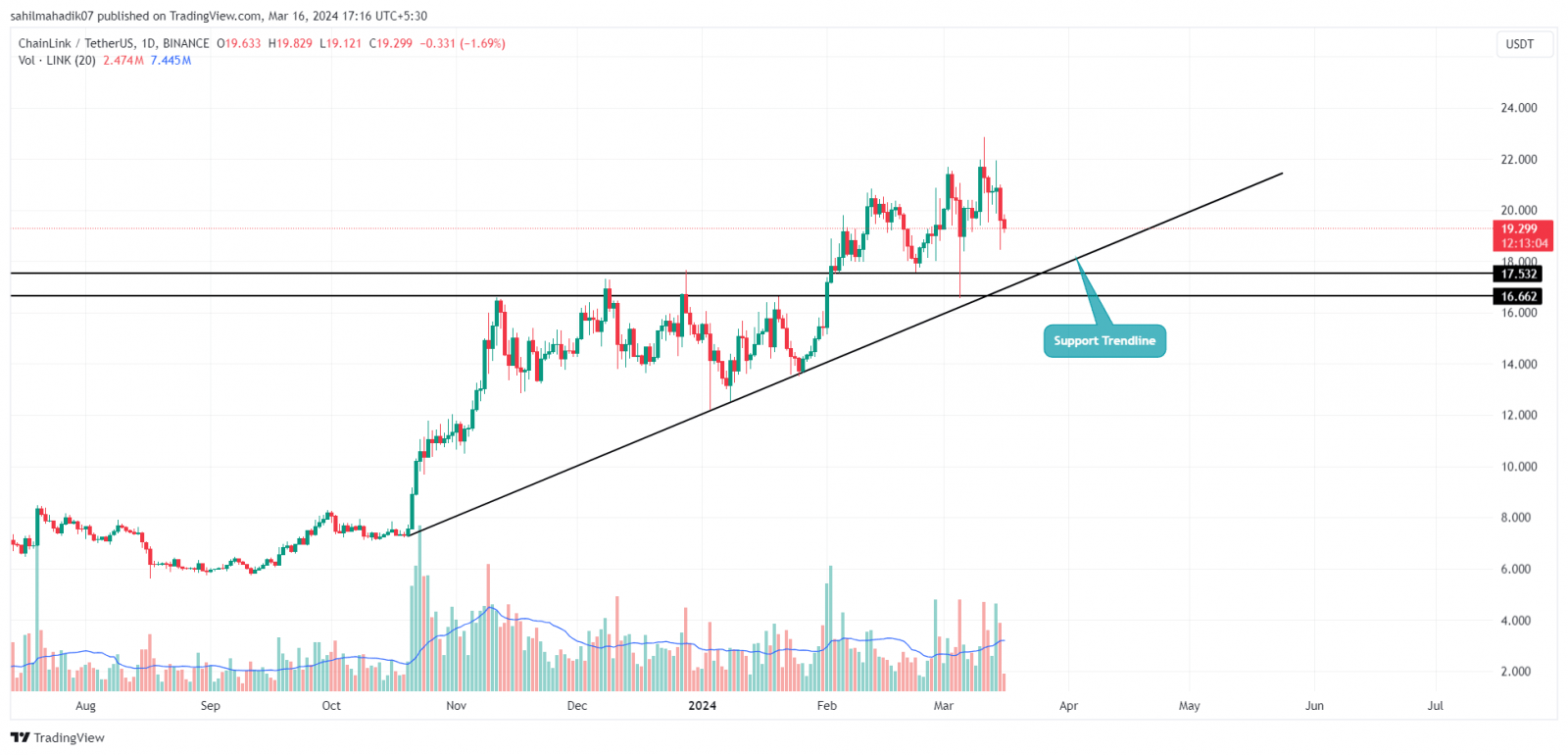

Chainlink(LINK)| Tradingview

Chainlink (LINK) stands out in the crypto space as an ecosystem of decentralized oracle networks that act as a bridge between blockchain smart contracts and external data sources, enhancing their real-world applicability.

LINK, the native cryptocurrency of the Chainlink network has witnessed a significant surge in volatility recently highlighted by a chainsaw movement in the daily chart. The LINK price is currently trading at $19.33, with a trading volume of $1.16B and a market capitalization of $11.36B.

If the broader market correction prolongs the downward momentum in Chainlink price, the coin holders may seek support at the $17.5 and $16.6 mark. Alternatively, the buyers may face notable supply pressure at the $17.5 and $16.6 mark.

Takeaway

The current correction trend in Bitcoin price is perceived as a post-rally correction aimed at regaining the exhausted bullish momentum. The major altcoins are influenced by the supply pressure retesting local support and offering a discounted value to potential traders.

Related Articles

- Solana Price Approach $200 Amid Historic Spike in New SPL Token Creation

- Top Analyst Predicts Bitcoin Price Correction to $63K, Best Time to Sell Meme Coins

- El Salvador Sets Bitcoin Piggy Bank With $400 Mln Bitcoin

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  Dogecoin

Dogecoin  Cardano

Cardano  TRON

TRON  Chainlink

Chainlink  LEO Token

LEO Token  Stellar

Stellar  Hedera

Hedera  Litecoin

Litecoin  Bitcoin Cash

Bitcoin Cash  Monero

Monero  Dai

Dai  OKB

OKB  Gate

Gate  Ethereum Classic

Ethereum Classic  Cronos

Cronos  VeChain

VeChain  Cosmos Hub

Cosmos Hub  Algorand

Algorand  KuCoin

KuCoin  Maker

Maker  Stacks

Stacks  Theta Network

Theta Network  Tezos

Tezos  Tether Gold

Tether Gold  IOTA

IOTA  Zcash

Zcash  NEO

NEO  TrueUSD

TrueUSD  Polygon

Polygon  Synthetix Network

Synthetix Network  Dash

Dash  Zilliqa

Zilliqa  0x Protocol

0x Protocol  Qtum

Qtum  Basic Attention

Basic Attention  Decred

Decred  Holo

Holo  DigiByte

DigiByte  Siacoin

Siacoin  Ravencoin

Ravencoin  NEM

NEM  Enjin Coin

Enjin Coin  Nano

Nano  Ontology

Ontology  Waves

Waves  Hive

Hive  Lisk

Lisk  Status

Status  Pax Dollar

Pax Dollar  Steem

Steem  Numeraire

Numeraire  Huobi

Huobi  BUSD

BUSD  OMG Network

OMG Network  Bitcoin Gold

Bitcoin Gold  Ren

Ren  Bitcoin Diamond

Bitcoin Diamond  Augur

Augur  HUSD

HUSD  Kyber Network Crystal Legacy

Kyber Network Crystal Legacy