CySEC Oversees 328 Companies as AUM Hits €9.4 Billion Despite Yearly Decline

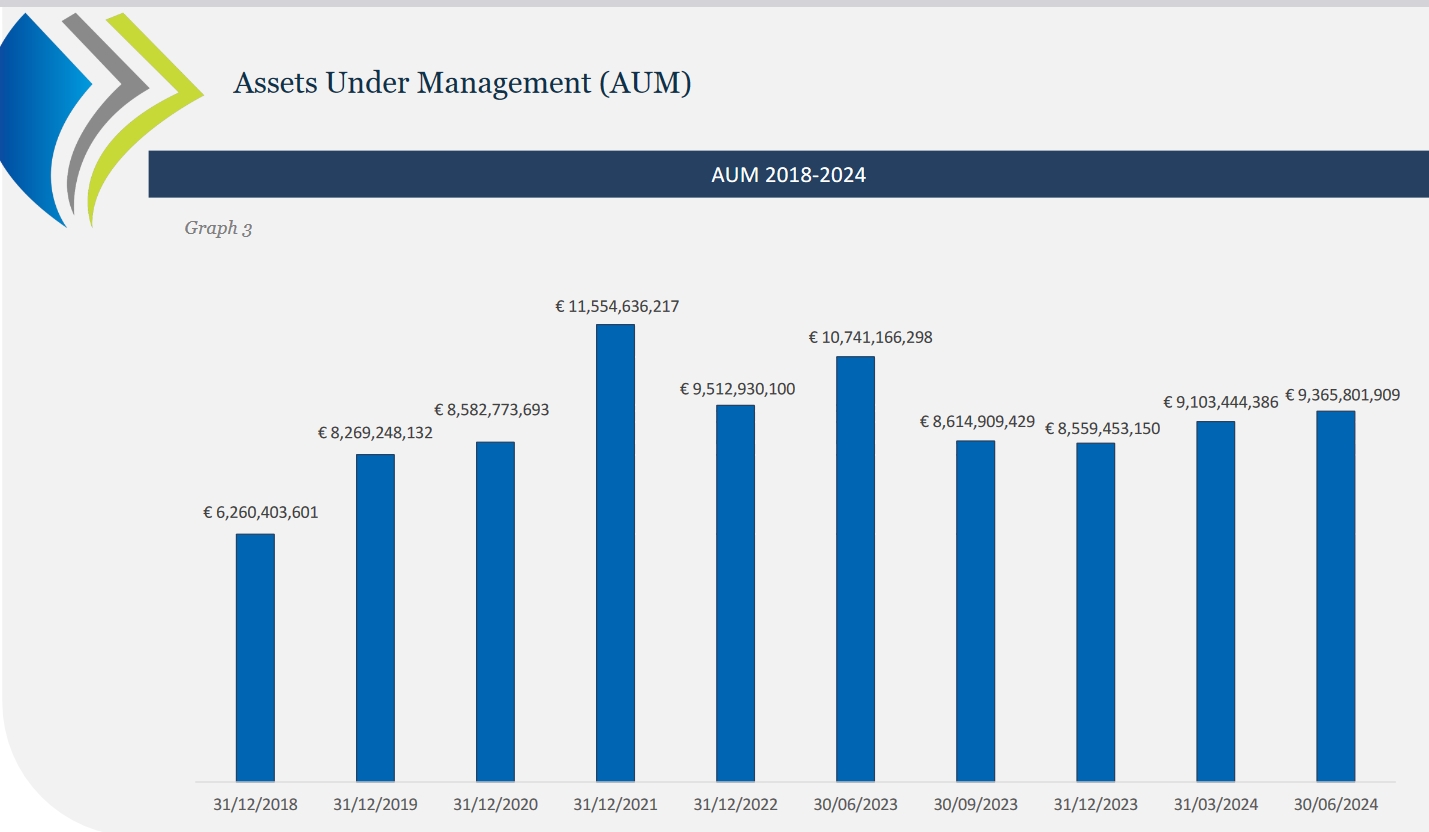

In the second quarter of 2024, the number of Management Companies and Undertakings of Collective Investments (UCIs) in Cyprus remained at 328. At the same time, assets under management (AUM) increased to €9.4 billion, according to the quarterly statistics bulletin released by the Cyprus Securities and Exchange Commission (CySEC).

CySEC Management Companies Decrease

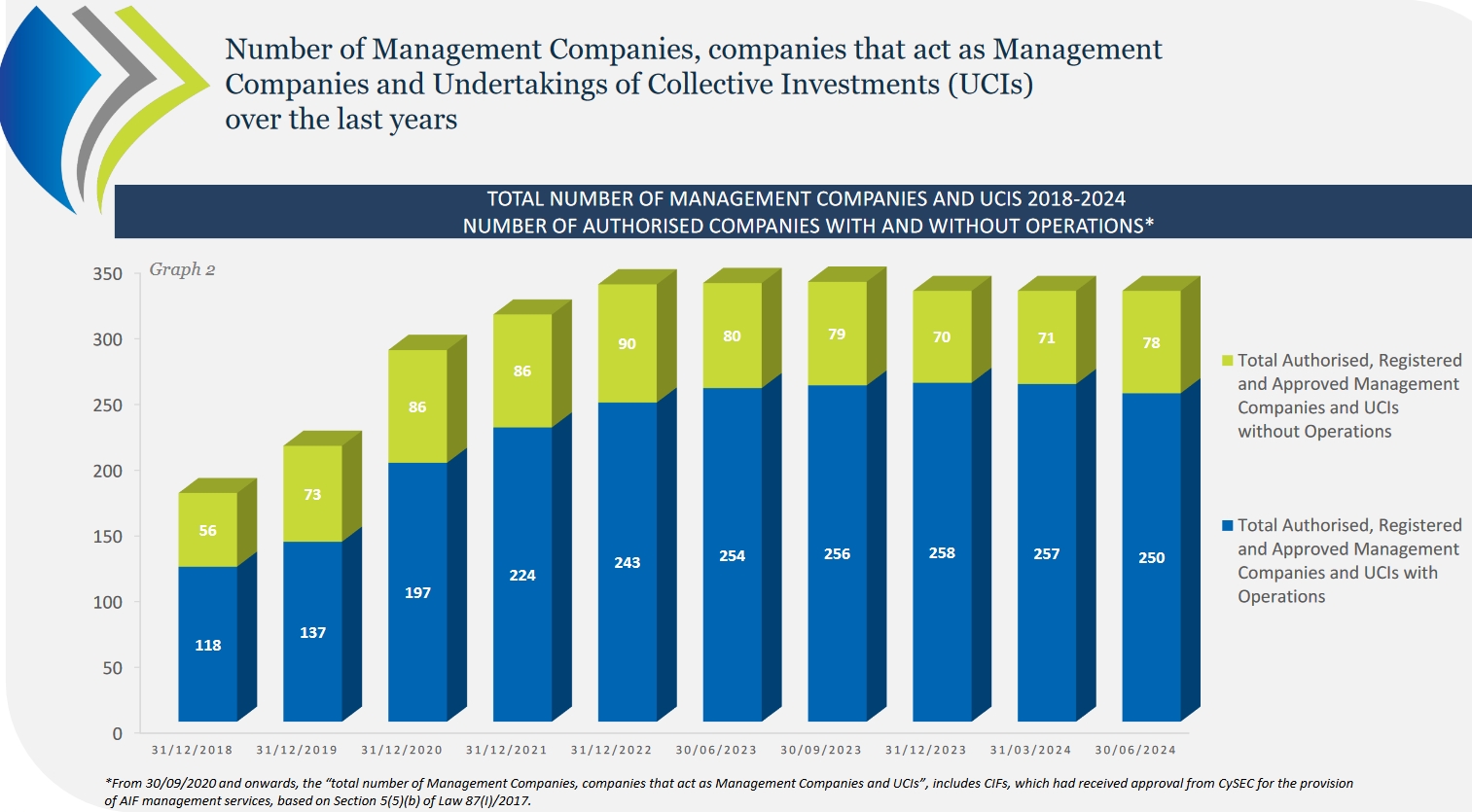

CySEC oversees 328 Management Companies and UCIs, a decrease from 334 in the same quarter of the previous year, indicating a decline of 1.8 percent. The current total includes 236 Externally Managed UCIs, 33 Internally Managed UCIs, and 69 External Fund Managers.

The overall count features 44 Alternative Investment Fund Managers (AIFMs), 50 Sub-threshold AIFMs, 3 UCITS Management Companies, and 5 dual-license entities that function as both AIFMs and UCITS Management Companies.

Total assets under management reached €9.4 billion in the second quarter of 2024, reflecting an increase of 2.88 percent from the previous quarter. However, there was a decrease of 12.8 percent compared to the same period in 2023. The net asset value of the UCIs managed by these companies was €8.9 billion.

Source: CySEC

Diverse Investment Allocations Overview

In terms of asset allocation, 59 percent of the AUM was managed by AIFMs. The distribution includes 18 percent managed by AIFMs and UCITS Management Companies, 11 percent by Sub-threshold AIFMs, and another 11 percent by UCITS Management Companies. Regulated UCIs managed by foreign fund managers accounted for just 1 percent of the total.

The breakdown of UCITS’ assets under management shows that the majority, 89.3 percent, was invested in transferable securities.

Smaller portions were allocated to UCITS and other UCIs, as well as bank deposits. For AIFs, AIFLNPs, and RAIFs, significant investments were made in private equity, hedge funds, and real estate, while funds of funds comprised a smaller share of the total AUM.

Among the 225 operational UCIs during this period, 198 were domiciled in Cyprus, holding 74.1 percent of the total AUM. This group includes 13 UCITS, 49 AIFs, 45 AIFLNPs, and 91 RAIFs. Of these, 162 invest partially or entirely in Cyprus, totaling €2.5 billion, which represents 26.6 percent of the total AUM.

Private equity investments accounted for a significant share of investments in Cyprus, while real estate also represented a noteworthy portion.

Source: CySEC

Energy, Fintech Investments Rise

In terms of unitholder categorization, retail investors made up a substantial majority of UCITS. For AIFs, AIFNLPs, and RAIFs, a majority were well-informed investors, followed by professional investors, with retail investors constituting a smaller percentage.

Specific sector investments during the second quarter of 2024 included significant amounts in energy, fintech, shipping, and sustainable investments. In the energy sector, investments reached €543 million, while €233 million went to fintech. Shipping attracted €743 million, and sustainable investments accounted for €78 million.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  Dogecoin

Dogecoin  USDC

USDC  Cardano

Cardano  TRON

TRON  Chainlink

Chainlink  Stellar

Stellar  Hedera

Hedera  Bitcoin Cash

Bitcoin Cash  LEO Token

LEO Token  Litecoin

Litecoin  Cronos

Cronos  Ethereum Classic

Ethereum Classic  Monero

Monero  Dai

Dai  Algorand

Algorand  OKB

OKB  Cosmos Hub

Cosmos Hub  Stacks

Stacks  Theta Network

Theta Network  Gate

Gate  Maker

Maker  Tezos

Tezos  KuCoin

KuCoin  IOTA

IOTA  NEO

NEO  Polygon

Polygon  Zcash

Zcash  Synthetix Network

Synthetix Network  Tether Gold

Tether Gold  TrueUSD

TrueUSD  Dash

Dash  Holo

Holo  Zilliqa

Zilliqa  Enjin Coin

Enjin Coin  0x Protocol

0x Protocol  Basic Attention

Basic Attention  Qtum

Qtum  Siacoin

Siacoin  Ravencoin

Ravencoin  Bitcoin Gold

Bitcoin Gold  Decred

Decred  NEM

NEM  Ontology

Ontology  DigiByte

DigiByte  Nano

Nano  Huobi

Huobi  Status

Status  Lisk

Lisk  Waves

Waves  Numeraire

Numeraire  Hive

Hive  Steem

Steem  Pax Dollar

Pax Dollar  BUSD

BUSD  OMG Network

OMG Network  Ren

Ren  Bitcoin Diamond

Bitcoin Diamond  Bytom

Bytom