Daily Market Review: BTC, ETH, ENA, AIOZ, FTM

The bears are in control of today’s session, as seen from the decrease in the global market cap. The total cap stood at $3.32T as of press time, representing a 5.72% increase over the last 24 hours, while the trading volume jumped by 4.78% over the same period to stand at $274.37B as of press time

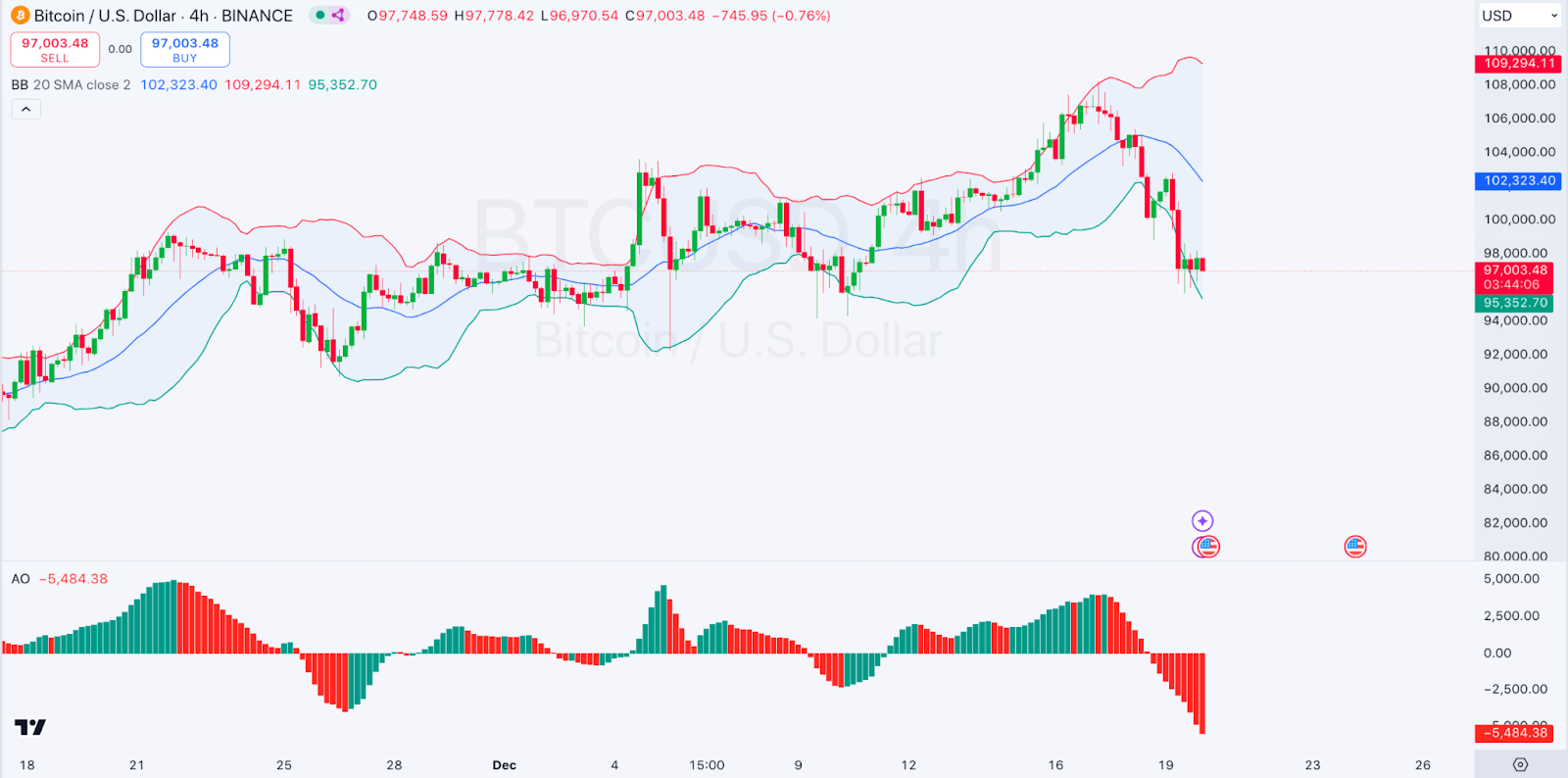

Bitcoin Price Review

Bitcoin, $BTC, has failed to post gains in today’s session, as seen from its price movements. Looking at an in-depth analysis, we see that the the Bitcoin price has recently dipped below the lower Bollinger band, indicating a potential oversold condition.

On the other hand, we see that the Awesome Oscillator shows increasing bearish momentum as indicated by growing red bars. This could suggest further downside or at least continuation of the current bearish trend. Bitcoin traded at $96,810 as of press time, representing a 4.84% decrease over the last 24 hours.

4-hour BTC|USD Chart | Source: TradingView

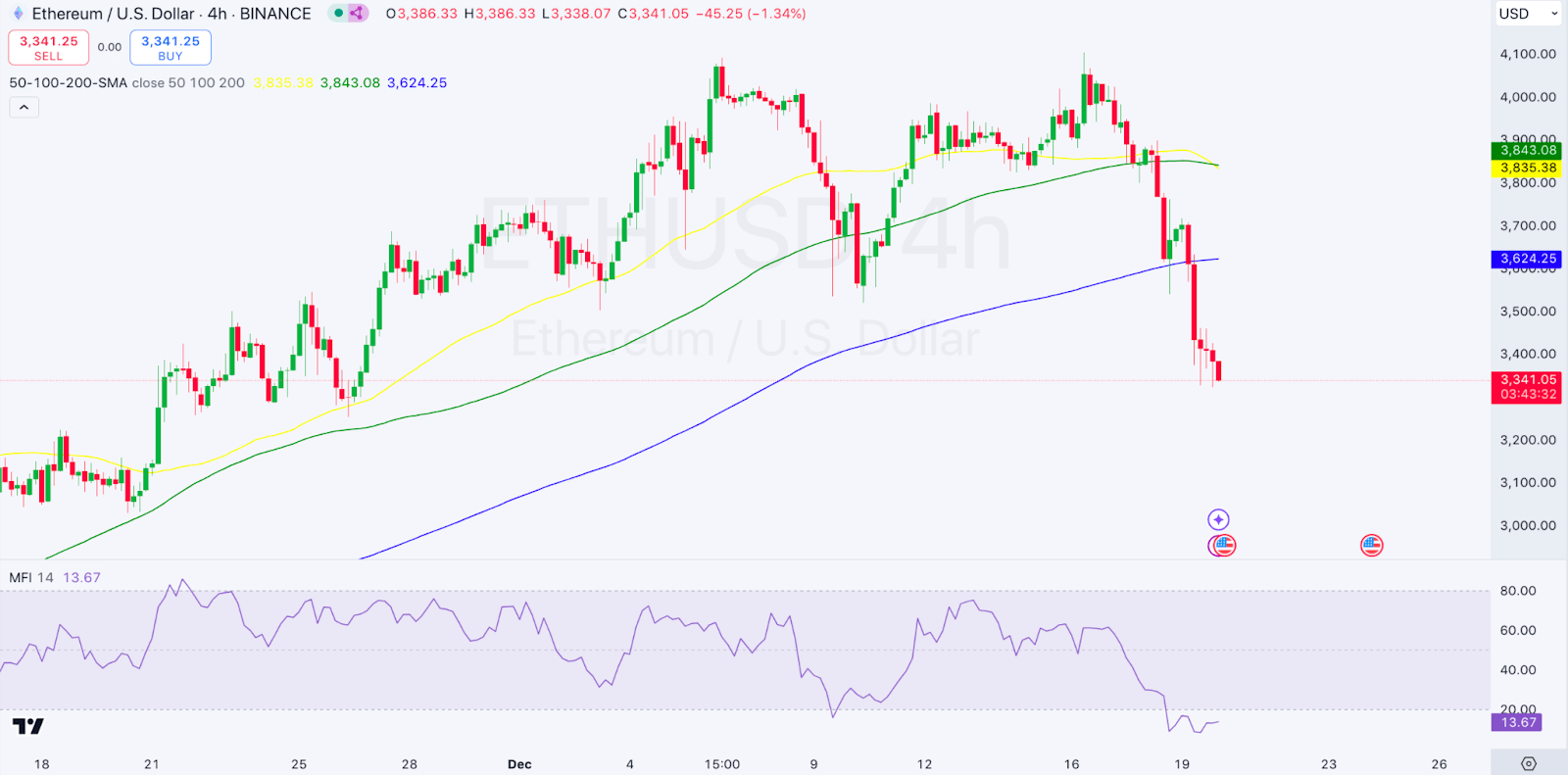

Ethereum Price Prediction

Ethereum, $ETH, is also not among the gainers in today’s session. Looking at an in-depth analysis, we see that Simple Moving Averages (50, 100, 200 SMA), Money Flow Index (MFI) The price recently broke below the 200 SMA, a bearish signal indicating strong selling pressure.

On the other hand, we see that the MFI very low (around 13.67), indicating oversold conditions which sometimes precede a potential reversal or bounce back in price. Ethereum traded at $3,324 as of press time, representing a 9.5% decrease over the last 24 hours.

4-hour ETH/USD Chart | Source: TradingView

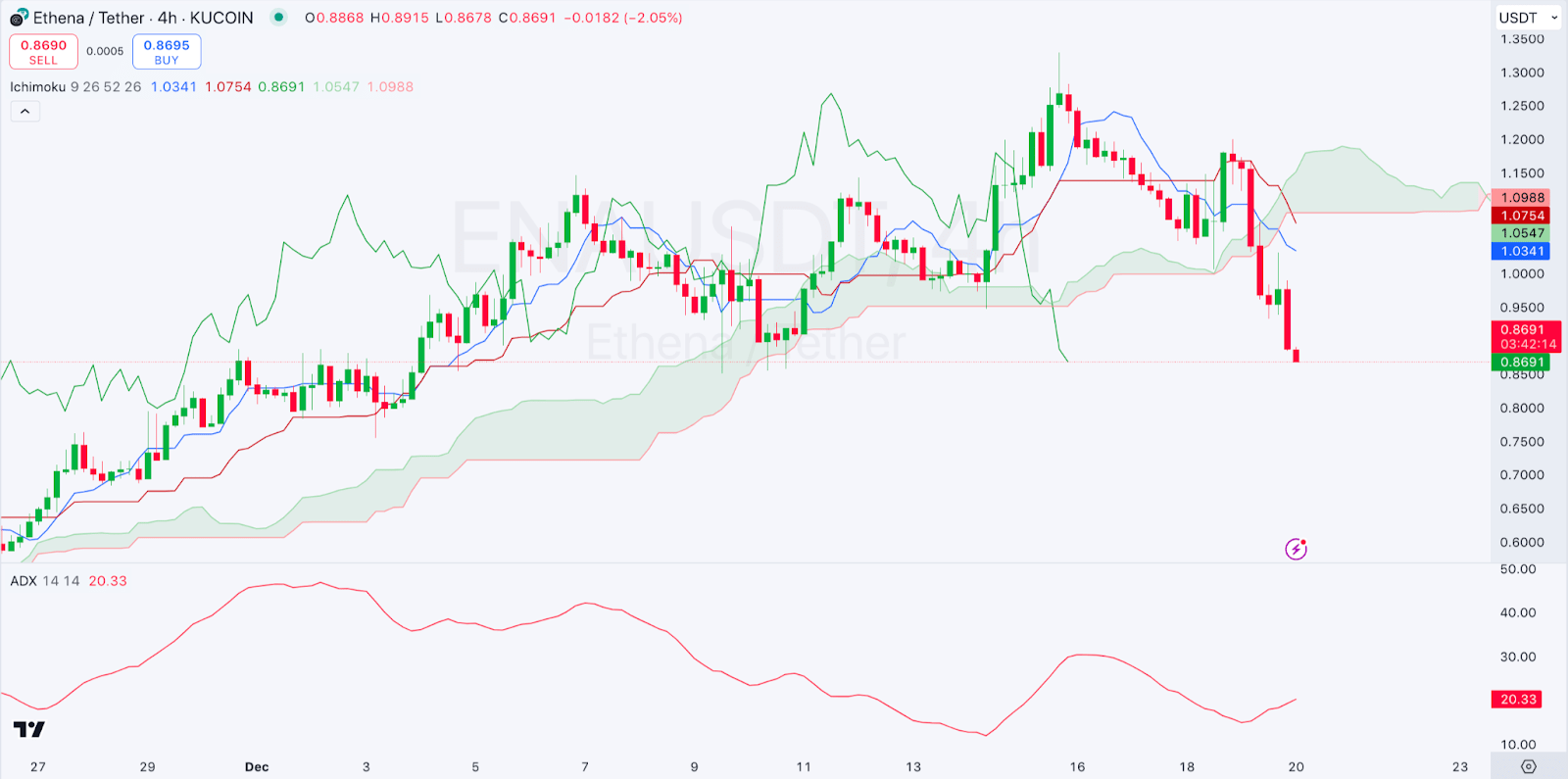

Ethena Price Review

Ethena, $ENA, is not among today’s session as also seen from its price movements. Looking at an in-depth analysis, we see that the Ethena price is below the Ichimoku Cloud, signifying a bearish trend.

On the other hand, we see that the ADX is high (around 20.33), suggesting that the current trend is strong, with bearish sentiment prevailing. Ethena traded at $0.8685 as of press time, representing a 25.39% decrease over the last 24 hours.

4-hour ENA/USD Chart | Source: TradingView

AIOZ Network Price Review

AIOZ Network, $AIOZ, is also not among today’s session as also seen from its price movements. Looking at an in-depth analysis, AIOZ is in a consolidation phase, with price weaving through the Alligator indicator’s lines, suggesting a lack of clear trend.

On the other hand, we see that the ADX, indicating weakening trend strength which might suggest a period of range-bound movement or consolidation. AIOZ Network traded at $0.8685 as of press time, representing a 16.78% decrease over the last 24 hours.

4-hour AIOZ/USD Chart | Source: TradingView

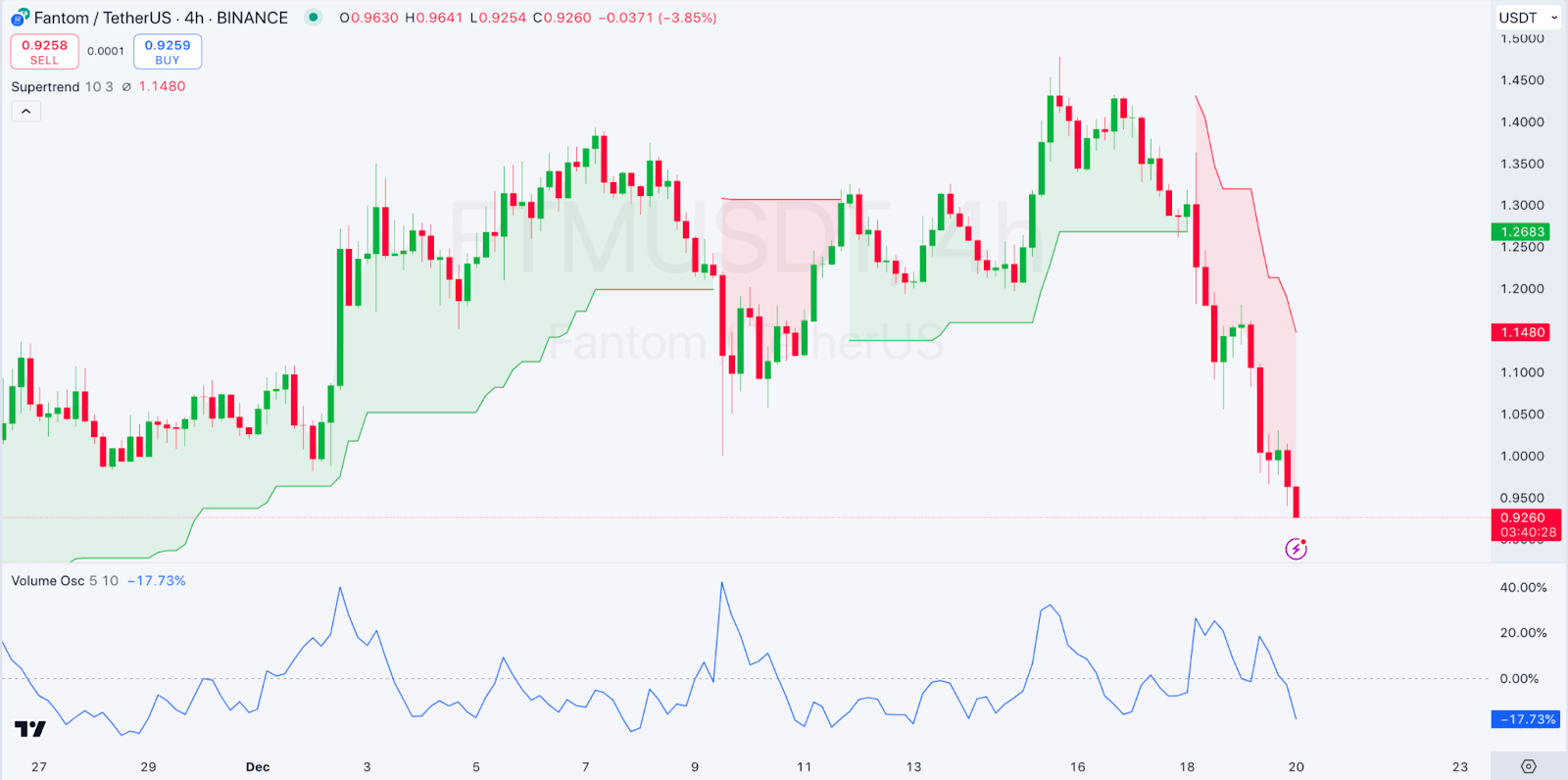

Fantom Price Review

Fantom, $FTM, is also among the top losers in today’s session as also seen from its price movements. Looking at an in-depth analysis, we see that the recent sharp price decline with the SuperTrend indicator signaling a sell.

On the other hand, we see the Volume Oscillator shows a decrease in volume, potentially indicating less conviction in the recent downward movements which could hint at a possible stabilization or reversal. Fantom traded at $0.9168 as of press time, representing a 19.66% decrease over the last 24 hours.

4-hour FTM/USD Chart | Source: TradingView

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  Dogecoin

Dogecoin  USDC

USDC  Cardano

Cardano  TRON

TRON  Chainlink

Chainlink  Stellar

Stellar  Hedera

Hedera  Bitcoin Cash

Bitcoin Cash  LEO Token

LEO Token  Litecoin

Litecoin  Cronos

Cronos  Ethereum Classic

Ethereum Classic  Monero

Monero  Dai

Dai  Algorand

Algorand  OKB

OKB  Cosmos Hub

Cosmos Hub  Stacks

Stacks  Theta Network

Theta Network  Gate

Gate  Maker

Maker  KuCoin

KuCoin  Tezos

Tezos  IOTA

IOTA  NEO

NEO  Zcash

Zcash  Polygon

Polygon  Synthetix Network

Synthetix Network  Tether Gold

Tether Gold  TrueUSD

TrueUSD  Dash

Dash  Holo

Holo  Zilliqa

Zilliqa  Enjin Coin

Enjin Coin  0x Protocol

0x Protocol  Siacoin

Siacoin  Basic Attention

Basic Attention  Qtum

Qtum  Ravencoin

Ravencoin  Bitcoin Gold

Bitcoin Gold  Decred

Decred  NEM

NEM  DigiByte

DigiByte  Ontology

Ontology  Nano

Nano  Status

Status  Hive

Hive  Waves

Waves  Huobi

Huobi  Lisk

Lisk  Steem

Steem  Numeraire

Numeraire  Pax Dollar

Pax Dollar  BUSD

BUSD  OMG Network

OMG Network  Ren

Ren  Bitcoin Diamond

Bitcoin Diamond  Bytom

Bytom