Daily Market Review: BTC, ETH, RNDR, NEAR, SOL

The bulls are in total control in today’s session, as seen from the increase in the global market cap. The total cap stood at $2.26T as of press time, representing a 2.66% increase over the last 24 hours, while the trading volume jumped by 50% over the same period to stand at $87B as of press time.

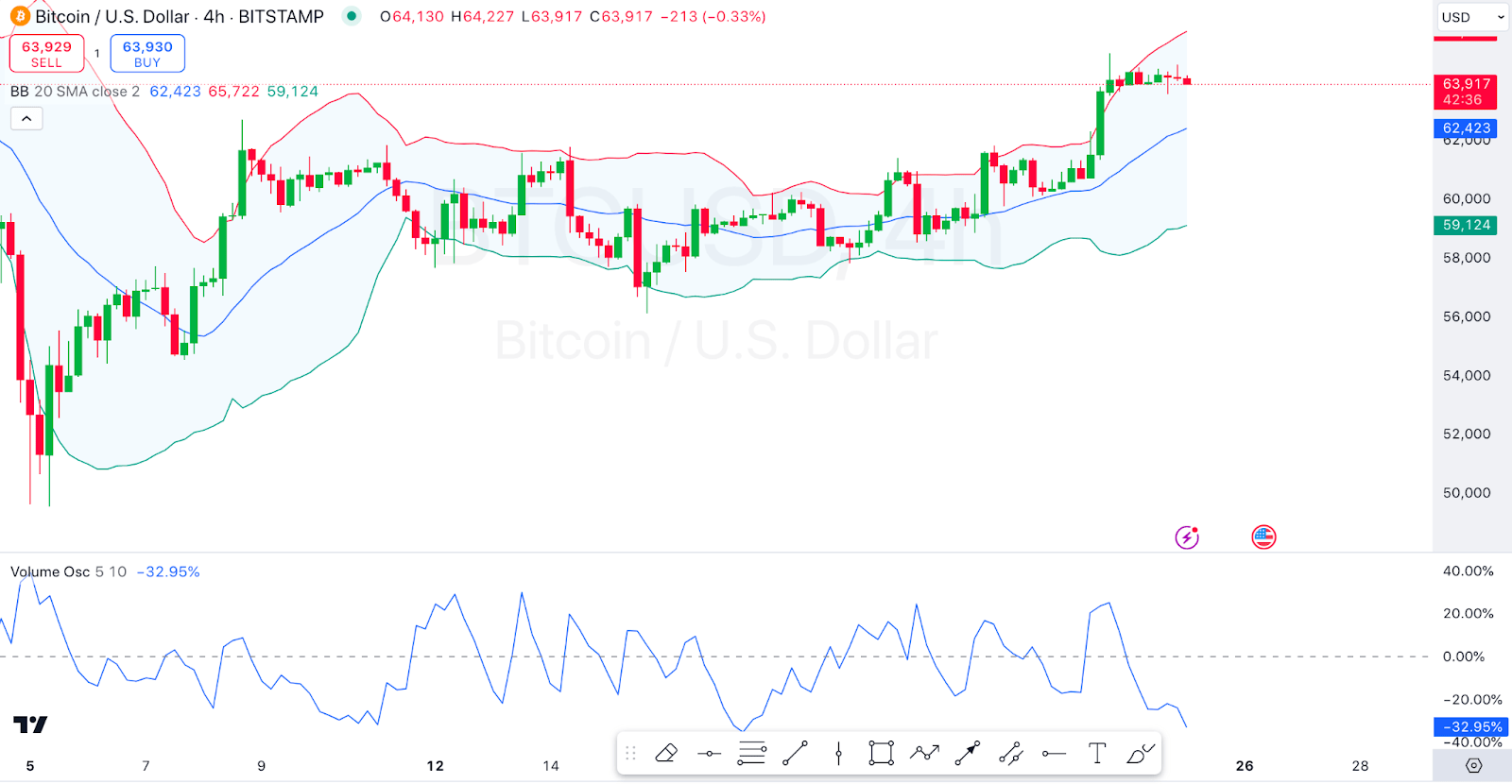

Bitcoin Price Review

Bitcoin, $BTC, is not posting gains in today’s session, as seen from its price movements. Looking at an in-depth analysis, the Bitcoin price is currently moving towards the upper band, suggesting an overbought condition. A pullback may occur if the price fails to break through the upper band.

On the other hand, we see that the Volume Oscillator is currently negative, indicating decreasing trading volume, which may signal weakening momentum. Bitcoin traded at $63.888 as of press time, representing a 0.5% decrease over the last 24 hours.

4-hour BTC/USD Chart | Source: TradingView

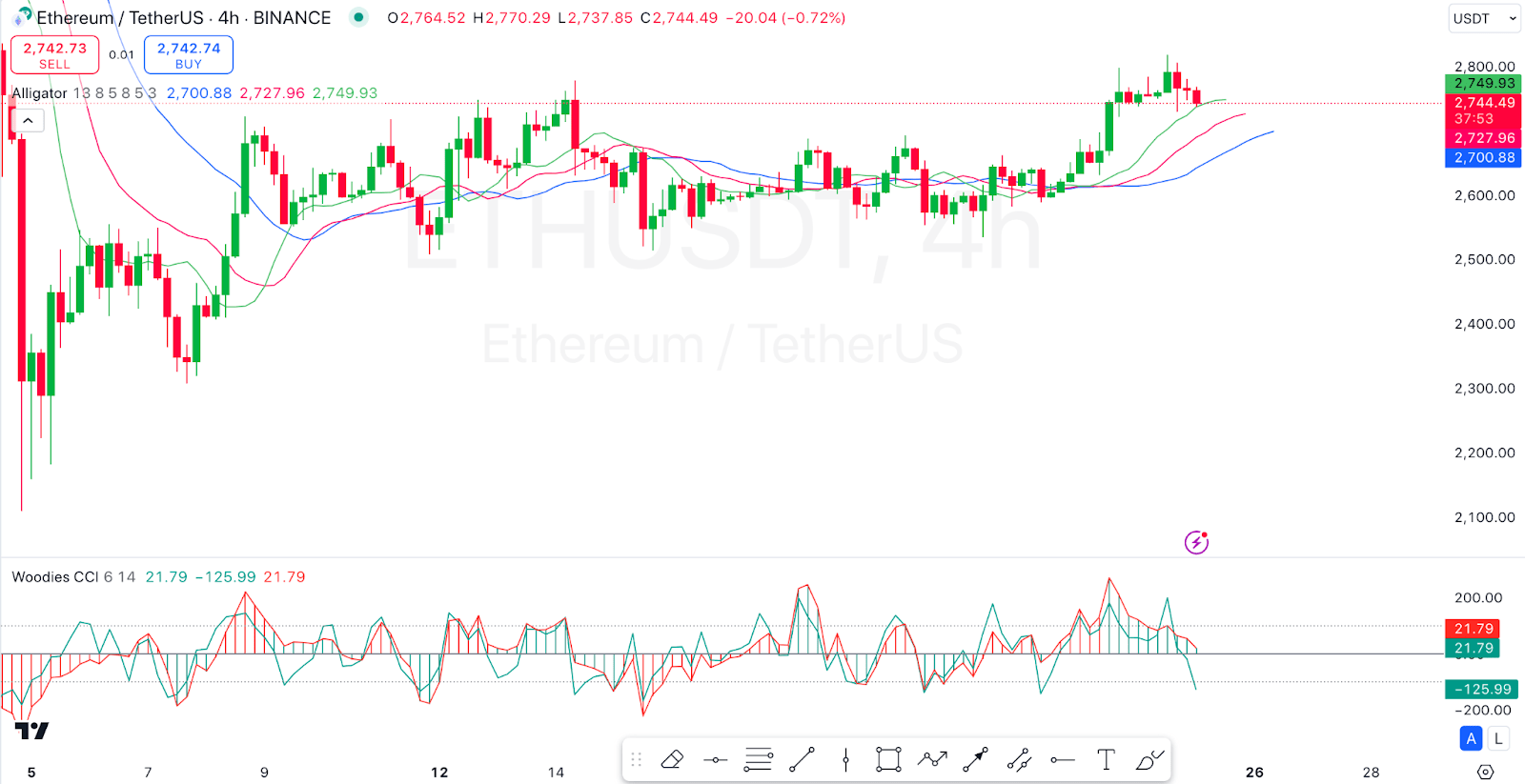

Ethereum Price Review

Ethereum, $ETH, is also among the gainers in today’s session as seen from its price movements. Looking at an in-depth analysis, we see that the Ethereum price is above the Ichimoku Cloud, with the Tenkan-sen (conversion line) above the Kijun-sen (baseline), indicating a strong bullish trend. The future cloud is also green, reinforcing bullish sentiment.

On the other hand, we see that the RSI is above 70, suggesting an overbought condition. A potential pullback may occur if the RSI continues to stay in the overbought territory. Ethereum traded at $2,736 as of press time, representing a 0.82% decrease over the last 24 hours.

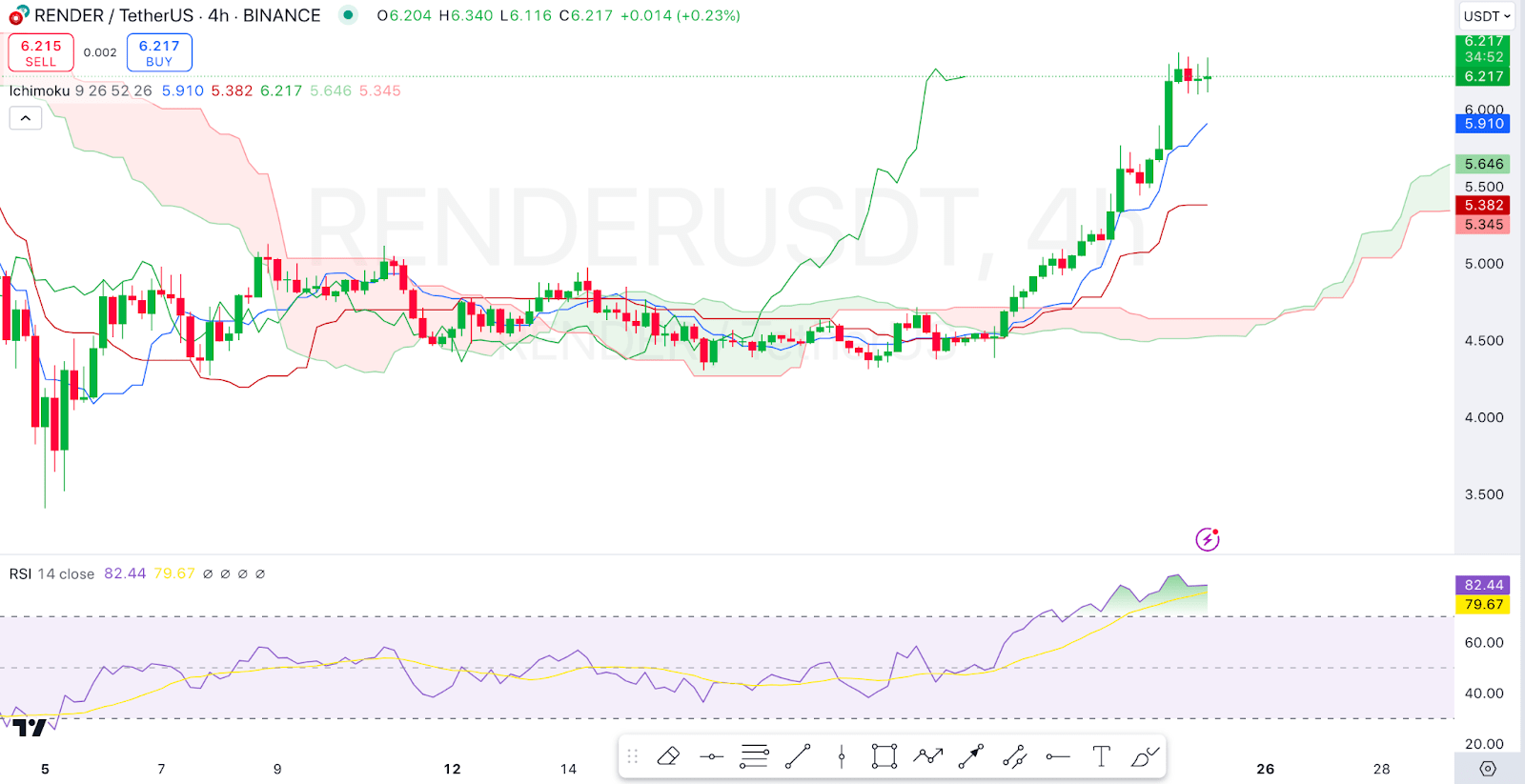

Render Price Review

Render, $RNDR, is also a gainer in today’s session as seen from its price movements, looking at an in-depth analysis, we see that the Supertrend indicator is currently showing a buy signal, indicating a bullish trend. However, the price is showing signs of rejection near the upper level.

On the other hand, we see that the Volume Oscillator is slightly negative, suggesting a potential decrease in buying pressure or weakening momentum. Render traded at $6.14 as of press time, representing a 4.85% increase over the last 24 hours.

4-hour RNDR/USDT Chart | Source: TradingView

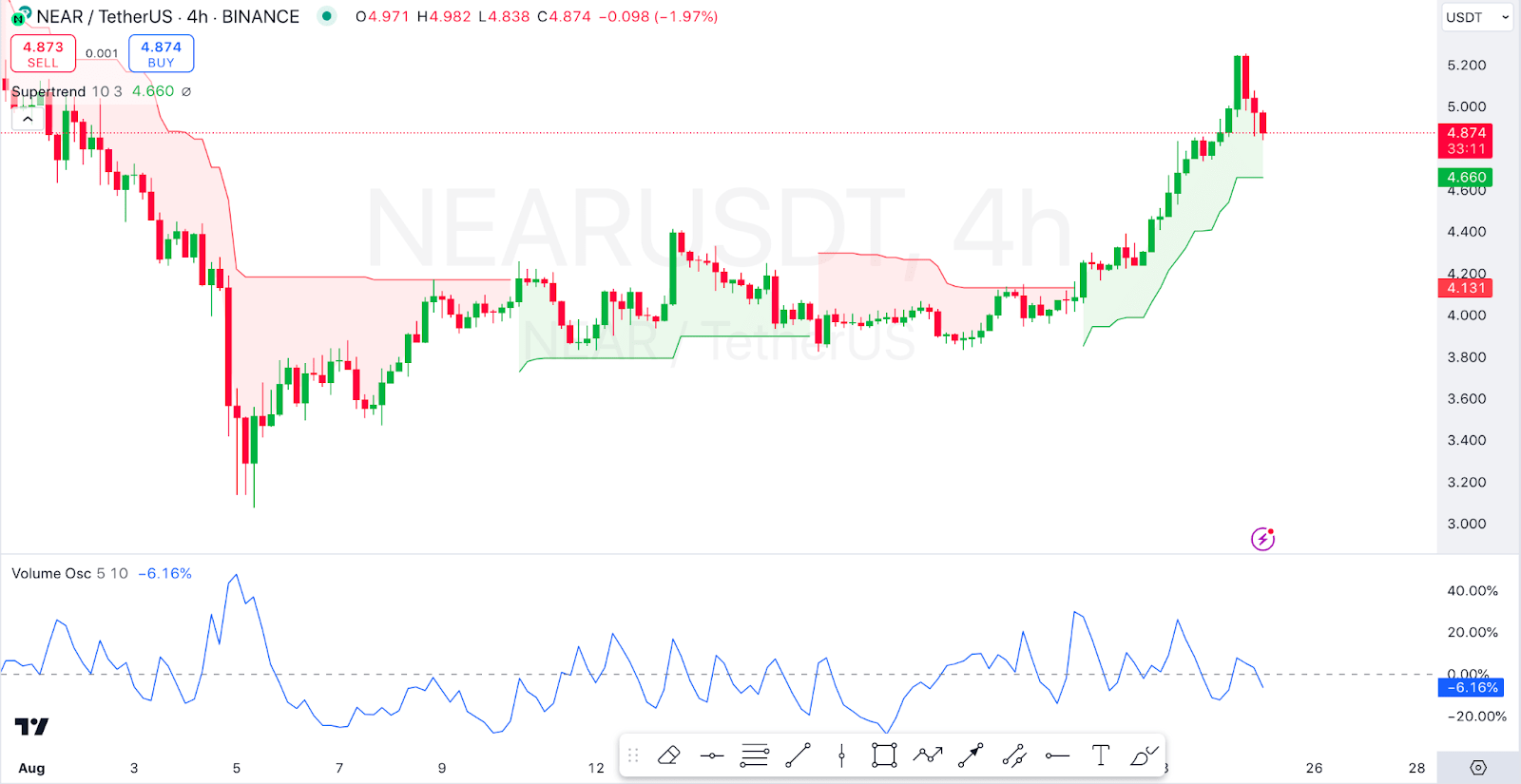

NEAR Price Review

NEAR Protocol, $NEAR is also among the gainers in today’s session as seen from its price movements, Looking at an in-depth analysis, we see that the price is moving within the upward pitchfork channel, suggesting a bullish trend. The recent price action indicates a pullback from the upper channel line.

On the other hand, we see that the MFI is around 79, indicating overbought conditions. This suggests a potential pullback or consolidation in the near term. NEAR Protocol traded at $4.83 as of press time, representing a 0.73% increase over the last 24 hours.

4-hour NEAR/USDT Chart | Source: TradingView

Solana Price Review

Solana, $SOL, is also among the gainers in today’s session as seen from its price movements. Looking at an in-depth analysis, we see that the Solana price is moving within the upward pitchfork channel, suggesting a bullish trend. The recent price action indicates a pullback from the upper channel line.

On the other hand, MFI is around 79, indicating overbought conditions. This suggests a potential pullback or consolidation in the near term. Solana traded at $157.25 as of press time, representing a 0.91% increase over the last 24 hours.

4-hour SOL/USD Chart | Source: TradingView

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  Dogecoin

Dogecoin  USDC

USDC  Cardano

Cardano  TRON

TRON  Chainlink

Chainlink  Stellar

Stellar  Hedera

Hedera  Bitcoin Cash

Bitcoin Cash  LEO Token

LEO Token  Litecoin

Litecoin  Cronos

Cronos  Ethereum Classic

Ethereum Classic  Monero

Monero  Dai

Dai  Algorand

Algorand  OKB

OKB  Cosmos Hub

Cosmos Hub  Stacks

Stacks  Theta Network

Theta Network  Gate

Gate  Maker

Maker  Tezos

Tezos  KuCoin

KuCoin  IOTA

IOTA  NEO

NEO  Zcash

Zcash  Polygon

Polygon  Synthetix Network

Synthetix Network  Tether Gold

Tether Gold  TrueUSD

TrueUSD  Dash

Dash  Holo

Holo  Zilliqa

Zilliqa  Enjin Coin

Enjin Coin  0x Protocol

0x Protocol  Qtum

Qtum  Basic Attention

Basic Attention  Siacoin

Siacoin  Ravencoin

Ravencoin  Bitcoin Gold

Bitcoin Gold  Decred

Decred  NEM

NEM  DigiByte

DigiByte  Ontology

Ontology  Nano

Nano  Hive

Hive  Waves

Waves  Status

Status  Huobi

Huobi  Lisk

Lisk  Numeraire

Numeraire  Steem

Steem  Pax Dollar

Pax Dollar  BUSD

BUSD  OMG Network

OMG Network  Ren

Ren  Bitcoin Diamond

Bitcoin Diamond  Bytom

Bytom