Defi Frenzy: Dex and Perpetuals Smash $52.81B in January’s First 4 Days

After an unprecedented rise in decentralized exchange (dex) and perpetuals volumes last month, these decentralized finance (defi) platforms have witnessed $52.81 billion in trading volume across the initial four days of January 2025.

Uniswap and Hyperliquid Dominate Defi Trading Volumes in 2025

The new year kicks off with a promising note, as the crypto economy’s net value has climbed above last week’s figures, now perched at $3.51 trillion. While centralized exchanges took the lead last month to end the year on a high note, decentralized exchange (dex) platforms also experienced a considerable uptick in volume. According to Defillama data, December 2024 proved to be the high point for both dex trade volume and decentralized perpetuals volumes.

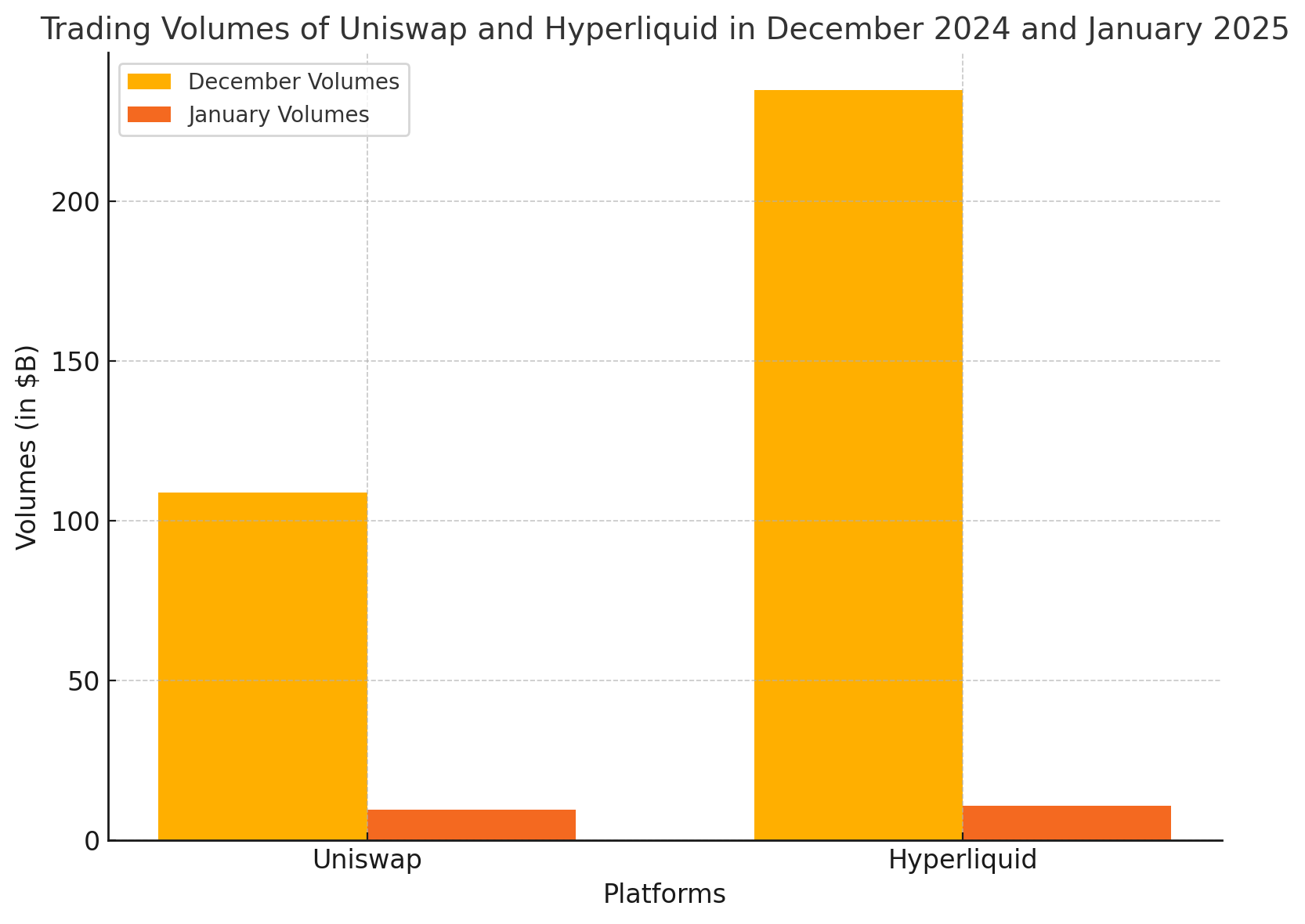

Dex trading volume rose to $322.25 billion in December, with Uniswap claiming the lion’s share, amassing over $109 billion. Uniswap, a dex for spot crypto trading, operates on an automated market maker (AMM) model, leveraging liquidity pools for straightforward token swaps. Decentralized perpetuals protocols amassed $369.4 billion, as per Defillama metrics. Hyperliquid spearheaded this domain, boasting a staggering $235 billion last month.

In contrast to conventional dex platforms like Uniswap, Hyperliquid is a high-performance decentralized perpetuals platform on its own layer one (L1) blockchain, equipped with an onchain order book for sophisticated perpetual (perps) futures trading, characterized by low latency, high throughput, and professional-grade tools. Both Uniswap and Hyperliquid dominated the $52.81 billion in volume over the past four days, with Uniswap securing $9.48 billion and Hyperliquid achieving $10.75 billion.

Below Uniswap sits Raydium, and the Solana-based protocol has seen $8.61 billion so far during the initial days of January 2025. Like Uniswap, this dex utilizes an AMM but integrates with Solana‘s high-speed, cost-effective infrastructure, providing swift transactions and substantial liquidity. Similarly, the second largest decentralized perps exchange, Jupiter, is also constructed on the Solana blockchain for these same advantages. Jupiter’s perpetual exchange diverges from traditional decentralized perpetuals platforms like Hyperliquid through its LP-to-trader model.

Instead of employing order books, Jupiter depends on the JLP pool, where liquidity providers serve as counterparties to trades, facilitating zero slippage and profound liquidity via oracle integration. Over the past four days, statistics show that Jupiter has logged approximately $2.45 billion in total trade volume. Other leading perps protocols include Synfutures, Apex Protocol, Satori Finance, Bluefin, Drift, GMX, and JOJO. Over the past 24 hours, 109 decentralized perps platforms combined have seen $6.611 billion in total trade volume according to Defillama stats.

On the dex front, in addition to Uniswap and Raydium, notable dexes include Pancakeswap, Aerodrome, Lifinity, Orca, Curve Finance, Cetus, Pump.fun, and Dexalot. These decentralized exchanges have experienced $11.464 billion in total trade volume over the last day. The explosive expansion in defi trading volumes over recent months signifies a transformative shift in crypto markets, highlighting innovation and adoption in decentralized platforms. As participants redefine trading dynamics, the challenge now is to maintain this momentum into 2025. So far, the volumes have stayed elevated.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  Dogecoin

Dogecoin  USDC

USDC  Cardano

Cardano  TRON

TRON  Chainlink

Chainlink  Stellar

Stellar  Hedera

Hedera  Bitcoin Cash

Bitcoin Cash  Litecoin

Litecoin  LEO Token

LEO Token  Cronos

Cronos  Ethereum Classic

Ethereum Classic  Monero

Monero  Algorand

Algorand  Dai

Dai  OKB

OKB  Cosmos Hub

Cosmos Hub  Stacks

Stacks  Theta Network

Theta Network  Gate

Gate  Tezos

Tezos  Maker

Maker  IOTA

IOTA  KuCoin

KuCoin  NEO

NEO  Polygon

Polygon  Zcash

Zcash  Synthetix Network

Synthetix Network  Tether Gold

Tether Gold  Dash

Dash  TrueUSD

TrueUSD  Zilliqa

Zilliqa  Holo

Holo  0x Protocol

0x Protocol  Enjin Coin

Enjin Coin  Basic Attention

Basic Attention  Siacoin

Siacoin  Qtum

Qtum  Ravencoin

Ravencoin  Hive

Hive  Decred

Decred  DigiByte

DigiByte  NEM

NEM  Bitcoin Gold

Bitcoin Gold  Ontology

Ontology  Huobi

Huobi  Nano

Nano  Status

Status  Waves

Waves  Lisk

Lisk  Steem

Steem  Numeraire

Numeraire  Pax Dollar

Pax Dollar  BUSD

BUSD  OMG Network

OMG Network  Ren

Ren  Bitcoin Diamond

Bitcoin Diamond