Election burnout has come for political memecoins

Today, enjoy the Empire newsletter on Blockworks.co. Tomorrow, get the news delivered directly to your inbox. Subscribe to the Empire newsletter.

Happy Friday.

A friendly reminder to not believe Big Fall propagandists. The super lame “meteorological summer” might have technically ended on August 31, but we still have about nine days left until the much cooler “astrological summer” is actually over, marked by the September equinox.

So, forget what your boss said about no more Summer Fridays. They’re still very much alive. Go on, take the afternoon off. Empire said it’s okay.

In the meantime, enjoy these takes on political memecoins, FTX and prediction markets. Viva La Summer!

— David Canellis

Keeping with tradition

If you’re suffering from severe political burnout, you’re not alone.

Political memecoins — or PolitiFi — are just as down in the dumps about the whole affair as anyone.

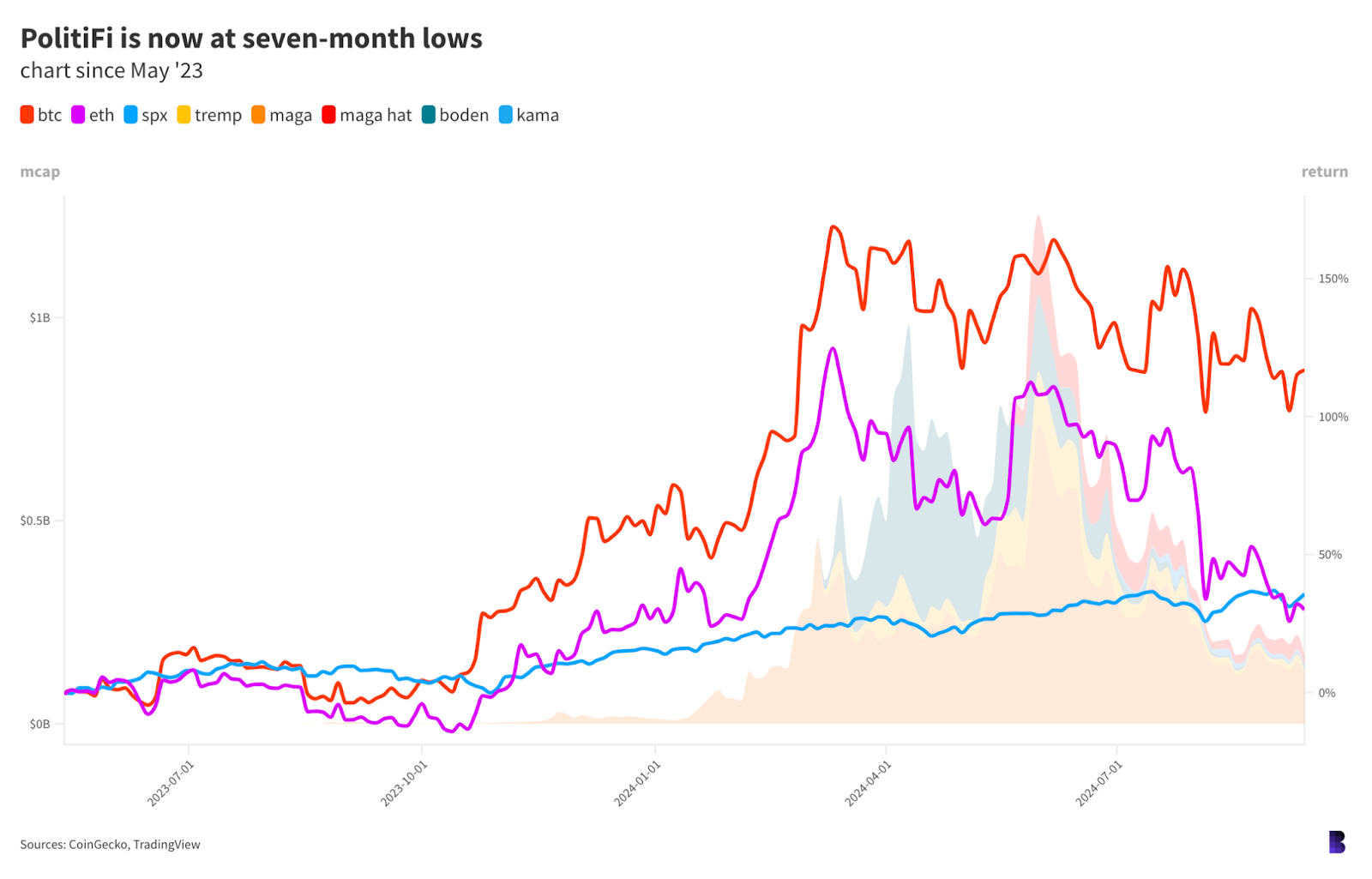

The five most prominent tokens, MAGA (TRUMP), MAGA Hat (MAGA), Doland Tremp (TREMP), Jeo Boden (BODEN) and Kamala Horris (KAMA), altogether peaked at over $1.25 billion market cap at the start of June.

Now they’re worth under $170 million, a near-90% collapse.

The remnants of ConstitutionDAO, which lost an auction of a rare first-print of the US constitution to Citadel CEO Ken Griffin in late 2021, now make up almost two-thirds of the entire PolitiFi market. Although, it’s arguable whether it should be really ranked alongside political parody memecoins and such.

PolitiFi didn’t even exist this time last year. This election season has been its big moment, with the largest Trump memecoin launching only in August 2023 — just as bitcoin was warming up for its major rally.

ETH has now underperformed the S&P 500 over the past 14 months

Bitcoin’s bull run between October and March really gave cover for PolitiFi. The chart above plots the market caps of the big-five political memecoins (faded areas in the back) against the performance of bitcoin (orange line), ether (purple line) and the S&P 500 (blue line).

You can see that PolitiFi has mostly mirrored ETH price action over that period — the purple line follows the shape of PolitiFi’s market cap — while bitcoin is holding up better, for now, at least.

Is PolitiFi over? Probably not. But considering the Kamala Harris-themed memecoins aren’t doing any better than the Trump ones is somewhat telling.

A simple reason this particular flavor of memecoin is down could be that there’s no new fresh wave of interested holders entering their markets, whose liquidity might’ve outweighed sellers’ and boost prices.

MAGA’s holders are split between four different blockchains, with about three-quarters on Ethereum and Solana

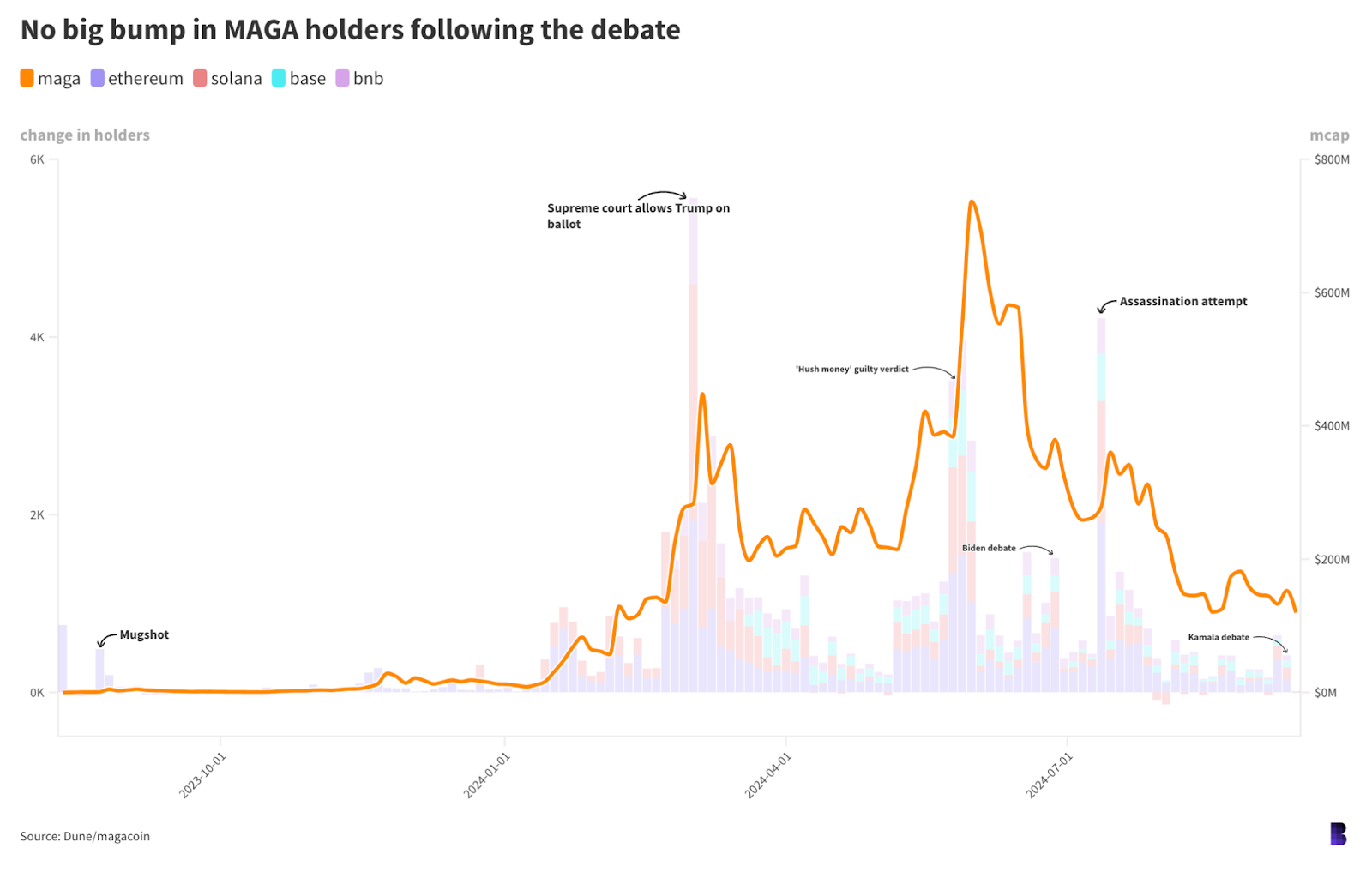

This chart zooms into the market cap of the largest Trump memecoin — as shown by the orange line — and maps it against changes in the number of new holders.

Notice that major points in Trump’s narrative directly coincide with huge influxes of new holders.

Thousands of addresses added MAGA (TRUMP) to their bags around the Supreme Court’s election ballot ruling, Trump’s ‘hush money’ guilty verdict, and his assassination attempt in July.

No such luck since, with only 424 new holders following the debate against Harris on Tuesday.

All told, out of the 80,190 addresses holding MAGA (TRUMP), about 30% of them (24,300) bought in after the token set an all-time high of $17.51 in early June. It’s currently trading at $2.25 after losing nine-tenths of its value.

And sure, 80% drawdowns are one of the oldest traditions in crypto. But if there was a time for a huge Trump headline to revive PolitiFi, then now would be it.

— David Canellis

IYKYK

Empire host Jason Yanowitz spoke to Allen Ng of Everest Ventures Group in today’s Empire podcast. Which, you may have guessed by the name, is a venture-building group focused on Web3.

Ng gave Empire listeners a rundown on a variety of topics: from the regulatory fallout following the Terra and FTX implosions, to a glimpse of how folks across Asia interact with crypto.

Focusing in on the FTX and Terra of it all, Ng offered insight into how both of those now-defining moments in crypto impacted the way that various Asian countries handled the regulatory environment in the aftermath. Oh, isn’t it fun to recount that time in crypto?

Anyway, Ng very interestingly highlighted the negative impact FTX had in some Asian countries, given that FTX actually started in Hong Kong.

“I think it only [had] a bigger impact in the US because, in the later part, after [they used] Asia for the success [of the] business, they raised a lot of capital from the US and then” they infamously involved a lot of famous people, Ng said.

And now you know.

While we could rehash more of what happened with FTX and the fallout there — and trust me, we’ll be talking about FTX again soon enough with a court hearing coming up — I wanted to turn our attention over to the Commodities Futures Trading Commission’s legal battle with regulated prediction market Kalshi.

Unlike Polymarket, which dropped US users as part of a CFTC settlement in 2022, Kalshi is able to offer US prediction markets. And, as of Thursday afternoon, is now the only firm to offer election markets to US users. (Unlike Polymarket, Kalshi doesn’t run on smart contracts, blockchain or crypto, although it does offer markets for crypto-related topics.)

Now, the fight between the CFTC and Kalshi isn’t over. CFTC lawyers are pushing really hard for an extension of the emergency stay in court yesterday (which Judge Jia Cobb denied), and the CFTC had a notice of appeal filed before the dust had even settled after the hearing.

The plan, at least from the hearing yesterday, is for the CFTC to seek a two-week emergency stay with the Appellate court.

Kalshi wasted no time getting its election markets up, before having to halt them earlier today as the CFTC moves forward with an appeal. And with the popularity of Polymarket so widespread (not only making prediction markets relevant again, but also quietly pushing a hot use case for crypto), this is going to be a case to watch.

— Katherine Ross

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  Dogecoin

Dogecoin  USDC

USDC  Cardano

Cardano  TRON

TRON  Chainlink

Chainlink  Stellar

Stellar  Hedera

Hedera  Bitcoin Cash

Bitcoin Cash  LEO Token

LEO Token  Litecoin

Litecoin  Cronos

Cronos  Ethereum Classic

Ethereum Classic  Monero

Monero  Dai

Dai  Algorand

Algorand  OKB

OKB  Cosmos Hub

Cosmos Hub  Stacks

Stacks  Theta Network

Theta Network  Gate

Gate  Maker

Maker  KuCoin

KuCoin  Tezos

Tezos  IOTA

IOTA  NEO

NEO  Polygon

Polygon  Zcash

Zcash  Synthetix Network

Synthetix Network  Tether Gold

Tether Gold  TrueUSD

TrueUSD  Dash

Dash  Holo

Holo  Zilliqa

Zilliqa  0x Protocol

0x Protocol  Enjin Coin

Enjin Coin  Qtum

Qtum  Siacoin

Siacoin  Basic Attention

Basic Attention  Ravencoin

Ravencoin  Bitcoin Gold

Bitcoin Gold  Decred

Decred  NEM

NEM  Ontology

Ontology  DigiByte

DigiByte  Nano

Nano  Status

Status  Hive

Hive  Huobi

Huobi  Lisk

Lisk  Waves

Waves  Numeraire

Numeraire  Steem

Steem  Pax Dollar

Pax Dollar  BUSD

BUSD  OMG Network

OMG Network  Ren

Ren  Bitcoin Diamond

Bitcoin Diamond  Bytom

Bytom