Empire Newsletter: What would a strategic bitcoin reserve look like?

Today, enjoy the Empire newsletter on Blockworks.co. Tomorrow, get the news delivered directly to your inbox. Subscribe to the Empire newsletter.

1 million BTC

The US government has four official reserve assets. Why shouldn’t bitcoin be the fifth?

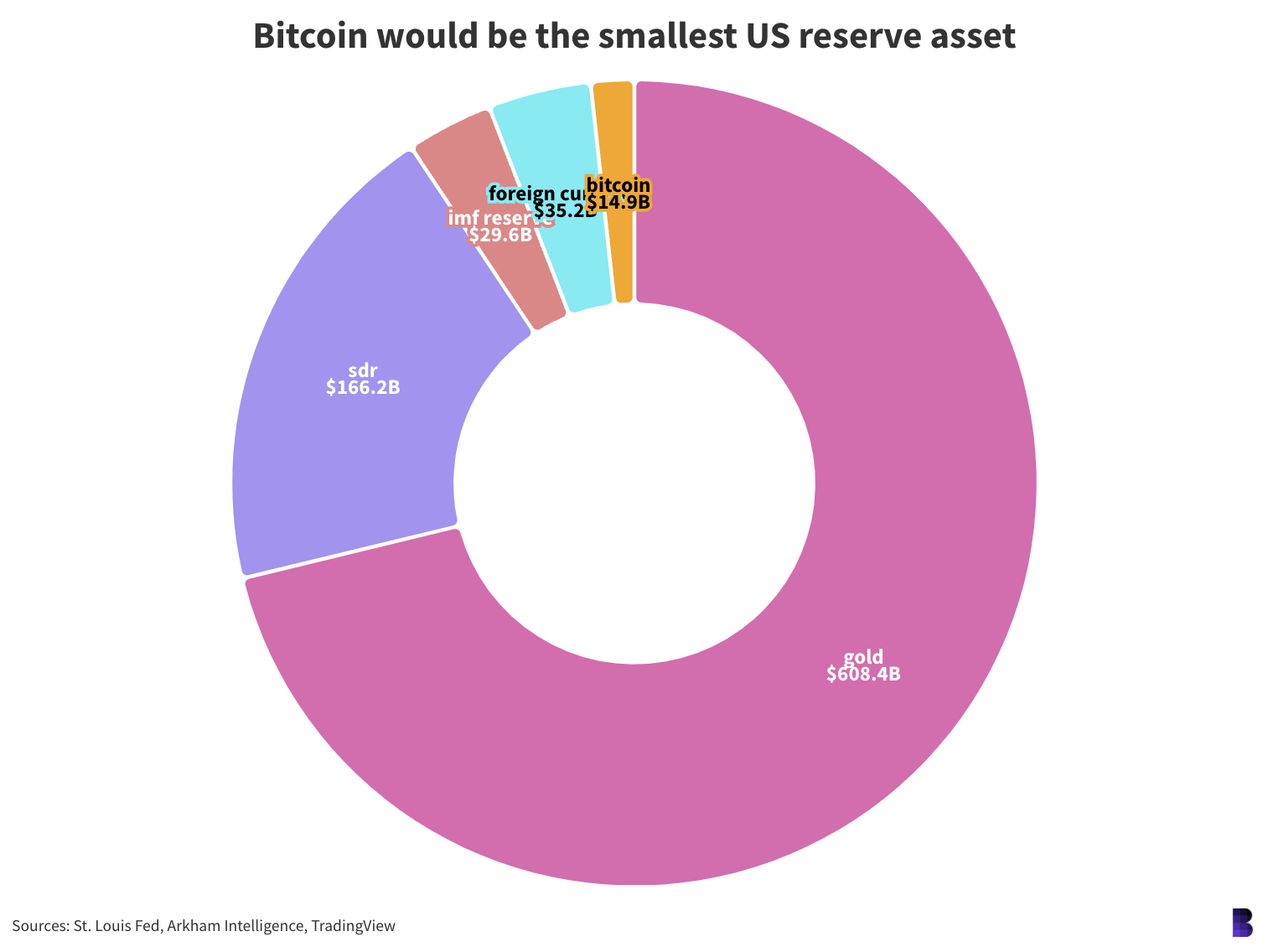

Gold is by far the biggest. Or, more precisely, gold certificates. The US currently holds dollar-denominated certificates to almost 261.5 million fine troy ounces of gold.

The Fed values those certificates at $42.22 per ounce, a statutory price it has kept by law as of 1973. Gold currently trades for nearly $2,400, giving the Fed’s gold certificates at market value of $608.35 billion.

There’s also $166.21 million of claims to special drawing rights (SDR), a reserve asset maintained by the International Monetary Fund (IMF).

SDR is a liquidity pool, currently worth $943 billion, from which countries can potentially pull. It consists of a basket of international currencies including the US dollar, euro, Chinese renminbi, yen and the sterling.

US reserves also contain $35.2 billion in foreign currency, denominated in the euro and yen, as well as an additional $29.6 billion that can be withdrawn from the IMF on short notice (separate from the SDR pool).

The US maintains strategic reserves of other valuable stuff, including oil (374.4 million barrels with a market value of $29.9 billion). But oil is not an official reserve asset like gold and foreign currencies.

Bitcoin does look right at home amongst the other US reserve assets

Still, if bitcoin-friendly Senator Cynthia Lummis gets her way, the US government will buy one million BTC ($67.7 billion) over five years to bolster Treasury coffers. A strategic bitcoin reserve managed by the US government.

President Donald Trump otherwise floated a plan to stop the US from selling anymore of its seized bitcoin at Bitcoin 2024 in Nashville. He’d prefer that the US indefinitely holds its remaining 213,240 BTC ($14.85 billion), which authorities seized from a variety of criminal cases including Silk Road and the Bitfinex hack.

Trump didn’t go so far as to suggest an official strategic reserve in the same way that Lummis said she plans to in an upcoming Congress bill.

If the US began to consider bitcoin an official reserve asset — which sadly feels unlikely — then it would contribute 1.74% of the US’s total official reserves at current prices ($14.85 billion out of $854.3 billion).

But what would US reserves look like if Lummis actually gets her way?

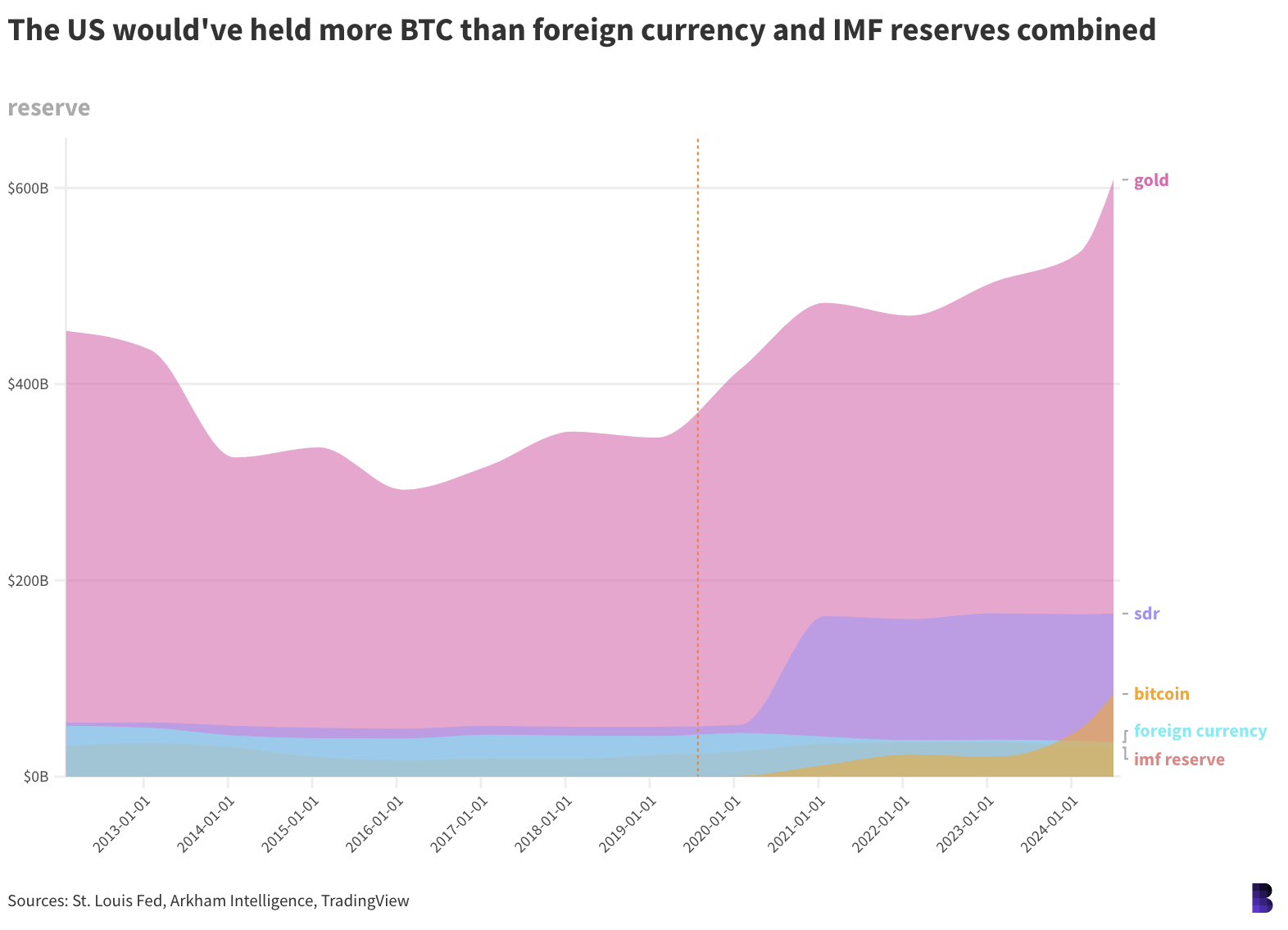

It’s hard to calculate looking forward, because that would take predicting the price of bitcoin. It is however possible to run her buying strategy over the past five years instead.

Had Lummis’ plan to buy one million BTC started five years ago, buying the same amount of BTC each month, then the US would now be sitting on $69.44 billion in bitcoin, including its seized criminal stash.

Bitcoin would be the third-largest US reserve asset in that case, behind gold and SDR. The orange line shows when buying would’ve started

The real kicker is that the US would’ve spent “only” $31.4 billion to acquire one million BTC — which works out to be 120% unrealized profit.

It would still take some market luck. But perhaps Lummis is onto something.

— David Canellis

Data Center

- Bitcoin forks BCH and BSV are climbing the highest today, up 16.6% and 15.6% apiece.

- TIA and CORE are yet to start their own legs up, down 22% and 14% in the past week.

- Bitcoin open intereston CEXs is at an all-time high: $39.69 billion, beating the previous record of $39.03 billion at the end of March.

- Monthly DEX volumes are set to top both May and June, currently $173.72 billion with three days left to go (including Monday).

- Weekly Polygon NFT volumeis up 77% to $15.9 billion, compared to $31.5 million on Ethereum.

Can you take me higher?

We’re sitting right under $70,000 (at time of publication), marking highs that we haven’t yet seen this summer.

And, yes, while I’m talking specifically about bitcoin here, both SOL and ETH are up over 3% over the last 24 hours. Even bitcoin cash — which has experienced some volatility following the Mt. Gox repayments — is up in the past 24 hours, though it’s still down in the last year compared to the rest of the market.

The point is: Bulls are back in the driver’s seat. Or so it seems.

Notably, there are some levels to watch for as bitcoin hovers around $70,000. If it can break above $72,000, for example, then it’ll have broken out of consolidation and could carve out fresh highs.

Loading Tweet..

As I’m sure we’re all aware by now, part of this leg up can be attributed to former President Donald Trump’s speech over the weekend at Bitcoin 2024. Our very own Casey Wagner detailed the important parts of his nearly hour-long talk in case you somehow missed it (or in case you logged off for the weekend, which is a very healthy habit but too bad I’m notoriously online all the time).

There was even some movement on the Democratic side, with a group of lawmakers pushing presidential hopeful Kamala Harris to take on a more pro-crypto stance.

Back to the markets though: ETC Group, in a note published after this weekend’s events, said that its Cryptoasset Sentiment Index shows bullish sentiment, but the market hasn’t reached euphoric levels yet.

“Last week, there were significant reversals in the BTC one-month implied volatility and BTC perpetual funding rate which tend to be bullish signals,” analysts wrote. Altcoins are also struggling to outperform bitcoin right now.

“Increasing (decreasing) altcoin outperformance tends to be a sign of increasing (decreasing) risk appetite within cryptoasset markets and the latest altcoin underperformance is a signal of decreasing appetite for risk at the moment,” they continued.

But, as I outlined on Friday, there are other bullish indicators including Michigan’s retirement system allocating roughly 5% to bitcoin ETFs.

“The confluence of Trump’s unexpected support, favorable macroeconomic

conditions, increased institutional interest, and strategic decisions by major industry players

creates a compelling case for Bitcoin’s bullish trajectory,” wrote HyBlock Capital’s Shubh Varma in a market note this morning.

“While market dynamics can shift rapidly, the current setup suggests that bitcoin may be on the verge of a significant upward move, potentially breaking new ground and reinforcing its status as a leading alternative asset.”

CoinShares, in its fund flow report, also found “renewed investors confidence” in bitcoin ETFs, with month-to-date inflows hitting $3.6 billion.

The Fear & Greed Index from Glassnode shows that markets are still greedy, a change from the fear reading last month.

There are some other bullish indicators to keep an eye on though.

One, noted by BRN analysts, is the triggering of the Hash Ribbon signal, which is “a long-term bullish indicator highlighting the end of miner capitulation and the increase of the processing power used to mine bitcoin,” making the case for a move higher pretty compelling.

— Katherine Ross

The Works

- Cantor Fitzgerald will launch a bitcoin financing business with $2 billion in initial financing, the firm announced over the weekend.

- The campaign for Vice President Kamala Harris is seeking a “reset” in relationships with crypto firms, the Financial Times reported.

- Grayscale received approval from the Securities and Exchange Commission for its Bitcoin Mini Trust.

- The ether ETF launch saw $2.2 billion of inflows, which was offset by outflows, CoinShares noted.

- Slovenia issued a sovereign digital bond, the first EU nation to do so, CoinDesk reported.

The Riff

Q: Was Trump’s speech at Bitcoin 2024 the defining moment for crypto this cycle?

As I wrote above, it’s definitely a potential catalyst for a move higher. I think we’re in such uncharted territory that you could argue it’s a momentous moment — especially if he acts on the action items he laid out in his speech — but I don’t think Trump is alone in notching “defining moments” this cycle.

To pull away from the politics, we’ve talked so much about institutional support, which I think is defining on its own this time around. And, to that point, both the ETH and bitcoin ETFs. While the ETH ETFs are still shaking off the jitters, I’d argue that the legitimacy of two types of crypto ETFs has really been the big win for crypto.

Money talks, right? The bitcoin ETFs have done more yapping than any politician so far this year.

Then you have Polymarket. And I haven’t even touched on DeFi…

Anyway, my point is that we’re seeing a lot of wins besides Trump that are pushing the crypto landscape forward.

— Katherine Ross

First off, props to whoever trained the Trump campaign in bitcoin talking points ahead of the Nashville speech. They deserve a raise.

But if I had to pick one defining moment for crypto since markets picked up in November 2022, I have to piggy-back off Katherine’s response and say Larry Fink’s January appearance on CNBC takes the cake.

Like Trump, the BlackRock CEO hit all the right notes, not just for bitcoin but for the value proposition of crypto more broadly. “It’s [bitcoin] no different than gold… an asset class that protects you.”

“[Bitcoin] ETFs are step one in the technological revolution in the financial markets. Step two is going to be the tokenization of every financial asset … This eliminates all corruption, having a tokenized system.“

That we get similar soundbites from Trump in the same cycle is just icing on the cake.

— David Canellis

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  Dogecoin

Dogecoin  TRON

TRON  Cardano

Cardano  Chainlink

Chainlink  Bitcoin Cash

Bitcoin Cash  LEO Token

LEO Token  Litecoin

Litecoin  Dai

Dai  Monero

Monero  Ethereum Classic

Ethereum Classic  Stellar

Stellar  Stacks

Stacks  OKB

OKB  Cronos

Cronos  Hedera

Hedera  Cosmos Hub

Cosmos Hub  Theta Network

Theta Network  Maker

Maker  Gate

Gate  KuCoin

KuCoin  Algorand

Algorand  Polygon

Polygon  Tether Gold

Tether Gold  NEO

NEO  EOS

EOS  Tezos

Tezos  Zcash

Zcash  TrueUSD

TrueUSD  Synthetix Network

Synthetix Network  Bitcoin Gold

Bitcoin Gold  IOTA

IOTA  Holo

Holo  0x Protocol

0x Protocol  Dash

Dash  Zilliqa

Zilliqa  Siacoin

Siacoin  Enjin Coin

Enjin Coin  Ravencoin

Ravencoin  Basic Attention

Basic Attention  Qtum

Qtum  Decred

Decred  Ontology

Ontology  NEM

NEM  Lisk

Lisk  Pax Dollar

Pax Dollar  Nano

Nano  Numeraire

Numeraire  DigiByte

DigiByte  Waves

Waves  Status

Status  Huobi

Huobi  Hive

Hive  Steem

Steem  BUSD

BUSD  Ren

Ren  OMG Network

OMG Network  Bitcoin Diamond

Bitcoin Diamond  Bytom

Bytom  Kyber Network Crystal Legacy

Kyber Network Crystal Legacy  HUSD

HUSD