Ethereum Bulls Hold 100-Day EMA: Is ETH Ready to Explode?

Despite Ethereum being down by 17% over the past week, buyers hope for a bounce back from the 100-day EMA.

Ethereum bulls are losing momentum, with ETH’s price nearing the $3,000 psychological level. A bearish week saw its market cap fall below $400 billion, and Ethereum is struggling to make a comeback.

As bulls hold steady at the key $3,000 mark, will a broader market recovery propel Ethereum to $4,000?

Ethereum Price Analysis

Ethereum’s price action on the daily chart shows bullish support above the 100-day EMA line. Currently, ETH is trading at $3,295, with an intraday gain of 0.52%. This represents a minor recovery after a bearish weekend.

Ethereum Price Chart

On Saturday, December 21, ETH dropped by 3.84%, creating a bearish engulfing candle, followed by a 1.75% drop on Sunday. Now, the price sustaining above the 100-day EMA line currently creates a doji candle, with ETH struggling to surpass the $3,300 level.

Using Fibonacci levels, the price is encountering rejection near the 61.80% Fibonacci retracement at $3,180.

With multiple support factors converging, the current doji candle increases the chances of recovery. However, the daily RSI is approaching the oversold boundary, reflecting rising selling pressure. This could require some minor consolidation before a trend reversal.

Ethereum ETFs End The Bullish Streak

Last week, ETH formed a massive bearish engulfing candle, dropping 17.16%. This took the price from a recent swing high of $4,109 to a weekly low of $3,095.

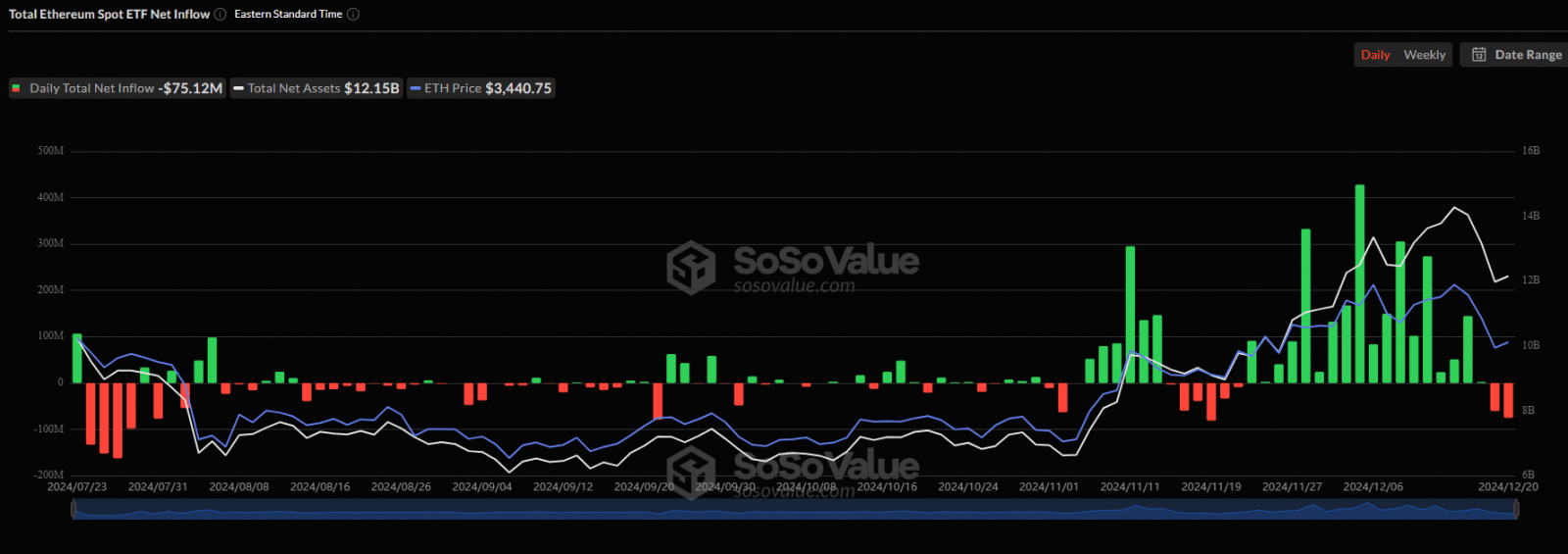

Amid the bearish pullback, institutional support waned, with Ethereum ETF outflows reaching $60.47 million on December 12. Meanwhile, inflows were recorded for subsequent days. However, on Friday, U.S. spot Ethereum ETFs closed the week with a negative flow of $75.12 million.

Despite this, the overall sentiment remained bullish, with a net inflow of $62.73 million for last week. This marked Ethereum’s fourth consecutive bullish week, though it ended a daily streak of 18 consecutive days of inflows.

Ethereum Spot ETFs

Ethereum Price Targets

Should the demand for ETH resurface with Bitcoin regaining bullish momentum, ETH price could bounce back. Based on the Fibonacci retracement tool, ETH’s immediate price target is $3,553 and the $4,000 psychological mark. Meanwhile, the solid support remains at $3,180.

Beyond this, the dynamic 200-day EMA at $3,944 aligns with the $3,000 psychological mark. The growing number of support factors suggests that ETH could sustain upward momentum this week.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  Dogecoin

Dogecoin  USDC

USDC  Cardano

Cardano  TRON

TRON  Chainlink

Chainlink  Hedera

Hedera  Stellar

Stellar  Bitcoin Cash

Bitcoin Cash  LEO Token

LEO Token  Litecoin

Litecoin  Cronos

Cronos  Ethereum Classic

Ethereum Classic  Monero

Monero  Dai

Dai  Algorand

Algorand  OKB

OKB  Cosmos Hub

Cosmos Hub  Stacks

Stacks  Theta Network

Theta Network  Gate

Gate  Maker

Maker  Tezos

Tezos  KuCoin

KuCoin  IOTA

IOTA  Zcash

Zcash  NEO

NEO  Polygon

Polygon  Synthetix Network

Synthetix Network  Tether Gold

Tether Gold  Dash

Dash  TrueUSD

TrueUSD  Holo

Holo  Zilliqa

Zilliqa  Enjin Coin

Enjin Coin  0x Protocol

0x Protocol  Basic Attention

Basic Attention  Qtum

Qtum  Siacoin

Siacoin  Ravencoin

Ravencoin  Decred

Decred  Bitcoin Gold

Bitcoin Gold  NEM

NEM  DigiByte

DigiByte  Ontology

Ontology  Nano

Nano  Status

Status  Huobi

Huobi  Waves

Waves  Lisk

Lisk  Hive

Hive  Numeraire

Numeraire  Steem

Steem  Pax Dollar

Pax Dollar  BUSD

BUSD  OMG Network

OMG Network  Ren

Ren  Bitcoin Diamond

Bitcoin Diamond