Ethereum Could See a 53% Price Correction If This Happens—Analyst

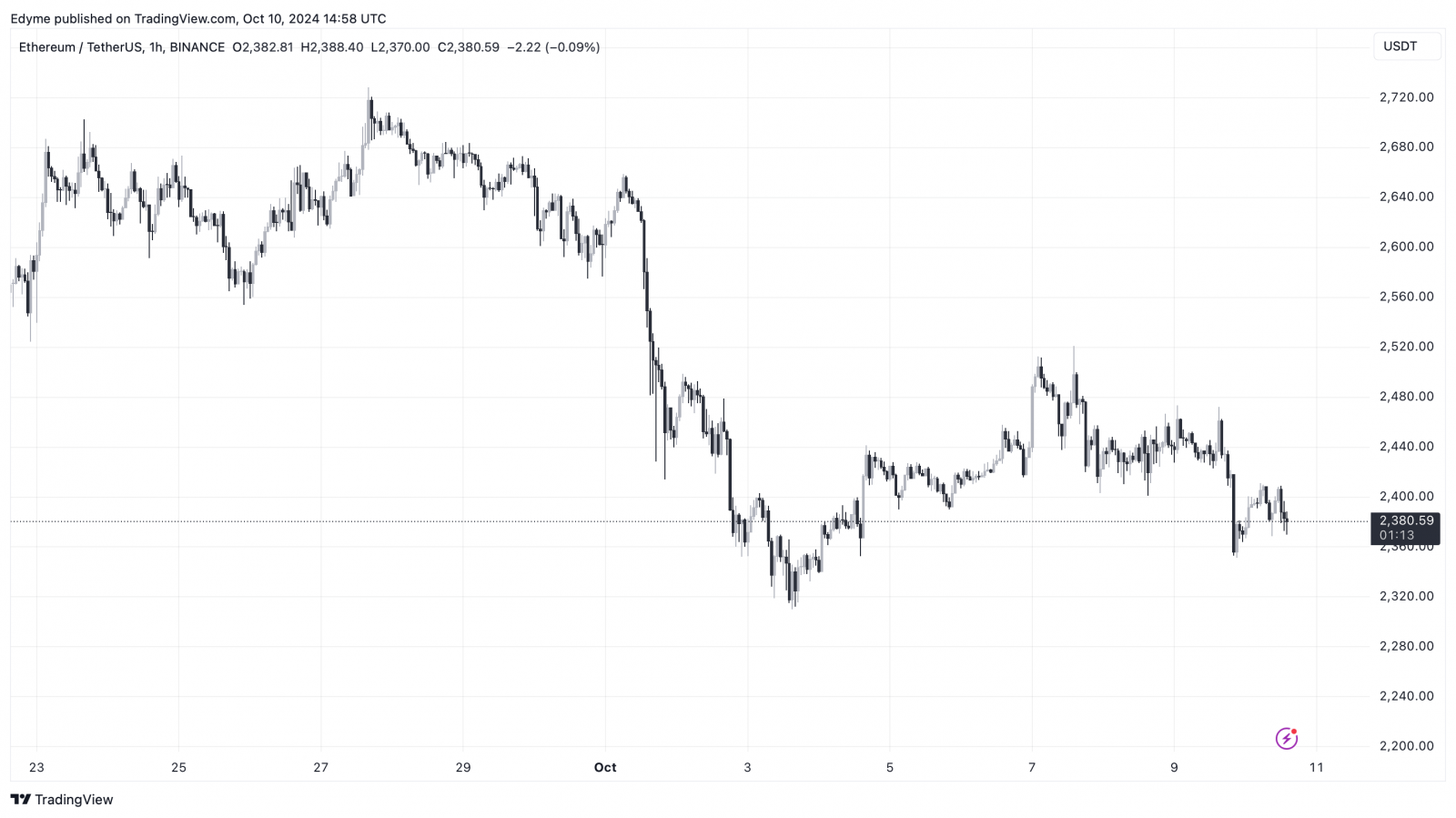

Ethereum has been experiencing sluggishness in its price performance recently, as the cryptocurrency continues to closely follow Bitcoin’s movements. Currently trading at $2,392, Ethereum is down 1.5% in the past 24 hours, adding to its gradual decline in recent days.

This drop follows a brief price surge last week, where Ethereum saw a slight surge to above $2,600. Despite the minor increase, Ethereum remains down by 51% from its all-time high of $4,878, recorded in 2021.

Ethereum Potential To Fall 53%

The sideways movement in Ethereum’s price has left traders cautious. Amid this, renowned crypto analyst Ali has offered his perspective on Ethereum’s current trajectory in a recent post on X.

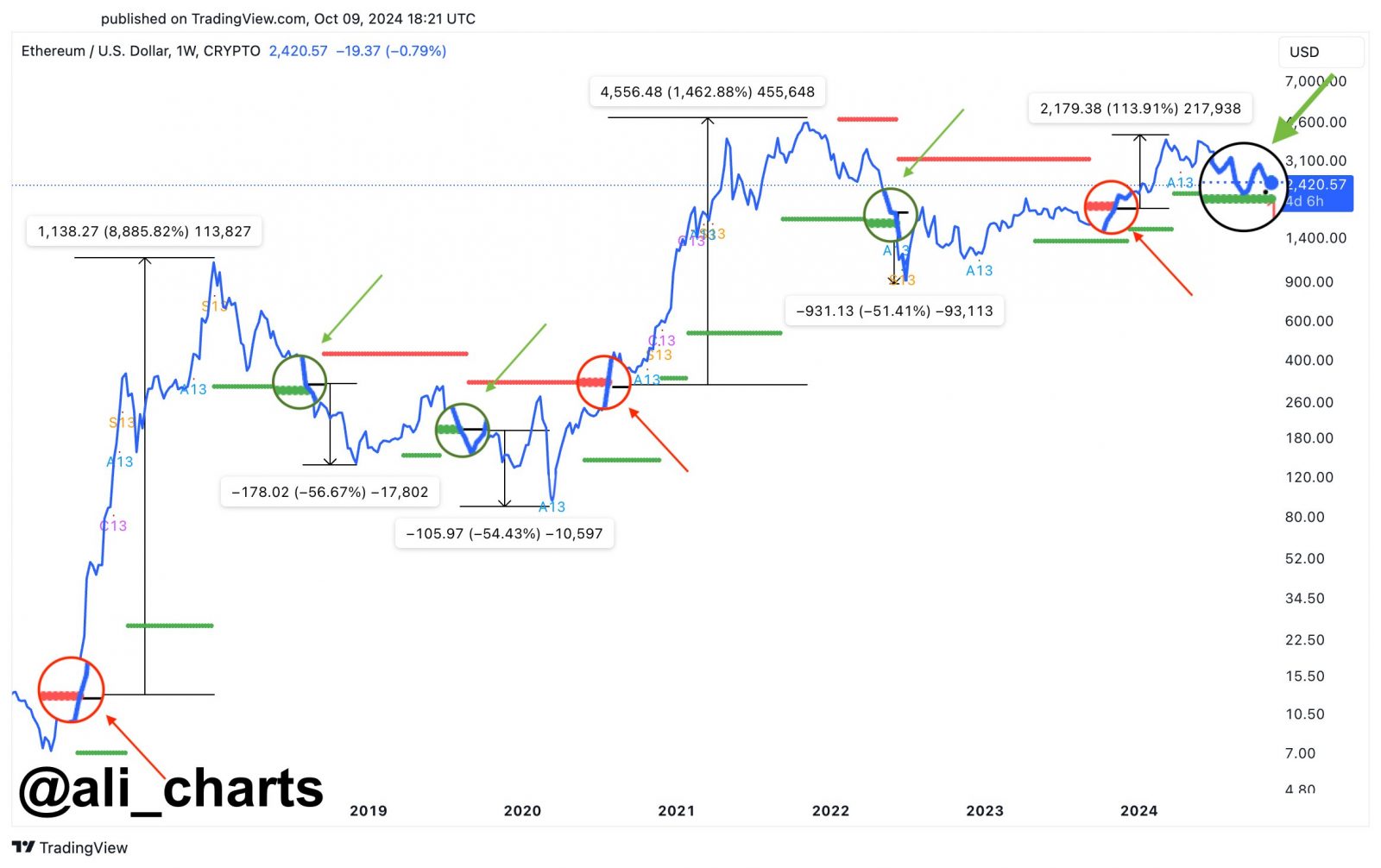

Ali pointed out that Ethereum’s price action tends to follow a particular pattern based on TD Sequential indicators. He explained that whenever Ethereum breaks above the TD setup resistance trendline, a strong bull run often ensues.

However, when Ethereum dips below the TD setup support trendline, it typically results in a significant price correction. According to Ali, Ethereum is nearing a critical support level of $2,250, warning that if this support is breached, it could trigger a major price drop.

Ali further emphasized that ETH has previously seen an average of 53% corrections following similar breakdowns, suggesting that losing the $2,250 level could spell trouble for the cryptocurrency.

Each time #Ethereum breaks above the TD setup resistance trendline 🔴, a strong bull run follows. But when $ETH breaks below the TD setup support trendline 🟢, we’ve seen an average 53% correction.

The key support now is $2,250—losing it could trigger a significant price drop. pic.twitter.com/PljkRda78S

— Ali (@ali_charts) October 10, 2024

On The Flip Side

While Ali expresses concern over Ethereum’s potential for a significant downturn, other analysts remain optimistic about its long-term potential.

A crypto analyst going by the name EtherNasYoNAL on X recently shared a bullish outlook for ETH, suggesting that the cryptocurrency could be on the verge of entering a new “mega bull” cycle.

According to the analyst, ETH is currently in the final stages of what they describe as a “retest and accumulation process.” This phase is reminiscent of Ethereum’s price movements in 2020, where it underwent a similar process before the 2021 mega bull run.

The analyst added that Ethereum’s price action in the months of August, September, and October 2020 followed a specific pattern, with accumulation and retests before the asset saw a significant rise.

EtherNasYoNAL believes Ethereum is currently mirroring this process and is poised to enter another mega bull cycle, expected to occur around 2025.

Despite the current decline, the analyst remains confident that Ethereum’s long-term trajectory is still bullish, encouraging investors to remain patient and await the expected price surge.

#Ethereum winks at the 2025 mega bull!

Before the 2021 mega bull, we witnessed the retest and accumulation process in August, September and October 2020.$ETH is in the final stage of the retest and accumulation process in August, September and finally October before the 2025… pic.twitter.com/VsE36le746

— EᴛʜᴇʀNᴀꜱʏᴏɴᴀL 📈 (@EtherNasyonaL) October 9, 2024

Featured image created with DALL-E, Chart from TradingView

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  Dogecoin

Dogecoin  USDC

USDC  Cardano

Cardano  TRON

TRON  Chainlink

Chainlink  Stellar

Stellar  Hedera

Hedera  Bitcoin Cash

Bitcoin Cash  LEO Token

LEO Token  Litecoin

Litecoin  Cronos

Cronos  Ethereum Classic

Ethereum Classic  Monero

Monero  Dai

Dai  Algorand

Algorand  OKB

OKB  Cosmos Hub

Cosmos Hub  Stacks

Stacks  Theta Network

Theta Network  Gate

Gate  Maker

Maker  KuCoin

KuCoin  Tezos

Tezos  IOTA

IOTA  NEO

NEO  Polygon

Polygon  Zcash

Zcash  Synthetix Network

Synthetix Network  Tether Gold

Tether Gold  TrueUSD

TrueUSD  Dash

Dash  Holo

Holo  Zilliqa

Zilliqa  Enjin Coin

Enjin Coin  0x Protocol

0x Protocol  Qtum

Qtum  Basic Attention

Basic Attention  Siacoin

Siacoin  Ravencoin

Ravencoin  Bitcoin Gold

Bitcoin Gold  Decred

Decred  NEM

NEM  Ontology

Ontology  DigiByte

DigiByte  Nano

Nano  Status

Status  Hive

Hive  Huobi

Huobi  Lisk

Lisk  Waves

Waves  Numeraire

Numeraire  Steem

Steem  Pax Dollar

Pax Dollar  BUSD

BUSD  OMG Network

OMG Network  Ren

Ren  Bitcoin Diamond

Bitcoin Diamond  Bytom

Bytom