Ethereum (ETH) Price Might Tank 15%: Here’s Why

Ethereum (ETH) has experienced a modest 1% price increase over the past 24 hours, reflecting the broader cryptocurrency market’s uptrend. This rebound comes after a week-long decline, largely attributed to political tensions in the Middle East.

Although the rally offers temporary relief for ETH holders, BeInCrypto’s analysis indicates it may be short-lived. Weak on-chain demand and a persistent bearish sentiment surrounding the altcoin suggest that the recovery could struggle to maintain momentum.

Ethereum Witnesses Poor Demand

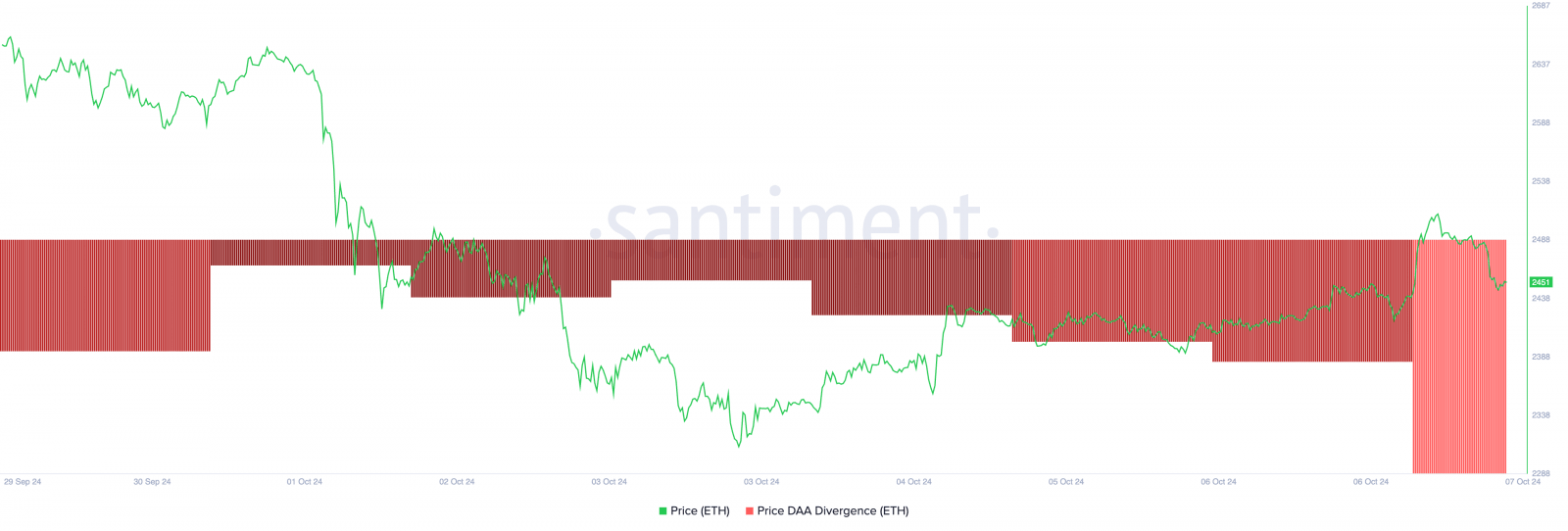

The negative readings from ETH’s price daily active address (DAA) divergence reflect the poor demand for the altcoin among market participants. This metric, which measures an asset’s price movements with the changes in its number of daily active addresses, is at -70.34% at press time.

For context, DAA have remained negative despite its price rally since last weekend. Historically, when an asset’s price rises while active addresses decrease, it’s considered a sell signal. This suggests the rally is driven by speculation rather than real demand, implying that the price surge may be short-lived.

Read more: How to Invest in Ethereum ETFs?

Ethereum Price Daily Active Address Divergence. Source: Santiment

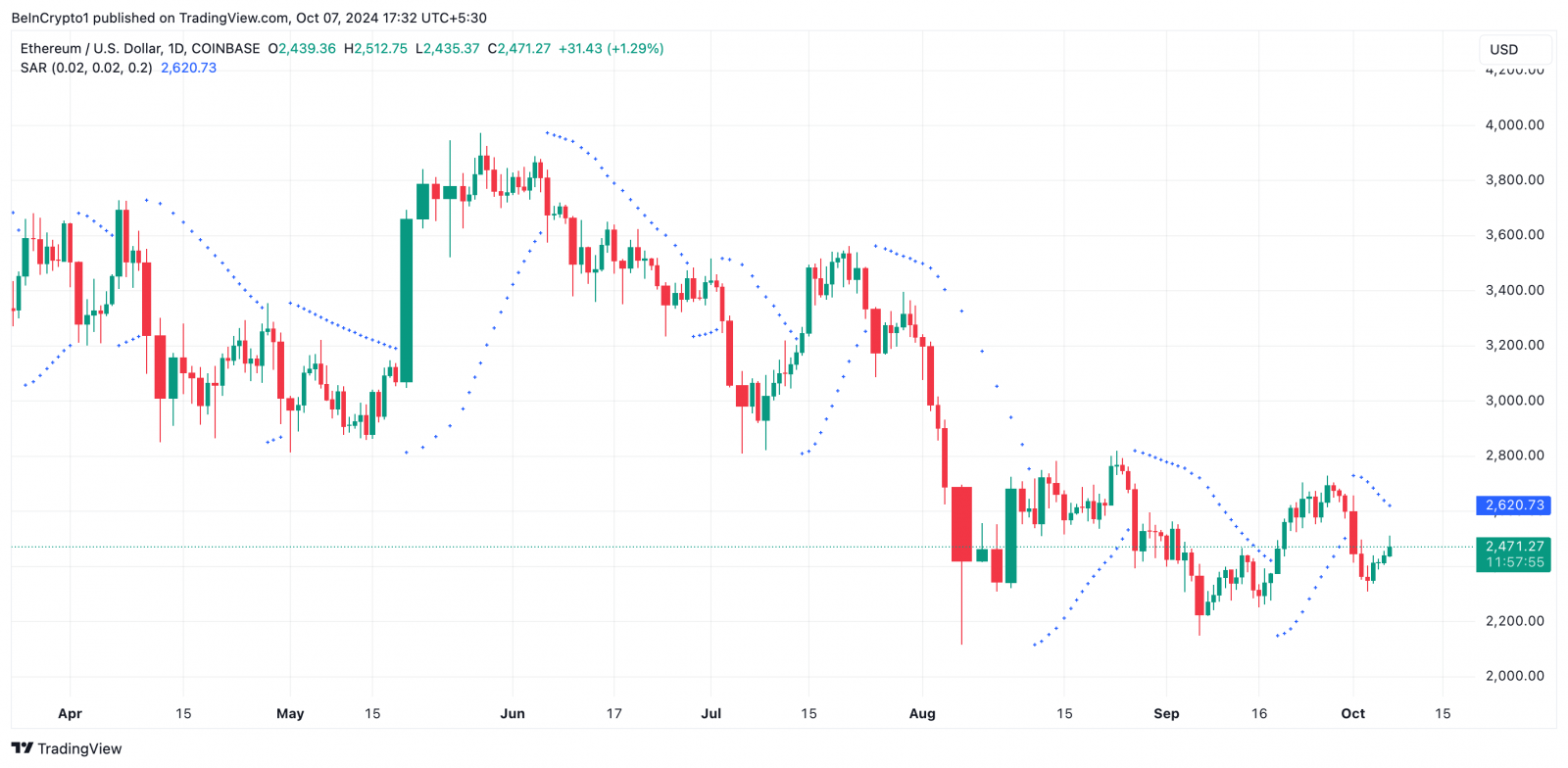

Furthermore, Ethereum’s Parabolic Stop and Reverse (SAR) indicator, which helps identify trend direction and potential reversal points, reinforces the bearish outlook. Currently, the indicator’s dots are positioned above ETH’s price.

When the Parabolic SAR dots appear above an asset’s price, it signals downward pressure and suggests that the trend is likely bearish. Traders typically view this as an indicator to hold or consider initiating short positions, expecting further price declines.

Ethereum Parabolic SAR. Source: TradingView

ETH Price Prediction: August 5 Low on the Horizon

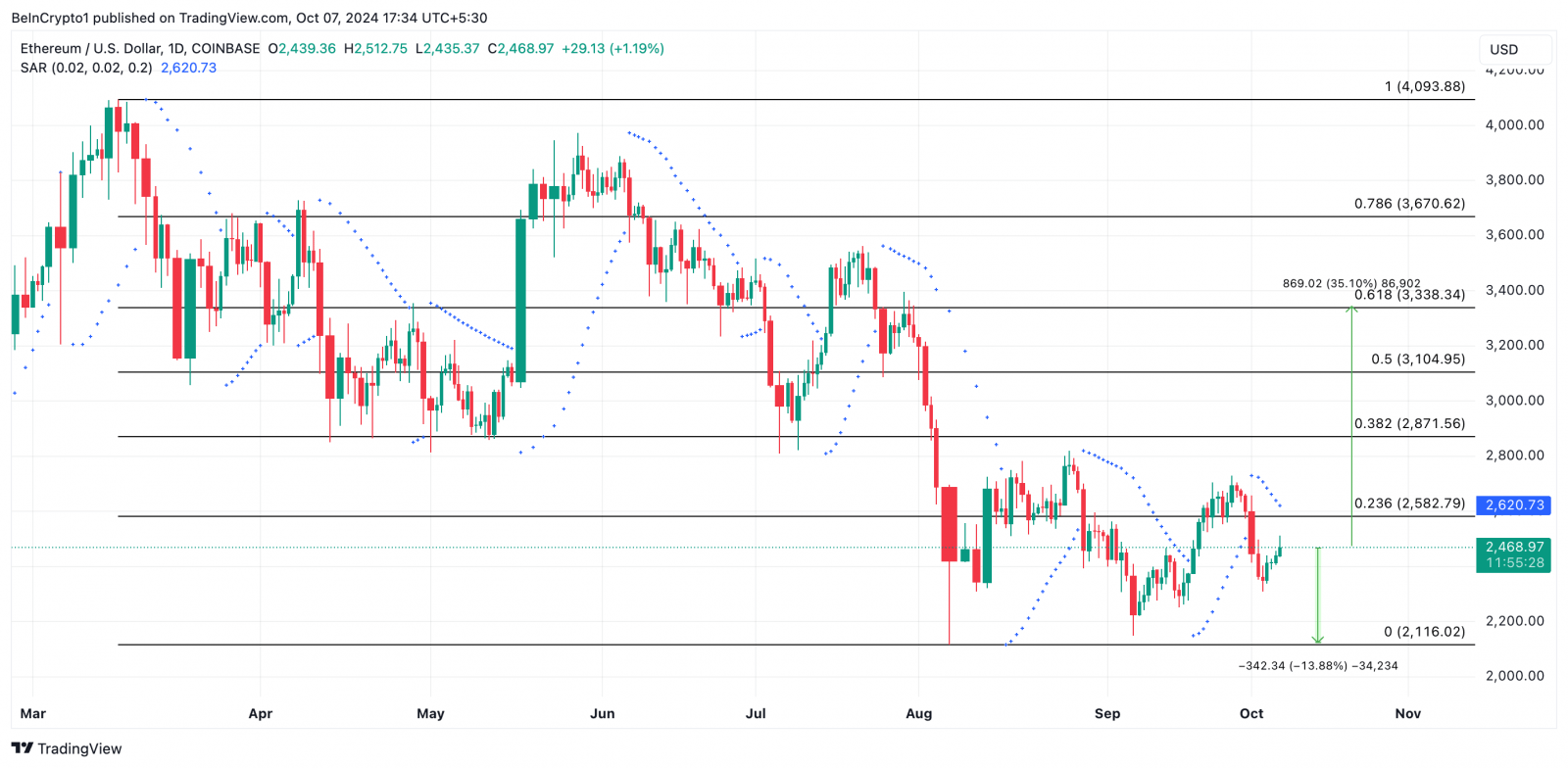

The Parabolic SAR dots above the price can act as a form of dynamic resistance. If the price tries to rise, it might face selling pressure near these dots, reinforcing the bearish trend.

These dots currently rest at $2620, suggesting that ETH will face a surge in selling pressure once it approaches this level. If selling pressure strengthens, Ethereum’s price risks falling 14% to its August 5 low of $2,116.

Read more: Ethereum (ETH) Price Prediction 2024/2025/2030

Ethereum Price Analysis. Source: TradingView

However, if it witnesses a resurgence in demand, ETH may break above the resistance formed at the $2,700 price level and target $3,338.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  Dogecoin

Dogecoin  Cardano

Cardano  TRON

TRON  Chainlink

Chainlink  Bitcoin Cash

Bitcoin Cash  LEO Token

LEO Token  Litecoin

Litecoin  Dai

Dai  Stellar

Stellar  Ethereum Classic

Ethereum Classic  Monero

Monero  Cronos

Cronos  Stacks

Stacks  OKB

OKB  Hedera

Hedera  Cosmos Hub

Cosmos Hub  Maker

Maker  KuCoin

KuCoin  Theta Network

Theta Network  Gate

Gate  Algorand

Algorand  Polygon

Polygon  NEO

NEO  EOS

EOS  Tezos

Tezos  Zcash

Zcash  Tether Gold

Tether Gold  Synthetix Network

Synthetix Network  TrueUSD

TrueUSD  IOTA

IOTA  Bitcoin Gold

Bitcoin Gold  Holo

Holo  Dash

Dash  0x Protocol

0x Protocol  Zilliqa

Zilliqa  Siacoin

Siacoin  Enjin Coin

Enjin Coin  Ravencoin

Ravencoin  Qtum

Qtum  Basic Attention

Basic Attention  Decred

Decred  Ontology

Ontology  NEM

NEM  Lisk

Lisk  Nano

Nano  Numeraire

Numeraire  Waves

Waves  Pax Dollar

Pax Dollar  DigiByte

DigiByte  Status

Status  Huobi

Huobi  Hive

Hive  Steem

Steem  BUSD

BUSD  Ren

Ren  OMG Network

OMG Network  Bitcoin Diamond

Bitcoin Diamond  Bytom

Bytom  Kyber Network Crystal Legacy

Kyber Network Crystal Legacy  HUSD

HUSD