Ethereum (ETH) Whales Abandon Ship as Coin Dips by Double Digits

Leading altcoin Ethereum has seen a significant price decline. Currently trading at $2,551, ETH has dropped by over 20% in the past month.

This downturn has led Ethereum whales to gradually reduce their positions in the past few weeks.

Ethereum Large Holders Excercise Caution

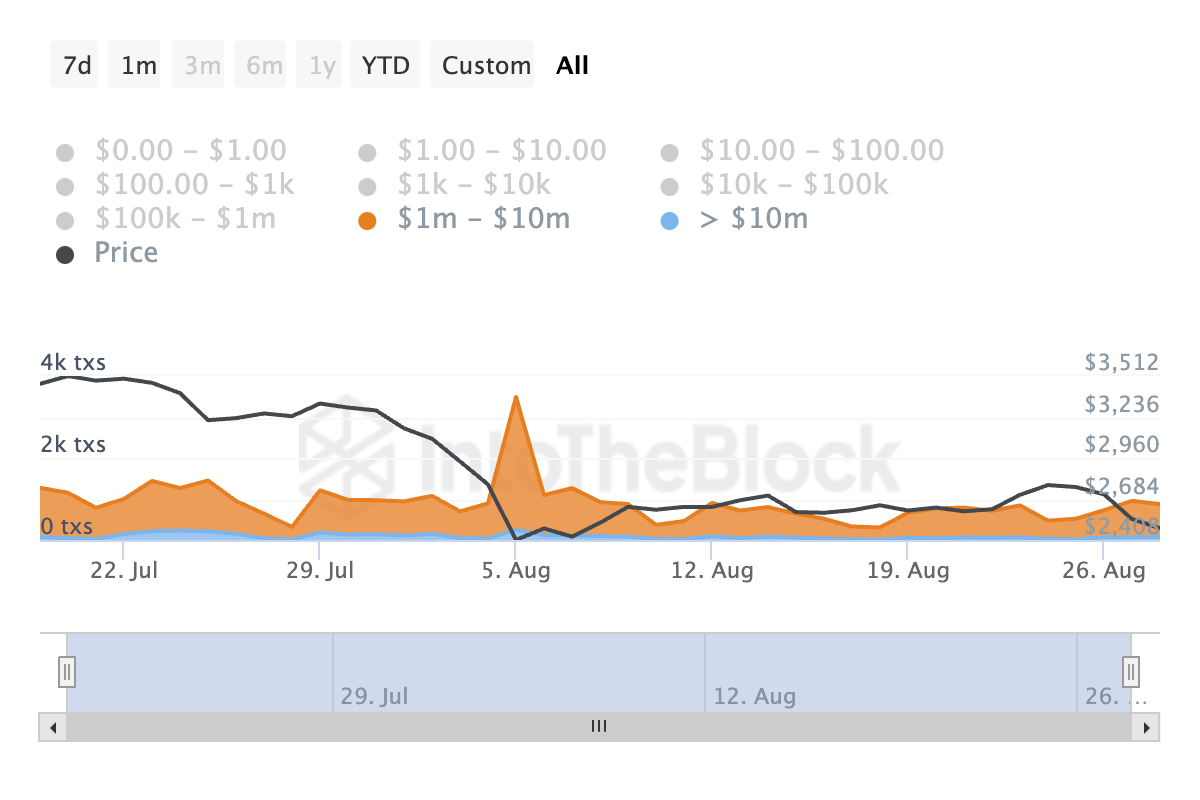

Due to ETH’s double-digit price decline, ETH whales have reduced their trading activity over the past month. This can be gleaned from the decline in the coin’s large transaction count in the past 30 days.

According to IntoTheBlock’s data, the daily count of ETH transactions worth between $1 million and $10 million has dropped by 5% during this period. At the same time, the daily count of larger transactions valued above $10 million has fallen by 45%.

Ethereum Transaction Count. Source: IntoTheBlock

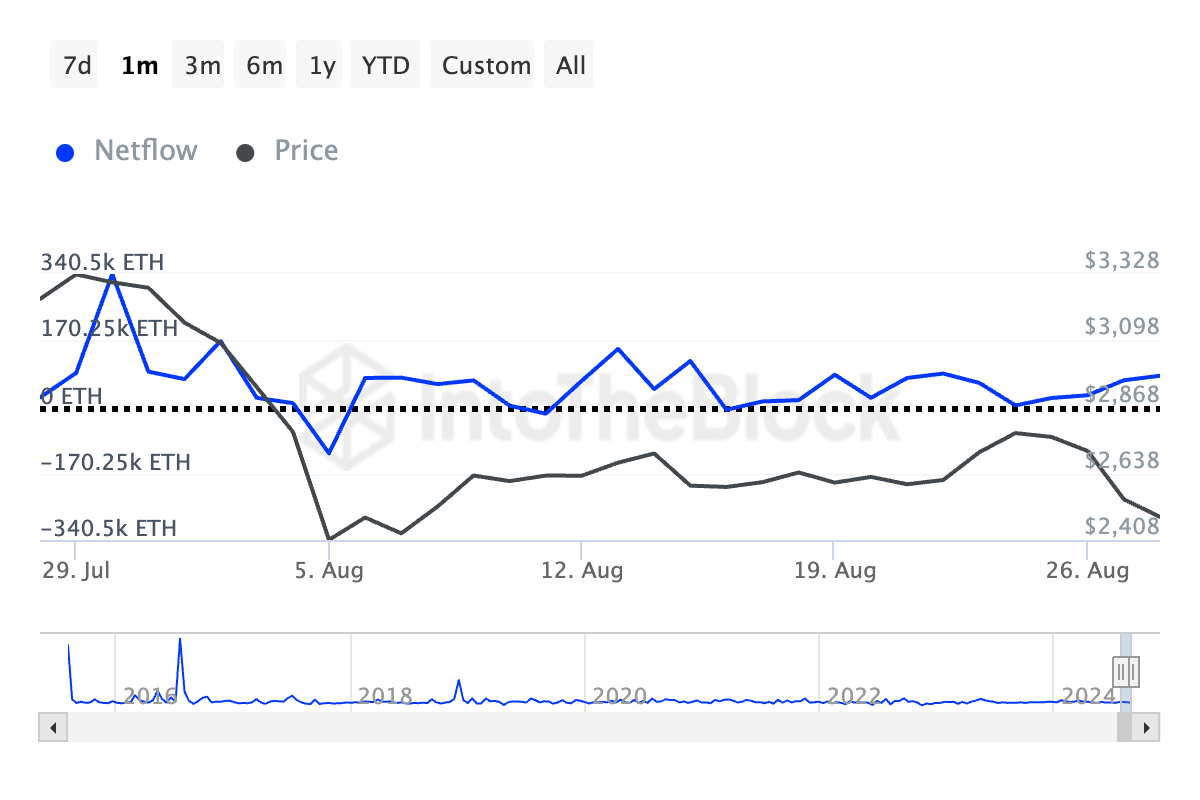

Additionally, the netflow of large holders for Ethereum (ETH) has plummeted by 77%. Large holders, or whales, are those who own over 0.1% of the asset’s circulating supply.

The large holders’ netflow measures the difference between the amount of ETH that these whales buy and the amount they sell over a specific period.

Read more: How To Buy Ethereum (ETH) With a Credit Card: A Step-by-Step Guide

Ethereum Large Holders Netflow. Source: IntoTheBlock

When the large holders’ netflow metric drops, it indicates whale distribution, which is often a bearish signal. This usually precedes further price declines, as reduced whale activity can negatively impact market sentiment.

ETH Price Prediction: Price Eyes August 5 Lows

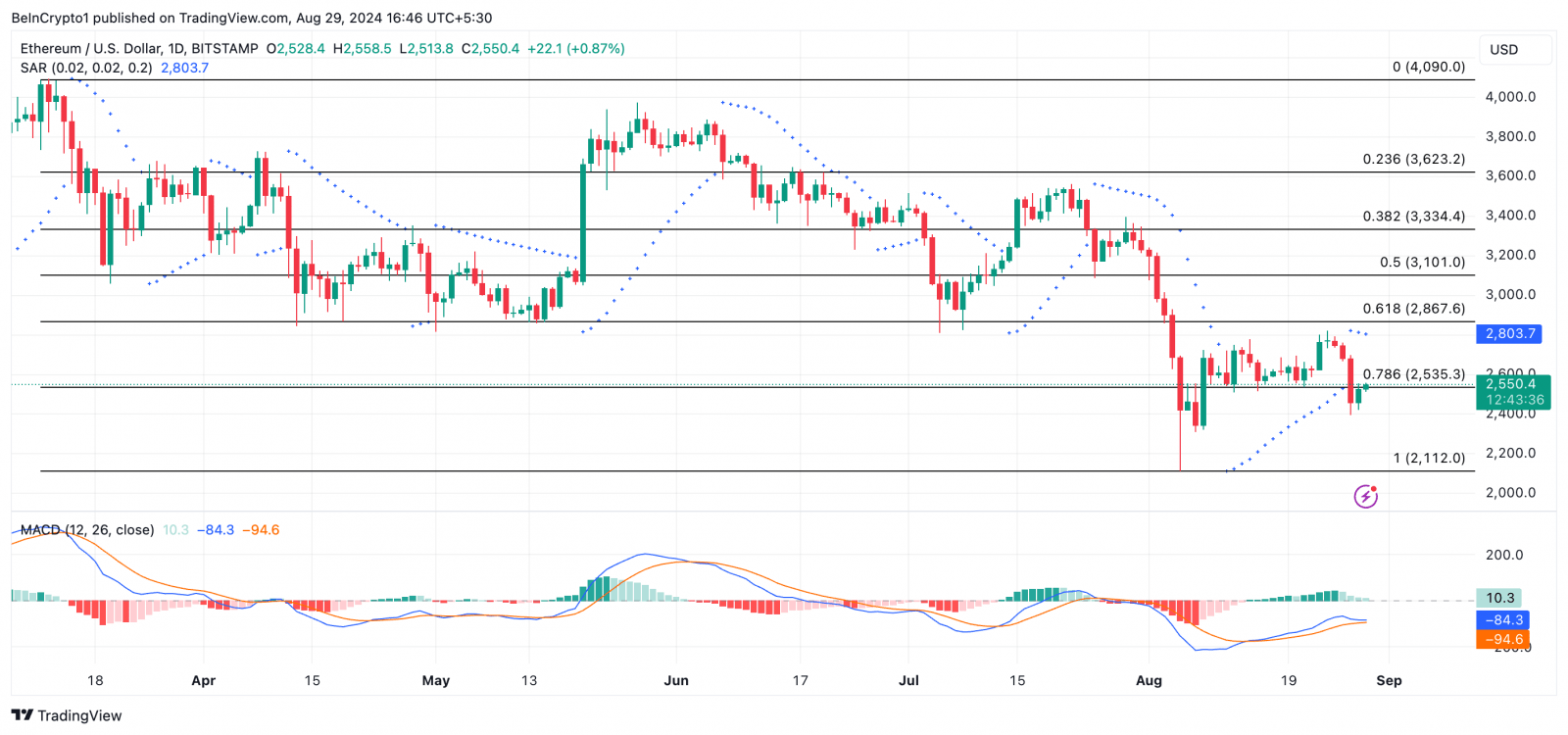

The bearish outlook for Ethereum (ETH) is reinforced by the setup of its Parabolic Stop and Reverse (SAR) indicator on the one-day chart. Currently, the indicator’s dots are positioned above the coin’s price, signaling a downtrend.

The Parabolic SAR is a tool used to identify potential trend direction and reversals. When the dots appear above an asset’s price, it indicates that the market is in a decline and that the asset’s price may continue to fall.

Additionally, Ethereum’s Moving Average Convergence Divergence (MACD) is showing bearish signs, with the MACD line (blue) nearing a cross below the signal line (orange). This crossover typically suggests a strengthening downtrend, often interpreted by traders as a signal to consider selling or taking profits.

Read more: Ethereum ETF Explained: What It Is and How It Works

Ethereum Price Analysis. Source: TradingView

If selling pressure intensifies, ETH’s price could drop toward its August 5 low of $2,112. However, if the market trend shifts and buying activity picks up, the price could potentially rally to $2,867.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  Dogecoin

Dogecoin  TRON

TRON  Cardano

Cardano  Chainlink

Chainlink  Bitcoin Cash

Bitcoin Cash  LEO Token

LEO Token  Litecoin

Litecoin  Dai

Dai  Monero

Monero  Ethereum Classic

Ethereum Classic  Stellar

Stellar  Stacks

Stacks  OKB

OKB  Cronos

Cronos  Hedera

Hedera  Cosmos Hub

Cosmos Hub  Theta Network

Theta Network  Maker

Maker  Gate

Gate  KuCoin

KuCoin  Algorand

Algorand  Polygon

Polygon  NEO

NEO  EOS

EOS  Tether Gold

Tether Gold  Tezos

Tezos  Zcash

Zcash  TrueUSD

TrueUSD  Synthetix Network

Synthetix Network  Bitcoin Gold

Bitcoin Gold  IOTA

IOTA  Holo

Holo  0x Protocol

0x Protocol  Dash

Dash  Zilliqa

Zilliqa  Siacoin

Siacoin  Enjin Coin

Enjin Coin  Ravencoin

Ravencoin  Basic Attention

Basic Attention  Qtum

Qtum  Decred

Decred  Ontology

Ontology  NEM

NEM  Lisk

Lisk  Nano

Nano  Numeraire

Numeraire  Pax Dollar

Pax Dollar  DigiByte

DigiByte  Waves

Waves  Status

Status  Huobi

Huobi  Hive

Hive  Steem

Steem  BUSD

BUSD  Ren

Ren  OMG Network

OMG Network  Bitcoin Diamond

Bitcoin Diamond  Bytom

Bytom  Kyber Network Crystal Legacy

Kyber Network Crystal Legacy  HUSD

HUSD