Ethereum Technical Analysis: Bullish Breakout Needed to Reverse Bearish Trend

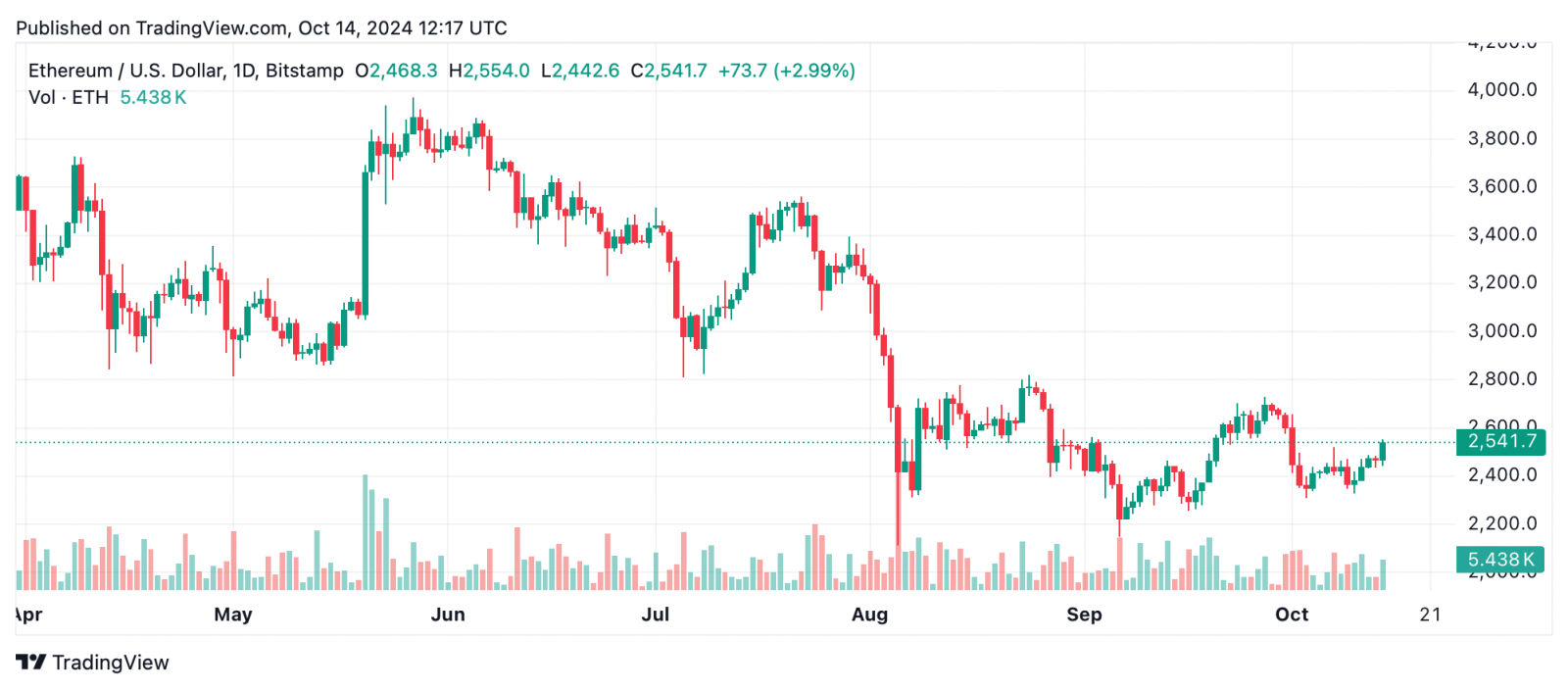

As of Oct. 14, 2024, ethereum’s price is $2,541, with a total market cap reaching $305 billion. In the last 24 hours, ETH has swung between $2,436 and $2,555, supported by a trading volume of $14.31 billion. Despite this activity, technical indicators hint at continued bearish momentum, with key support levels under pressure.

Ethereum

On the 1-hour chart, ethereum continues to show weakness, trading below both its 50- and 200-hour moving averages, signaling a short-term bearish trend. Oscillators like the relative strength index (RSI) sit around 45, indicating neutral to slightly bearish momentum. The moving average convergence divergence (MACD) remains below the signal line, further reinforcing the bearish outlook. Unless ethereum breaks above $2,560, more declines seem probable.

The 4-hour chart gives a wider perspective on ethereum’s ongoing struggles. ETH has been unable to recapture its 50-period moving average, now acting as resistance around $2,560. A descending pattern is forming, with lower highs, while oscillators like the stochastic RSI show overbought conditions, hinting at a potential downward correction. Support at $2,450 is critical in this timeframe.

Zooming out to the daily chart, ethereum remains below its 100-day moving average, a key indicator of long-term trends. The MACD histogram has stayed negative for several days, and the RSI remains near 40, emphasizing persistent selling pressure. Although ethereum experienced brief upward moves within its 24-hour range, it hasn’t managed to break away from its bearish path.

Moving averages (MAs) across all charts paint a picture of bearish dominance. ETH stays below both its 50-day and 200-day moving averages, indicating that bears still have the upper hand. Traders should keep a close eye on the $2,500 level—if it breaks, the downtrend could extend to the next support at $2,430.

Bull Verdict:

For the bulls, ethereum needs to make a decisive move above $2,543 and reclaim its 50-period moving averages across key timeframes. If this happens, it could spark buying momentum, pushing ETH toward its next resistance at $2,600. With increasing volume and bullish oscillators, ethereum might see a shift in sentiment and potentially reverse the current bearish trend.

Bear Verdict:

For the bears, the outlook remains favorable as long as ethereum struggles below $2,543 and remains under key moving averages. A break below $2,500 would confirm the continuation of the downtrend, with the next major support at $2,430. Ongoing weakness in oscillators and negative moving average crossovers suggest that ethereum may face further downside pressure in the short term.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  Dogecoin

Dogecoin  TRON

TRON  Cardano

Cardano  Bitcoin Cash

Bitcoin Cash  Chainlink

Chainlink  LEO Token

LEO Token  Litecoin

Litecoin  Dai

Dai  Monero

Monero  Stellar

Stellar  Ethereum Classic

Ethereum Classic  Stacks

Stacks  OKB

OKB  Cronos

Cronos  Hedera

Hedera  Cosmos Hub

Cosmos Hub  Gate

Gate  KuCoin

KuCoin  Theta Network

Theta Network  Maker

Maker  Algorand

Algorand  Polygon

Polygon  Tether Gold

Tether Gold  NEO

NEO  EOS

EOS  Tezos

Tezos  Zcash

Zcash  TrueUSD

TrueUSD  Synthetix Network

Synthetix Network  Bitcoin Gold

Bitcoin Gold  IOTA

IOTA  Holo

Holo  Dash

Dash  Zilliqa

Zilliqa  Siacoin

Siacoin  0x Protocol

0x Protocol  Ravencoin

Ravencoin  Basic Attention

Basic Attention  Enjin Coin

Enjin Coin  Qtum

Qtum  Decred

Decred  Ontology

Ontology  NEM

NEM  Lisk

Lisk  Pax Dollar

Pax Dollar  Nano

Nano  Numeraire

Numeraire  Waves

Waves  Status

Status  DigiByte

DigiByte  Huobi

Huobi  Hive

Hive  Steem

Steem  BUSD

BUSD  Ren

Ren  OMG Network

OMG Network  Bitcoin Diamond

Bitcoin Diamond  Bytom

Bytom  Kyber Network Crystal Legacy

Kyber Network Crystal Legacy  HUSD

HUSD  Energi

Energi