Ethereum’s $2,500 Breakout Spurs Dormant Coin Activity, Exchange Deposits Soar

Ethereum’s price breached the $2,579 resistance level on Monday. This triggered a wave of older, less active coins to start changing hands. Many of these coins appear to be making their way to cryptocurrency exchanges, as evidenced by a sharp increase in ETH’s netflow onto these platforms.

This may put downward pressure on the altcoin’s price, putting it at risk of shedding its recent gains. This analysis delves into what coin holders may expect.

Ethereum Long-Term Holders Aim for Profit

Broader market sentiment has shifted from neutral to greed as trading activity begins to gain momentum. Over the past 24 hours, Ethereum’s price has jumped 4%.

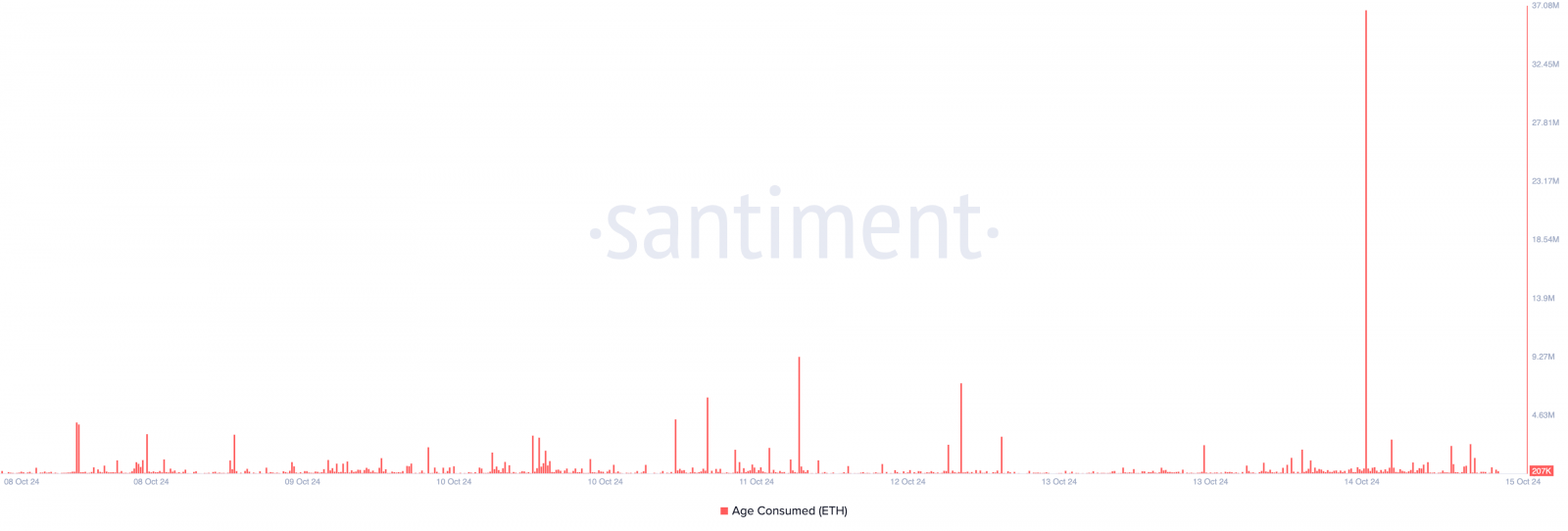

This price rally has prompted many dormant coin holders to become active, as evidenced by the spike in ETH’s age consumed. Santiment’s data shows that this metric, which tracks the movement of long-held coins, skyrocketed by over 400% on Monday, reaching 66.42 million — its highest since October 4.

Read more: How To Buy Ethereum (ETH) With a Credit Card: Complete Guide

Ethereum Age Consumed. Source: Santiment

When an asset’s age consumed spikes, it indicates that many previously inactive coins or tokens have recently been moved or traded. Generally, when dormant coins re-enter circulation, it indicates renewed activity from long-term holders.

However, the accompanying uptick in Ethereum’s netflow volume suggests that a substantial portion of these reactivated coins have been deposited onto exchanges. BeinCrypto’s assessment of Ethereum’s exchange activity reveals that on Monday, 51,881 ETH coins, valued at over $135 million based on current market prices, were transferred to cryptocurrency exchanges.

When an asset witnesses an increase in its exchange deposit, it means more investors are selling than buying.

Ethereum Net Transfer To Exchanges. Source: Glassnode

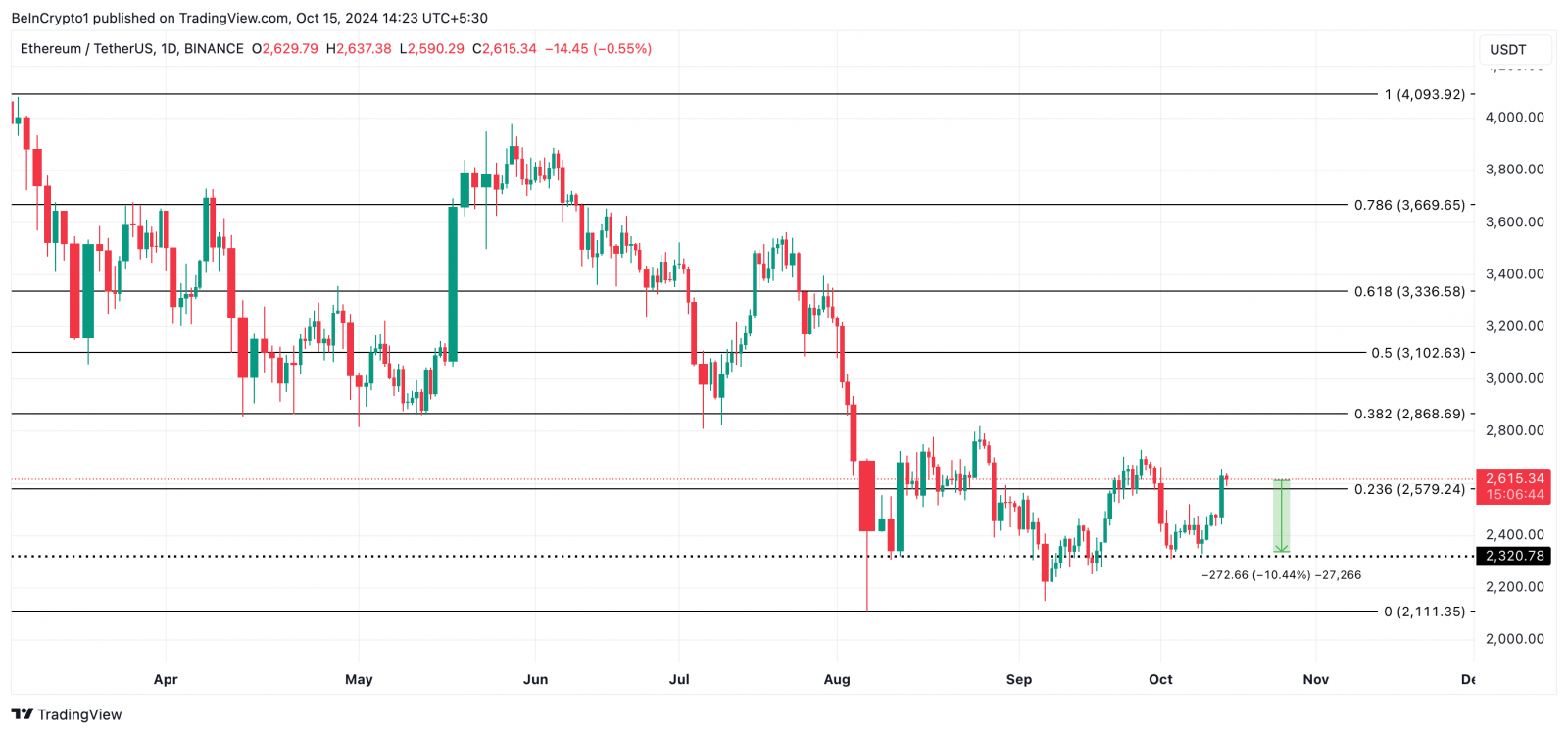

ETH Price Prediction: Price Risks 10% Drop

Ethereum’s price may fall toward resistance at $2,579 if selling activity gains momentum. If the level fails to hold as support, the altcoin’s price may dip further to the support formed at $2,320, representing a 10% drop from its current value of $2,616.

Read more: Ethereum (ETH) Price Prediction 2024/2025/2030

Ethereum Price Analysis. Source: TradingView

However, if selling pressure weakens and new demand enters the market, the bearish projection above is invalidated. Ethereum’s price will extend its gains and climb toward the next major resistance at $3,102.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  Dogecoin

Dogecoin  USDC

USDC  Cardano

Cardano  TRON

TRON  Chainlink

Chainlink  Stellar

Stellar  Hedera

Hedera  Bitcoin Cash

Bitcoin Cash  LEO Token

LEO Token  Litecoin

Litecoin  Cronos

Cronos  Ethereum Classic

Ethereum Classic  Monero

Monero  Dai

Dai  Algorand

Algorand  OKB

OKB  Cosmos Hub

Cosmos Hub  Stacks

Stacks  Theta Network

Theta Network  Gate

Gate  Maker

Maker  Tezos

Tezos  KuCoin

KuCoin  IOTA

IOTA  NEO

NEO  Polygon

Polygon  Zcash

Zcash  Synthetix Network

Synthetix Network  Tether Gold

Tether Gold  TrueUSD

TrueUSD  Dash

Dash  Holo

Holo  Zilliqa

Zilliqa  Enjin Coin

Enjin Coin  0x Protocol

0x Protocol  Basic Attention

Basic Attention  Qtum

Qtum  Siacoin

Siacoin  Ravencoin

Ravencoin  Bitcoin Gold

Bitcoin Gold  Decred

Decred  NEM

NEM  Ontology

Ontology  DigiByte

DigiByte  Nano

Nano  Huobi

Huobi  Status

Status  Lisk

Lisk  Waves

Waves  Numeraire

Numeraire  Hive

Hive  Steem

Steem  Pax Dollar

Pax Dollar  BUSD

BUSD  OMG Network

OMG Network  Ren

Ren  Bitcoin Diamond

Bitcoin Diamond  Bytom

Bytom