ETHFI price goes vertical as Ether.fi’s restaking assets rises

Ether.fi (ETHFI) token price has gone parabolic in the past few days. The token surged to an all-time high of $6.80, much higher than its all-time low of $0.23. This surge has brought its total market cap to over $708 million, according to CoinMarketCap.

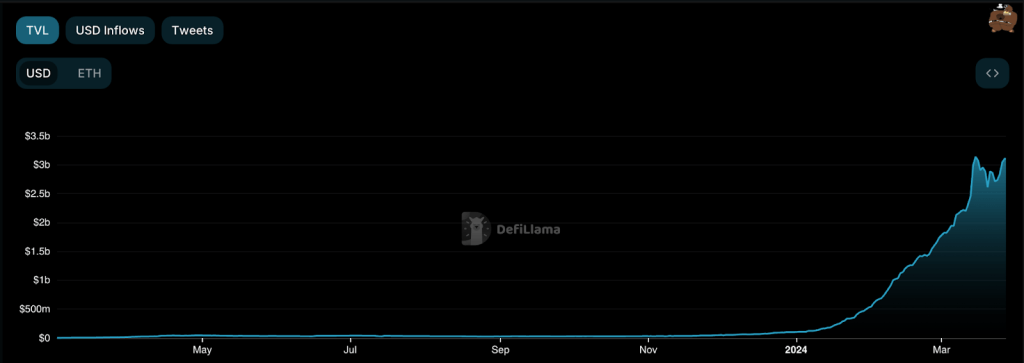

Ether.fi has had a remarkable growth rate in the past few weeks, making it one of the fastest-growing platforms in the crypto industry. Data compiled by DeFi Llama shows that the network has grown its total value locked (TVL) has jumped to over $3.17 billion. It has over 847k ETH in its ecosystem.

Ether.fi total value locked

This trend has transitioned Ether.fi to become the 12th biggest player in the decentralised finance (DeFi) industry. It has also become the second-biggest player in the fast-growing restaking platform after EigenLayer.

Ether.fi is a DeFi platform in the restaking industry. The concept behind this approach is relatively simple. In it, a user stakes Ethereum (ETH) and gets eTH, which is a natively restaked liquid staking token.

Restaking is seen as a better approach to the traditional approach of staking, In it, users stake already liquid staking tokens to be staked with validators in other networks, As a result, users can earn more rewards while helping to protect Ethereum’s network.

Ether.fi uses a different approach to restaking. In it, users hold the eETH and weETH where the native restaking happens at the protocol level. The benefit of this is that users can redeem your ETH out of the eETH/weETH without any delay.

Therefore, the ETHFi token price is soaring because of the growing demand for these restaking solutions. Analysts believe that these assets will continue soaring in the coming months. For example, Lido, the biggest liquid staking platform has grown to over $34 billion in assets.

The post ETHFI price goes vertical as Ether.fi’s restaking assets rises appeared first on Invezz

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  Dogecoin

Dogecoin  USDC

USDC  Cardano

Cardano  TRON

TRON  Chainlink

Chainlink  Stellar

Stellar  Hedera

Hedera  Bitcoin Cash

Bitcoin Cash  LEO Token

LEO Token  Litecoin

Litecoin  Cronos

Cronos  Ethereum Classic

Ethereum Classic  Monero

Monero  Dai

Dai  Algorand

Algorand  OKB

OKB  Cosmos Hub

Cosmos Hub  Stacks

Stacks  Theta Network

Theta Network  Gate

Gate  Maker

Maker  KuCoin

KuCoin  Tezos

Tezos  IOTA

IOTA  NEO

NEO  Polygon

Polygon  Zcash

Zcash  Synthetix Network

Synthetix Network  Tether Gold

Tether Gold  TrueUSD

TrueUSD  Dash

Dash  Holo

Holo  Zilliqa

Zilliqa  0x Protocol

0x Protocol  Enjin Coin

Enjin Coin  Siacoin

Siacoin  Qtum

Qtum  Basic Attention

Basic Attention  Bitcoin Gold

Bitcoin Gold  Ravencoin

Ravencoin  Decred

Decred  NEM

NEM  DigiByte

DigiByte  Ontology

Ontology  Waves

Waves  Nano

Nano  Status

Status  Huobi

Huobi  Lisk

Lisk  Hive

Hive  Numeraire

Numeraire  Steem

Steem  Pax Dollar

Pax Dollar  BUSD

BUSD  OMG Network

OMG Network  Ren

Ren  Bitcoin Diamond

Bitcoin Diamond  Bytom

Bytom