Exact Reason Behind Bitcoin (BTC) Drop Finally Revealed

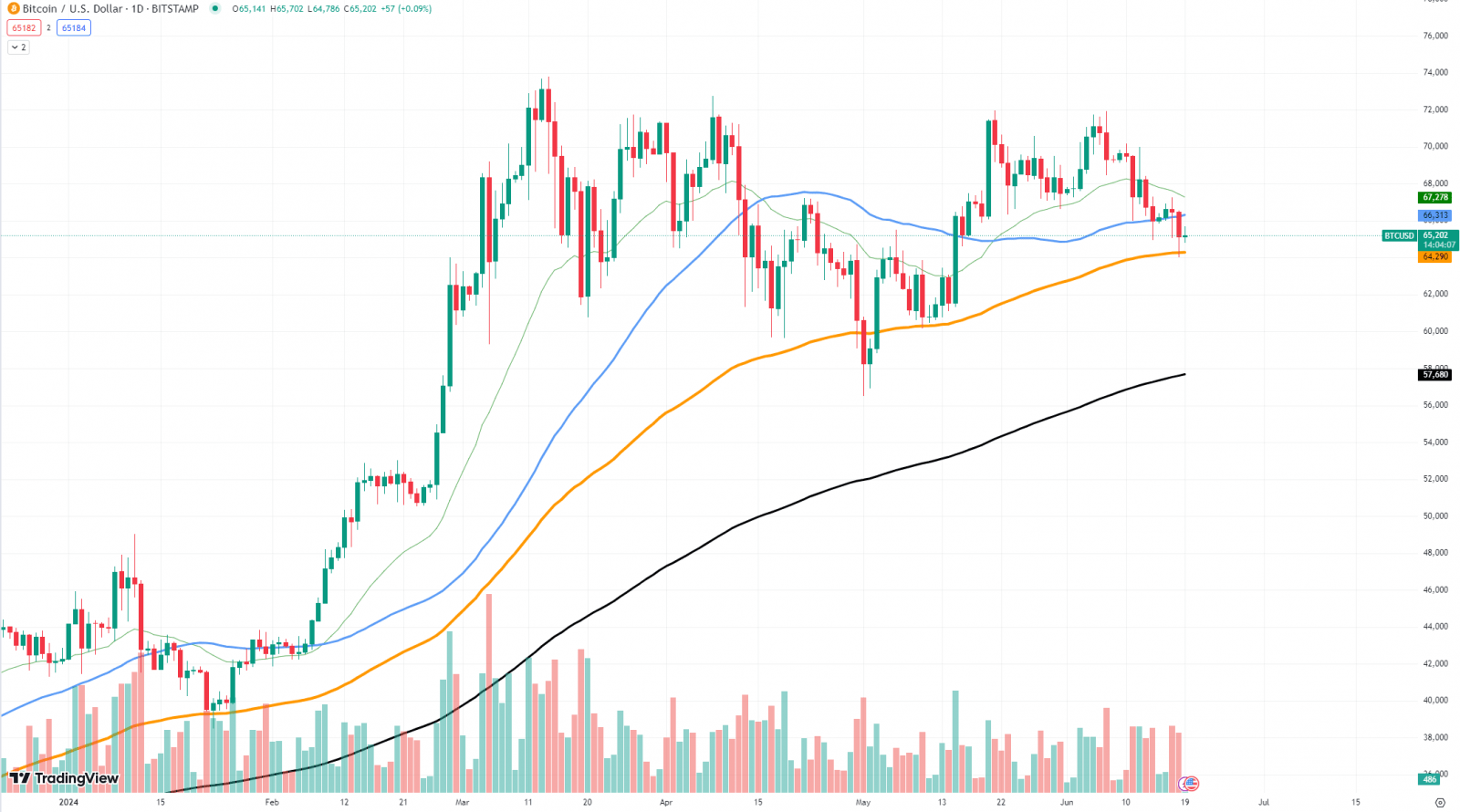

Bitcoin’s drop below $65,000 was clearly unexpected, and the reasons behind it were quite shady and determining what exactly caused it is complicated. However, we might have an answer.

Recently, cryptocurrency hedge funds have completely given up on Bitcoin. Throughout the previous 20 trading days, they have decreased their exposure to the BTC market to just 0.37. This is the lowest level since October 2020. The charts show the price trend of Bitcoin from 2019 to 2024, emphasizing notable highs and lows.

Hedge funds’ reduced exposure to Bitcoin offers an important reason for the recent steep decline in the cryptocurrency. The lower chart illustrates the rolling one-month beta of global crypto hedge funds to Bitcoin, demonstrating the degree to which hedge fund performance is influenced by changes in the price of Bitcoin.

A hedge fund’s performance follows Bitcoin if its beta value is one, whereas a beta of less than one denotes reduced exposure. The drop to a beta of 0.37 indicates that hedge funds are far less vulnerable to changes in the price of Bitcoin than they were a few years ago.

Hedge fund exposure was last at this low point in October 2020 just before Bitcoin saw a notable bull run. Hedge funds are well known for their calculated actions and frequently have access to cutting-edge data and industry knowledge. They may have been expecting more drops or volatility based on their withdrawal from Bitcoin.

There are a number of reasons for this cautious approach, such as shifting internal investment strategies, macroeconomic conditions or regulatory uncertainties. Since there has been less exposure, there has probably been more selling pressure on Bitcoin, which has pushed the price below the crucial $65,000 mark.

Given that they frequently have significant capital under their control, hedge funds have a significant influence on the market. The mood of the market and price action greatly affects the flow of funds.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  Dogecoin

Dogecoin  TRON

TRON  Cardano

Cardano  Bitcoin Cash

Bitcoin Cash  Chainlink

Chainlink  LEO Token

LEO Token  Litecoin

Litecoin  Dai

Dai  Monero

Monero  Stellar

Stellar  Ethereum Classic

Ethereum Classic  Stacks

Stacks  OKB

OKB  Cronos

Cronos  Hedera

Hedera  Cosmos Hub

Cosmos Hub  Gate

Gate  KuCoin

KuCoin  Theta Network

Theta Network  Maker

Maker  Algorand

Algorand  Polygon

Polygon  Tether Gold

Tether Gold  NEO

NEO  EOS

EOS  Tezos

Tezos  Zcash

Zcash  TrueUSD

TrueUSD  Synthetix Network

Synthetix Network  Bitcoin Gold

Bitcoin Gold  IOTA

IOTA  Holo

Holo  Dash

Dash  Zilliqa

Zilliqa  Siacoin

Siacoin  0x Protocol

0x Protocol  Ravencoin

Ravencoin  Basic Attention

Basic Attention  Enjin Coin

Enjin Coin  Qtum

Qtum  Decred

Decred  Ontology

Ontology  NEM

NEM  Lisk

Lisk  Pax Dollar

Pax Dollar  Nano

Nano  Numeraire

Numeraire  Waves

Waves  Status

Status  DigiByte

DigiByte  Huobi

Huobi  Hive

Hive  Steem

Steem  BUSD

BUSD  Ren

Ren  OMG Network

OMG Network  Bitcoin Diamond

Bitcoin Diamond  Bytom

Bytom  Kyber Network Crystal Legacy

Kyber Network Crystal Legacy  HUSD

HUSD  Energi

Energi