Expert Predicts Timeline For Bitcoin Surge As BTC Price in Halving Years: 2024 Mirrors 2016 and 2020

Historical data confirms Bitcoin price movements in 2024 mirror patterns witnessed in previous halving years such as 2016 and 2020.

This is according to a report from Julio Moreno, Head of Research at market intelligence platform CryptoQuant. Moreno disclosed this on X while citing insights from the “Cumulative Return Index on Halving Years,” a metric that tracks Bitcoin’s price action for every year it witnesses a halving.

Bitcoin Follows Previous Patterns

Interestingly, the metric confirms that Bitcoin’s price movements were similar at the start of all four halving years. These include 2012, 2016, 2020 and most recently, 2024. However, a discrepancy observed this year was a rapid price surge witnessed by Bitcoin toward the close of the first quarter.

For context, Bitcoin’s uptrend for this cycle began as far back as September 2023. From this point, the premier crypto asset recorded seven consecutive months of persistent gains. This campaign culminated with a new all-time high above $73,000 in March 2024, a month before the 2024 Bitcoin halving.

This was unprecedented, as Bitcoin has always reached a new all-time high after each halving, not before. Analysts attributed the change in trend to the emergence of the spot Bitcoin ETFs, which pumped considerable capital into the market. At press time, the ETF products have gulped over $17 billion in net inflows within seven months.

Notably, after breaching the all-time high in March 2024, Bitcoin faced a correction, dropping by 15% in April. This marked its first monthly loss since September 2023. The losses persisted into Q2 2024, but data from the Cumulative Return Index metric indicates that this drop actually brought Bitcoin back on track to levels witnessed in past cycles.

A Persistent Performance

Essentially, despite concerns around the dump, Bitcoin is currently trading at the position it was in past halvings. This suggests that the firstborn cryptocurrency is exactly where it needs to be, per historical data on the 2016 and 2020 halvings. The only outlier is 2012, when Bitcoin spiked 220% from $5 to $16 between May and August.

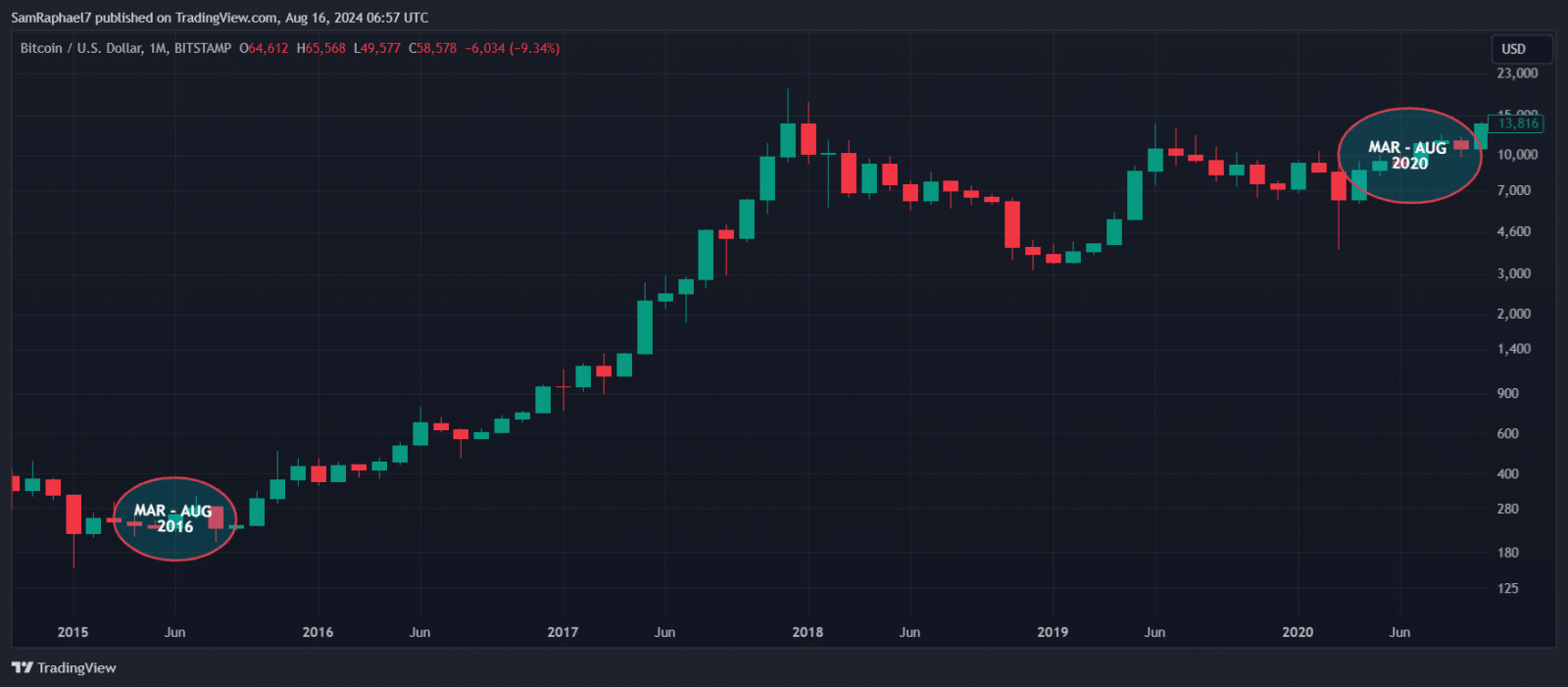

Bitcoin Trends in 2016 and 2020

However, in 2016 and 2020, BTC largely consolidated from March to August. This confirms that the bearish consolidation the market currently faces is not unique. Interestingly, further data suggests there might be light at the end of the tunnel. In 2016 and 2020, following the consolidation from Q2 to Q3, BTC recovered toward Q4.

Citing this pattern, Moreno emphasized that if Bitcoin will rebound from the ongoing bearish phase, such a push could come up in the fourth quarter of this year. At press time, Bitcoin currently trades for $58,405. Market veteran Peter Brandt expects an eventual spike to $92,579.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  Dogecoin

Dogecoin  TRON

TRON  Cardano

Cardano  Bitcoin Cash

Bitcoin Cash  Chainlink

Chainlink  LEO Token

LEO Token  Litecoin

Litecoin  Dai

Dai  Monero

Monero  Stellar

Stellar  Ethereum Classic

Ethereum Classic  Stacks

Stacks  OKB

OKB  Cronos

Cronos  Hedera

Hedera  Cosmos Hub

Cosmos Hub  KuCoin

KuCoin  Gate

Gate  Theta Network

Theta Network  Maker

Maker  Algorand

Algorand  Polygon

Polygon  Tether Gold

Tether Gold  NEO

NEO  EOS

EOS  Tezos

Tezos  Zcash

Zcash  TrueUSD

TrueUSD  Synthetix Network

Synthetix Network  Bitcoin Gold

Bitcoin Gold  IOTA

IOTA  Holo

Holo  Dash

Dash  Zilliqa

Zilliqa  0x Protocol

0x Protocol  Siacoin

Siacoin  Ravencoin

Ravencoin  Basic Attention

Basic Attention  Enjin Coin

Enjin Coin  Qtum

Qtum  Decred

Decred  Ontology

Ontology  NEM

NEM  Lisk

Lisk  Pax Dollar

Pax Dollar  Nano

Nano  Numeraire

Numeraire  Waves

Waves  Status

Status  DigiByte

DigiByte  Huobi

Huobi  Hive

Hive  Steem

Steem  BUSD

BUSD  Ren

Ren  OMG Network

OMG Network  Bitcoin Diamond

Bitcoin Diamond  Bytom

Bytom  Kyber Network Crystal Legacy

Kyber Network Crystal Legacy  HUSD

HUSD