Exploring SynFutures V3 and the Oyster AMM

SynFutures, a decentralized perps exchange, has been waking waves in DeFi for the past few years. It has prominent investors, a large user base, and an impressive trading volume, which means it has all the factors that could make it a project to watch in 2024 and beyond. In this article, let’s dive into SynFutures to understand the project and look at what’s so special about its recent product releases and campaigns.

Early Stage

SynFutures is a multi-chain decentralized derivatives exchange. The project has the backing of numerous big VCs, including Pantera, Polychain Capital, DragonFly, and Standard Crypto, and the DEX recently raised over $22 million in a Series B funding round. SynFutures V1, the first iteration of the platform, launched in June 2021 and introduced the concept of single-token liquidity through the Synthetic Automated Market Maker (sAMM) model. This allowed LPs to fund any pool on the protocol with just one token, usually a stablecoin.

Single-token liquidity brought much attention and interest to the project, which quickly followed up on its success with the launch of SynFutures V2. V2 introduced permissionless listing, allowing LPs to list any crypto tokens, coins, NFTs, and indices in 30 seconds without prior approval. With permissionless listing and single-token liquidity, the project aims to become the primary derivatives destination for big and small assets.

According to reports from Messari, V1 and V2 have a cumulative volume of more than $23 billion, with over 10,000 users and nearly 250 pairs listed for trade. The achievement is impressive, considering the project has yet to announce a token. Once that announcement is made, we can expect increased trading activity from new users and airdrop farmers, which will likely boost its trading metrics, and the fees earned through those activities will also shoot up.

Launch of V3

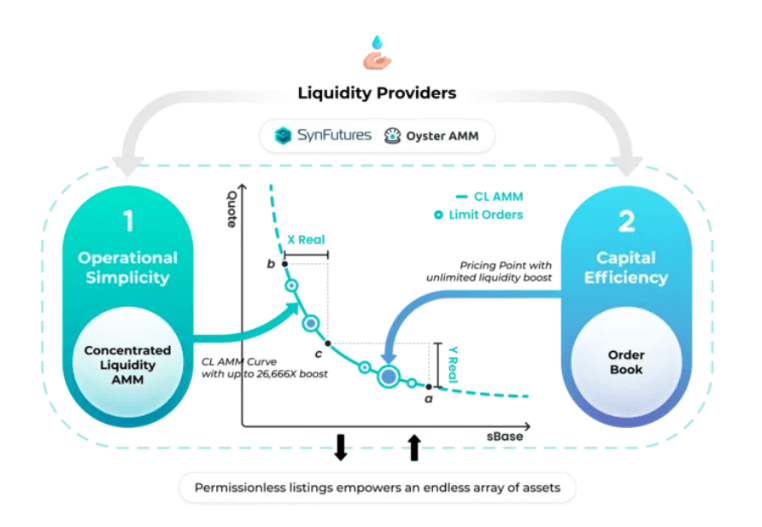

The protocol just launched SynFutures V3 on Blast mainnet. Like the previous versions, V3 introduces an upgrade that will majorly impact liquidity providers (LPs) and traders. The new version comes with a new AMM model called Oyster AMM (or oAMM), allowing LPs to provide concentrated liquidity for any derivative pair listed on the platform. LPs can already provide single-token liquidity, but with the new AMM, LPs will also be able to provide single-token concentrated liquidity. This new feature could improve capital efficiency for liquidity providers and get them higher returns while decreasing slippage for traders; it’s a win-win solution for all parties involved.

How V3 works

According to the SynFutures V3 whitepaper draft, the Oyster AMM model was inspired by the synthetic Automated Market Maker (sAMM) model from SynFutures V1 and the Concentrated Liquidity Market Maker (CLMM) model from Uniswap V3.

In the order book model, liquidity is normally concentrated around the asset’s current price, while the AMM model spreads it across the entire price range. This makes AMMs less efficient for LPs and results in more slippage for traders. To avoid this, Oyster introduces concentrated liquidity that allows LPs to choose a range around the current price where their liquidity would be active. In addition, Oyster also will enable traders to place limit orders using the order book model. These orders are then placed on the AMM curve as another source of liquidity.

While Oyster AMM is not the first time a project has tried to combine AMM with an order book, the previous attempts have mostly followed a hybrid system where some parts of the transaction take place off-chain while others take place on-chain. Such a system ultimately depends on the centralized administrators who control the off-chain part of the transaction, thereby making it neither decentralized nor trustless. Such systems are also exposed to potential backdoors and other vulnerabilities. Oyster, on the other hand, is fully on-chain, ensuring transparency and increased security.

Combining AMM and Orderbook on-chain is a complex task. Therefore, to ensure that the two types of liquidity complement each other, Oyster uses a structure called ‘Pearl,’ which is a collection of all the concentrated liquidity covering a price point and all open limit orders at the same price. The image and the explanation below provide a step-by-step account of how the model works and how an order gets executed in Oyster AMM.

- When a market taker places a new order, Oyster first checks the Pearl at that price point.

- It then takes liquidity from the limit orders present at that Pearl. The transaction is completed if the liquidity in the limit orders is enough to fill the market taker’s order.

- If not, Oyster AMM then takes liquidity from the AMM. This increases the price and moves it along the AMM curve.

- If the order gets fulfilled on the curve, the transaction ends. If not, the price keeps increasing until the next Pearl is reached.

- The same process is followed again, where the liquidity from the limit order is filled first, and then liquidity from the AMM is taken.

- This process continues until the entire order is filled.

This twin approach allows SynFutures V3 to have significantly higher capital efficiency than most of its peers in the derivatives space. It even provides better capital efficiency than a spot Dex like Uniswap V3. The table below, taken from their whitepaper, shows the capital efficiency comparison between UniSwap V3 and SynFutures V3 at a specific range.

| Model | Range | Capital Efficiency Boost |

|---|---|---|

| Oyster AMM | 99.99% to 100.01% | 39,997.0x |

| UniSwap v3 | 99.99% to 100.01% | 20,000.5x |

SynFutures & Oyster Odyssey

To celebrate the launch of V3 and Oyster AMM, SynFutures has announced ‘Oyster Odyssey’ campaign that rewards users with points for providing liquidity on the protocol, the system is designed to reward user engagement and contribution to SynFutures ecosystem.

The points system is designed to reward users who provide liquidity and bring new users to the platform. There is also a mystery box mechanism and a spin-the-wheel system which adds an element of luck and fun to the campaign.

Trade on SynFutures V3 to learn more.

Conclusion

Efficient use of capital is essential in DeFi, especially in the early stage, where the total liquidity available is limited. While AMM models democratized liquidity provision, it suffers from lower capital efficiency. Improving upon it is a crucial step in taking DeFi mainstream. SynFutures’ Oyster AMM is one such improvement that allows a trader to theoretically take a trade with zero slippage while still being fully on-chain; that is a welcome development.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  Dogecoin

Dogecoin  Cardano

Cardano  TRON

TRON  Chainlink

Chainlink  LEO Token

LEO Token  Stellar

Stellar  Hedera

Hedera  Litecoin

Litecoin  Bitcoin Cash

Bitcoin Cash  Monero

Monero  Dai

Dai  OKB

OKB  Gate

Gate  Cronos

Cronos  Ethereum Classic

Ethereum Classic  VeChain

VeChain  Cosmos Hub

Cosmos Hub  Algorand

Algorand  KuCoin

KuCoin  Maker

Maker  Stacks

Stacks  Theta Network

Theta Network  Tezos

Tezos  Tether Gold

Tether Gold  IOTA

IOTA  Zcash

Zcash  NEO

NEO  TrueUSD

TrueUSD  Polygon

Polygon  Synthetix Network

Synthetix Network  Dash

Dash  Zilliqa

Zilliqa  0x Protocol

0x Protocol  Qtum

Qtum  Basic Attention

Basic Attention  Holo

Holo  Decred

Decred  DigiByte

DigiByte  Siacoin

Siacoin  Ravencoin

Ravencoin  NEM

NEM  Enjin Coin

Enjin Coin  Nano

Nano  Ontology

Ontology  Waves

Waves  Hive

Hive  Lisk

Lisk  Status

Status  Pax Dollar

Pax Dollar  Huobi

Huobi  Numeraire

Numeraire  Steem

Steem  BUSD

BUSD  OMG Network

OMG Network  Ren

Ren  Bitcoin Diamond

Bitcoin Diamond  Augur

Augur  Bitcoin Gold

Bitcoin Gold  HUSD

HUSD  Kyber Network Crystal Legacy

Kyber Network Crystal Legacy